Financial Accounting Environment

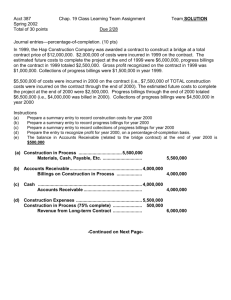

advertisement

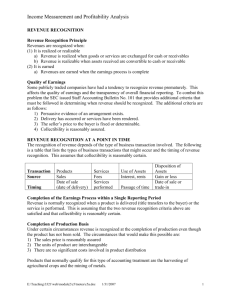

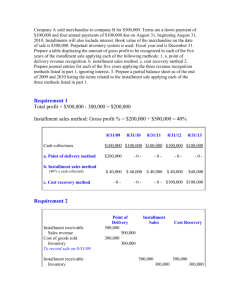

Income Measurement and Profitability Analysis REVENUE RECOGNITION Revenue Recognition Principle Revenues are recognized when: (1) It is realized or realizable a) Revenue is realized when goods or services are exchanged for cash or receivables b) Revenue is realizable when assets received are convertible to cash or receivable (2) It is earned a) Revenues are earned when the earnings process is complete Quality of Earnings Some publicly traded companies have had a tendency to recognize revenue prematurely. This affects the quality of earnings and the transparency of overall financial reporting. To combat this problem the SEC issued Staff Accounting Bulletin No. 101 that provides additional criteria that must be followed in determining when revenue should be recognized. The additional criteria are as follows: 1) Persuasive evidence of an arrangement exists. 2) Delivery has occurred or services have been rendered. 3) The seller’s price to the buyer is fixed or determinable. 4) Collectibility is reasonably assured. REVENUE RECOGNITION AT A POINT IN TIME The recognition of revenue depends of the type of business transaction involved. The following is a table that lists the types of business transactions that might occur and the timing of revenue recognition. This assumes that collectibility is reasonably certain. Transaction Source Timing Products Sales Date of sale (date of delivery) Services Fees Services performed Use of Assets Interest, rents Passage of time Disposition of Assets Gain or loss Date of sale or trade-in Completion of Production Basis Under certain circumstances revenue is recognized at the completion of production even though the product has not been sold. The circumstances that would make this possible are: 1) The sales price is reasonably assured 2) The units of product are interchangeable 3) There are no significant costs involved in product distribution Products that normally qualify for this type of accounting treatment are the harvesting of agricultural crops and the mining of metals. Revenue Recognition After Delivery Installment Sales Accounting Method D:\106762953.doc 3/9/2016 1 Income Measurement and Profitability Analysis The recognition of revenue is based on the collection of cash rather than the completion of the sale. It is used in industries where collection is relatively uncertain. To accomplish this we use a separate set of accounts to record “Installment Receivables” and “Deferred Gross Profit.” Year of Installment Sale: (1) Record all transactions as follows: ACCOUNT DEBIT CREDIT Installment receivables $XX,XXX Inventory $XX,XXX Deferred gross profit, (current year) $X,XXX To record installment sales and related deferred gross profit for the year. (2) Calculate the gross profit percentage for all sales for the current year. Amount $100,000 60,000 $40,000 Installment sales Cost of installment sales Gross profit on installment sales Percentage 100% 60% 40% (3) Record the collection of installment receivables and the recognition of gross profit as follows: ACCOUNT Cash Installment receivables To record cash collected on installment receivables DEBIT $XX,XXX Deferred gross profit, (current year) $X,XXX Realized gross profit To recognize gross profit on the collection of installment receivables CREDIT $XX,XXX $X,XXX Installment Collections on Prior Year Sales: Apply each year’s gross profit percentage to the installment collections related to that year’s sales as follows: D:\106762953.doc 3/9/2016 2 Income Measurement and Profitability Analysis ACCOUNT Cash Installment receivables, (year 1) Installment receivables, (year 2) To record cash collected on installment receivables DEBIT $XX,XXX CREDIT $XX,XXX $XX,XXX Deferred gross profit, (year 1) $X,XXX Deferred gross profit, (year 2) $X,XXX Realized gross profit To recognize gross profit on the collection of installment receivables $X,XXX Financial Statement Presentation The gross profit realized in the current year is reported as a separate component of gross profit in the income statement. If a company has regular sales and installment sales the income statement would be presented as follows. Sales Cost of goods sold Gross profit on sales Gross profit realized on installment sales Total gross profit $500,000 400,000 100,000 16,200 $116,200 Cost Recovery Method The cost recovery method is use primarily in the real estate industry. It is used when the collection of the selling price is uncertain. The same procedure is used as we demonstrated in the installment method except that during the earlier periods no gross profit is recognized. We do not recognize any gross profit until all of the costs have been recovered. Deposit Method Under the deposit method the seller has not performed on the contract but has received cash from the buyer. The seller records the cash deposit as a credit to a current liability account. When the seller has completed the service or delivered the product then the deposit will be reclassified to revenue and recognized in the income statement. Buyback Agreements There is no sale if a repurchase agreement is in place whereby the seller agrees to repurchase the entire inventory at a set price which covers the holding costs. The inventory remains on the seller’s books until the buyer resells the merchandise thus completing the transaction. Right of Return In industries where there is a high rate of returns, there are three possible alternatives to recording revenue. (1) Delay recording the sale until the privilege for return has expired (2) Recording the sale and an estimate of future returns D:\106762953.doc 3/9/2016 3 Income Measurement and Profitability Analysis (3) Recoding the sale and recording the returns as they occur The following six conditions must be met to record the revenue from a sales transaction recorded. (1) Price must be determinable (2) Buyer is obligated to pay seller with no contingencies (3) Buyers obligation would not change because of changed conditions of inventory (4) Buyer has economic substance in product (5) Seller does not have significant obligations to effect the resale of the produce (6) Amount of future returns can be reasonably estimated If returned merchandise is a part of the normal business operations then an allowance should be estimated for returns. Trade Loading In some industries, manufacturers will provide incentives to wholesalers to purchase more product than can be resold. This overstates sales of the manufacturer. Channel Stuffing In order to inflate sales some manufacturers have offered deep discounts to distributors to overbuy produce. The manufacturers then record the sale as complete as the product leaves the sellers loading dock. Consignment Sales The consignor is the seller of the merchandise who ships the goods on consignment to the consignee. The consignee is just an agent in the selling process and does not actually own the goods. Therefore, at year-end the consignor (seller) should include the consigned goods in its inventory even though it may still be in the physical possession of the consignee. No sale takes place until the consignee sells the goods, deducts the commission earned and remits the remainder of the selling price to the consignor. REVENUE RECOGNITION OVER TIME Service Revenue Earned over Time When services are provided over an extended period of time, revenue is recognized in each accounting period in which the services were provided and the revenue earned. Long-Term Contracts In construction-type contracts the builder (seller) will normally interim bill the customer (buyer) as the contract progresses. There are two different methods of accounting for long-term construction contracts. (1) Percentage-of-Completion Method At the end of each accounting period the contractor recognizes the percentage of revenue earned on the contract. This requires the use of two new general ledger accounts. a) Construction in Process (Inventory Account - Debit Balance) D:\106762953.doc 3/9/2016 4 Income Measurement and Profitability Analysis This account reflects the accumulation of construction costs since the beginning of the project and the periodic recognition of gross profit based on the percentage of completion at the end of each accounting period. b) Billings on Construction in Process (Contra-Inventory Account – Credit Balance) (2) Completed-Contract Method The contractor recognizes revenue earned on the contract at the end of the contract. The general ledger accounts are used but there is no accumulation of gross profit during the construction project. Gross profit is only recognized once the project is completed. Percentage-of-Completion Method There are various methods of measuring progress on long-term contracts. The most common method used in construction projects is the cost-to-cost basis. The costs incurred to date are compared with the currently estimated total costs to derive a percentage of completion as of the end of the accounting period. The formula for determining the percentage completion is as follows: Costs incurred to date Current estimate of total costs = Percentage complete The percentage complete as of the end of the accounting period is used to calculate the revenue to be recognized to date. At the end of the accounting period the percentage complete to date is multiplied by the total revenue associated with the long-term contract to derive revenue recognized to date. The following formula determining the revenue recognized to date is as follows: Percentage complete X Estimated total revenue = Revenue recognized to date Normally we are interested in preparing financial statements for an accounting period so therefore we need to know the revenue earned in the current accounting period. To derive this amount the revenue recognized in prior periods is subtracted from the revenue recognized to date to derive the current period revenue earned on the long-term contract. The following formula is used to do this caluculation. Revenue recognized to date - Revenue recognized in prior periods = Current period revenue Example The following fact pattern pertains to the long-term contract that Spencer Construction Company has with Fido Chow, Inc. D:\106762953.doc 3/9/2016 5 Income Measurement and Profitability Analysis Costs to date Estimated costs to complete Progress billings during year Cash collected during year 2000 100,000 400,000 120,000 90,000 2001 300,000 200,000 350,000 200,000 2002 550,000 130,000 250,000 At the beginning of the contract in 2000, the estimated costs are $500,000 and the contract price is $600,000. Note that sometime in year 2002 it became clear that the total costs on this contract were going to be more than originally estimated. The total estimated costs are reevaluated at the end of each accounting period and adjusted based on the currently available information. Also note, that the progress billings and the cash collections are reported for the current year. Be sure you examine the fact pattern to determine if the amounts are being presented as year to date or current year. It will effect the way you prepare your analysis. Now that we have the fact pattern we can determine the percentage completion on a costto-cost basis for each year. The following provides this analysis. 2000 Percentage complete Costs incurred to date Costs to complete Total estimated costs Percentage complete 2001 100,000 400,000 500,000 20% 300,000 200,000 500,000 60% 2002 550,000 0 550,000 100% The revenue on this long-term contract is fixed as of the signing of the contract. We know that the total revenue will be $600,000 so therefore using the above percentage completion we can determine the amount of revenue that should be recognized. 2000 Revenue recognized Contract price Percentage complete Revenue recognized to date Revenue recognized in prior periods Revenue recognized in current period 600,000 20% 120,000 0 120,000 2001 600,000 60% 360,000 120,000 240,000 2002 600,000 100% 600,000 360,000 240,000 To derive the gross profit to be recognized during the current accounting period we need to convert the costs incurred to date to the current period costs. The following provides this analysis. 2000 Current costs Costs incurred to date Costs recoginzed in prior period Current costs D:\106762953.doc 3/9/2016 100,000 0 100,000 6 2001 300,000 100,000 200,000 2002 550,000 300,000 250,000 Income Measurement and Profitability Analysis Having determined the current period revenue and costs we can know calculate the gross profit that should be recorded during each accounting period. The following provides this analysis. 2000 Current period gross profit Revenue recognized in current period Current costs Current period gross profit 2001 120,000 100,000 20,000 2002 240,000 200,000 40,000 240,000 250,000 (10,000) Note that we were not aware of our higher construction costs until the last year. Normally this would not be the case. At any time during the construction cycle estimated total costs may be adjusted based on new information. Now that we have completed the analysis we need to prepare the journal entries for each year’s transactions. The following reflects the journal entries for 2000. During the year the construction costs, billings and collections would be recorded as they take place. We are going to record them as one general journal entry for the sake of simplicity. DATE 2000 2000 2000 12/31/00 ACCOUNT Construction in process Accounts payable To record construction costs during year Accounts receivable Billings on construction in process To record progress billings Cash Accounts receivable To record collections on account DEBIT 100,000 CREDIT 100,000 120,000 120,000 90,000 90,000 Construction in process Construction expenses Revenue from long-term contract 20,000 100,000 120,000 To record current period expenses and revenue on long-term contract that is 20% complete Note that the “Construction expenses” and Revenue from long-term contract” accounts are nominal accounts and will be closed out at the end of the accounting period. The two accounts that we need to keep track of throughout the life of the long-term contract are the “Construction in process” and “Billings on construction in process” accounts. The following is the T-account analysis at the end of 2000. D:\106762953.doc 3/9/2016 7 Income Measurement and Profitability Analysis Construction in Process DATE DESCRIPTION DEBIT 2000 Construction costs for 2000 100,000 12/31/00 Gross profit for 2000 20,000 DATE 2000 Billings on Construction in Process DESCRIPTION DEBIT Progress billings for 2000 CREDIT BALANCE 100,000 120,000 CREDIT 120,000 BALANCE 120,000 Now we will repeat this process for 2001. The following are the journal entries to record the transactions and adjusting journal entries for 2001. DATE 2001 2001 2001 12/31/01 ACCOUNT Construction in process Accounts payable To record construction costs during year DEBIT 200,000 CREDIT 200,000 Accounts receivable Billings on construction in process To record progress billings 350,000 Cash Accounts receivable To record collections on account 200,000 Construction in process Construction expenses Revenue from long-term contract To record current period expenses and revenue on long-term contract that is 60% complete 40,000 200,000 350,000 200,000 240,000 After these entries have been posted we should have the following balances in the Taccounts of the “Construction in process” and Billings on construction in process” accounts. D:\106762953.doc 3/9/2016 8 Income Measurement and Profitability Analysis DATE 2000 12/31/00 2001 12/31/01 DATE 2000 2001 Construction in Process DESCRIPTION DEBIT Construction costs for 2000 100,000 Gross profit for 2000 20,000 Construction costs for 2001 200,000 Gross profit for 2001 40,000 Billings on Construction in Process DESCRIPTION DEBIT Progress billings for 2000 Progress billings for 2001 CREDIT BALANCE 100,000 120,000 320,000 360,000 CREDIT 120,000 350,000 BALANCE 120,000 470,000 The activity for the final year of 2002 is listed below. DATE 2002 2002 2002 12/31/02 ACCOUNT Construction in process Accounts payable To record construction costs during year DEBIT 250,000 CREDIT 250,000 Accounts receivable Billings on construction in process To record progress billings 130,000 Cash Accounts receivable To record collections on account 250,000 130,000 250,000 Construction in process Construction expenses Revenue from long-term contract To record current period expenses and revenue on long-term contract that is 100% complete 10,000 250,000 240,000 The following is the T-account analysis reflecting the accumulation of these entries to the two accounts of which we have been keeping track. D:\106762953.doc 3/9/2016 9 Income Measurement and Profitability Analysis DATE 2000 12/31/00 2001 12/31/01 2002 12/31/02 DATE 2000 2001 2002 Construction in Process DESCRIPTION DEBIT Construction costs for 2000 100,000 Gross profit for 2000 20,000 Construction costs for 2001 200,000 Gross profit for 2001 40,000 Construction costs for 2002 250,000 Gross profit for 2002 Billings on Construction in Process DESCRIPTION DEBIT Progress billings for 2000 Progress billings for 2001 Progress billings for 2002 CREDIT 10,000 BALANCE 100,000 120,000 320,000 360,000 610,000 600,000 CREDIT 120,000 350,000 130,000 BALANCE 120,000 470,000 600,000 Please note that at the end of the long-term construction contract the balance in the “Construction in Process” account is equal to the balance in the “Billings on Construction in Process” account. The reason for this is that each year we recorded the gross profit in the “Construction in Process” account and created two nominal accounts to reflect the current period expenses and revenue. We are not ready to close the “Construction in Process” and the Billings on Construction in Process” accounts. The final journal entry is presented below. DATE 12/31/02 ACCOUNT Billings on construction in process Construction in process To close the long-term contract accounts DEBIT 600,000 CREDIT 600,000 Financial Statement Presentation The difference between the Construction in Process and the Billings on Construction in Process accounts is presented in the balance sheet as either a current asset (net debit balance) or a current liability (net credit balance). The following is a balance sheet presentation at the end of each year that the contract is not complete. D:\106762953.doc 3/9/2016 10 Income Measurement and Profitability Analysis December 31, 2000 Current Asset Construction in process 120,000 Less: progress billings 120,000 Costs and recognized profit in excess of billings 0 December 31, 2002 Current Liability Construction in process Less: progress billings Billings in excess of costs and recognized profit 360,000 470,000 110,000 Completed-Contract Method On rare occasions a company might use the completed-contract method. The same balance sheet accounts will be used but there will be no adjusting journal entry at the end of the accounting period. The company will accumulate costs and billings on the longterm contract until it is complete. Once the contract is complete and accepted by the customer the balance sheet accounts are closed and revenue and expenses are recorded in the income statement. Losses on Long-Term Contracts Overall Profitable Contracts: If the estimated costs increase resulting in less profit then originally estimated, the loss in the current accounting period is recorded. This is a change in accounting estimate. Unprofitable Contracts: If the estimated costs increase resulting in a loss on the entire long-term contract the entire loss is recorded in the period it is discovered. SOFTWARE REVENUE RECOGNITION Many computer companies sell hardware, software and support services under a single contract. To the extent that the revenue has not been earned when received or billed the computer company must defer the unearned revenue. The deferred revenue is recognized in the accounting period(s) in which the services are performed or the revenue is earned. FRANCHISE SALES Franchises are a popular means of operating many retail business enterprises. The franchise fee is normally comprised of two amounts. The franchisor receives an initial franchise fee for the right to sell products or services under the franchisors name. This fee may be earned over a period of months or years depending on the terms of the contract. In addition, the franchisee is required to pay to the franchisor a periodic fee to cover continuing services such as advertising and/or other continuing services provided by the franchisor. These fees are normally based on the gross volume of the franchise and are recognized by the franchisor as earned. D:\106762953.doc 3/9/2016 11