A Random Walk Down Wall Street

advertisement

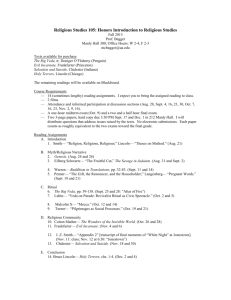

A Random Walk Down Wall Street Stat 006p Fall 2004 Hanes 308 Instructor: Chuanshu Ji Office: 203 Smith Building Phone: 962-3917 Email: cji@email.unc.edu Office Hours: by appointment TA: Jason Rein Email: jrein@email.unc.edu Office Hours: by appointment Class Website: www.stat.unc.edu/faculty/ji.html Class Meeting Schedule: TR 9:30-10:45 Required Texts: A Random Walk Down Wall Street by Burton G. Malkiel. The Wall Street Journal Understanding the current business and economic environment is an essential step in learning about the stock market. Current events will be discussed weekly in class. The Wall Street Journal provides semester subscriptions at a discounted price for students in classes in which the text is required. Course Objectives: The goal of this class is to provide an introduction to the stock market and the market mechanisms that drive its behavior. Various statistical, economic, and market analyses will be incorporated to aid in the learning experience. Grading: 25% Participation: The goal of UNC’s freshman seminar program is to engage underclassmen in a small, discussion-oriented learning environment. Direct interaction with fellow students and the professor is fundamental in enhancing the learning process. Attendance and participation are expected. 75% Group projects, papers and homeworks: The remaining portion of grades for the class will come from various assignments established throughout the semester. The work will include statistical analysis, writing and presentations. ** Grading, assignments and schedule are subject to change throughout the semester as deemed fit by the instructors. Students will be given ample notification if this is the case. Class Schedule: Week 1: Introduction to class and stock market game T Aug. 24: R Aug. 26: Read chapter 1: “Firm Foundations and Castles in the Air” Week 2: Initial market introduction T Aug 31: R Sept. 2: Read chapter 2: “The Madness of Crowds” Week 3: History and current state of the economy T Sept. 7: Read chapter 3: “Stock Valuation ‘60s-‘90s” R Sept. 9: Random Walk as a Toy Probability Model Week 4: Research and analysis: Yahoo! review T Sept. 14: Read chapter 4: “Firm Foundation Theory” R Sept. 16: Descriptive Statistics Read chapter 5: “Technical and Fundamental Analysis” Week 5 Technical analysis – Financial Time Series T Sept. 21: Read chapter 6: “Technical Analysis and Random Walk Theory” R Sept. 23: Technical stock analysis homework 1 Week 6: Technical analysis – Financial Time Series continued T Sept. 28: R Sept. 30: Technical stock analysis homework 2 Week 7: Technical and Fundamental analysis T Oct. 5: Read chapter 7: “How Good is Fundamental Analysis?” R Oct. 7: Research report on companies invested in due Assignment of group scandal projects Week 8: T Oct. 12: R Oct. 14: University Day (no classes from 9:30 to 12:30) Fall Break Week 9: Fundamental analysis; how to create and manage a successful portfolio T Oct. 19: Read chapter 8: “Modern Portfolio Theory” R Oct. 21: Mid-semester portfolio analysis due Compound Interest Rates Week 10 Fundamental analysis; how to create and manage a successful portfolio (continued) T Oct. 26: Read chapter 9: “Reaping Rewards by Increasing Risk” R Oct. 28: Risk, Reward and Volatility analysis Week 11: Thinking long-term T Nov. 2: R Nov. 4: Read chapter 10: Assault on the Random Walk Statistics and the Random Walk Chapter 12: “Three Eras of Market Returns” Week 12 Scandals and the shaping of sentiment T Nov. 9: Group presentations on scandals R Nov. 11: Group presentations on scandals Week 13: T Nov. 16: R Nov. 18: Read chapter 13: “Life-Cycle Guide to Investing” Advanced Statistics Concepts Week 14 T Nov. 23: R Nov. 25: Read chapter 14: “3 Giant Steps Down Wall Street” Thanksgiving Break Week 15 T Nov. 30: R Dec. 2: Final Summary, Statistical Analysis Final paper due