The Oxford Guide to Financial Modeling: Applications for Capital

advertisement

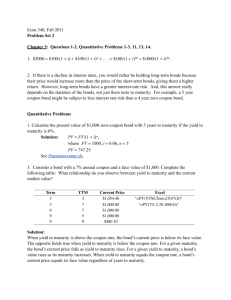

The Oxford Guide to Financial Modeling: Applications for Capital Markets, Corporate Finance, Risk Management and Financial Institutions Thomas S.Y. Ho and Sang Bin Lee 2004 Chapter 3: Bond Markets: The Bond Model A bond is a debt instrument requiring the issuer (also called the debtor or borrower) to repay to the lender/investor the amount borrowed plus interest over a specified period of time. A typical (“plain vanilla”) bond issued in the United States specifies (1) a fixed date when the amount borrowed (the principal) is due, and (2) the contractual amount of interest, which typically is paid every six months. The date on which the principal is required to be repaid is called the maturity date. Assuming that the issuer does not default or redeem the issue prior to the maturity date, an investor holding this bond until the maturity date is assured of a known cash flow. The bond indenture is the contract specifying all contractual terms of the relationship between the bond issuer and the bond owner. The bond trustee is typically a commercial bank identified to monitor the bond issuer’s performance per the terms of the indenture. Security Status – Some bond are secured by claims on specific assets of the issuer, so that in the event of default (failure to make payment as scheduled) the bondholders have a claim on specified assets or the proceeds from liquidation of the assets. Bonds of this type are often referred to as mortgage bonds, collateralized bonds or collateralized trust bonds. Bonds which represent a general (unsecured) obligation of the issuer are often times referred to as debentures. Claims represented by more junior bonds (subordinated debentures) rank behind the claims of secured bondholders, general obligation bondholders, and other unsecured creditors. Time to maturity – bond pays principal value plus final coupon payment on specified maturity date, T. Time to maturity (T – t) Bond cash flows: Maurity value = Face value = par value = (notional) principal = M Coupon rate = c = annualized percentage of principal paid as interest Bond price: as percentage of principal value, M=$100 for a semi-annual pay coupon bond with n/2 years to maturity. n P C t 1 (1 0.5 * y ) t M * (1 0.5 * y) n P = invoice price C = 0.5*c*M 1 y = yield M = maturity value or call price or put price Taxation of bond income: Coupon income subject to income tax Price appreciation/depreciation (M – P(t)) subject to capital gains tax P(t) = Price (clean) = Invoice (dirty) price – accrued interest Invoice price = present value of remaining cashflows Accrued Interest – In the United States the buyer of a coupon bond owes the seller accrued interest through the settlement date of the transaction. Each marketplace i.e. Treasury, corporate, municipal, has a specific set of conventions that are used to calculate accrued interest. clean price accrued interest invoice price + In an efficient market, the present value of the remaining bond payments is equivalent to the invoice price. Day counts include the settlement date and omit the cash flow date. Treasury coupon markets (notes, bonds) use actual/actual day count convention. Corporate, Municipal markets use 30/360 day count convention. US – Treasury Bond 11 5/8 coupon, maturity 11/15/2004, issued 10/30/84 coupon 11.625 maturity 11/15/04 SD bid ask ask NCD LCD w v accrued ask invoice yield 8/9/99 124.08 124.14 6.12% 11/15/99 5/15/99 0.4674 0.5326 2.717 124.4375 127.15421 9/04/03 111.31 1.47% 11/15/03 5/15/03 0.6087 0.3913 3.538 111.96875 115.50675 8/31/04 102.03 1.422% 11/15/04 5/15/04 0.5870 0.4130 3.412 102.09375 105.50575 On any date except a coupon payment date bond transactions will involve accrued interest. The buyer of the bond will pay the seller of the bond the “clean” price plus accrued interest. The sum of the “clean” price and the accrued interest is often called the invoice price; it is the cash outlay necessary to purchase the bond. The invoice price is the present value of the bond’s remaining cash flows. 2 The quote information from Barron’s 8/9/99 reflects secondary market dealer quotes for the 115/8% of 2004 Treasury bond. The “clean” bid price is 124 8/32 = $124.25 per $100 face value. The dealer is willing to pay $124.25 to purchase this bond. The “clean” ask price is 124 14/32 = $124.4375 per $100 face value. The dealer is willing to sell this bond for $124.4375. The accrued interest for a transaction on the settlement date, 8/9/99, will depend on the days since the last coupon payment and the day count conventions in the Treasury market. In the Treasury market the actual/actual day count convention is used. w days between LCD and SD (1 v) days between LCD and NCD The fraction (w) is the portion of a six-month period since the last coupon payment date. # days between 5/15/99 and 8/9/99 = 86 # days between 5/15/99 and 11/15/99 = 184 w = 86/184 = .467391 The calculation of accrued interest depends on; w, face value, and coupon rate. For this example the face value is $100. accrued interest = (1/2)*(.11625)*(0.46739)*(100) = 2.7167 To purchase this bond the invoice price = “clean” ask price + accrued interest. invoice price = $124.4375 + 2.7167 = 127.1542. Bond yield measures: Yield to maturity – internal rate of return. – Measure of expected return if P(t) paid, bond held to maturity, coupons received as promised, coupons reinvested at yield to maturity through maturity date. Total return of investment i.e., (total future dollars)/P(t) scaled for time and stated on annual basis = yield to maturity. Yield to maturity = coupon rate ++ > invoice price = par value Yield to maturity < coupon rate ++ > invoice price > par value Yield to maturity > coupon rate ++ > invoice price < par value Invoice price and yield to maturity are inversely related for straight bonds (non-callable, non-convertible) the relationship is convex. 3 The yield to maturity of a portfolio is not the weighted average of the yield to maturities of the individual bonds. To calculate the yield to maturity of a portfolio of bonds; 1. Determine the market value of the portfolio of bonds: (clean price and accrued interest). 2. Determine the size and timing of the cash flows promised to accrue to the portfolio. 3. Find the required yield that makes the discounted value of the promised cash flows equal to the market value of the bond portfolio. BOND A B C Coupon 5% 6.50% 7% Maturity 3 7 10 ytm 3% 4% 6% M Value P/$ 1.056971872 1.15132811 1.074387374 $1,000,000 $2,000,000 $3,000,000 $1,056,971.87 $2,302,656.22 $3,223,162.12 Current value ytm WA ytms Cashflow map portfolio Period A B C Portfolio 1 25000 65000 105000 195000 2 25000 65000 105000 195000 3 25000 65000 105000 195000 4 25000 65000 105000 195000 5 25000 65000 105000 195000 6 1025000 65000 105000 1195000 7 65000 105000 170000 8 65000 105000 170000 9 65000 105000 170000 10 65000 105000 170000 11 65000 105000 170000 12 65000 105000 170000 13 65000 105000 170000 14 2065000 105000 2170000 15 105000 105000 16 105000 105000 17 105000 105000 18 105000 105000 19 105000 105000 20 3105000 3105000 Portfolio $6,582,790.21 5.1491% 4.8187% 190105.6096 185334.0657 180682.2849 176147.2611 171726.0639 1025958.586 142288.9476 138717.5751 135235.8419 131841.4983 128532.3508 125306.2611 122161.1444 1520212.243 71712.376 69912.43569 68157.67286 66446.95359 64779.17242 1867531.869 6582790.214 4 Call Provision (Option) – Issuer’s option to payoff bond before scheduled maturity date as specified in call provision terms. Callable for purpose of refinancing, Callable for general business purposes (financial reorganizations, sinking fund purposes, etc.) Sinking Fund - Retirement of a portion of a bond issue at regularly scheduled intervals. Conversion Option – Some bonds are convertible to equity or other assets at the option of the bond holder. Put Option – Some bonds can be sold back to the issuer on dates prior to the maturity date. Interest rate risk, bond characteristics, level of ytm, direction of change ytm: n P C t 1 (1 0.5 * y ) t M * (1 0.5 * y) n P = invoice price C = 0.5*c*M y = yield M = maturity value or call price or put price Basis point = 1/100 of 1% , in decimal form 0.0001. v=0; ytm = 5%, coupon rate = 5%, maturity = 5 years, semi-annual, change in bps = 50 bps. 1. Increasing ytm will cause a smaller percentage price decline than decreasing ytm the same number of basis points will cause a percentage price increase. (Convexity) 5-year maturity, 5%-coupon (Price ytm = 5%) = $100 (Price ytm = 5.50%) = $97.84, change = -2.16% (Price ytm = 4.50%) = $102.22, change = +2.22% 2. The percentage change in price caused by a given change in ytm is greater the smaller the initial ytm. (Convexity) 5-year maturity, 5%-coupon (Price ytm = 5%) = $100 (Price ytm = 5.50%) = $97.84, change = -2.16% 5 5-year maturity, 5%-coupon (Price ytm = 10%) = $80.70 (Price ytm = 10.50%) = $79.02, change = -2.08% Price volatility and cash flows (timing and size): 3. The percentage change in price caused by a given change in ytm is greater the longer the time to maturity. First bond has 5-year maturity. Second bond has 10-year maturity 5-year maturity, 5%-coupon (Price ytm = 5%) = $100 (Price ytm = 5.50%) = $97.84, change = -2.16% 10-year maturity, 5%-coupon (Price ytm=5%) = $100 (Price ytm =5.5%)=$96.19, change = -3.81% 4. The percentage change in price caused by a given change in ytm is greater the smaller the coupon rate. First bond has 5% coupon rate. Second bond is a zerocoupon 5-year bond. 5-year maturity, 5%-coupon (Price ytm = 5%) = $100 (Price ytm = 5.50%) = $97.84, change = -2.16% 5-year maturity, 0%-coupon (Price ytm=5%) = $78.12 (Price ytm=5.5%)=$76.24, change = -2.41% Measures of interest rate risk: Price Value of a Basis Point (PVBP) – a measure of localized price risk. 5-year maturity, 5%-coupon (Price ytm = 5% )= $100 (Price ytm = 5.01% )= $99.95625, PVBP = $0.04375 10-year maturity, 5%-coupon (Price ytm = 5% )= $100 (Price ytm = 5.01%) = $99.9221, PVBP = $0.07791 5-year maturity, 0%-coupon (Price ytm=5%) = $78.12 (Price ytm=5.01%)=$78.08, PVBP = $0.03810 6 Yield value of a 32nd – A measure of localized price risk 1/32nd of $1 = $0.03125 5-year maturity, 5%-coupon (ytmPrice=$100) = 5% (ytmPrice = $99.96875) = 5.00714%, YV32 = 0.71423% 10-year maturity, 5%-coupon (ytmPrice=$100) = 5% (ytmPrice =$99.96875) = 5.00401%, YV32=0.0041% 5-year maturity, 0%-coupon (ytmPrice =$78.12)=5% (ytm Price=$78.0886) = 5.0082%, YV32=0.0082% 5-yr,c=5%,ytm=5% P0 $100.00 PVBP $0.0437 YV32 0.0071% MaCaulay Modified 4.4854 4.3760 10-yr, c=5%,ytm=5% 5-yr,c=0%,ytm=5% $100.00 $78.12 $0.0779 $0.0381 0.0041% 0.0082% 7.9894 5.0000 7.7946 4.8780 5-yr,c=5%,ytm=10% $80.70 $0.0339 0.0092% 4.4138 4.2036 From Taylor series expansion of bond price-yield to maturity relationship, P=P(y): dP P( y1 ) P( y 0 ) P 1 2P ( y1 y 0 ) ( y1 y 0 ) 2 Rm 2 y 2 y Modified duration = D* C D* y 2 1 (1 y) n(M C y) (1 y) n P dP D* ( P) (dy) Macaulay’s duration = D n D t C t 1 (1 y ) t n M (1 y ) n P 7 ( n 1) 1 P P y Modified duration = D* = D/(1+y) Duration is typically measured in years. It is necessary to divide duration measured in six-month periods by two to restate on an annual basis. Duration and market risk management: A bond that has a Macaulay’s duration equal to the investor’s investment horizon is said to immunize the investor against a change in the level of interest rates. Over the time period equal to a bond’s Macaulay’s duration a change in value due to a parallel shift in the yield curve (change in yield to maturity) is exactly balanced by the change in reinvestment income and bond price change. When yield to maturity increases value falls but reinvestment income increases. When yield to maturity decreases value increases but reinvestment income decreases. If the bond’s Macaulay’s duration is greater than an investor’s investment horizon the bond will add interest rate risk exposure (reduce reinvestment risk exposure) to the investor’s position. If the duration of a bond is shorter than the investor’s investment horizon the bond will add reinvestment risk exposure (reduce interest rate risk exposure). Duration does not contract on a year-to-year basis as bond approaches maturity. 5% Semi-annual coupon bond, yield-to-maturity 6% 30 25 20 15 10 5 4 3 Maturity (years) Macaulay’s 14.77 13.76 12.37 10.47 7.90 4.47 3.67 2.74 2 1 1.93 0.99 To maintain an immunized position an investor must rebalance the position as time passes. In addition to the time pattern of duration illustrated in the table, duration rises whenever a bond pays a coupon. This regular fluctuation in duration is more pronounced for longer maturity bonds. Duration is a function of yield to maturity. yield to maturity Macaulay’s 5% Semi-annual coupon bond, 30-year 5% 6% 7% 8% 15.84 14.77 13.73 12.75 9% 10% 11.82 10.96 To maintain an immunized position after substantial change in a bond’s yield to maturity an investor must rebalance the position to protect against additional changes in yield to maturity. 8 The duration (D or D*) of a portfolio is equal to the weighted average of the component bond’s duration’s. Convexity is determined by the second derivative of the bond price-yield to maturity relationship : 2P y 2 2C y 3 1 (1 y) 2Cny n 2 (1 y ) ( n 1) n(n 1)( M C ) (1 y ) ( n 2) y 2P (4 P) years y 2 From Taylor series expansion of bond price-yield to maturity relationship: Convexity = CV = dP P( y1 ) P( y 0 ) P 1 2P ( y1 y 0 ) ( y1 y 0 ) 2 Rm 2 y 2 y 1 (CV ) ( P) (dy ) 2 2 1 dP D * ( P) (dy ) (CV ) ( P) (dy ) 2 Rm 2 dP The convexity of a portfolio is the weighted average of the convexities of the portfolio’s assets. Yield spreads – differences in yield to maturity of financial assets. Factors that affect yield spreads: 1. 2. 3. 4. 5. 6. 7. Type of issuer – federal, agency, state, municipal, corporate Perceived credit worthiness of issuer – credit rating Collateral, sinking fund provisions, status in default Term to maturity Embedded options – call, conversion Tax treatment of interest Liquidity of issue. On-the-run Treasury securities vs. off-the-run Treasury securities http://www.publicdebt.treas.gov/ Monthly Statement of the Public Debt and Auction information The term structure of interest rates – the relationship between spot rates and time to maturity all other factors affecting yield held constant. 9 A spot rate is the yield to maturity on a zero-coupon bond. Each maturity has a potentially unique spot rate. The term structure of interest rates produced from the market quotes of Treasury securities is referred to as the default risk free term structure. The default risk free term structure is an important input in the pricing of other debt market instruments such as bank loans, mortgages, corporate bonds, etc. A U.S. Treasury bond can be thought of as a portfolio of zero coupon payments, each occurring for a different holding period. The bond pricing equation can be expressed as a sequence of lump sum payments discounted at spot rates corresponding to the holding period of each payment. n (1) P Ct t 1 (1 0.5 rt ) t M (1 0.5 rn ) n Where r1 = annualized six-month spot rate, r2 = annualized one-year spot rate, …, rn is the annualized rate applicable to a cash flow occurring at the last payment date of the bond. (r1, r2, . . . rn) are the default risk free term structure of interest rates. Value of 5%, 5-year,M=$100 and US Treasury spot rate curves Feb-80 Feb-85 Feb-90 Feb-95 Feb-96 Feb-97 Sep-99 Value $75.07 $75.88 $85.99 $90.46 $97.90 $95.21 $96.43 ytm 11.73% 11.47% 8.49% 7.31% 5.49% 6.13% 5.83% Spot Rates 6M 13.47% 8.93% 8.24% 6.34% 4.89% 5.35% 5.09% 12M 13.34% 9.32% 8.28% 6.66% 4.82% 5.57% 5.38% 18M 12.45% 8.96% 8.30% 6.98% 5.82% 5.75% 5.49% 24M 12.18% 9.18% 8.37% 7.05% 5.73% 5.88% 5.59% 30M 12.03% 9.82% 8.32% 7.14% 5.46% 5.96% 5.63% 36M 11.86% 11.12% 8.40% 7.16% 5.62% 6.02% 5.67% 42M 11.86% 10.42% 8.40% 7.26% 5.16% 6.10% 5.76% 48M 11.71% 10.76% 8.42% 7.30% 5.05% 6.16% 5.77% 54M 11.61% 11.03% 8.43% 7.33% 5.44% 6.21% 5.81% 60M 11.69% 11.64% 8.51% 7.33% 5.50% 6.14% 5.85% 10 Sep-03 $108.65 3.12% 1.03% 1.18% 1.44% 1.70% 1.96% 2.21% 2.46% 2.71% 2.97% 3.22% n (2) P Ct t 1 (1 0.5 (rt RP )) t M (1 0.5 (rn RP )) n (2) augments (1) to allow for risk premiums appropriate for the cash flows being priced. The process for deriving the spot rate curve. The spot rate curve (term structure) is extracted from prices of US Treasury securities (Tbills, notes, bonds or STRIPS). There are many methods used in practice. Here, I will illustrate how to extract the spot rate curve from the set of on-the-run Treasury securities. Steps to construct the spot rate curve from market information. 1. Identify set of Treasury securities to be utilized. This step depends on the ultimate use of the spot rate curve. If the spot rate curve is produced to provide a general picture of the term structure all available (longest time to maturity possible) Treasury price (ytm) data, is required. If the spot rate curve is produced to value a specific bond Treasury price (ytm) data spanning the cash flows of the bond are necessary. Data sources useful for identifying appropriate Treasury securities: Yield Book: www.yieldbook.com http://www.publicdebt.treas.gov/ 2. Assemble the par coupon curve. First, find the yield to maturity of each of the basic securities identified in step 1. The par coupon curve is the set of yields to maturity and times to maturity from each of the Treasury securities identified in step 1. Second, use linear interpolation (more advanced methods can be used) to find the par coupon curve for six-month increments. 3. Bootstrap the spot rate curve from the par rate curve. 4. From the spot rate curve interpolate spot rates appropriate for the bond’s cash flow dates. Example: On-the-run Treasury securities (time to maturity and yield to maturity) settlement 8/1/2003 maturity coupon days years semi ytm T-bill 12/26/2003 NA 147 0.403 0.805479 0.94% T-bill 3/18/2004 NA 230 0.630 1.260274 1.01% 11 T-note T-note T-note T-note 8/31/2004 8/31/2005 8/15/2006 9/15/2008 2.1250% 2.0000% 2.3750% 3.1250% 396 761 1110 1872 1.085 2.169863 1.14% 2.085 4.169863 1.66% 3.041 6.082192 2.13% 5.129 10.25753 3.09% The par coupon curve (par/coupon rate) is the ytm=coupon rate necessary to make a bond with given maturity sell at par value. Par/coupon curve constructed using linear interpolation between (times to maturity, ytm) of on-the-run Treasuries. annual 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 semi 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 par/coupon PV(spot) rate spot 0.9699% 0.995174 0.9699% 1.1157% 1.0056 0.9944 0.988931 1.1161% 1.3558% 1.0068 0.988931 0.982272 1.1960% 1.6158% 1.0081 0.983452 0.97557 1.2405% 1.8640% 1.0093 0.978009 0.968978 1.2645% 2.1098% 1.0105 0.972604 0.962451 1.2798% 2.3410% 1.0117 0.967235 0.956044 1.2885% 2.5709% 1.0129 0.961901 1.2946% z1 z2 z3 z4 z5 z6 z7 z8 Constructing spot rate curve from par rate curve: For semi-annual period = 2, using face value = $1 $1 0.5 *1.1157% 1 0.5 *1.1157% (1 0.5 * 0.9699%) (1 0.5 * z 2 ) 2 For semi-annual period = 3, using face value = $1 0.5 * 1.3558% 0.5 *1.3558% 1 0.5 * 1.3558% (1 0.5 * 0.9699%) (1 0.5 * 1.1161%) 2 (1 0.5 * z 3 ) 3 In general spot rates are extracted from the par coupon curve through an algebraic process. $1 12 1 c z n 2 n 1 1 1 c i 1 (1 z i ) i 2 1/ n 1 where c = 0.5*coupon rate Using spot rate curve to find the value of a 4% coupon, semi-annual pay bond with payment dates 1/15, 7/15. Settlement date 8/01/03. Bond RP Coupon M P ytm 0.50% 4% $100 106.56 1.7747% Payment dates 1/15/2004 7/15/2004 1/15/2005 7/15/2005 1/15/2006 7/15/2006 days 167 349 533 714 898 1079 cash years semi zero z+RP flow 0.458 0.915 0.9472% 1.4472% $2.0 0.956 1.912 1.1033% 1.6033% $2.0 1.460 2.921 1.1897% 1.6897% $2.0 1.956 3.912 1.2366% 1.7366% $2.0 2.460 4.921 1.2626% 1.7626% $2.0 2.956 5.912 1.2785% 1.7785% $102.0 sum PV 1.986848 1.969694 1.951459 1.933483 1.915488 96.79841 106.5554 Forward rates Forward Period: Time Line in 6MO increments: 0-------------j-------------k The forward period (j,k) begins j periods from today[0] and ends k periods from today. The length of the forward period is k-j. 13 A forward rate is the rate earned during the forward period that makes the total return from a sequential loan at zj rolled over at the forward rate, jfk, equivalent to a single loan for k periods at zk. Calculating a annualized forward rate from semi-annual spot rates: Time Line in 6MO increments: 0-------------j-------------k (1 0.5 z j ) j (1 0.5 j f (k j ) ) (k j ) (1 0.5 z k ) k 1 0.5 z k k j f ( k j ) 2 j 1 0.5 z j 1 (k j ) 1 For these notes I will forego the algebraic adjustment accounting for semi-annual compounding. The final result will be multiplied by 2. zi = ½ x spot rate ifj = ½ x forward rate From the definition of a forward rate: (1 z 2 ) 2 (1 z1 ) (11f1 ) and (1 z3 ) 3 (1 z 2 ) 2 (1 2 f1 ) Substituting from the first expression into the second (1 z3 ) 3 (1 z1 ) (11f1 ) (1 2 f1 ) Solving for the rate z3: z3 2 3 (1 z1) (11f1) (1 2 f1) 1 Another way to write the same thing z3 2 (1 z1 ) (11f1) (1 2 f1) 1 3 1 Long rates (z3) are a geometric average of the short rate (z1) and forward rates (1f1 , 2f1). 14 Lending Strategies (a similar discussion concerning borrowing strategies is also possible): Consider the following setting: Semi 1 Spot z1 2 z2 Rate forward period 3% 1f1 = 5% 4% In this circumstance there are two possible lending strategies for a two period loan. Strategy #1: Buy two period zero coupon bond Total return form Strategy #1 is 4%. This equivalent to earning z1 = 3% over the first semi-annual period and 1f1 = 5% during the forward period. There is no interest rate risk in Strategy #1. Strategy #2 Sequential lending i.e. purchase one-period zero coupon bond planning to roll over proceeds into a second one-period bond at the end of the first period. The rate to be earned in the second period is a random variable. Label this rate 1 ~ z1 . Interest rate risk is present in Strategy #2. The realized rate during the second period could be less than 5%. Suppose the decision maker expects that the one-period rate during the forward period will be 6%, i.e. E0 (1~ z1 ) 6% . Which Strategy will the decision maker choose? How will the decision maker’s choice be reflected in the price of zero coupon bonds? If E(z)s equal forward rates then total return is equal for all investment strategies spanning an investment horizon. If E(z)s do not equal forward rates then total returns are not equal for all investment strategies spanning an investment horizon. Conditioned on E(z)s and decision maker’s risk tolerance, a decision maker may select a strategy that produces an interest rate risk exposure if the expected return from the investment strategy or expected cost from borrowing strategy is sufficient to compensate for the additional interest rate risk exposure. Term structure theories attempt to answer the question 15 “What determines the “shape” of the term structure?” Ultimately the term structure is determined by the factors that affect the supply and demand for fixed income securities of different maturities. The factors determine the relative price of securities of different maturities and hence the relative yields. Term structure theories are important in that they help market participants anticipate how economic phenomena will affect the level and slope of the term structure. Transacting in securities with time to maturity different than the participant’s investment (borrowing) horizon exposes the market participant to either price or reinvestment risk. The term structure theories discussed in the text (pages 111-116) are predicated on different assumptions concerning market participant’s interest rate risk tolerance. Pure expectations theory; Assumption – market participants are indifferent to the risk of trading in securities whose maturity is different than the participant’s investment (borrowing) horizon. Outcome – Zero coupon bonds prices (spot rates) will adjust until forward rates are equal to participant’s expectations of spot rates in future periods. Implication 1 – The shape of the term structure is determined by market participant’s expectations of short rates in future periods. jfk = E0(jzk) Implication 2 - The term structure will change level and/or shape when market participant’s expectations of short rates change. Implication 3 – Long-term spot rates are geometric averages of the shortest term spot rate and market participants expectations of spot rates. 1 z3 2 (1 z1) (1 E0 (1~ z2 )) (1 E0 ( 2 ~ z3 )) 3 1 The Liquidity Theory, Preferred Habitat Theory and the Segmented Markets theory differ in the assumed response of market participants to the risk of transacting in securities with time to maturity different than the participant’s investment (borrowing) horizon. These theories posit that market participants are averse to the risk of transacting in securities with time to maturity that does not match their investment (borrowing) horizon. The Liquidity Theory states that to get lenders to lend long term borrowers will have to offer a higher expected return to overcome the lender’s loss of liquidity. Hence the price of zero-coupon bonds reflects not only expected short rates as in the expectations hypothesis, but also reflects the necessary premium required to entice lenders. Liquidity theory; 16 Assumption – market participants are averse to the risk of trading in securities whose maturity is different than the participant’s investment (borrowing) horizon. Outcome – Zero coupon bond prices (spot rates) will adjust until forward rates reflect participant’s expectations of short rates in future periods and the necessary liquidity premiums. Implication – The shape of the term structure is determined by market participant’s expectations of short rates in future periods and the necessary liquidity premiums. jfk = E0(jzk) +jk The term structure will change level and/or shape when market participant’s expectations of short rates change and/or when liquidity premiums change. Preferred Habitat theory; Assumption – market participants are averse to the risk of trading in securities whose maturity is different than the participant’s investment (borrowing) horizon. Outcome – Zero coupon bond prices (spot rates) will adjust until forward rates reflect participant’s expectations of short rates in future periods and the necessary premiums to eliminate excess supply/excess demand for each segment of the term structure. Implication – The shape of the term structure is determined by market participant’s expectations of short rates and the necessary premiums. Premiums can be either positive or negative and need not be uniformly increasing. jfk = E0(jzk) +jk The term structure will change level and/or shape when market participant’s expectations of short rates change and/or when premiums change. Segmented Markets theory; Assumption – market participants are extremely averse to the risk of trading in securities whose maturity is different than the participant’s investment (borrowing) horizon. In fact market participants will only transact in securities that have time to maturity that matches their investment (borrowing) horizon. Outcome – Zero coupon bond prices (spot rates) reflect only the supply and demand for securities. The borrowers who have a horizon equal to the time to maturity determine the supply for a given time to maturity. The lenders who have a horizon equal to the time to maturity determine the demand for a given time to maturity. Implication – The shape of the term structure is independent of expectations of future interest rates and risk premiums. The term structure will change level and/or shape when factors affecting either supply or demand in a maturity segment change.Yield Spreads: Money markets: 17 LIBOR – London interbank offer rate – rate at which US dollar deposits are offered on loan. Deposits outside US banking system (not subject to reserve requirements and other regulatory costs of US banking system) LIBID – London interbank bid rate – rate bid for US dollars dollar deposits in the interbank market. LIBOR and LIBID reflect the credit rating (usually AA) of the money center banks operating in this market. LIBOR/LIBID interest cost/revenue computed using an actual/360 day count convention. Treasury bills: Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount basis using a 360 day year. A quote of 3% indicates the price of the bill is calculated as a 3% discount from face value. Given, M=$1,000,000 and t = 82 a quote of Yd = 3% can be used to find the purchase price for the bill: D = dollar discount = $1,000,000 * 0.03 * 82/360 = $6,833.33 P = M – D = $1,000,000 – 6,833.33 = 993,166.67 To state the yield on a bill in a comparable format to the yield on Treasury notes and bonds it is necessary to account for the discount interest of the bill and the 360 day money-market convention. For bills with less than 182 days till maturity BEY = D 365 $6,833.33 365 = = 3.063% P t $993,166.67 82 To calculate bond equivalent yield, for bills with maturity greater than 182 days it is also necessary to account for the fact that bills pay no coupons but notes and bonds do. Given, M=$1,000,000 and t = 200 a quote of Yd = 3% can be used to find the purchase price for the bill: D = dollar discount = $1,000,000 * 0.03 * 200/360 = $16,666.67 P = M – D = $1,000,000 – $16,666.67 = 983,333.33 18 BEY = 2 t 2 365 2 t 365t 2 365 11 M P 2 t 1 365 = 3.089% To compare the yield of a Treasury bill with the yield offered on non-discount money market instruments such as CDs the return on a Treasury bill must be adjusted to account for the discount interest of the bill. The CD equivalent (money market equivalent) yield on a Treasury bill can be found simply from the discount rate (all bill maturities) CDEY = 360 Yd 360 t Yd For the 82 day bill examined above: CDEY = 360 0.03 3.021% 360 82 0.03 Treasury auctions – Treasury bills notes and bonds are sold originally by the Treasury through regularly scheduled auctions. Details concerning the Treasury auctions (announcements, results, etc.) may be found at http://www.publicdebt.treas.gov/ Bills are generally auctioned on a Monday. Buyers receive the bills the following Thursday. Bills auctioned in October 2003: Recent Treasury Bill Auction Results Term Issue Date Maturity Discount Investment Date Rate % Rate % Price Per $100 CUSIP 28-DAY 10-23-2003 11-20-2003 0.895 0.916 99.930 912795NX5 91-DAY 10-23-2003 01-22-2004 0.920 0.939 99.767 912795PG0 182-DAY 10-23-2003 04-22-2004 1.015 1.037 99.487 912795PV7 28-DAY 10-16-2003 11-13-2003 0.870 0.889 99.932 912795NW7 91-DAY 10-16-2003 01-15-2004 0.905 0.923 99.771 912795PF2 182-DAY 10-16-2003 04-15-2004 0.985 1.006 99.502 912795PU9 28-DAY 10-09-2003 11-06-2003 0.855 0.863 99.934 912795NV9 91-DAY 10-09-2003 01-08-2004 0.920 0.939 99.767 912795PE5 19 182-DAY 10-09-2003 04-08-2004 0.995 1.017 99.497 912795PT2 12-DAY 10-03-2003 10-15-2003 0.920 0.946 99.969 912795QH7 28-DAY 10-02-2003 10-30-2003 0.845 0.863 99.934 912795NU1 92-DAY 10-02-2003 01-02-2004 0.935 0.953 99.761 912795PD7 182-DAY 10-02-2003 04-01-2004 1.005 1.027 99.492 912795PS4 20