Content of an Interim Financial Report

advertisement

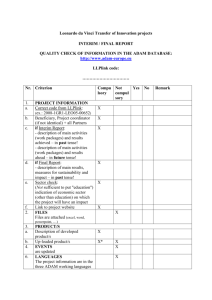

[Type text] for Accounting Professionals IAS 34 Interim financial reporting 2011 http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng IAS 34 Interim financial reporting IFRS WORKBOOKS (1 million downloaded) Welcome to IFRS Workbooks! These are the latest versions of the legendary workbooks in Russian and English produced by 3 TACIS projects, sponsored by the European Union (2003-2009) and led by PricewaterhouseCoopers. They have also appeared on the website of the Ministry of Finance of the Russian Federation. The workbooks cover various concepts of IFRS based accounting. They are intended to be practical self-instruction aids that professional accountants can use to upgrade their knowledge, understanding and skills. Each workbook is a self-standing short course designed for approximately of three hours of study. Although the workbooks are part of a series, each one is independent of the others. Each workbook is a combination of Information, Examples, Self-Test Questions and Answers. A basic knowledge of accounting is assumed, but if any additional knowledge is required this is mentioned at the beginning of the section. Having written the first three editions, we want to update them and provide them to you to download. Please tell your friends and colleagues. Relating to the first three editions and updated texts, the copyright of the material contained in each workbook belongs to the European Union and according to its policy may be used free of charge for any non-commercial purpose. The copyright and responsibility of later books and the updates are ours. Our copyright policy is the same as that of the European Union. We wish to especially thank Elizabeth Appraxine (European Union) who administered these TACIS projects, Richard J. Gregson (Partner, PricewaterhouseCoopers) who led the projects and all friends at Bankir.Ru for hosting the books. TACIS project partners included Rosexpertiza (Russia), ACCA (UK), Agriconsulting (Italy), FBK (Russia), and European Savings Bank Group (Brussels). The help of Philip W. Smith (editor of the third edition) and Allan Gamborg, project managers and Ekaterina Nekrasova, Director of PricewaterhouseCoopers, who managed the production of the Russian version (2008-9) is gratefully acknowledged. Glyn R. Phillips, manager of the first two projects conceived the idea, designed the workbooks and edited the first two versions. We are proud to realise his vision. Robin Joyce Professor of the Chair of International Banking and Finance Financial University under the Government of the Russian Federation Visiting Professor of the Siberian Academy of Finance and Banking http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Moscow, Russia 2011 Updated 2 IAS 34 Interim financial reporting CONTENTS Introduction Introduction 3 Aim The aim of this workbook is to assist the individual in understanding Interim Financial Reporting according to IAS 34. Definitions 5 IAS 34 for Banks 5 Content of an Interim Financial Report ....................... 5 Disclosure of Compliance with IAS 34....................... 10 Disclosure in Annual Financial Statements .............. 13 Recognition and Measurement .................................. 13 Restatement of Previously Reported Interim Periods16 Examples of applying the recognition and measurement principles ..................... 16 Examples of the use of estimates .............................. 23 Multiple choice questions 24 Answers to multiple choice questions ...................... 28 Note: Material from the following PricewaterhouseCoopers publications has been used in this workbook: Applying IFRS, IFRS News, Accounting Solutions http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng An interim financial report is a financial report that contains either a complete, or condensed, set of financial statements, for a period shorter than a full financial year. IAS 34 does not mandate which undertakings should publish interim financial reports, how frequently, or how soon after the end of an interim period. Those matters should be decided by national governments, securities regulators, stock exchanges, and accountancy bodies. IAS 34 applies if a company publishes an interim financial report in accordance with IFRS. IAS 34: (i) defines the minimum content of an interim financial report; and (ii) identifies the recognition and measurement principles that should be applied in an interim financial report. The interim notes include primarily an explanation of the events, and changes, that are significant to an understanding of the changes in financial position, and performance, since the last annual reporting date. Virtually none of the notes to the annual financial statements are repeated, nor updated in the interim report. 3 IAS 34 Interim financial reporting An undertaking should apply the same accounting policies in its interim financial report as are applied in its annual financial statements, except for policy changes made after the most recent annual statements, which are to be reflected in the next annual statements. EXAMPLE-change of accounting policy during the year In your financial statements in 2XX6, you accounted for property, using the cost method. You decide that for 2XX7, you will revalue your property. This change of policy should be reflected in your interim reports for 2XX7. Measurements for interim reporting purposes are made on a year-to-date basis. EXAMPLE-year-to-date basis You produce quarterly interim reports. In your second and third reports, you report cumulative (year-to-date) results, and provide notes on these figures, rather than just the results for that quarter. Income tax expense for an interim period is based on an estimated average annual effective income tax rate, consistent with the annual assessment of taxes. EXAMPLE-income tax rates You have 2 income tax rates. For the first $250.000, the rate is 20%. Above that it is 40% for all profits, including the first $250.000. Your profit for the interim period is $200.000. You will make $1m profit in the whole year. In your interim report, you use 40% as your tax rate. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Materiality should be considered on a year-to-date basis, not just the interim period. It should not be based on forecasted annual data. EXAMPLE-materiality based on interim results The bankruptcy of a key client has reduced your interim profit by 30%. The impact on the whole year will be minimal, as this interim period has little influence on the year as a whole. (This is due to your business being seasonal.) The bankruptcy is material in relation to the interim result, and should be fully disclosed in the interim report. Objective The objective of IAS 34 is to prescribe the minimum content of an interim financial report, and to prescribe the principles for recognition, and measurement, in complete (or condensed) financial statements for an interim period. Timely and reliable interim financial reporting improves the ability of investors, creditors, and others to understand an undertaking’s capacity to generate earnings, and cash flows, and its financial condition and liquidity. Scope Publicly-traded undertakings should provide interim financial reports that conform to IAS 34. Specifically, they are encouraged: (i) to provide interim financial reports at least as of the end of the first half of their financial year; and (ii) to make their interim financial reports available not later than 60 days after the end of the interim period. 4 IAS 34 Interim financial reporting If an undertaking’s interim financial report is described as complying with IFRS, it must comply with all of the requirements of IAS 34. Definitions Interim period is a financial reporting period shorter than a financial year. Interim financial report means a financial report containing either a complete set of financial statements, or a set of condensed financial statements, for an interim period. In reviewing interim reports of clients, analysts should recall that interim reports are rarely audited. Therefore, reliance on the information is less than can be placed on annual financial statements. Content of an Interim Financial Report IAS 1 defines a complete set of financial statements as including the following components: ((i) a statement of financial position as at the end of the period; IAS 34 for Banks (ii) a statement of comprehensive income for the period; The publication of interim reports enables banks to update interested parties on their progress since the previous annual financial statements. IAS 34 provides no specific guidance on how much IFRS 7 information relating to risk management is required. Banks can choose between an update of the annual financial statements, or to provide a comprehensive analysis of similar detail to that provided in the annual financial statements. (iii) a statement of changes in equity for the period; In the economic climate of 2007-8, confidence in the international banking system has been low. Interim reports provide an opportunity to provide comprehensive details of the risk management systems to enhance confidence in the bank, rather than just a short update. Confidence in a bank and its risk management provides a lower cost of funds in contrast to those banks about which less is known, or which have chosen not to update interested parties since the previous annual financial statements. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng (iv) a statement of cash flows for the period; (v) notes, comprising a summary of significant accounting policies and other explanatory information; and (vi) a statement of financial position as at the beginning of the earliest comparative period when an undertaking applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements. (Note: an audit report is not required, though is generally provided.) An undertaking may provide less information at interim dates as compared with its annual statements. 5 IAS 34 Interim financial reporting An undertaking may publish a complete set of financial statements in its interim financial report, rather than condensed statements and selected explanatory notes. It may publish more than the minimum line items, or selected explanatory notes, as set out in IAS 34. Minimum Components of an Interim Financial Report Minimum content of an interim financial report is a: condensed balance sheet (statement of financial position), income, income;, - Additional line items, or notes, should be included if their omission would make the condensed interim statements misleading. Basic, and diluted, earnings per share should be presented on the face of an income statement, complete or condensed, for an interim period when the undertaking is within the scope of IAS 33 Earnings per Share. IAS 1 provides guidance on major headings and subtotals. condensed cash flow statement, - Condensed statements should include, at a minimum, each of the headings and subtotals that were included in its most recent annual statements, and the selected explanatory notes as required by IAS 34. condensed income statement of comprehensive presented as either: (i) a condensed single statement; or (ii) a condensed separate income statement and a condensed statement of comprehensive - A complete set of financial statements presented in an interim financial report, should conform to the requirements of IAS 1 for a complete set of financial statements. condensed statement showing changes in equity showing either (i) all changes in equity or (ii) changes in equity other than those arising from capital transactions with owners and distributions to owners; and Changes in equity arising from capital transactions with owners, and distributions to owners, may be shown either on the face of the statement of changes in equity, or in the notes. An undertaking follows the same format in its interim statement showing changes in equity as it did in its most recent annual statement. selected explanatory notes. Form and Content of Interim Financial Statements http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng EXAMPLE-transactions with owners In your annual statement, you used the notes to detail dividends and new share issues, rather than on the face of the changes in 6 IAS 34 Interim financial reporting equity statement. You will use the same format for the interim reports. An interim report is prepared on a consolidated basis, if the undertaking’s most recent annual statements were consolidated statements. The inclusion of the parent’s separate statements in the interim report is optional. EXAMPLE- Impact of timing of interims Undertaking A has a 65% subsidiary, undertaking B. A and B will prepare its first annual IFRS financial statements for the year ending 31 December 2005. The transition date for each undertaking is therefore 1 January 2004. Undertakings A and B both have shares that are publicly traded, but they are listed on different stock exchanges. Undertaking A’s regulator requires half-yearly interim information to be published, whereas undertaking B’s regulator requires quarterly interim information to be published. Undertaking B will therefore publish IFRS financial statements before its parent. Both regulators require the interim information to be published in accordance with IFRS. Does this trigger the requirement of IFRS 1, First-time Adoption, which requires a parent that becomes a first-time adopter later than its subsidiary to measure the assets and liabilities of the subsidiary at the same carrying amounts as in the subsidiary’s financial statements? http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng No. A subsidiary publishing interim results before its parent does not cause the requirement of IFRS 1 to be triggered. The requirement is applicable only if the transition date of the subsidiary is earlier than the transition date of the parent. Undertakings A and B have the same transition date, so undertaking A is not required to use the same carrying amounts for B’s assets and liabilities as are recognised in B’s own IFRS financial statements. Selected Explanatory Notes It is unnecessary to provide relatively-insignificant updates to the information that was reported in the most recent annual report. EXAMPLE- relatively-insignificant updates Your annual statements provided a full description of your pension plan. Labour turnover has been higher than planned since then, but your advisers have said that there is no need to reconsider contribution levels until later. This information should not be included in the interim report, unless pensions generally, or your plan specifically, are of current concern to the users. At an interim date, an explanation of events and transactions which are significant to the changes in financial position, and performance, since the last annual report is more useful. EXAMPLE- IFRS 7 and interim reporting Undertaking B is applying IFRS 7, Financial Instruments: Disclosures, for the first time from 1 January 2007. 7 IAS 34 Interim financial reporting statements or, if those policies or methods have been changed, a description of the nature and effect of the change; Management is preparing its condensed interim financial report for the period ending 30 June 2007 in accordance with IAS 34. Should B apply IFRS 7 in the interim financial statements for the period ending 30 June 2007? IFRS 7 is a disclosure standard rather than a measurement standard. IAS 34 requires the interim report to be prepared using the same policies as will be used for the next annual financial statements, and that any changes to the policies are explained in the notes. Adopting IFRS 7 will not affect the amounts reported in the primary statements and will not cause a change to the interim reporting where a condensed interim report is presented. However, IAS 34 requires that an explanation of events and transactions is given where an understanding of these is significant to understanding the current interim period. When identifying the disclosures necessary to explain such an event or transaction, consideration should be given to the IFRS 7 disclosures that might be required for that event or transaction in the annual financial statements. However, an undertaking that includes a complete set of financial statements in its interim report, rather than condensed financial information, should present all of the disclosures required by IFRS 7, including full comparative information. An undertaking should include the following information, as a minimum, in the notes to its interim statements, if material and if not disclosed elsewhere: (i) a statement that the same policies and methods of computation are followed in the interim statements as compared with the most recent annual financial http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng EXAMPLE-change of policy You have changed your inventory policy from FIFO to weightedaverage cost, at the start of the year. This needs to be disclosed, with the reasons and the impact on results. (ii) explanatory comments about the seasonality, or cyclicality, of interim operations; EXAMPLE-seasonality You run a travel business. You make profits in summer, from the holiday trade, and make losses during the rest of the year. This needs to be fully explained in the interim reports. (ii) the nature and amount of items affecting assets, liabilities, equity, net income, or cash flows that are unusual due to their nature, size, or incidence; EXAMPLE-unusual cash flows You have received a large advance payment for a contract that enables you to repay many loans. The details need to be disclosed. (iv) the nature and amount of changes in estimates reported in prior interim periods of the current financial year, or changes in estimates of amounts reported in prior financial years, if those changes have a material effect in the current interim period; EXAMPLE-changes in estimates 8 IAS 34 Interim financial reporting In a prior year, you made a provision of $5m to settle a lawsuit. This year, you make the settlement, and it costs you only $3m. The $2m gain needs to be identified, and explained. (v) issuances, repurchases, and repayments of debt and equity securities; EXAMPLE-repayments of debt You have exchanged $30m of your bonds by issuing $24m of shares. This needs to be disclosed. (vi) dividends paid (aggregate, or per share) separately for ordinary shares and other shares; EXAMPLE-dividends paid You have paid $0,50 dividend per share on your ordinary shares, and $0,24 dividend per share on your preferred shares. $0,12c of the preferred share dividend was in arrears, due in the last financial year, but not paid. All of this information needs to be disclosed. (vii) segment revenue and segment result for operating segments (see IFRS 8 workbook); The following segment information (disclosure of segment information is required in an undertaking’s interim financial report only if IFRS 8 Operating Segments requires that undertaking to disclose segment information in its annual financial statements): i. revenues from external customers, if included in the measure of segment profit or loss reviewed by the chief operating decision maker or otherwise regularly provided to the chief operating decision maker; http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng ii. intersegment revenues, if included in the measure of segment profit or loss reviewed by the chief operating decision maker or otherwise regularly provided to the chief operating decision maker; iii. a measure of segment profit or loss; iv. total assets for which there has been a material change from the amount disclosed in the last annual financial statements; v. a description of differences from the last annual financial statements in the basis of segmentation or in the basis of measurement of segment profit or loss; vi. a reconciliation of the total of the reportable segments' measures of profit or loss to the undertaking's profit or loss before tax expense (tax income) and discontinued operations. However, if an undertaking allocates to reportable segments items such as tax expense (tax income), the undertaking may reconcile the total of the segments' measures of profit or loss to profit or loss after those items. Material reconciling items shall be separately identified and described in that reconciliation. (viii) material events, subsequent to the end of the interim period, that have not been reflected in the financial statements for the interim period; EXAMPLE- material events, subsequent to the end of the interim period 9 IAS 34 Interim financial reporting Your interim report is to June 30th. On July 5th, you agree to purchase a competitor, which will add 50% to your business. This is vital information to users, and should be fully disclosed in the interim report. (ix) the effect of changes in the composition of the undertaking during the interim period, including business combinations, acquisition or disposal of subsidiaries and long-term investments, restructurings, and discontinuing operations; and EXAMPLE-disposal of subsidiaries Individual IFRS provide guidance regarding disclosures for many of these items: (i) the write-down of inventories to net realisable value, and the reversal of such a write-down (IAS 2); (ii) recognition of a loss from the impairment of property, plant, and equipment, intangible assets, or other assets, and the reversal of such an impairment loss (IAS 36); (iii) the reversal of any provisions for the costs of restructuring (IAS 37); (iv) acquisitions and disposals of items of property, plant, and equipment (IAS 16); (v) commitments for the purchase of property, plant, and equipment (IAS 16); (vi) litigation settlements (IAS 37); (vii) corrections of errors in previously-reported financial data (IAS 8); (viii) any debt default, or any breach of a debt covenant, that has not been corrected subsequently (IAS 1); and (ix) related party transactions (IAS 24). During the reporting period, you sold a subsidiary that represented 25% of your sales and 20% of your profit. This needs to be disclosed. (x) changes in contingent liabilities, or contingent assets, since the last annual balance sheet date. EXAMPLE-changes in contingent liabilities You are being sued for environmental damage. You have previously recorded a contingent liability for $25m, but the government is now suing you for $100m. You take professional advice, and if necessary, change the contingent liability, and disclose the details. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng The disclosures required by other IFRS are not required if an undertaking’s interim financial report includes only condensed financial statements, and notes. Disclosure of Compliance with IAS 34 10 IAS 34 Interim financial reporting If an undertaking’s interim financial report is in compliance with IAS 34, that fact should be disclosed. Periods for which Interim Financial Statements are Required to be Presented Interim reports should include interim statements (condensed, or complete) for periods as follows: (assuming December year-end) (i) balance sheet as of the end of the current interim period, and a comparative balance sheet, as of the end of the immediately-preceding financial year; EXAMPLE-balance sheets Current period September 2XX5, comparative December 2XX4. (ii) income statements of comprehensive income for the current interim period and cumulatively for the current financial year to date, with comparative income statements of comprehensive income for the comparable interim periods (current and year-to-date) of the immediately preceding financial year;. As permitted by IAS 1, an interim report may present for each period either a single statement of comprehensive income, or a statement displaying components of profit or loss (separate income statement) and a second statement beginning with profit or loss and displaying components of other comprehensive income (statement of comprehensive income). EXAMPLE-income statements Current period July-September 2XX5, cumulative January to September 2XX5, comparative July- September 2XX4, cumulative January to September 2XX4. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Note: There is a mismatch between the dates of the balance sheets and the income statements presented according to IAS 34. Additional information can be presented to overcome this. (ii) statement showing changes in equity cumulatively for the current financial year to date, with a comparative statement for the comparable year-to-date period of the immediately-preceding financial year; and EXAMPLE-changes in equity Cumulative January to September 2XX5, comparative January to September 2XX4. (iv) cash flow statement cumulatively for the current financial year to date, with a comparative statement for the comparable year-to-date period of the immediatelypreceding financial year. EXAMPLE-cash flow statement Cumulative January to September 2XX5, comparative January to September 2XX4. In addition, for a business that is highly seasonal, financial information for the twelve months ending on the interim reporting date, and comparative information for the prior twelve-month period may be useful. EXAMPLE-seasonal reporting Cumulative October 2XX4 to September 2XX5, comparative October 2XX3 to September 2XX4. 11 IAS 34 Interim financial reporting Undertaking Publishes Interim Financial Reports Half-Yearly The undertaking’s financial year ends 31 December (calendar year). The undertaking will present the following financial statements (condensed or complete) in its half-yearly interim financial report as of 30 June 2XX1: Balance Sheet: At Income Statement: 6 months ending Cash Flow Statement: 6 months ending Statement of Changes in Equity: 6 months ending 30 June 2XX1 31 December 2XX0 Balance Sheet: At Income Statement: 6 months ending 3 months ending Cash Flow Statement: 6 months ending Statement of Changes in Equity: 6 months ending 30 June 2XX1 31 December 2XX0 30 June 2XX1 30 June 2XX0 30 June 2XX1 30 June 2XX0 30 June 2XX1 30 June 2XX0 30 June 2XX1 30 June 2XX0 30 June 2XX1 30 June 2XX0 Materiality 30 June 2XX1 30 June 2XX0 30 June 2XX1 30 June 2XX0 Materiality should be assessed in relation to the interim period financial data. Interim measurements may rely on estimates to a greater extent than measurements of annual financial data. Information is material if its omission, or misstatement, could influence the decisions of users. Undertaking Publishes Interim Financial Reports Quarterly The undertaking’s financial year ends 31 December (calendar year). The undertaking will present the following financial statements (condensed or complete) in its quarterly interim financial report as of 30 June 2XX1: IAS 8 requires that Net Profit for the Period requires separate disclosure of unusual items, discontinued operations, changes in accounting estimates, errors, and changes in accounting policies. IAS 8 does not contain quantified guidance as to materiality. EXAMPLE-errors http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 12 IAS 34 Interim financial reporting An interim audit discovers that sales have been materially current period, or is expected to have a material effect in subsequent periods. overstated in the previous year. This will be disclosed, and accounted for under IAS 8. An interim financial report includes all information, that is relevant to understanding the financial position, and performance during the interim period. Disclosure in Annual Financial Statements If an estimate of an amount reported in an interim period is changed significantly during the final interim period of the year, but a separate financial report is not published for that period, the nature and amount of that change in estimate should be disclosed in the annual statements for that financial year. EXAMPLE-estimates changed in the last part of the year You settle a lawsuit in December, just prior to your year-end. This costs you $5m more than your provision, which you showed in your interim report. This update will be reported in your year-end accounts. IAS 8 requires disclosure of the nature and the amount of a change in estimate, that either has a material impact in the http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng EXAMPLE-material impact in subsequent periods Following approval of your annual financial statements, you decide to accelerate the depreciation on your properties. As these comprise your largest asset group, there will be a material impact on future periods. Details will be disclosed in your interim report. IAS 34 requires similar disclosure in an interim financial report. Examples include changes in estimate in the final interim period relating to: - inventory write-downs, - restructurings, or - impairment losses that were reported in an earlier interim period of the financial year. The disclosure is intended to be narrow in scope - relating only to the change in estimate. An undertaking is not required to include additional interim period financial information in its annual statements. Recognition and Measurement Same Accounting Policies as Annual The principles for recognising assets, liabilities, income, and expenses for interim periods are the same as in annual financial statements. 13 IAS 34 Interim financial reporting To illustrate: (i) the principles for recognising and measuring losses from inventory write-downs, restructurings, or impairments in an interim period are the same as those that an undertaking would follow if it prepared only annual statements. However, if such items are recognised and measured in one interim period and the estimate changes later in the same financial year, the original estimate is changed in the later period either by accrual of an additional amount of loss, or by reversal of the previously recognised amount; EXAMPLE-extra inventory write-downs In your first interim report, you disclose a provision against obsolete inventory of $10m. You believe that you will be able to sell 33% of the obsolete inventory abroad, so the provision represents only 67% of the inventory. In the next period, you are unable to sell the inventory abroad, and know that it will have to be scrapped. You increase the provision to $15m to reflect this. (ii) a cost that does not meet the definition of an asset, at the end of an interim period, is not deferred on the balance sheet, but treated as a cost; and EXAMPLE- cost that does not meet the definition of an asset You have been incurring research costs. You anticipate that the project will soon qualify for the development stage (IAS 38). These research costs should be recognised as expense, not deferred on the balance sheet. (iii) income tax expense is recognised in each interim period based on the best estimate of the weighted- http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng average annual income tax rate expected for the full financial year. Amounts accrued for income tax expense in one interim period, may have to be adjusted in a subsequent interim period, if the estimate of the annual income tax rate changes. EXAMPLE- income tax rate changes You make $10m profit in the first quarter. The annual tax rate is 20%, so you provide for $2m income tax. In the next quarter, the national tax rate is lifted to 30%. You make a $20m profit. You provide for $6m income tax for that quarter, plus $1m to adjust for the new rate being applied to first quarter profit. A liability at an interim reporting date must represent an existing obligation at that date, just as it must at an annual reporting date. EXAMPLE-Provisions IAS 37 prescribes the limits of when provisions can be made (and when they cannot). IAS 37 applies equally to interim reports. Restructuring provisions for reorganisations later in the year must meet the criteria at the balance sheet date of the interim report to be included. It is not enough that those criteria will be met before year-end. Income and expenses reported in the current interim period will reflect any changes in estimates (such as depreciation, doubtful debt provisions) reported in prior-interim periods of the financial year. 14 IAS 34 Interim financial reporting Changes in estimates are defined in IAS 8. The amounts reported in an interim financial report are not retrospectively adjusted. However, the nature and amount of any significant changes in estimates be disclosed. EXAMPLE-interims not retrospectively adjusted After you interim report is published, a key client goes into liquidation. Your doubtful debt provision proves to be inadequate, and you have a significant write-off in the next period. The interim report is not restated, but the next report will detail the impact of this liquidation. An undertaking that reports more frequently than half-yearly measures income and expenses on a year-to-date basis for each interim period. EXAMPLE-materiality is based on cumulative figures In the third quarter, you have an inventory write-down. In deciding whether it is material, and whether it should be reported, the cumulative figures (rather than those for the quarter) provide the basis for judgement. EXAMPLES- revenues received seasonally, cyclically, or occasionally Dividend revenue, royalties, and government grants: if these revenues have not been recognised (see IAS 18 and IAS 20) at the interim date, they should not be recorded in anticipation of year-end, or because they are being received later in the year than last year. Additionally, some undertakings consistently earn more revenues in certain interim periods of a financial year than in other interim periods, for example, seasonal revenues of retailers. Such revenues are recognised when they occur. EXAMPLE-seasonal revenue of retailers You are a retailer that makes losses in the first quarter, compensated by profits in the second, third and fourth quarters. You show the each quarter’s results as they are, without transferring revenues from one quarter to another. Costs Incurred Unevenly During the Financial Year Costs that are incurred unevenly during the financial year should Revenues Received Seasonally, Cyclically, or Occasionally be anticipated (or deferred) for interim reporting purposes, only if Revenues that are received seasonally, cyclically, or occasionally it is also appropriate to anticipate (or defer) that type of cost at within a financial year should not be anticipated (or deferred) as the end of the financial year. of an interim date, if anticipation (or deferral) would not be appropriate at the end of the undertaking’s financial year. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng EXAMPLE-construction contracts (IAS 11) To match contract revenue, certain costs can be transferred to work in progress, rather than immediately expensed. Other costs 15 IAS 34 Interim financial reporting must be expensed when incurred, regardless of the recognition of revenue. These rules apply equally to interim reports. will also have to restate the first quarter interim results, and any comparative results (from prior years) that are presented. Use of Estimates Examples of applying the recognition and measurement principles . 1. Employer payroll taxes and insurance contributions Interim financial reports generally will require a greater use of estimation methods than annual financial reports. EXAMPLE-estimates at the interim Inventories may not be counted at the interim, and accounting figures may be relied upon. This gives more reliance to estimates than counting the inventory. Restatement of Previously Reported Interim Periods If employer payroll taxes or social service payments are assessed on an annual basis, the employer’s related expense is recognised in interim periods using an estimated average annual effective rate, even though a large portion of the A change in accounting policy, other than one for which the transition is specified by a new Standard, should be reflected by restating the financial statements of prior-interim periods of the current financial year, and the comparable interim periods of prior years. A single accounting policy is applied to a particular class of payments may be made early in the financial year. transactions throughout an entire financial year. higher income employees, the maximum income is reached Any change in accounting policy is to be applied retrospectively to the beginning of the financial year. EXAMPLE-restatement of prior years-inventory valuation In June, you decide to change your inventory measurement form weighted-average method to FIFO. You will have to apply this change with effect from the beginning of the financial year. You http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng Sometimes, an employer payroll tax or insurance contribution is imposed up to a maximum level of earnings per employee. For before the end of the financial year, and the employer makes no further payments through the end of the year. 2. Major planned periodic maintenance or overhaul 16 IAS 34 Interim financial reporting The cost of a planned major periodic maintenance or overhaul or IAS34 requires that an undertaking apply the same criteria for similar seasonal expenditure that is expected to occur late in the recognising and measuring a provision at an interim date as year is not anticipated for interim reporting purposes unless it would at the end of its financial year. The existence or non- an event has caused the undertaking to have a legal or existence of an obligation is a question of fact. constructive obligation. The mere intention or necessity to incur 4.Year-end bonuses Year-end bonuses vary widely. Some are earned simply by expenditure related to the future is not sufficient to give rise to an obligation. continued employment during a time period. Some bonuses are earned based on a monthly, quarterly, or annual measure of operating result. They may be purely discretionary, contractual, or based on years of historical precedent. 3. Provisions A provision is recognised when there is no realistic alternative but to make a transfer of benefits as a result of an event that has created a legal or constructive obligation. The amount of the A bonus is recorded for interim reporting purposes only if, (i) the bonus is a legal obligation or past practice would make the bonus a constructive obligation for which the undertaking has no realistic alternative but to make the payments, and obligation is adjusted up or down, with a corresponding loss or (ii) a reliable estimate of the obligation can be made. (IAS 19 provides guidance). gain recorded in the income statement, if the undertaking’s 5.Contingent lease payments (see IAS17) estimate of the amount of the obligation changes. Contingent lease payments can be an example of a legal or constructive obligation that are recognised as a liability. These http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 17 IAS 34 Interim financial reporting are payments in addition to the standard rent for each period of a asset. ‘Deferring’ costs as assets in an interim balance sheet in lease. (Many photocopier leases require additional payment for the hope that the recognition criteria will be met later in the copies in excess of a specified number in each period.) financial year is not justified. If contingent payments are based on the lessee achieving a 7. Pensions Pension cost for an interim period is calculated on a year-to-date certain level of annual sales (such as a franchisee), an obligation basis by using the actuarially-determined pension cost rate at can arise in the interim periods of the financial year before the the end of the prior financial year, adjusted for significant required annual level of sales has been achieved, if that market fluctuations since that time and for significant required level of sales is expected to be achieved and there is curtailments, settlements, or other significant one-time no realistic alternative but to make the future lease payment. events. 6. Intangible assets 8. Holidays, and other short-term paid absences An undertaking will apply the definition and recognition criteria for an intangible asset in the same way in an interim period as in an Accumulating paid absences are those that are carried forward annual period. Costs incurred before the recognition criteria and can be used in future periods if the current period’s (the research phase) for an intangible asset are met are entitlement is not used in full. recognised as an expense. Costs incurred after the specific point in time at which the criteria are met are recognised (the IAS 19 requires that an undertaking measure the expected cost of and obligation for accumulating paid absences at the amount development phase) as part of the cost of an intangible http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 18 IAS 34 Interim financial reporting it expects to pay as a result of the unused entitlement that 10. Measuring interim income tax expense has accumulated at the balance sheet date. Interim period income tax expense is accrued using the tax rate that would be applicable to expected total annual earnings, that is, the estimated average annual effective income tax rate applied to the pre-tax income of the interim period. (IAS 12 provides guidance.) That principle is also applied at interim financial reporting dates (not an estimate based on the anticipated amount at yearend). Conversely, an undertaking recognises no expense or liability for non-accumulating paid absences at an interim reporting date, and recognises none at an annual reporting date. 9. Other planned but irregularly occurring costs An undertaking’s budget may include certain costs expected to A separate estimated tax rate is determined for each taxing jurisdiction and applied individually to the interim period pre-tax income of each jurisdiction. If different income tax rates apply to different categories of income (such as capital gains or income earned in particular industries), a separate rate is applied to each individual category of income. A weighted average of rates across jurisdictions or across categories of income is used if it is a reasonable approximation of the effect of using more specific rates. 11.Difference in financial reporting year and tax year be incurred irregularly during the financial year, such as charitable contributions and employee training costs. Those costs generally are discretionary even though they are planned and tend to recur from year to year. Recognising an obligation at an interim financial reporting date for such costs that have not yet been incurred generally is not consistent with the definition of a liability. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng If the financial reporting year and the tax year differ, tax expense for the interim periods of that financial reporting year is measured using separate weighted average tax rates for each of the tax years applied to the portion of pre-tax income earned in each of those income tax years. 12. Tax credits 19 IAS 34 Interim financial reporting Some tax jurisdictions give taxpayers credits against the tax payable based on amounts of capital expenditures, exports, research and development expenditures, or other bases. Anticipated tax benefits of this type for the full year are generally reflected in computing the estimated annual effective income tax rate, because those credits are granted and calculated on an annual basis under most tax laws and regulations. However, tax benefits that relate to a one-time event, or related to capital expenditure, are recorded in computing tax expense in that interim period. 13. Tax loss and tax credit carrybacks and carryforwards A tax loss carryback is recorded in the interim period in which the related tax loss occurs. A tax loss that can be carried back to recover tax of a previous period shall be recognised as an asset. A corresponding reduction of tax expense is also recognised. payer and the recipient, it is probable that they have been earned or will take effect. Contractual rebates and discounts are anticipated but discretionary rebates and discounts are not anticipated. EXAMPLE - Interims and recognition of volume rebates Undertaking F, a paint manufacturer, is preparing its interim financial report for the period ending 30 June 2007 in accordance with IAS 34. It offers stepped rebates on sales based on the following volumes: Litres Discount Under 100,000 No discount 100,000 – 250,000 5% on cumulative sales for the year Over 250,000 10% on cumulative sales for the year All rebates will be paid to the customer after the year end, 31 December 2007. IAS 12 provides criteria for assessing the probability of future taxable profit against which the unused tax losses and credits can be utilised. Those criteria are applied at the end of each interim period and, if they are met, the effect of the tax loss carryforward is reflected in the computation of the estimated average annual effective income tax rate. 14. Contractual or anticipated purchase price changes When volume rebates, discounts and other contractual changes in contract prices are anticipated in interim periods, by both the http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng By 30 June 2007, a customer has purchased 200,000 litres and has a history of purchasing around 400,000 litres each year. How should F recognise the volume rebate in its interim accounts? Where costs are incurred unevenly during the financial year, IAS 34 states that they should be anticipated or deferred for interim reporting purposes only if it is appropriate to anticipate or defer that type of cost at the end of the financial year. At 30 June 2007, the manufacturer has a contractual liability to 20 IAS 34 Interim financial reporting pay the customer a rebate of 5% on all sales to date, because the volume threshold of 100,000 litres has been exceeded. 18. Interim period manufacturing cost variances However, based on all the available evidence, it is probable that the customer will also exceed the 250,000 litre threshold by the end of the year and that the manufacturer will pay a rebate of 10% on all sales. Price, efficiency, spending, and volume variances are recorded at interim reporting dates as those variances are recorded in the income statement at year-end. Consequently, in the interim accounts F should recognise a provision for volume rebates based on 10% of sales to date with a corresponding adjustment to revenue. 15 .Depreciation and amortisation Deferral of variances that are expected to be absorbed by yearend is not appropriate. (If operations are halted for holidays in a specific interim period, the dead time is not spread to other periods.) Depreciation and amortisation for an interim period is based only on assets owned during that interim period. It does not take into account asset acquisitions, or disposals, planned for later in the financial year. 19. Foreign currency translation gains and losses 16. Inventories Foreign currency translation gains and losses are measured for interim financial reporting by the same principles as at yearend. Inventories are measured for interim financial reporting by the same principles as at financial year-end. 17. Net realisable value of inventories The net realisable value of inventories is determined by reference to selling prices and related costs to complete and dispose at interim dates. An undertaking will reverse a write-down to net realisable value in a subsequent interim period only if it would be appropriate to do so at the end of the financial year. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng IAS 21 specifies the methodology. The actual average and closing rates for the interim period are used. Undertakings do not anticipate some future changes in foreign exchange rates in the remainder of the current financial year in translating foreign operations at an interim date. If IAS 21 requires translation adjustments to be recorded as income or expense in the period in which they arise, that principle is applied during each interim period. 21 IAS 34 Interim financial reporting Undertakings do not defer any foreign currency translation adjustments at an interim date if the adjustment is expected to reverse before the end of the financial year. the most recent financial year to determine whether such a calculation is needed. IFRIC Interpretation 10 Interim Financial Reporting and Impairment 20. Interim financial reporting in hyperinflationary economies Interim financial reports in hyperinflationary economies are prepared by the same principles as at financial year-end (see IAS 29). An undertaking shall not reverse an impairment loss recognised in a previous interim period in respect of goodwill or an investment in either an equity instrument or a financial asset carried at cost. An undertaking shall not extend this consensus by analogy to other areas of potential conflict between IAS 34 and other standards. EXAMPLE - Interim financial reporting Undertakings do not annualise the recognition of the gain or loss on the net monetary position. Nor do they use an estimated annual inflation rate in preparing an interim financial report in a hyperinflationary economy. 21. Impairment of assets Company D, a retailer, has goodwill on its balance sheet that is attached to a shop. During the first half of the year, a competitor opens an outlet nearby and the shop becomes loss-making. This necessitates an impairment review of the shop, which results in the recognition of an impairment of the goodwill in the interim report. IAS 36 requires that an undertaking apply the same impairment testing, recognition, and reversal criteria at an interim date as it would at the end of its financial year. In the second half of the year, the competitor goes into liquidation and the competing outlet closes. The results of D’s shop return to their previous levels. However, an undertaking need not make a detailed impairment calculation at the end of each interim period. An undertaking will review for indications of significant impairment since the end of http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng However, IAS 36 prohibits the reversal of impaired goodwill. Had the retailer not prepared an interim report, then no impairment would have been recognised. Should the impairment be recognised in the annual report? 22 IAS 34 Interim financial reporting There are two approaches: One view is that once a company has reported an impairment in any set of accounts, whether interim accounts or annual financial statements, it should not be reversed. The alternative approach is to look at the difference between the opening position and the position at the end of the year, by which time the value of the shop would have recovered and no impairment would be recognised. The interpretations’ arm of the International Accounting Standards Board, IFRIC, has issued Interpretation 10 Interim Financial Reporting and Impairment, which proposes that having recognised an impairment in the interim accounts, a company must report it in the annual accounts. As it is an interpretation clarifying the application of an existing endorsed standard, D should consider carefully whether adopting any other treatment would be appropriate. Examples of the use of estimates 1 Inventories: Full stock-taking and valuation procedures may not be required for inventories at interim dates, although it may be done at financial year-end. It may be sufficient to make estimates at interim dates based on sales margins. 2. Classifications of current and non-current assets and liabilities: Undertakings may do a more thorough investigation for classifying assets and liabilities as current or non-current at annual reporting dates than at interim dates. 3. Provisions: (such as provisions for warranties, environmental costs, and site restoration costs) Determination of the amount of a provision may be complex, costly and time-consuming and may involve outside experts to assist in the annual calculations. Making similar estimates at interim dates often entails updating of the prior annual provision, rather than the engaging of outside experts to do a new calculation. 4. Pensions: IAS 19 requires that an undertaking determine the present value of defined benefit obligations and the market value of plan assets at each balance sheet date and encourages an undertaking to involve actuary in measurements. For interim reporting purposes, reliable measurement is often obtainable by extrapolation of the latest actuarial valuation. 5. Income taxes: http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 23 IAS 34 Interim financial reporting Undertakings may calculate income tax expense and deferred income tax liability at annual dates by applying the tax rate for each individual jurisdiction to measures of income for each jurisdiction. One view is that some intercompany balances that are reconciled on a detailed level in preparing consolidated financial statements at financial year end might be reconciled at a less detailed level in preparing consolidated financial statements at an interim date. A weighted average of rates across jurisdictions or across categories of income is used if it is a reasonable approximation of the effect of using more specific rates. Experienced accountants know how critical it is that intercompany balances are agreed. Failure to agree them indicates that an unknown number of transactions have not been accounted for in one or both of the companies concerned. 6. Contingencies: The measurement of contingencies may involve the opinions and /or formal reports of specialists, Opinions about litigation, claims, assessments, and other contingencies and uncertainties may or may not also be needed at interim dates. The net difference may represent any combination of income, expenses, assets, liabilities and even equity, which may be offsetting each other in the net figure. Agreeing intercompany balances is a basic routine. Failure to do so imperils the financial statements. 9 Specialised industries: 7. Revaluations and fair value accounting: IAS 16 allows an undertaking to choose as its accounting policy the revaluation model whereby items of property, plant and equipment are revalued to fair value. Similarly, IAS 40 requires an undertaking to determine the fair value of investment property. Due to complexity, costliness, and time, interim period measurements in specialised industries might be less precise than at financial year-end. An example would be calculation of insurance reserves by insurance companies. For those measurements, an undertaking may rely on professionally qualified valuers at annual reporting dates though not at interim reporting dates. Multiple choice questions 8 Intercompany reconciliations: 1. IAS 34 mandates interim financial reports for: 1. Listed companies. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 24 IAS 34 Interim financial reporting 2. All companies. 3. No-one 2.The accounting policies to be used are: 1. The same as in the last annual statements. 2. The same as in the last annual statements. except for new policies to be used in the next annual statements. 3. Unique to interim statements. 3. Measurements for interim accounts should: 1. Be annualised. 2. Be made solely on the figures of the interim period. 3. Be made on a year-to-date basis. 4. Income tax expense should use: 1. Estimated effective annual rate. 2. Last year’s effective rate. 3. The rate relating to the interim period. 5. Listed companies should provide interim reports not later than: 1. 30 days after the period end. 2. 60 days after the period end. 3. 90 days after the period end. 4. 120 days after the period end. 6. IAS 1 defines a complete set of financial statements as including the following components: (i) Balance sheet. (ii) Income statement. (iii) Statement showing changes in equity. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng (iv) (v) (vi) (vii) (viii) 1. 2. 3. 4. 5. 6. 7. 8. Cash flow statement. Accounting policies. Explanatory notes. Audit report. Management review. (i) (i)-(ii) (i)- (iii) (i)-(iv) (i)-(v) (i)-(vi) (i)-(vii) (i)-(viii) 7. Minimum content of an interim financial report is a: (i) Condensed balance sheet. (ii) Condensed income statement. (iii) Condensed cash flow statement. (iv) Condensed statement showing changes in equity. (v) Selected explanatory notes. (vi) Audit report. (vii) Management review. 1. 2. 3. 4. 5. 6. 7. (i) (i)-(ii) (i)- (iii) (i)-(iv) (i)-(v) (i)-(vi) (i)-(vii) 8. The income statement should show: 1. Basic earnings per share for the interim period. 2. Diluted earnings per share for the interim period. 25 IAS 34 Interim financial reporting 3. Both. 9. An interim report is prepared on a consolidated basis. The inclusion of the parent’s separate statements in the interim report is: 1. Optional. 2. Compulsory. 3. Forbidden. (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) changed, a description of the nature and effect of the change. Explanatory comments about the seasonality, or cyclicality, of interim operations. The nature and amount of items affecting assets, liabilities, equity, net income, or cash flows that are unusual due to their nature, size, or incidence. The nature and amount of changes in estimates reported in prior interim periods of the current financial year, or changes in estimates of amounts reported in prior financial years, if those changes have a material effect in the current interim period. Issuances, repurchases, and repayments of debt and equity securities. Dividends paid (aggregate, or per share) separately for ordinary shares and other shares. Segment revenue and segment result for operating segments. Material events, subsequent to the end of the interim period, that have not been reflected in the financial statements for the interim period. The effect of changes in the composition of the undertaking during the interim period, including business combinations, acquisition or disposal of subsidiaries and 10. An undertaking should include the following information, as a minimum, in the notes to its interim statements, if material and if not disclosed elsewhere: (i) A statement that the same policies and methods of computation are followed in the interim statements as compared with the most recent annual financial statements or, if those policies or methods have been http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng long-term investments, restructurings, and discontinuing operations. and (x) Changes in contingent liabilities, or contingent assets, since the last annual balance sheet date. 26 IAS 34 Interim financial reporting 1. (i) 2. (i)-(ii) 3. (i)- (iii) 4. (i)-(iv) 5. (i)-(v) 6. (i)-(vi) 7. (i)-(vii) 8. (i)-(viii) 9. (i)-(ix) 10. (i)-(x) 2. 31 December 2XX4. 3. 30 June 2XX4 13. See table above. 1. 31 December 2XX5. 2. 31 December 2XX4. 3. 30 June 2XX4 Undertaking Publishes Interim Financial Reports Half-Yearly The undertaking’s financial year ends 31 December (calendar year). The undertaking will present the following financial statements (condensed or complete) in its half-yearly interim financial report as of 30 June 2XX5: Balance Sheet: At Income Statement: 6 months ending Cash Flow Statement: 6 months ending Statement of Changes in Equity: 6 months ending Fill in the blanks: 30 June 2XX5 Question 11 30 June 2XX5 Question 12 30 June 2XX5 Question 13 30 June 2XX5 Question 14 11. See table above. 1. 31 December 2XX5. 2. 31 December 2XX4. 3. 30 June 2XX4 12 See table above. 1. 31 December 2XX5. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 14. See table above. 1. 31 December 2XX5. 2. 31 December 2XX4. 3. 30 June 2XX4 Undertaking Publishes Interim Financial Reports Quarterly The undertaking’s financial year ends 31 December (calendar year). The undertaking will present the following financial statements (condensed or complete) in its quarterly interim financial report as of 30 June 2XX8: Balance Sheet: At Income Statement: 6 months ending 3 months ending Cash Flow Statement: 6 months ending Statement of Changes in Equity: 6 months ending Fill in the blanks: 30 June 2XX8 Question 15 30 June 2XX8 Question 16 30 June 2XX8 Question 17 30 June 2XX8 Question 18 30 June 2XX8 Question 19 15. See table above. 1. 31 December 2XX8. 2. 31 December 2XX7. 3. 30 June 2XX7 27 IAS 34 Interim financial reporting 3. Is charged pro-rata in the interim report. 16. See table above. 1. 31 December 2XX8. 2. 31 December 2XX7. 3. 30 June 2XX7 17. See table above. 1. 31 December 2XX8. 2. 31 December 2XX7. 3. 30 June 2XX7 18. See table above. 1. 31 December 2XX8. 2. 31 December 2XX7. 3. 30 June 2XX7 19. See table above. 1. 31 December 2XX8. 2. 31 December 2XX7. 3. 30 June 2XX7 20. After your interim report is published, a key client goes into liquidation. Your doubtful debt provision proves to be inadequate, and you have a significant write-off in the next period. 1. The interim report is restated. 2. The interim report is not restated, but the next report will detail the impact of this liquidation. 3. No disclosure is necessary. 21. Normally, the cost of a planned major periodic maintenance, or other seasonal expenditure that is expected to occur late in the year: 1. Is not anticipated for interim reporting purposes. 2. Is anticipated for interim reporting purposes. http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 22. Normally, discretionary bonuses: 1. Are not anticipated for interim reporting purposes. 2. Are anticipated for interim reporting purposes. 3. Are charged pro-rata in the interim report. 23. Accumulating compensated absences: 1. Are not anticipated for interim reporting purposes. 2. Are anticipated for interim reporting purposes. 3. Are charged pro-rata in the interim report. 24. Depreciation on assets that have been paid for, but are not yet owned: 1. Is not anticipated for interim reporting purposes. 2. Is anticipated for interim reporting purposes. 3. Is charged pro-rata in the interim report. Answers to multiple choice questions Question Answer 1. 3 2. 2 3. 3 4. 1 5. 2 6. 6 7. 5 8. 3 9. 1 10. 10 11. 2 12. 3 13. 3 14. 3 28 IAS 34 Interim financial reporting 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 2 3 3 3 3 2 1 1 2 1 Note: Material from the following PricewaterhouseCoopers publications has been used in this workbook: Applying IFRS, IFRS News, -Accounting Solutions http://bankir.ru/technology/vestnik/uchebnye-posobiya-po-msfoeng 29