Course Outline of Record

advertisement

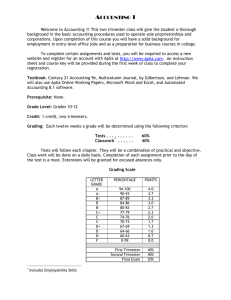

COLLEGE OF THE DESERT Course Code: BUAC-001A Course Outline of Record 1. Course Code: BUAC-001A 2. a. Long Course Title: b. Short Course Title: (formerly BUAC-001) Financial Accounting I FINANCIAL ACCTG I 3. a. Catalog Description: This course expands upon basic fundamentals of the double entry accrual accounting system. It includes accounting for service and merchandising enterprises with special emphasis on receivables, payables, inventories, plant asset depreciation methods, internal controls, payroll and other sub-systems. b. Schedule Description: Emphasizes accounting procedures for small merchandising businesses. c. Semester Cycle (if applicable): 4. Total Units: Lecture Units: Lab Units: 3 3 0 Total Semester Hrs: Semester Lecture Hrs: Semester Lab Hrs: 54 54 0 5. Prerequisite or Corequisite Courses or Advisories: Prerequisite: BUAC-066 or demonstrated competence in basic bookkeeping Corequisite: None Advisory: None 6. a. Textbooks, Required Reading or Software: (List in APA or MLA format.) Heintz, J. A. & Parry, R. W. (2005). College Accounting. (18th ed.). Cincinnati, Ohio: South-Western Thomson Learning. ISBN #0-324-20147-8 Heintz, J. A. & Parry, R. W. (2005). College Accounting. Stdy Guide/Working Papers (18th ed.). Cincinnati, Ohio: South-Western Thomson Learning. ISBN #0-324-22183-5 b. Textbook Reading Level: College Level: Yes No Flesch-Kincaid reading level: 12.0 7. Entrance Skills: Before entering the course students must be able: a. Demonstrate competence in all steps of the accounting cycle. b. Perform bank reconciliations c. Calculate basic payroll solutions and make necessary journal entries relating to payroll expenses and liabilities. d. Understand the differences between the 3 basic accounting methods: Cash, modified cash, and accrual. 8. Course Content and Scope: a. Accounting for sales and cash receipts i. Merchandise sales transactions ii. Merchandise sales accounts iii. Journalizing and posting sales transactions iv. Journalizing and posting cash receipts v. Schedule of accounts receivable CCForm#1 Page 1 Approved: 12/1/2005 COLLEGE OF THE DESERT Course Code: BUAC-001A b. Accounting for purchases and cash payments i. Merchandise purchase transactions ii. Merchandise purchase accounts iii. Journalizing and posting purchases transactions iv. Journalizing and posting cash payments v. Schedule of accounts payable 3. The voucher system i. Internal control of expenditures ii. Preparing and voucher and the voucher register iii. Payments using the voucher system iv. The check register 4. Adjustments and the worksheet for merchandising firms i. Adjustment for inventory ii. Adjustment for unearned revenue iii. Preparing the worksheet 5. Year-End accounting for merchandising firms i. The Income statement ii. The statement of owner's equity and balance sheet iii. Financial statement analysis iv. Closing and reversing entries 6. Accounting for accounts receivable i. Allowance method ii. Estimating and writing off uncollectibles iii. Direct write-off method 7. Accounting for notes and interest i. The promissory note ii. Calculating interest and the due date iii. Notes receivable and payable transactions 8. Accounting for merchandise inventory i. Periodic and perpetual systems ii. Assigning cost to inventory and cost of goods sold iii. Estimating inventory without counting units 9. Accounting for long term assets i. Acquisition cost of plant assets ii. Depreciation methods iii. Repairs, additions, and improvements to plant assets iv. Disposal of plant assets v. Accounting for natural resources and intangible assets 9. Course Objectives: a. Complete the accounting cycle for merchandising enterprises. b. Understand reversing entries and unearned revenue. c. Demonstrate competence in handling complex transactions in these areas: Accounts receivable, inventory valuation, notes payable and receivable, plant asset acquisition, depreciation, and disposal. 10. Student Learning Outcomes: 11. Methods of Instruction: (Relate instructional methods to course objectives.) Lecture and demonstration by instructor, with in-class practice, including feedback, coaching, and evaluation by the instructor; online format.* *Distance Education modalities approved 10/18/07 CCForm#1 Page 2 Approved: 12/1/2005 COLLEGE OF THE DESERT Course Code: BUAC-001A 12. Assignments: (List samples of student learning activities) a. Readings in the textbook and in recommended supplementary literature. b. Attendance of lectures and occasional guest speakers, including the taking of detailed notes. c. Examinations of various types, such as essay and multiple choice. 13. Methods of Evaluating Student Progress: (How will you measure whether students achieve the learning objectives?) a. Review of homework assignments b. Multiple-choice examinations c. Short quizzes d. Group problem-solving situations e Comprehensive end-of-semester problem 14. Credit Status: Degree Credit Non Degree Credit Noncredit 15. Transfer Status: this course is already transferable to both CSU and UC a. Would you like this course to transfer to the CSU system? Yes No b. . Do you wish to propose this course be included on the UC Transfer Course List? Yes No 16. 17. General Education: a. Do you wish to propose this course be included on the COD GE Requirement list? Yes No If you answered “yes” indicate proposed Area/#: b. Do you wish to propose this course be included on the CSU GE Requirement list? Yes No If you answered “yes” indicate proposed Area/#: c. Do you wish to propose this course be included on the IGETC list? Yes No If you answered “yes” indicate proposed Area/#: Special Materials and/or Equipment required of students: None Faculty Initiator: CCForm#1 Mike Manis Date: Page 3 10/31/05 Approved: 12/1/2005 COLLEGE OF THE DESERT Course Code: BUAC-001A COURSE CHARACTERISTICS (Required of all courses) 18. 19. 3 New Course Substantial/Major Modification - Proposed change(s): Minor Modification - Proposed change(s): Change course code from: BUAC-001 to: BUAC-001A; change course title from: Accounting I to: Financial Accounting I Provide reasons for the substantial modifications or new course: 20. 21. SIU’s: Cross-Listed (Enter Course Code): Replacement Course (Enter original Course Code) BUAC-001, Accounting I GRADING METHOD (choose one:) Letter Grade [A,B,C,D, F and W. Letter grades are used in calculating GPA] Credit/No Credit [CR, NC. Credit/No Credit grades are not used in calculating GPA but are used in the determination of Academic and Progress Probation status.) Student Option (Student may choose Letter or Credit/No Credit grading option.) 22. MIS COURSE DATA ELEMENTS a. b. c. T.O.P Code [CB03] : Basic Skills Status [CB08]: Vocational Status [CB09]: 0502.00 Precollegiate Basic Skills Basic Skills Not Basic Skills Apprenticeship Adv. Occupational Clearly Occupational Possibly Occupational Non-Occupational Course Classification [CB11]: Occupational Education Repeatability [CB12]: May be repeated 0 times (other than for unsatisfactory grade) State reason why course may be repeated: Course Prior to College Level [CB21]: N/A (For English, writing, ESL, reading or mathematics courses only.) Course Noncredit Category [CB22]: N/A (For noncredit courses only.) Course CAN Code [CB14]: Date Applied: Date Approved: Work-Based-Learning-Activities [XB09]: Yes No d. e. f. g. h. i. 23. STAND-ALONE COURSE CHECKLIST (check appropriate responses below): Is this course part of an Approved Program? Yes Name of Approved Program: Accounting, Business No Administration, CIS, Economics, General Business, Hotel/Restaurant Mgmt, (Degree, Certificate) Where does this course fit in the program? Required and Elective (Attach listings of Degree and/or Certificate Programs showing this course as a required or a restricted elective.) *For a Stand-alone Course, complete the Application for Approval of Credit Course Form to be submitted to the Chancellor’s Office for approval. CCForm#1 Page 4 Approved: 12/1/2005 COLLEGE OF THE DESERT Course Code: BUAC-001A Student Learning Outcomes Defined Course Title: Financial Accounting 1 Date: January 26, 2009 Course Number: BUAC-001A OAC Review Date: 2/10/09 Faculty Originator: Joel Glassman OAC Approved Date: 2/10/09 Student Learning Outcomes Upon successful completion of this course, students will be able to: 1. Apply the basic and specialized concepts and techniques used in the accounting process and complete all steps of the accounting cycle for a merchandising business. CCForm#1 Page 5 Approved: 12/1/2005