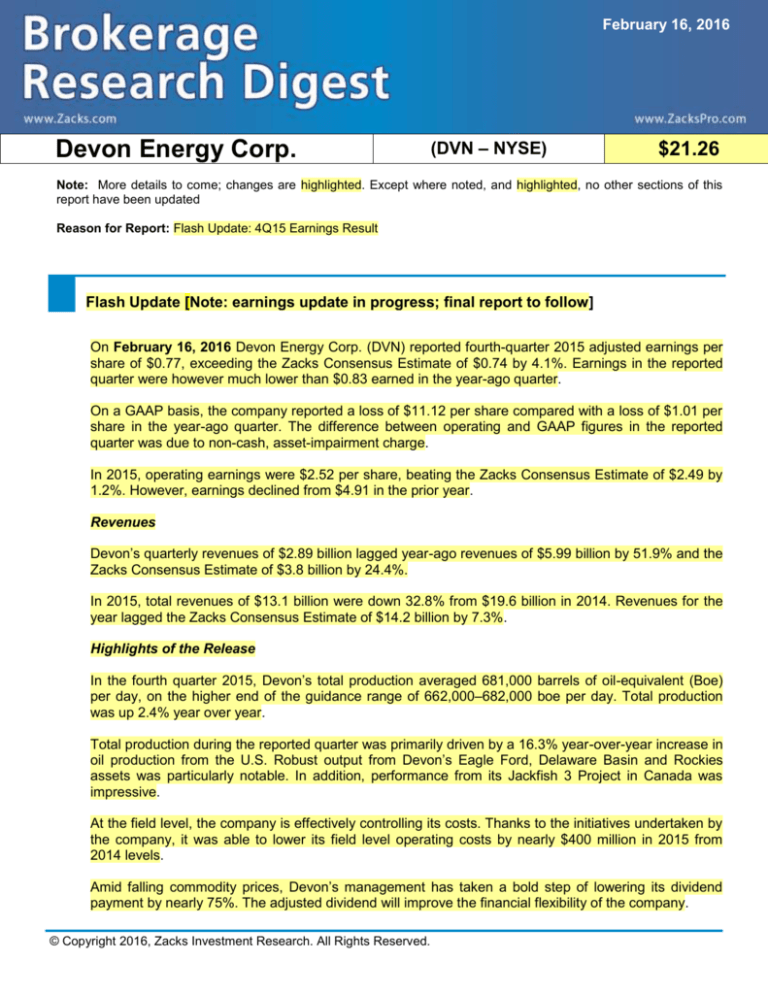

February 16, 2016

Devon Energy Corp.

(DVN – NYSE)

$21.26

Note: More details to come; changes are highlighted. Except where noted, and highlighted, no other sections of this

report have been updated

Reason for Report: Flash Update: 4Q15 Earnings Result

Flash Update [Note: earnings update in progress; final report to follow]

On February 16, 2016 Devon Energy Corp. (DVN) reported fourth-quarter 2015 adjusted earnings per

share of $0.77, exceeding the Zacks Consensus Estimate of $0.74 by 4.1%. Earnings in the reported

quarter were however much lower than $0.83 earned in the year-ago quarter.

On a GAAP basis, the company reported a loss of $11.12 per share compared with a loss of $1.01 per

share in the year-ago quarter. The difference between operating and GAAP figures in the reported

quarter was due to non-cash, asset-impairment charge.

In 2015, operating earnings were $2.52 per share, beating the Zacks Consensus Estimate of $2.49 by

1.2%. However, earnings declined from $4.91 in the prior year.

Revenues

Devon’s quarterly revenues of $2.89 billion lagged year-ago revenues of $5.99 billion by 51.9% and the

Zacks Consensus Estimate of $3.8 billion by 24.4%.

In 2015, total revenues of $13.1 billion were down 32.8% from $19.6 billion in 2014. Revenues for the

year lagged the Zacks Consensus Estimate of $14.2 billion by 7.3%.

Highlights of the Release

In the fourth quarter 2015, Devon’s total production averaged 681,000 barrels of oil-equivalent (Boe)

per day, on the higher end of the guidance range of 662,000–682,000 boe per day. Total production

was up 2.4% year over year.

Total production during the reported quarter was primarily driven by a 16.3% year-over-year increase in

oil production from the U.S. Robust output from Devon’s Eagle Ford, Delaware Basin and Rockies

assets was particularly notable. In addition, performance from its Jackfish 3 Project in Canada was

impressive.

At the field level, the company is effectively controlling its costs. Thanks to the initiatives undertaken by

the company, it was able to lower its field level operating costs by nearly $400 million in 2015 from

2014 levels.

Amid falling commodity prices, Devon’s management has taken a bold step of lowering its dividend

payment by nearly 75%. The adjusted dividend will improve the financial flexibility of the company.

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

Realized Prices

Realized oil prices in the quarter were $53.67 per barrel, down 23.1% from $69.80 per barrel in the

year-ago quarter. Realized prices for natural gas liquids were down 50.5% to $8.81 per barrel from

$17.79 per barrel in the year-ago quarter.

Natural gas price realization was down 33.6% year over year to $2.45 per thousand cubic feet (Mcf)

from $3.69 per Mcf in the year-ago quarter.

Total realized prices in the fourth quarter, including cash settlements, were $29.44 per boe, down

23.3% year over year, due to lower prices of all commodities sold by the company.

Financial Health

As of Dec 31, 2015, the company had a cash balance of $2,310 million, up from $1,480 million as of

Dec 31, 2014.

Long-term debt as of Dec 31, 2015, was $12,137 million compared with $9,830 million as of Dec 31,

2014.

Devon’s cash flow from operating activities in fourth-quarter 2015 was $1,081 million compared with

$963 million in fourth-quarter 2014.

Capital expenditure was $1,079 million, lower than $1,975 million in fourth-quarter 2014.

Guidance

Devon Energy estimates total production for the first quarter of 2016 in the range of 657,000–693,000

boe per day. The company expects 2015 daily total production in the range of 597,000–634,000 boe.

Capital expenditure (capex) in the first quarter is expected in the range of $450–$525 million. The

company expects 2016 capex to be in the range of $1,170 million to $1,445 million.

Devon’s 2016 E&P capital investment is estimated in a $900 million to $1.1 billion range, a decrease of

75% from 2015 levels. This will be entirely focused on the development of its core assets.

Devon Energy expects to achieve cost savings of $800 million in 2016.

.

MORE DETAILS WILL COME IN LATER, IMMINENT EDITIONS OF ZACKS RD REPORTS ON DVN.

Portfolio Manager Executive Summary [Note: Only highlighted material has been changed.]

Based in Oklahoma City, Devon Energy Corporation is an independent energy company engaged

primarily in the exploration, development and production of oil and natural gas. The company’s oil and

gas operations are mainly concentrated in the onshore areas of North America, including the U.S. and

Canada.

Besides the exploration and production (E&P) business, Devon has marketing and midstream

operations, primarily in North America. Over the last few years, Devon’s capital spending has primarily

been directed toward expanding and developing its oil and liquid-rich assets to achieve a more

balanced portfolio.

Page 2

www.zackspro.com

Of the 20 firms covering Devon, 16 firms provided positive ratings and 4 gave neutral ratings. None of

the firms provided a negative rating. The Zacks Digest average target price is $67.94 ( $9.66 from the

previous report; 42.8% upside from the current price), with target prices ranging between a Digest low

of $44.00 (7.5% downside from the current price) and a Digest high of $92.00 (93.3% upside from the

current price).

The following is a summarized opinion of the diverse brokerage viewpoints:

Positive or equivalent (80%; 16/20 firms): The firms like Devon Energy’s strategy of refocusing on its

core assets in Barnett, Anadarko Basin, Eagle Ford, Permian and Oil Sands, with all of these

generating impressive returns, while the company continues divesting its non-core assets. Production

volume is expected to build up due to higher oil shale and oil sands volumes. The bullish firms believe

that the newly formed Master Limited Partnership, Enlink Midstream, will act as a growth catalyst for the

stock going forward.

Neutral or equivalent (20%; 4/20 firms): The neutral firms expect Devon’s assets in diverse North

American plays will help it in the long run. However, they believe that the ongoing softness in

commodity prices might impact the cash flow of the company. The steep decline in earnings and cash

flow is indicative of the roll-off of high-price hedge positions by the end of 2015.

August 10, 2015

Overview [Note: Only highlighted material has been changed.]

Firms have identified the following factors for evaluating the investment strategy of the company:

Key Positive Arguments

Key Negative Arguments

Fundamentals

A deep and diversified portfolio with a flexible

capital spending program

Fundamentals

Project delays

production

Growth Potential

A strong portfolio of assets provides organic

growth opportunities and significant untapped

potential.

Increased oil production from the Eagle Ford

Shale and Delaware Basin

Systematic asset divestment strategy

Stable liquidity position

Formation of an Master Limited Partnership

with Crosstex provides a long-term growth

profile, diversification and liquidity to the

company.

Competitive Threats

High finding and development costs versus its peers

associated

with

its

offshore

Macro Issues

Limited control over third-party operations

Volatile oil and gas prices

Roll-off of high-price hedge by 2015-end

Based in Oklahoma City, Devon Energy Corporation is an independent energy company engaged

primarily in the exploration, development and production of oil and natural gas. The company’s oil and

gas operations are mainly concentrated in the onshore areas of North America, including the U.S. and

Canada.

Besides the exploration and production (E&P) business, Devon has marketing and midstream

operations, primarily in North America. Over the last few years, Devon’s capital spending has primarily

been directed toward expanding and developing its oil and liquid-rich assets to achieve a more

balanced portfolio.

Page 3

www.zackspro.com

With the creation of EnLink in first-quarter 2014, Devon currently has three reporting segments – U.S.,

Canada and EnLink.

The U.S. operations are spread in the Permian Basin, Mid-Continent, Rocky Mountains and Gulf Coast.

The Canadian holdings are located in the central and southern plains of Alberta and Saskatchewan,

northwestern Alberta and northeastern British Columbia, Lloydminster region, the Horn River basin and

the Deep Basin.

The EnLink segment is engaged in midstream activities. It is a combination of all U.S. midstream assets

of Devon and properties from the former Crosstex Energy, Inc. and Crosstex Energy, L.P. The segment

consists of two entities – EnLink Midstream, LLC and EnLink Midstream Partners, LP – which are

collectively known as EnLink Midstream. Devon also has a master limited Partnership (MLP) with

Crosstex.

At the end of 2014, Devon had proved reserves of approximately 2.8 billion barrels of oil equivalent

(BOE), up 7% y/y. Proved oil reserves reached a record 895 million barrels. Oil reserve from Devon’s

retained U.S. properties increased 65% y/y to 351 million barrels. More information is available at

www.devonenergy.com. Devon’s financial year ends on Dec 31.

August 10, 2015

Long-Term Growth [Note: Only highlighted material has been changed.]

Devon’s deep and diversified portfolio, primarily composed of unconventional resources, holds

significant long-term growth potential. Strong competition exists in all industries under the oil and gas

sector. Devon Energy competes with major integrated and other independent oil and gas companies for

the acquisition of properties and leases.

Devon Energy has grown rapidly through a series of major acquisitions with greater part of its future

growth based on drilling pursuits. The company initiated a strategy to get back on a more sustainable

growth track and drive up its returns to more competitive levels. Asset sales are part of management’s

plan to drive the value of the company. By divesting properties with relatively high decline rates and

lower returns, Devon Energy will likely improve its profitability and streamline its base to a better growth

platform.

Devon Energy provides an attractive way to invest in diverse U.S. natural gas and liquids plays. Its core

operations are located in the Barnett Shale in north Texas, in Permian Basin, Eagle Ford, Delaware

Basin and Heavy Oil. Devon Energy plans to spend $3.9–$4.0 billion in 2015 for E&P activities, much

lower than 2014 levels, without compromising on its new oil production growth outlook of 25% to 35%

for the year. The primary focus of the company is to develop high-margin oil assets. Devon’s ongoing

projects in these high-quality basins are going to drive its performance over the long term.

EnLink Midstream has generated sizable revenues in the last three quarters of 2014. The segment

generated 28.7% of the total revenue in the first quarter, and 37.6% in the second quarter. EnLink

Midstream owns assets in several mineral-rich territories, including the Barnett Shale as well as the

Cana and Arkoma Woodford shales. To solidify EnLink Midstream’s operations, Devon plans to

connect the new Victoria Express Pipeline and Access Pipeline expansion projects with EnLink

Midstream through a dropdown transaction. This will enable EnLink Midstream to serve more upstream

players and generate higher revenues for Devon, going forward.

Devon Energy’s decision to monetize portions of its non-core acreage and enter into strategic ventures

with international players also bode well for future development goals. Contribution from midstream

assets, cost savings and higher production from retained assets are going to improve the company’s

cash flow.

Page 4

www.zackspro.com

Devon Energy plans to drill about six wells in each of the Wolfcamp and Leonard shales this year. The

company expects more liquid-rich content during the second half of the year and into 2016.

Management is also planning a capital expenditure of $2–$2.5 billion for increasing oil production. The

company also plans to increase its Wolfcamp acreage by 40% to 140,000 net prospective acres. Going

ahead, Devon will to step up activity in the Meramec oil window as well.

August 10, 2015

Target Price/Valuation [Note: Only highlighted material has been changed.]

Rating Distribution

Positive

80%

Neutral

20%

Negative

0.0%

Avg. Target Price

$67.94

Highest Target Price

$92.00

Lowest Target Price

$44.00

No. of Brokerage Firms with Target Price/Total

16/20

Key risks impeding target price realization include volatility in oil and gas prices, stringent government

regulations, lower-than-expected volume growth and changes in fiscal regime. In addition, geological

risks and extreme weather conditions may cause delay in operations and drilling process.

Recent Events [Note: Only highlighted material has been changed.]

On Aug 4, 2015, Devon Energy reported 2Q15 adjusted earnings per share of $0.78, 62.5% higher

than the Zacks Consensus Estimate of $0.48. Earnings in the reported quarter were much lower than

$1.40 in the year-ago quarter.

On a GAAP basis, the company reported a loss of $6.94 per share as compared to earnings of $1.64

per share in the year-ago quarter. The difference between the operating and GAAP figures in the

reported quarter was due to the change in value of financial instruments and foreign currency as well as

asset impairments.

Devon’s quarterly operating revenues of $3,393 million lagged the year-ago figure of $4,510 million by

24.8% and the Zacks Consensus Estimate of $3,750 million by 9.5%. Marketing and midstream

revenues also dropped 22.1% to $2.01 billion.

Revenue [Note: Only highlighted material has been changed.]

Devon’s quarterly operating revenues of $3,393 million lagged the year-ago figure of $4,510 million by

24.8% and the Zacks Consensus Estimate of $3,750 million by 9.5%. Marketing and midstream

revenues also dropped 22.1% to $2.01 billion.

Page 5

www.zackspro.com

Provided below is a summary of revenues as compiled by Zacks Digest:

Revenue ($ M)

2Q14A

1Q15A

2Q15A

3Q15E

2014A

2015E

2016E

Digest High

$4,510.2

$3,267.1

$3,393.0

$4,195.0

$19,566.0

$15,056.0

$16,690.0

Digest Low

$4,510.0

$3,265.0

$3,393.0

$4,064.1

$19,566.0

$14,950.3

$14,288.9

Digest Average

$4,510.0

$3,265.2

$3,393.0

$4,129.5

$19,566.0

$15,003.1

$15,489.5

Y-o-Y Growth

45.9%

-12.3%

-24.8%

-22.6%

88.1%

-23.3%

3.2%

Sequential Growth

21.1%

-45.5%

3.9%

21.7%

Production

In 2Q15, Devon’s total production averaged 674,000 barrels of oil equivalent per day (BOE/d), within

the company’s guided range of 660,000–688,000 BOE/d. Total production was up 1% y/y, which

increased nearly 9% excluding the divested asset.

The increase was primarily driven by oil production of 270,000 BOE/d per day (up 31.7%),

approximately 50% of which was sourced from the Permian Basin and Eagle Ford shale in Texas. NGL

output was flat, while natural gas output plunged 5%.

Realized Prices

Realized oil prices in the quarter were $62.77 per barrel, down 23.3% from $81.83 per barrel in the

year-ago quarter. Realized prices for natural gas liquids were down 59.7% to $10.31 per barrel from

$25.13 per barrel in the year-ago quarter.

Natural gas price realization was down 32.1% year over year to $2.71 per thousand cubic feet (Mcf)

from $3.99 per Mcf in the year-ago quarter.

Total realized prices in 2Q15, including cash settlements, were $33.69 per BOE, down 20.4% y/y due

to lower prices of all commodities sold by the company.

Guidance

Devon Energy estimates total production for 3Q15 in the range of 638,000–676,000 BOE/d. The

company maintained its 2015 total production guidance of 649,000–684,000 BOE/d.

Devon expects E&P capital spending to exceed $4 billion and expects operating cash flow and

proceeds from the EnLink dropdown will allow it to boost oil production in 2016. In the third quarter,

Devon expects production from heavy oil operations to be 105,000–115,000 barrels per day. This

implies a growth rate of approximately 35% compared to the third quarter of 2014.

Outlook

The bullish firms believe Devon Energy’s midstream operations will act as a catalyst. The initiatives

taken by the company to strengthen its midstream operations are expected to boost the top line. The

firms also expect Devon’s focus on the liquid rich plays to drive its performance.

Marketing and Midstream are expected to contribute significantly to long-term growth. Total oil

production is expected to grow in excess of 65% by 2018.

Page 6

www.zackspro.com

The bullish firms believe strong production from the Eagle Ford shale and Permian Basin will help

Devon Energy in achieving its 2015 production growth target of 25–35% year over year.

Please refer to the Zacks Research Digest spreadsheet on DVN for more details on revenue estimates.

Margins [Note: Only highlighted material has been changed.]

At the field level, the company has effectively controlled costs. Field-level operating costs, including

both lease operating expenses and production taxes, declined 8% y/y to $11.05 per BOE.

Total operating expenses however escalated 188.5% to $7.76 billion from $2.74 billion a year ago.

Excluding asset impairment of $4.16 billion in the reported quarter, operating expenses were up 31.1%

y/y. The increase was due to higher general and administrative (G&A) expenses.

Provided below is a summary of margins as compiled by Zacks Digest:

Margins

2Q14A

1Q15A

2Q15A

3Q15E

2014A

2015E

2016E

EBITDA Margin

44.4%

32.4%

27.8%

33.7%

39.5%

30.6%

31.5%

Operating Margin

23.3%

3.9%

-0.2%

14.9%

18.3%

0.8%

14.5%

Pretax Margin

19.0%

4.8%

13.3%

Net Margin

12.7%

2.7%

9.4%

6.9%

10.3%

6.7%

4.3%

Note: Blank cells indicate that brokers have not provided figures

Guidance

Devon expects operating costs and G&A to decline to nearly $14.50 per BOE for full-year 2015, which

translating into cost savings of nearly $400 million.

Outlook

The firms believe Devon has adopted a strategy to focus on its core areas, invest prudently in assets

with assured prospects and repositioning its asset base, which allow it to improve margins going ahead.

Management has raised the production guidance for the remaining quarters, suggesting expectations of

improved margins, contingent upon the continuation of cost cutting measures.

Please refer to the Zacks Research Digest spreadsheet on DVN for more details on margin estimates.

Earnings per Share [Note: Only highlighted material has been changed.]

Devon Energy reported 2Q15 adjusted earnings per share of $0.78, 62.5% higher than the Zacks

Consensus Estimate of $0.48. Earnings in the reported quarter were much lower than $1.40 earned in

the year-ago quarter.

On a GAAP basis, the company reported a loss of $6.94 per share as compared to earnings of $1.64

per share in the year-ago quarter. The difference between the operating and GAAP figures in the

reported quarter was due to the change in value of financial instruments and foreign currency as well as

asset impairments.

Page 7

www.zackspro.com

Provided below is a summary of EPS as compiled by Zacks Digest:

EPS (US$)

2Q14A

1Q15A

2Q15A

3Q15E

2014A

2015E

2016E

Digest High

$1.41

$0.22

$0.78

$0.77

$4.93

$2.57

$2.74

Digest Low

$1.40

$0.22

$0.77

$0.38

$4.90

$1.97

($0.76)

Digest Average

$1.40

$0.22

$0.78

$0.58

$4.91

$2.22

$0.84

Y-o-Y Growth

15.9%

-83.8%

-44.5%

-56.6%

15.3%

-54.9%

-62.0%

Sequential Growth

4.4%

-74.0%

257.7%

-24.9%

Outlook

A few bullish firms have lowered their earnings estimates for 2015 and 2016 after making changes in

assumptions for production volumes, commodity prices and costs. Since the company has hedged

almost half of its 2015 oil and gas production, it will continue to report attractive gains in spite of

depressed oil prices. However, the firms believe lack of hedges beyond 2015 could adversely impact

earnings per share in 2016 and hence result in slower-than-expected growth.

Highlights of the above table:

3Q15 forecasts range from $0.38 to $0.77; the average is $0.58.

2015 forecasts range from $1.97 to 2.57; the average is $2.22.

2016 forecasts range from $0.76 to $2.74; the average is $0.84.

Some bullish firms have however raised their forward earnings estimates encouraged by Devon’s

extensive portfolio of onshore North American assets and low risk Canadian steam-assisted gravity

drainage (SAGD) projects that provide high visibility into long-term production growth.

Please refer to the Zacks Research Digest spreadsheet on DVN for more details on EPS estimates.

Research Analyst

Copy Editor

Tania Bhattacharya

Content Ed.

Jewel Saha

Lead Analyst

Jewel Saha

QCA

Jewel Saha

No. of brokers reported/Total

brokers

Reason for Update

4Q15 Earnings Flash

Update

Page 8

www.zackspro.com