Banking and the Management of Financial Institutions

advertisement

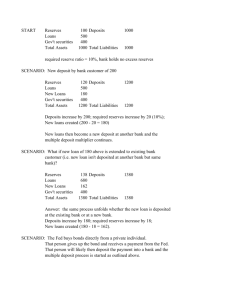

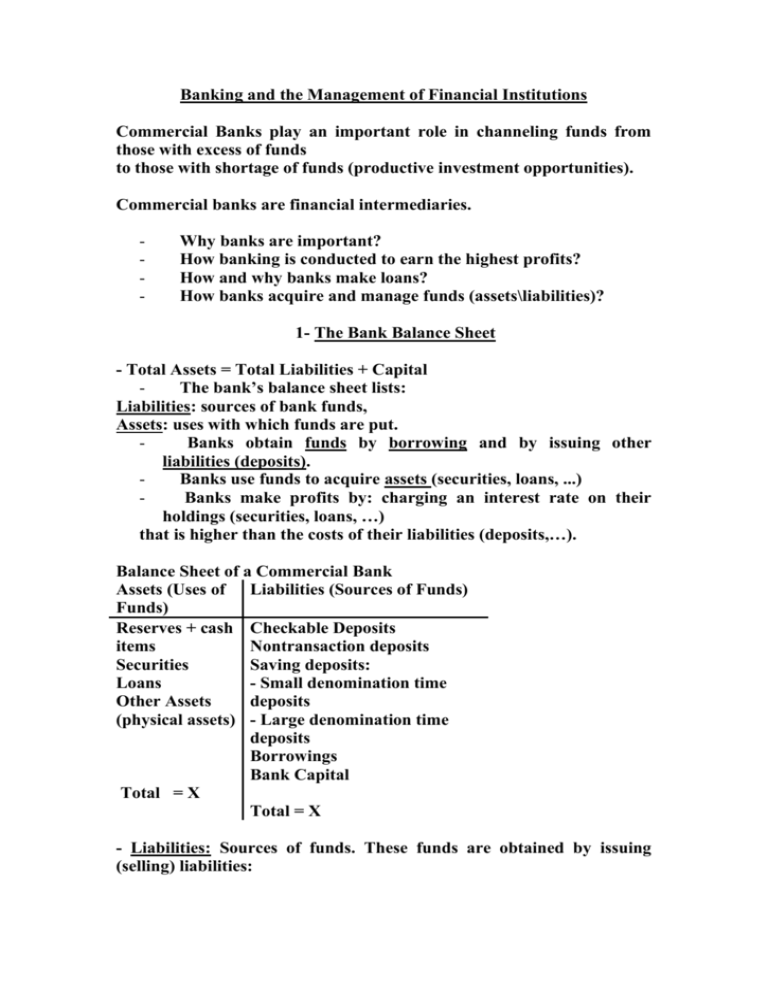

Banking and the Management of Financial Institutions Commercial Banks play an important role in channeling funds from those with excess of funds to those with shortage of funds (productive investment opportunities). Commercial banks are financial intermediaries. - Why banks are important? How banking is conducted to earn the highest profits? How and why banks make loans? How banks acquire and manage funds (assets\liabilities)? 1- The Bank Balance Sheet - Total Assets = Total Liabilities + Capital The bank’s balance sheet lists: Liabilities: sources of bank funds, Assets: uses with which funds are put. Banks obtain funds by borrowing and by issuing other liabilities (deposits). Banks use funds to acquire assets (securities, loans, ...) Banks make profits by: charging an interest rate on their holdings (securities, loans, …) that is higher than the costs of their liabilities (deposits,…). Balance Sheet of a Commercial Bank Assets (Uses of Liabilities (Sources of Funds) Funds) Reserves + cash Checkable Deposits items Nontransaction deposits Securities Saving deposits: Loans - Small denomination time Other Assets deposits (physical assets) - Large denomination time deposits Borrowings Bank Capital Total = X Total = X - Liabilities: Sources of funds. These funds are obtained by issuing (selling) liabilities: A. Checkable deposits: all bank accounts that allow the owner of the account to write checks to third party. Checkable deposits are bank liabilities because the owner of the deposit can withdraw from the account funds that the bank is obligated to pay. B. Nontransaction deposits: The primary source off bank funds, Owner cannot write checks, but earn higher interest than those on checkable deposits. This includes: savings accounts and times deposits (small and large (CDs)). C. Borrowings: from the central bank (discount loans) and other commercial banks (overnight). D. Bank Capital: the bank’s net worth: the difference between total assets and liabilities. Funds are raised by: selling new equity (stock) or retained earnings. Used against a drop in banks assets. Assets: uses of funds, the bank acquired these funds by issuing liabilities in order to purchase income earning assets. A. Reserves: Some of the funds that the bank acquire that are deposited at the central bank + Currency held by the bank (vault cash). Reserves do not pay interest but the bank do hold them because: 1- Reserve Requirements (required reserve ratio) 2- Excess Reserve Both can be used to meet obligations when funds are withdrawn. B. Cash items in process of collection C. Deposits at other banks D. Securities: an important income-earning asset: (securities: debt instruments for commercial banks. E. Loans: a liability for second party (individual or firm) receiving it but considered a bank’s asset. F. Other assets: Physical capital. 1- Basic Banking Banks make profits by selling liabilities (of particular combination of liquidity, risk, size, and return) and using the proceeds to buy assets (different combination of liquidity, risk, size, and return). This is called “asset transformation”: saving deposit transformed as mortgage loan. - Operations of a bank: The T-account The T-account: a simplified balance sheet of a bank. Example (1): - (X) goes to bank ONE, Open’s a checking account with 100KD. (This is a liability on the bank): The bank puts the 100KD into the vault so the bank assets increase by the 100KD: Assets Vault cash Liabilities Checkable +100KD deposits +100KD - Since the vault cash is also a part of the bank’s reserves: Assets Reserves +100KD Liabilities Checkable deposits +100KD Note: the increase in the bank’s reserves = the increase in checkable deposits If instead, (X) opens her checking account using a check written on an account at another bank, say bank TWO. Therefore, The final balance sheet for the two banks: Bank ONE Assets Reserves +100KD Liabilities Checkable deposits +100KD Bank TWO Assets Reserves -100KD Liabilities Checkable deposits 100KD Note: when a bank receives additional deposits, it gains an equal amount of reserves, when it loses deposits, it loses an equal amount of reserves. Example (2): Deposit = 100KD Required reserve ratio = 10% Bank ONE Assets RR +10KD Liabilities Checkable deposits Excess Reserves +90KD +100KD The bank is not making profits from the reserves it hold (because reserves pay no income). Therefore, the bank must put the reserves into productive usages (i.e. loans): Bank ONE make loan =90KD (the excess reserve): Bank ONE Assets RR +10KD Liabilities Checkable deposits Loans +90KD +100KD Since loans pay interest, the bank can make profits now. 3- General Principles of Bank Management How the bank manages its assets and liabilities to earn the highest possible profits? The manager of the bank has 4 primary concerns: 1. Liquidity management. 2. Asset management. 3. Liability management. 4. Capital adequacy management. 1- Liquidity management and the role of reserve: How the bank deals with deposit outflows? This is when deposits are lost because depositors make withdrawals and demand payment. Example: RRR (10%) Bank ONE initial balance sheet: Assets Reserves Loans Securities Liabilities 20 Deposits 80 Capital 10 100 10 The required reserve is (10), but total reserves = (20), therefore, the bank has excess reserves = (10). If a deposit outflow of (10) occurs, the bank’s balance sheet becomes: Assets Reserves Loans Securities Liabilities 10 Deposits 80 Capital 10 90 10 The bank loses (10) of deposits AND (10) of reserves. But since the total amount of deposits = (90), and RRR = (10%): Required reserve = (9), and Excess reserve = (1). If the bank has excess reserves, a deposits= outflow does not necessitate changes in other parts of its balance sheet. But what if the bank holds insufficient excess reserves? Example: the bank holds no excess reserves: Bank ONE Assets Liabilities Reserves 10 Deposits 100 Loans 90 Capital 10 Securities 10 The required reserve is (10), and total reserves = (10), therefore, the bank holds no excess reserves = (0). - if (10) deposit outflow occurs: Assets Reserves Loans Securities Liabilities 0 Deposits 90 Capital 10 90 10 There is a decline in deposits and reserves by (10). The reserves = (0), this is a problem since the required reserve must = (9: 10%×90). The bank has no RESERVE. To eliminate this problem, the bank has 4 options: 1- Borrowing from other banks (FED), or borrowing from corporation. The bank’s balance sheet becomes: Assets Reserves Loans Securities Liabilities 9 Deposits 90 90 Borrowing from other 10 banks or corp. 9 Capital 10 Pays interest = Federal Fund Rate 2- Sell securities: Sell securities worth (9), the balance sheet becomes: Assets Liabilities Reserves 9 Deposits Loans 90 Capital Securities 1 Cost= Liquidation, brokerage… 90 10 3- Borrowing from the Fed: Assets Reserves Loans Securities Liabilities 9 Deposits 90 Discount Loans 10 from the Fed Capital Pays interest = Discount rate. 90 9 10 4- Calling in or selling loans: Reducing its loans by (9) and depositing the (9): Assets Reserves Loans Securities Liabilities 9 Deposits 81 10 Capital 90 10 This solution is costly: May not be able to renew loans of some clients Sell loans at lower values This shows why a bank holds excess reserves though reserves pay no interest: to face deposits outflow. Excess reserves are insurance against the coat associated with deposits outflows. The higher the costs associated with deposit outflows, the more excess reserves bank will want to hold. 2- Asset Management When managing its assets (to maximize profits), the bank must: A. Seek the highest returns on loans and securities, B. Reduce risk, C. Enough provisions for liquidity (holding liquid assets). To accomplish these goals, four basic ways: 1- Find borrowers who will pay high interest rates but unlikely to default (Screening to reduce adverse selection problem). 2- Purchase securities with high returns and low risk. 3-Diversification of assets: purchase different type of assets, diversify borrowers. 4- Manage liquidity to satisfy reserves requirements. 3- Liability Management The use of liabilities in the creation of reserves and liquidity (Assets): Before: No interest paid on checkable deposits, therefore, no competition for deposits between banks. Banks rarely used overnight loans, After: Expansion of overnight loans Development of new financial instruments The flexibility in liability management means: the bank need not to depend on checkable deposits as the primary source of funds (liabilities). 4- Capital Adequacy Management Capital= Bank’s net worth = Total assets – Total liabilities Maintaining the appropriate capital (net worth) to prevent bank failure, maintain owners’ returns, and meet central bank regulations. 1- Prevent Bank Failure: Example (1): Consider two banks, one with capital to assets ratio of 10% and the other with 4%. High Capital Bank Assets Liabilities Reserves 10 Deposits 90 Loans 90 Bank Capital 10 Low Capital Bank Assets Liabilities Reserves 10 Deposits 96 Loans 90 Bank Capital 4 If the two banks lose % 5 million of their loans, their assets and capital will decline too by the same amount. The new balance sheets become as follows: High Capital Bank Assets Liabilities Reserves 10 Deposits 90 Loans 85 Bank Capital 5 Low Capital Bank Assets Liabilities Reserves 10 Deposits 96 Bank Capital Loans 85 1 - The high capital bank is still in a good situation because its net worth (capital) is still positive ($5 million). - The low capital bank is in a bad situation because its net worth is negative (-$1 million). The value of its assets is less than its liabilities, therefore it is insolvent (bankrupt): It does not have enough assets to pay off holders of its liabilities (creditors). When a bank becomes insolvent, the government closes it. 2- Bank Capital Affects Returns to Equity Holders: Bank owners need measures of bank profitability to know if the bank is managed well or not: A. Return on Assets (ROA): ROA = Net profit after taxes / Assets The ROA shows how efficiently a bank is being run by indicating how much profits are generated on average by each dollar of assets. B. Return on Equity (ROE): ROE = net profit after taxes / equity capital The ROE shows how much the bank earns on equity investment. C. Equity Multiplier (EM): EM = assets / equity capital It is the amount of assets per dollar of equity capital. It shows the direct relationship between ROA and ROE: Net profit after taxes / Equity capital = (net profit after taxes / assets) X (assets / equity capital) ROE = (ROA) X (EM) This formula show what happens to the return on equity when a bank holds a smaller amount of capital (equity) for a given amount of assets. Example The high capital bank has an EM = $100 million / $10 million = 10 The low capital bank has an EM = $100 million / $4 million = 25 If ROA is 1%, then: ROE for the high capital bank = 1% X 10 = 10% ROE for the low capital bank = 1% X 25= 25% Equity holders of the low capital bank are happier because they have a return twice higher. Thus, bank owners don't like holding a lot of capital (because it reduces ROE). Result: Given the ROA, the lower the bank capital, the higher the ROE. This show that there is a trade-off between safety and returns. Tradeoff: High bank capital reduces possibility of bankruptcy, but lowers (ROE). 3- Bank Capital Requirements: Banks hold capital because they are required by law to do so. Managing Credit Risk The bank must make good loans that are paid back (No default). - Screening and Monitoring, - Long-Term Customer Relation - Loan commitments - Collateral and Compensating Balances - Credit rationing Screening and the problem of Adverse Selection in loan market: when bad credit risk (most likely to default) are the ones who try to get loans. Investors with risky assets are the most eager to obtain loans, but are the least desirable borrowers. Must collect information about potential borrowers. Moral Hazard in loan market: borrowers may engage in undesirable activities from the lender’s point of view. Managing Interest-Rate Risk High volatility in interest rates makes banks exposed to interest- rate risk: The riskiness of earnings and returns that is associated with changes in interest rates. Example: First National Bank Assets Liabilities Rate-sensitive Rate-sensitive Assets Liabilities Fixed -rate Fixed-rate Assets Liabilities - $ 20 million of assets are rate sensitive, while $80 million with fixed rates. - $ 50 million of liabilities are rate sensitive, while $ 50 million with fixed rates. - If interest rate rises from 10% to 15% ( -income on assets rises by $1 million: in income = in interest X rate sensitive assets = 5% X $ 20 million = $ 1 million - payments on liabilities rise by $2.5 million: in cost of liabilities = in interest X rate sensitive liabilities = 5% X $ 50 million = $ 2.5 million - The bank profit's decline by $1.5 million ($2.5 - $1). - However, if interest rate falls by 5%, profit rises by $1.5 million. - Result: If a bank has more rate-sensitive liabilities than assets, a rise in interest rates reduces bank profits, while a decline in interest rates raises profits. Gap and Duration Analysis: 1-Gap Analysis: The sensitivity of bank profits to changes in interest rates can be measured directly using gap analysis by subtracting the amount of rate sensitive liabilities from the amount of rate sensitive assets. - In the example above, the gap equals $30 million ($20 - $50) - By multiplying the change in interest rate by the gap, we obtain the effect on profits: in profit = 5% X - $30 million = - $1.5 million. "Not all assets have same maturity": Maturity bucket approach. "Differing degrees of rate sensitivity": Standardize gap analysis. 2-Duration Analysis - An alternative measure of interest rate risk is duration analysis, which examines the sensitivity of the market value of the bank's total assets and liabilities to changes in interest rates. - Duration analysis uses the average duration of assets and liabilities to see how the net worth responds to a change in interest rates. - To measure the effect of bank's net worth due to a change in interest rate: %∆ in market value = ( - %∆ in interest rate) * (Duration) - In the example above, if average duration of assets is three years and liabilities is two years, assets are $100 million , and liabilities are $90 million. If interest rate rises by 5%: Value of assets falls by 15% (- 5% X 3 years), or $15 million. Value of liabilities falls by 10% (-5% X 2 years), or $9 million. Net worth falls by $ 6 million, or 6% of assets. - However, a 5% decline in interest rates increases net worth by 6% (of total assets). Can you show how? Off-Balance-Sheet Activities This involve activities that affect bank profits, but do not appear on the bank’s balance sheet. Trading financial instruments and generating income from fees and loan sales. 1- Loan Sales (Secondary Loan Participation): A contract that sells all or part of the cash stream of a loan therefore, it removes the loan from the bank’s balance sheet. 2- Generation of Fee Income: Earned from providing specialized services to customers: foreign exchange trade, mortgage backed security, banker’s acceptance… 3- Trading Activities and Risk management Techniques: - International Banking Trading in financial markets Speculations Risky activities: Insolvency.