Why do I need to use the AUSTRAC business profile form (ABPF)?

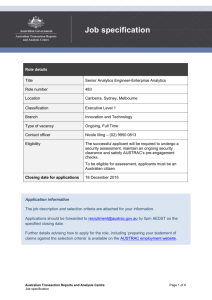

advertisement

Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Table of contents Introduction ......................................................................................................................... 2 What is a ‘cash dealer’? .................................................................................................... 2 Obligations on solicitors ..................................................................................................... 2 The AUSTRAC business profile form ................................................................................ 3 Why do I need to use the AUSTRAC business profile form (ABPF)? ................................. 3 What is AUSTRAC Online? ............................................................................................... 3 Where can I access the AUSTRAC business profile form? ................................................ 3 7 steps to download and complete the ABPF .................................................................... 4 Step 1: Download the AUSTRAC business profile form................................................... 5 If your business has not previously reported to AUSTRAC ................................................ 5 If your business has previously reported to AUSTRAC ...................................................... 6 Step 2: Complete/update the ‘Business information’ section of the form ...................... 7 Step 3: Complete/update the ‘Designated services information’ section of the form .... 8 Step 4: Complete/update the ‘Other details’ section ........................................................ 9 Step 5: Complete the AUSTRAC ‘Online access’ section .............................................. 10 Step 6: Complete the ‘Declaration and submit’ section ................................................. 11 Step 7: Your AUSTRAC Online business account has been created/ updated ............ 12 Who can help me with AUSTRAC Online? ...................................................................... 12 Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 1 of 13 Introduction This guide is designed to assist cash dealers and solicitors with obligations under the Financial Transaction and Reports Act 1988 (FTR Act) to access, complete and submit the AUSTRAC business profile form (ABPF). The ABPF is an online form used to create and maintain an AUSTRAC Online business account. This guide provides details on how cash dealers and solicitors can complete the ABPF. It includes: where to download the form how to complete the form how to use the form to maintain your business profile. What is a ‘cash dealer’? Cash dealers as defined in the FTR Act include: banks, building societies and credit unions, referred to as 'financial institutions' financial corporations insurance companies and insurance intermediaries securities dealers and futures brokers cash carriers managers and trustees of unit trusts firms that deal in travellers cheques, money orders and the like, and persons who collect, hold, exchange or remit currency on behalf of other persons currency and bullion dealers casinos and gambling houses Totalisator Agency Board. The FTR Act requires cash dealers to report to the AUSTRAC CEO: suspicious transactions significant cash transactions – that is, transactions of AUD10,000 or more (or the foreign currency equivalent) international funds transfer instructions (IFTIs). Note: The FTR Act reporting obligations do not apply if your business is required to submit a report about the transaction under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). Obligations on solicitors The FTR Act also requires solicitors to report significant cash transactions (AUD10,000 or more, or the foreign currency equivalent) to the AUSTRAC CEO. Note: The FTR Act reporting obligations do not apply if your business is required to submit a report about the transaction under the AML/CTF Act. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 2 of 13 The AUSTRAC business profile form Why do I need to use the AUSTRAC business profile form (ABPF)? To facilitate electronic submission of cash transaction reports of AUD10,000 or more and suspicious transactions, you need an AUSTRAC Online business account. The account can only be created by completing an ABPF. What is AUSTRAC Online? AUSTRAC Online is an internet-based system designed to assist you with your regulatory obligations under the AML/CTF Act and the FTR Act. An AUSTRAC Online business account: allows you to submit transaction reports to AUSTRAC electronically enables you to view and maintain your own information as held by AUSTRAC is a secure system which enables the protection of confidential information assists AUSTRAC to better understand and support the regulated population. Where can I access the AUSTRAC business profile form? If your business has never reported to AUSTRAC, you will need to download a blank ABPF via the AUSTRAC website. See page 5 of this guide for more information. If your business has previously reported to AUSTRAC, your business will have an existing AUSTRAC Online profile. A pre-filled ABPF can be accessed by logging into your existing AUSTRAC Online account. See page 6 of this guide for more information. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 3 of 13 7 steps to download and complete the ABPF Follow the steps below to download, complete or update the ABPF. Step Action Description 1 Download the AUSTRAC business profile form A writable Adobe SmartForm is open on your desktop and ready to complete 2 Complete the ‘Business information’ section of the form This section of the form relates to your business’s general identification and contact information 3 Complete the ‘Designated services information’ section of the form This section of the form relates to businesses that provide designated services under the AML/CTF Act and not relevant to cash dealers or solicitors. Simply answer ‘No’ to the questions on this page. 4 Complete the ‘Other details’ section of the form This section relates to your business’s obligations under the FTR Act 5 Complete the ‘AUSTRAC online access’ section of the form This section relates to new entities which require an AUSTRAC Online business account to access AUSTRAC Online 6 Complete the ‘Declaration and submit’ section of the form Read and complete the declaration and submit the form Your AUSTRAC Online business account is created/updated Once you have successfully completed and submitted the form, your AUSTRAC Online business account will be created/updated 7 Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 4 of 13 Step 1: Download the AUSTRAC business profile form There are two ways to download the ABPF, depending on whether your business has previously reported to AUSTRAC. If your business has not previously reported to AUSTRAC If your business has not previously reported to AUSTRAC, follow the steps below to download a blank ABPF from the Enrolment and registration page of the AUSTRAC website. From the Enrolment and registration page: Scroll down to the section titled How do I enrol and/or register my business? Under Businesses new to AUSTRAC click the Download and submit the AUSTRAC Business profile form link. A pop-up box will appear. Select Open. The ABPF will open in Adobe Acrobat. Note: You may be prompted to download the latest version of Adobe Reader if the version installed on your computer is not current or Adobe is not installed on your computer. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 5 of 13 If your business has previously reported to AUSTRAC If your business has previously reported to AUSTRAC and you already have an AUSTRAC Online business account, a pre-filled ABPF can be downloaded from your existing AUSTRAC Online business account. To access the ABPF through AUSTRAC Online: Go to the AUSTRAC Online login zone. Enter your existing user account details (user name and password). Click Login. Once you are logged in, expand the My business menu by clicking the + icon next to My Business. Select Business Profile from the menu. You will be directed to the Business Profile page. Click the link titled AUSTRAC Business Profile Form. A pop-up box screen will appear. Select Open. Complete steps 1, 2, 3, 4 and 6 to update your AUSTRAC Online profile. Forgotten your user name/password? Tip: Your user name is usually your email address. Tip: If you have forgotten your password, click the Forgot your password? link on the AUSTRAC Online login zone. Enter your user name on the Reset Password page and click Submit. Don’t have an existing user name/password? If your business has previously reported to AUSTRAC but you do not have an existing user name and/or password, please contact the AUSTRAC Help Desk on 1300 021 037 or help_desk@austrac.gov.au for assistance. Tip: Navigating the ABPF You can navigate through the various pages of the form by clicking on the tabs along the top. You will find these tabs on every page of the ABPF. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 6 of 13 Step 2: Complete/update the ‘Business information’ section of the form At the top of the ABPF, click the Business information tab, which will take you to the Business information page of the form. Once you have completed all relevant sections of the page, click ‘Validate section’. If there are any errors on the page, they will be shown in red at the end of the page. Correct and validate each error separately. Repeat the process until there are no errors on the page. Click OK Step 2 is now complete. Notes: To answer the question about the category that best describes the primary purpose of your business, choose the option which most accurately applies. Only choose ‘Other’ if none of the provided categories apply. Instructions provided on this form advise that the information is used for the Reporting Entities Roll. Entities that are regulated by the FTR Act only do not need to enrol on the Reporting Entities Roll. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 7 of 13 Step 3: Complete/update the ‘Designated services information’ section of the form Click on the Designated services information tab. Answer ‘No’ to both questions that appear on the page: Once you have completed all relevant sections of the page, click ‘Validate section’. If there are any errors on the page, they will be shown in red at the end of the page. Correct and validate each error separately. Repeat the process until there are no errors on the page. Click OK. Step 3 is now complete. Note: If you answer Yes to any questions in the ‘Designated services information’ page your business provides a ‘designated service’ under the AML/CTF Act and is a reporting entity. Reporting entities are required to enrol with AUSTRAC.’ For information on how to complete and submit the ABPF as a reporting entity, please refer to the AUSTRAC business profile form explanatory guide located on the Enrolment and registration page of the AUSTRAC website. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 8 of 13 Step 4: Complete/update the ‘Other details’ section Click on the Other details tab. Once you have completed all relevant sections of the page, click ‘Validate section’. If there are any errors on the page, they will be shown in red at the end of the page. Correct and validate each error separately. Repeat the process until there are no errors on the page. Click OK. Step 4 is now complete. Note: Cash dealers and solicitors must answer Yes to the question ‘Does the business have any ongoing obligations under the Financial Transaction Reports Act 1988?’ Note: The primary contact for your business will receive a user ID and temporary password soon after submitting the ABPF to enable access to AUSTRAC Online. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 9 of 13 Step 5: Complete the AUSTRAC ‘Online access’ section Click on the AUSTRAC Online access tab. Answer Yes to the question Do you require access to AUSTRAC Online? (this will create a user account to allow you to access AUSTRAC Online). Once you have completed all relevant sections of the page, click ‘Validate section’. If there are any errors on the page, they will be shown in red at the end of the page. Correct and validate each error separately. Repeat the process until there are no errors on the page. Click OK. Step 5 is now complete. Note: If you accessed the ABPF via your AUSTRAC Online business account, you will not be required to answer any questions on this page. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 10 of 13 Step 6: Complete the ‘Declaration and submit’ section Click on the Declaration and submit tab. Complete the Declaration section of the page (ensure that you read the declaration). Once you have completed all relevant sections of the form, click Submit. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 11 of 13 Step 7: Your AUSTRAC Online business account has been created/ updated Once you have submitted the ABPF you will receive a confirmation email and receipt. Save the receipt to your computer as directed. If you have not previously reported to AUSTRAC and do not have an existing AUSTRAC Online business account, an account will automatically be created for you. A temporary user ID and password will be emailed to the primary contact person for your business, as listed/nominated in the ‘Other details’ section of the form. Who can help me with AUSTRAC Online? The AUSTRAC Help Desk can assist you with further information about AUSTRAC Online or your obligations under the AML/CTF Act or FTR Act. The AUSTRAC Help Desk can be contacted on: phone: (local call within Australia) 1300 021 037 phone: (international) +61 2 9950 0055 email: help_desk@austrac.gov.au National Relay Service (within Australia): TTY or computer with modem users phone 133 677 and ask for 1300 021 037. Speak and listen (speech to speech relay) users phone 1300 555 727 and ask for 1300 021 037. Guide for cash dealers and solicitors on completing the AUSTRAC Business Profile Form Page 12 of 13