Chapter 3 Business Transactions

advertisement

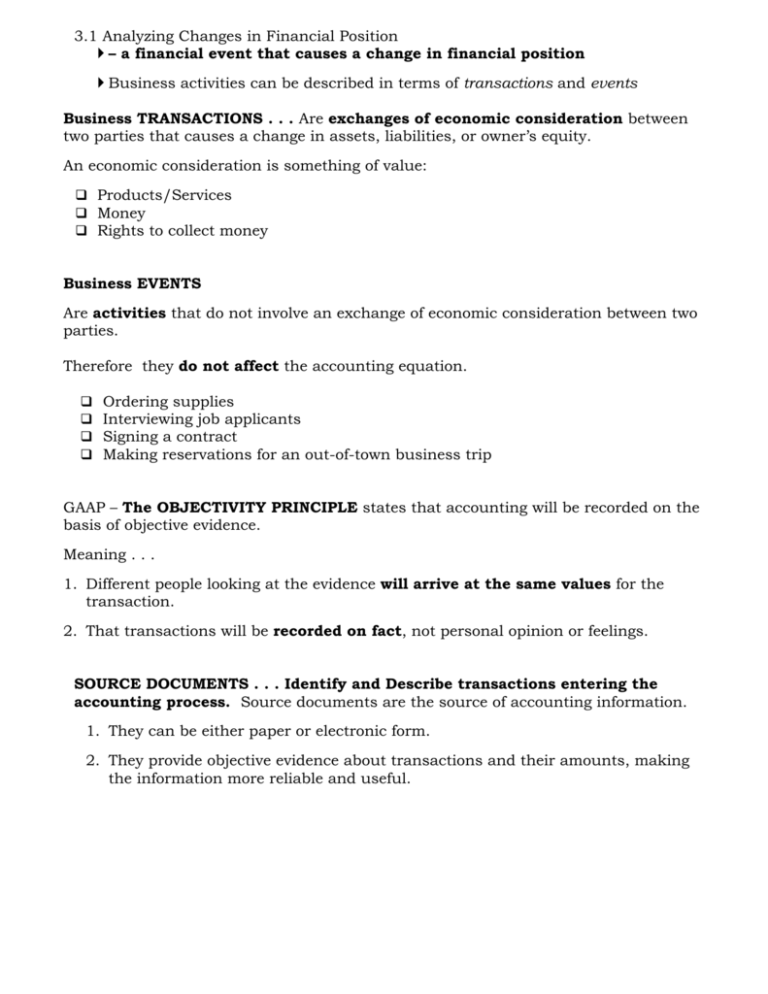

3.1 Analyzing Changes in Financial Position – a financial event that causes a change in financial position Business activities can be described in terms of transactions and events Business TRANSACTIONS . . . Are exchanges of economic consideration between two parties that causes a change in assets, liabilities, or owner’s equity. An economic consideration is something of value: Products/Services Money Rights to collect money Business EVENTS Are activities that do not involve an exchange of economic consideration between two parties. Therefore they do not affect the accounting equation. Ordering supplies Interviewing job applicants Signing a contract Making reservations for an out-of-town business trip GAAP – The OBJECTIVITY PRINCIPLE states that accounting will be recorded on the basis of objective evidence. Meaning . . . 1. Different people looking at the evidence will arrive at the same values for the transaction. 2. That transactions will be recorded on fact, not personal opinion or feelings. SOURCE DOCUMENTS . . . Identify and Describe transactions entering the accounting process. Source documents are the source of accounting information. 1. They can be either paper or electronic form. 2. They provide objective evidence about transactions and their amounts, making the information more reliable and useful. Remember . . . 1st Accounting entries are made from business papers known as source documents. 2nd Source documents are kept on file for reference purposes and are proof of the transaction. A normal business activity that changes assets, liabilities, or capital is called a transaction. A transaction for . . . The Sale of goods/services = an increase in capital. An increase in capital resulting from the operation of a business is called revenue. A transaction to . . . Pay for services = a decrease in capital A decrease in capital resulting from the operation of a business is called an expense. -----------------------------------------------------------------------------------------------------------Example Transaction A . . . Truck 20,000 Cash 20,000 Business buys a new delivery truck for $20,000 cash. Truck (asset) increases by $20,000 and Cash (asset) decreases by $20,000 Example Transaction B . . . Loan Payable 1,000 Cash 1,000 The business makes a payment of $1,000 against the $7,000 loan owed to the bank. Cash (asset) decreases by $1,000 and Loan Payable (liability) decreases by $1,000. 3 basic guides to . . . How transactions change an accounting equation. 1. 2. Each transaction makes at least 2 changes in items affecting the accounting equation. Receipt of Cash on Account. The amount of $1,900 is received from the client ten days after the billing for consulting services. When a transaction makes all changes in items on the equation’s left side (assets), items on the equation’s right side are not affected/changed. (liabilities/capital) Services & Rental Revenues Rendered for Credit. Finlay Interiors provides consulting services of $1,600. and rented furniture for $300. to a homebuilder, who is billed for $1,900. 3. When a transaction changes only one item on the equation’s left side (assets), an item(s) on the equation’s right side is also affected (liabilities or capital) WITHDRAWALS . . . assets taken out of the business for the owner’s personal use. A withdrawal decreases an owner’s capital. To Analyze & Record Transactions Follow the 3-step Approach: I. Select which items are affected II. Classify each item as an asset, liability, or capital III. State whether the items have increased or decreased. After every transaction, the accounting equation must still balance.