assessment of the organization's assets at fair value

advertisement

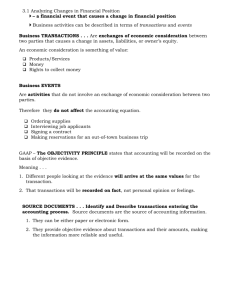

E.M. Sorokina Doctor of economic Sciences, Professor. Baikal state University of Economics and law. Russia ASSESSMENT OF THE ORGANIZATION'S ASSETS AT FAIR VALUE Abstract. The equivalent of a reliable assessment of the assets of the organization shall be the fair value. The article is considered information, why in the accounting cannot be applied evaluation of the organization's assets to fair value and a version of the submission of reliable financial information in the financial statements. Key words: fair value estimation of the asset, accounting, and reporting. To investors, creditors, managers and other interested persons to forecast cash flows and financial results, identify and assess possible risks, we need reliable information on the amount of cash, which can be obtained in the case of the sale of the asset of the organization, or which is required for the performance of obligations by buying it at a certain moment of time. The initial value at which the assets were accepted for accounting purposes, for a time, until the organization owns the assets may change significantly in comparison to their value at the time of submission of reporting data to the interested users. A kind of equivalent of a reliable assessment is considered to be the fair value. In accordance with IAS 39 «Financial instruments: recognition and measurement fair value is the amount of cash sufficient for the acquisition of an asset or performance of obligations under a transaction between a knowledgeable, willing to accomplish such transaction, independent of each other. From the definition formulated in the МСФО39 «Financial instruments: recognition and measurement», it follows that the definition of fair value, provides for three obligatory conditions, without the execution of which determine the fair value of the practice impossible. Firstly, the deal must be struck between the parties, well informed about the existing conditions of transactions with similar assets. Secondly, the transaction should not be forced. Thirdly, carrying out the transaction, the parties should be independent from each other. If we analyze the above-mentioned conditions, we can make two conclusions. On the one hand, the fair value provides an objective basis for assessing future cash flows in comparison with the initial value, provides a framework for comparability of the information about the assets, best combined with the principles of active management and contributes to the objective estimation of results of work of the management. On the other hand, if you use fair value as the evaluation of the assets of the organization in the accounting records may be considerable difficulties with its definition in the absence of an active market. They entail and the other negative point associated with the use of fair value is highly labor intensive and large extra costs caused by necessity of attraction of professional appraisers. As is known, all business transactions are recorded in the accounting records only on the basis of primary documents. Such documents are formed when performing economic operations. Only their presence gives legal effect of accounting information and provides accounting the opportunity to perform one of its main functions - control. Taking into account that the fair value of this variable, the estimated relative to which has not been determined yet definite formation procedure, we can make a conclusion about inexpediency and the inadmissibility of the use of it in the present time in the accounting records as a whole. This can be done only in exceptional cases. For example, on the sale of the organization as a whole property complex, in the planning of the issue of securities, when obtaining a loan under the pledge of real estate or other asset. In our opinion, in order to ensure the interested users of reliable accounting information necessary to use the valuation of assets at fair value when presenting the relevant data in the financial statements. Balance sheet data should be formed on the basis of the accounting data in the assessment, which currently can be formed in accounting, preserving the validity of the information and control functions. Information about the fair value of the assets of the organization is to be provided in the explanatory notes to the accounting balance sheet. Establishing the fair value of the assets in this implies a certain calculations. At issue arising in the evaluation of the assets of the organization, the fair value is the choice of an indicator that the most authentically reflects this value. There are many approaches to the definition of fair value, and, consequently, reflecting its indicators. For example, the spokesman of the fair value can be under certain conditions, the market value, replacement cost adjusted for depreciation, present value and other kinds of values. In foreign practice, most often the best indicator of fair value of the asset recognize its market value. However, these concepts are not equalized. Market value in full degree corresponds to the notion of fair value only in the conditions of the active market, i.e. the market in which prices are determined by supply and demand, deals are made quite often, without coercion, and the parties involved do not depend on each other. An example of an active market is the stock exchange. In an inactive market fair market value can be regarded as similar, if transactions on it are made regularly, but there is a possibility of compliance with the mandatory conditions, to determine the fair value. An example of an inactive market may be transactions with real estate objects. In Russian practice, the adoption of market value as a fair value in the current economic conditions is not always justified, and sometimes impossible. The reason lies in the fact that the concept of market value in the field of economic knowledge in General is not agreed, and that the domestic market of many of the assets or insufficiently developed, or is absent at all. In the Russian normative acts on accounting, the concept of the market value sometimes unreasonably mixed with the notion of the current market value. As is known, the market value is characterized by an interval value of the estimates, certain using a variety of methods, or the various sources of information. The current market value is a specific price, prevailing in a particular market. In addition, the current market value is sometimes incorrectly defined as the sum of cash, which can be obtained as a result of the sale of assets. In practice is not always the price of purchase and sale of a particular asset may be equivalent to the current market evaluation. For example, in the conditions of a forced transaction or the existence of dependence between the parties to a purchase-and-sale of the asset may be held on an individually-set prices. For the purposes of taxation in accordance with art. 40 of the Tax code of the Russian Federation under the market price means the price resulting from the interaction of demand and supply in the market of identical (or-in their absence - homogeneous) goods in comparable economic and commercial conditions. The market price is determined on the basis of official sources of information and stock quotes. In the absence of information on transactions with similar goods are equal to the market price of the price of subsequent sale and defined on the basis of depreciated replacement cost method. Allowed to participate expert-appraiser to determine the value of individual types of property in certain cases. To the greatest extent, the concept of fair value in accordance with МСФО39 «Financial instruments: recognition and measurement» corresponds to the concept of market value, used in the valuation activity. According to the Federal law «On valuation activities in the Russian Federation» under market value object of evaluation is understood as the most probable price, at which the given object of valuation can be disposed of on the open market in the conditions of competition, when the parties to the transaction acting reasonably, having all the necessary information, and at the price of the transaction is not recorded any emergency the circumstances, that is, when the one of the parties of the transaction is not obliged to alienate the object of the assessment, and the other party is not obliged to accept the performance; the parties of the transaction are well informed about the subject of the transaction and are acting in their own interests; the object of the assessment is presented on the open market in the form of a public offer; the price of the transaction represents a reasonable fee for the object of the assessment and coercion to commit the transaction in respect of the parties to the transaction with any side was not; payment for the object of the assessment is expressed in monetary form. As already noted, one of the indicators of fair value may be present value. Using the method of discounting to determine the fair value of the assets of the organization has a number of advantages. Firstly, the method of discounting allows to overcome the «justice» only at the time of the transaction. Secondly, when using it, is considered the usefulness of the asset from the point of view of future economic benefits associated with the ownership of the asset. Third, the present value of less subject to fluctuations in market conditions, as it is based on the factors that are most sensitive to the possible characteristics of the assets generated by the asset cash flows in time and all kinds of risks. The calculation of the present value of assets as a whole is carried out by a well-known formula t FCFn n n 1 (1 R ) PV where PV - the current (discounted) value of assets; FCFn - predictive values of net cash flow in the period n ; R - the discount rate; t - the duration of the evaluation period; n - the number of periods. At the present time organization in the practical determination of the present value of the face a number of difficulties. One of them is connected with the ambiguity of the calculation of discount rates. The discount rate in the assessment of assets economists use the weighted average cost of capital, the profitability of investments in the assets or return on equity, cumulative method (the method of summation of using the risk-free rate and the risk adjustments) and others. The most adequate method of determining the discount rate is cumulative method (the method of summation of using the risk-free rate and the risk adjustments). This method is applicable in our country, and therefore is used practicing appraisers. The calculation of the discount rate cumulative method is carried out according to the formula t R Rt Rn n 1 where R t - the risk free rate of return; Rn - the specific risks inherent in the asset. The rest of the symbols of the former. When determining the risk-free rate of return, as a rule, are oriented to the securities issued by the government of the Russian Federation. The accuracy of calculations using the cumulative method depends on the accuracy of the assessment of the risks inherent in the specific asset. This allows to make a conclusion that the fair value is reliable estimate of the assets of the organization. In theory its use in accounting will allow to satisfy the interests of different users of accounting information. However, at the present time has not yet formed a mechanism of its determination, which allows accounting at the same time serve and information, and the control function. Use in the accounting practice of evaluation of the organization's assets at fair value it is advisable for the formation of reporting data, in particular, the notes to the accounting balance sheet. The advantage in determining the fair value of the assets of the organization at the present time is the method of discounting. Literature: 1. The tax code of the Russian Federation of 31.07.1998 g. 2. The Federal law «On valuation activities in the Russian Federation» of 29.06.1998 g. № 135-FZ. 3. МСФО39 «Financial instruments: recognition and measurement» 4. МСФО13 «Fair value measurements»