Category2

advertisement

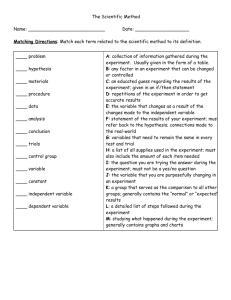

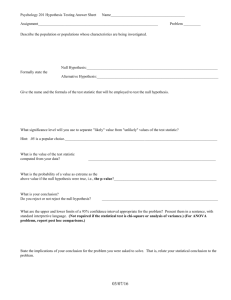

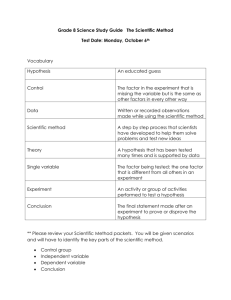

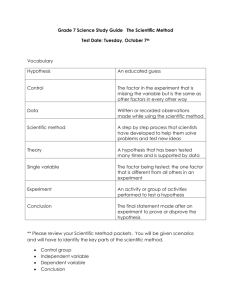

Prateek Sangal Senior Economics Major 10/03/03 Testing the Relationship of Education to Income “The purpose of this study is to test the relationship between “Levels of Education” and “Earnings”. Using the Human capital model, we conclude that an individual should get paid more if he/she has a higher productivity due to ability and additional skill that are a direct result of better education.” Introduction: Economists have long recognized that the benefits of higher education may not be restricted to the direct recipients but might spread over to others, in ways which either improve the productivity of the less educated or generally enhance their sense of well-being. Productivity effects have been the focus of most empirical analyses at micro levels and are the fundamental characteristic that leads to the process of economic growth. The purpose of this study is to test the relationship between “Levels of Education” and “Earnings”. The study focuses on determining that as level of education increases, an individual’s income progressively increases, which is based on the economic theory of the Human capital model. The hierarchical management of a firm usually depends on the workers level of qualification. As educated members join the workforce of a firm at the top management levels, higher returns are anticipated. In general, the wage rate of an employee is directly related to the output that is expected off of the individual. Firms pay varying salaries to individuals at different levels of education because the output per worker differs in every case.1 A fairly obvious example would be that a student in college does not earn as much as someone who has acquired a Masters degree in a particular field. Theory: 1 Ehrenberg, Ronald G and Smith, Robert Stewart, 1994 This study is based on the labor economics theory of the human capital model. We investigate the relationship between educational level and earnings, using elements of the human capital theory, which explains important empirical patterns observed from studying previous data. An implication of the investment model of educational choice is that earnings rise with the level of education, for if they did not; the incentives for students to invest in more education would fade away (Ehrenberg, Ronald G and Smith, Robert Stewart, 1994). This statement is clearly illustrated in figure 1, which indicates that the average earnings of more educated worker always exceeds those of less educated workers. A person considering college has, in some broad sense, a choice between two streams of earnings over his or her lifetime. Stream A begins immediately but does not rise very high; this is the earnings of a high school graduate. Stream B, which is a college graduate has a negative income initially (owing to college tuition costs), followed by a period when the salary of the two streams equate, but then it takes off and rises well above stream A. Obviously, the earnings of the college graduate would have to rise above those of the high school graduate to induce someone to invest in a college education (Ehrenberg, Ronald G and Smith, Robert Stewart, 1994). However, we must not ignore the fact that earnings are influenced by both wage rates and hours of work. To control for irregularity in hours, the data used in this study is for male, full-time and year round workers. Figure labeled ‘Earning Profiles’ on previous page shows a graph of the 1990 earnings of men of various ages with different levels of education. According to the human capital theory, an examination of the graph reveals that: Average earnings of full time workers rise with the level of education; The most rapid increase in earnings occurs early in one’s working life, thus giving it a convex shape; Age/earnings profiles tend to fan out, so that education related earnings differences later in workers lives are greater than those early on The more educated an individual is, the more higher returns are expected. This is shown as the vertical difference between the graphs of different levels education. (Ehrenberg, Ronald G and Smith, Robert Stewart, 1994) The signaling model is another concept that tells us that income increases are due to the increases in levels of education. The signaling model states that employers use signals to determine the cognitive ability and productivity of the labor being hired. The signals are taken from levels of education and in most cases test scores (Ehrenberg, Ronald G and Smith, Robert Stewart, 1994). The level of education acts as a signal to the employer to chose which post is best suited for the employee and at what income level. Hence we deduce that employers make income decisions based on the productivity that they expect off of the employee and educational levels signify the productivity of a worker. Therefore a worker with higher education is bound to get a higher income compared to someone with a lower education. The knowledge and skill that a worker has, comes from education and training. The experience that this learning yields generates a higher productivity level. However, the value of this amount of productivity is derived from how much the acquired skills can ‘earn’ in the labor market. As an example we compare the marginal productivity of labor (MRP L) for two individuals, ‘A’ and ‘B’ who work the same number of hours. The MRPL is the additional output obtained from the additional unit of this labor, multiplied by the additional revenue from an extra unit of output. The marginal product of labor MPL gives the additional output, and the marginal revenue MR gives the additional revenue.2 In a simpler model (shown above) we notice that due to the difference in education levels, two individuals, namely ‘A’ & ‘B’ have different marginal revenue products (MRP’s). Individual B who has a higher level of education has a higher marginal product (MRP L2), which yields him a greater wage rate even though he works the same number of hours as individual A. At a 100 labor hours MRPL2 receives a $15 wage per hour while MRPL1 (individual A) receives $10. This is due to the additional advantage in skill level or efficiency acquired through education. Another 2 Pindyck R and Rubinfeld D, 1998 aspect of this theory would be that if a person were more educated he would increase the productivity of a firm due to better and more efficient skills. As revenue increases for the firm due to higher productivity, it will increase the wages for its employees as a further incentive of increasing sales. This in turn raises the earnings for employees who are more efficient due to education or skill level (Pindyck R and Rubinfeld D, 1998). Hence we conclude that education increases productivity. Therefore if an individual is highly educated he ought to get paid more and have a higher income level. Data Set: The data used for this study is cross sectional and has been obtained from the Current Population Survey (CPS), which is a monthly survey of about 50,000 households conducted by the Bureau of the Census for the Bureau of Labor Statistics. To show a change in earnings due to the level of education, four categories are chosen which represent male workers from different sections of the population. The four categories include individuals who have 1). 12th grade no diploma 2). High school graduate-high school diploma 3). Some college but no degree, and 4). Master's degree (MA, MS, MENG, MED, MSW, MBA) 90 samples from each group have been randomly selected (by excel) and used for further testing. The objective of this study is to theoretically and empirically determine that as the level of education increases, productivity increases hence income increases. The conceptual model of this study can be expressed as: Earning = f (level of education) This model is a result of the conclusion of our theory. We have determined by economic analysis that an individuals earnings are a function of their level of education. The ‘unit of analysis’ in this cross sectional data for the year 2001 will be the ‘individual’. For my operational model, level of education and salary capture the human theory model. The operational variables are as follows: Salary = f (years of schooling) The data has been controlled for irregularity in working hours by using male, full-time year round workers. Women were not included in the data because of the irregularity of being in the work force. Women have a shorter expected work life due to their drop out rate from the labor market in the childbearing years. Hypothesis: Comparing the mean earnings of the respective categories represents the hypotheses of the study. The hypothesis deals with two sections at one time, in order to show a progression in increasing mean salaries if it is true that education increases income. The categories listed below are all one-tailed tests: Category1: H0 (Null hypothesis) G HS H1 (Alt hypothesis) G HS Where = mean, 12G= 12th grade no diploma and HS= High school graduate Category2: H0 (Null Hypothesis) HS Coll H1 (Alt Hypothesis) HS Coll Where = mean, HS= High school graduate and Coll= some college but no degree. Category3: H0 (Null Hypothesis) Coll H1 (Alt Hypothesis) Coll < MA Where mean, Coll= some college but no degree and MA= Master's degree (MA, MS, MENG, MED, MSW, MBA). To maintain the validity of the economic theory that we showed in the earlier section, we would expect the Null hypothesis to be rejected. Methodology & Results: Appendix) (Note: For this section refer to Tables 1, 2 and 3 in Initially, after extracting samples from the population, the mean, standard deviations and variances are calculated using excel (as shown in Table 1 of the Appendix). The mean is the average, which is the sum of all the values in the sample divided by the number of values in the sample. The variance is a measure of how spread out a distribution is. It is computed as the average squared deviation of each number from its mean and consequently we discover that the standard deviation is the positive square root of the variance.3 The logic behind hypothesis testing is that if the result obtained from the samples is significantly different from that of the hypothesized population value, then the hypothesis should be rejected. In order to test if the two populations have equal variances we do an F-test. In my particular analysis all the three categories as described in the ‘hypothesis’ section have been dealt with individually. The idea of calculating the categories separately is to determine if the variances for both the sections selected are from the same population and whether it is reasonable to assume that the two population means are equal. For all the categories in my example we choose the level of significance to be 5%, i.e. 95% level of confidence. The F test statistic can be calculated by the formula: F = s21 s2 2 Where s2 = sample standard deviation. To determine whether our theory holds true with our given data we need to check if our critical-F is less than or greater than the F-statistic. To calculate the F statistic we use the ‘FINV’ formula in excel (results in Table 2 of Appendix). The ‘FINV’ formula finds the critical F using the probability (in our case 0.05) and the combination of both the degrees of freedom. For every individual test that we calculated, it was noted that the F-stat was less than the Critical F. In all the three categories, at a 95% confidence level our Critical F values of 1.419 are greater than the F-stat values of ‘1’. With the results of the F-test statistic we conclude that our population variances are equal. In order to now prove our theory we move on to calculating the critical value of the t-statistic. 3 Groebner D, Shannon P, Fry P and Smith K, 2000. As a next step we consider calculating the T test for equal variances. The t test statistic will help us determine whether to accept or reject the Null hypothesis. If our t test statistic value lies within the region of the critical t then we accept our Null hypothesis, and if it lies outside the critical t region, then we accept our Alternative hypothesis (Groebner D, Shannon P, Fry P and Smith K, 2000). The test statistic is a function of the sampled observations that provides a basis for testing a statistical hypothesis. The t test gives a summary of the two variables being tested. It includes in itself the mean, variance, observations the test statistic value and the one and two tail critical t values. For our test only the one tail critical t values are relevant due to the nature of the hypothesis. While entering the information in excel, it is important to identify that the mean of the expected smaller samples (as indicated in the alternative hypothesis for all categories) is taken as the ‘A’ variable and the sample with the greater mean as ‘B’. This helps us identify that we are now interested in the negative area in the distribution. From the results of our data set in Table 3 of the Appendix, we observe that for ‘Category 1’ and ‘Category 3’ the t statistic lies outside the region of the Critical t. This is indicated in the graph below. Due to the nature of the test, in order to reject our Null hypothesis we expect the value of the t test statistic to lie outside the ‘negative’ value of the critical t region. The above distribution for Category 1 and 3 indicate that the t statistic lies outside the region of the critical t. This leads us to reject our Null hypothesis and conclude that our economics theory H1 holds true. Surprisingly, on evaluating the data from the second category (shown in graph above) we notice that the t statistic of –1.43 lies inside the critical t region of –1.65 and +1.65. For this particular category we are forced to say that due to the nature of our data, our Null hypothesis H 0 is being accepted in comparison to the economic theory of H 1. The reason for this is relatively evident from the individual categories that were chosen for the second hypothesis. The comparison of earnings was made between high school students who had a diploma and students who went to some college but did not receive a degree. From an employer’s standpoint, we could assume that the signal given out by both these categories in terms of ability and skill may not be very different. But employers may discriminate against individuals who had the opportunity of going to college but were not able to receive a degree. This in other words sends out a negative signal to employers about the productivity of the individual and may hence result in equal or in some cases lower salary levels. Even though the above-mentioned reason for our results may have some sort of perception error, we can safely state that a primary reason for H 0 being accepted may lie in the fact that the sample chosen from our population for our category of “some college but no degree” may have sampled observations that were either too close or below the values of the previous group, in turn creating a bias. To confirm that our economic theory in reality does hold true, we notice two distinct observations in our data calculations. Firstly, since our hypothesis states that as the level of education increase income increase we notice that the individual means for the samples progressively amplify (shown in table1 of the Appendix). From every level of education acquired (lowest to the highest) the means are at a constant rise. Secondly we notice that since the CPS codes give us different values to associate with the level of education, in my particular observation we jumped from a college-earning individual directly to a Masters degree holder. This omitting of numbers from 40 to 44, that is Bachelors, Associates degrees etc shows us that the mean from 39 to 44 had a huge increase from $24353.52 to $48491.16. Clearly this represents a strong relationship between education and income. As income rose in every subsequent group, the means and standard deviations rose. Conclusion: Our empirical analysis concludes that our alternative hypothesis holds true for two out of the three categories tested. Even though it seemed like the data set we used for our tests was valid and the results would all be consistent with H1, we were proven wrong. The reasons for this may be other factors at work, which may have been excluded or included in the data that force the results to get biased. The observations used in this study may not control for factors such as motivation levels, family backgrounds, and heads of households, circumstances and many other demographic variables that result in biases. There may be individuals in the sample who were forced out of college because of monetary or any other external circumstances. It may not be fair to use such observations in comparison to other means. Logically though, the alternative hypothesis for this study makes sense because if income did not increase due to an increase in the level of education then there would be fewer individuals in colleges today. There are people who get educated for the sheer pleasure of learning, but the truth remains that most people acquire education to become economically better off. Any level of education will make a person better off than the previous level. In today’s world the standard of living is much higher than it was 30 years ago. The cause of this lies in the fact that with the addition of many other factors at work, economic growth has taken place due to an increase in population, increase in ideas, more efficient working techniques and technological advancement. Three out of the four above mentioned reasons why standard of living is higher are due to the attainment of a higher level of education. It makes complete sense because a high schooled worth 10 years of education will not know as much as someone who has done 18 years of schooling and will not get paid more than the latter because in any given circumstance the individual with 18 years of education will be more productive. This reason is very apparent if you look at undergraduates compared to graduates in the labor market. Hence we conclude that an individual should get paid more if he/she has a higher productivity due to ability and additional skill that are a direct result of better education. Bibliography: [1] Groebner, D. Shannon, P. Fry, P and Smith K (2000) “Business statistics, A decision making approach”, fifth edition, published by Prentice Hall Inc, Upper saddle river, New Jersey 07458, 2000. [2] Pindyck, R and Rubinfeld, D (1998). “Microeconomics”, fourth edition, pg 513-540, published by Prentice Hall Inc, Upper saddle river, New Jersey 07458, 1998. [3] Ehrenberg, Ronald G and Smith, Robert Stewart (1994) “ Modern Labor Economics: Theory and Public Policy”, fifth edition, pg 279-320, published by Harper Collins, 10 East 53rd street, New York, NY 10022. [4] Frazis, H. (2002). Human capital, signaling, and the pattern of returns to education. US Bureau of Labor Statistics, 54, 298-320. [5] Belfield, C. (200). Economic principles for education: theory and evidence. Cheltenham, U.K. and Northampton, Mass.: Elgar, 04, 1-252. [6] Grossman, M. (2000). The human capital model. Handbooks in Economics, 17, 347-408.