Financial Statements

advertisement

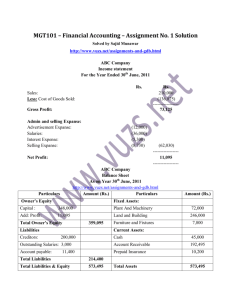

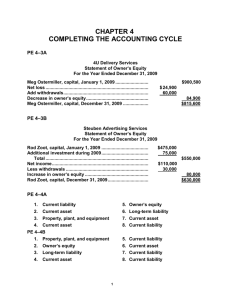

FI N A NC I A L AN A LY SI S 95-711 FALL 2002 LECTURE NOTES SESSION ONE Prof. L. A. Pastor F I N A N C I A L S TAT E M E N TS INTERPRETATION Managers’ decisions affect financial statements Financial Statements are designed to report performance consistently External users need financial statements to evaluate management decisions GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP) Guidelines and rules, that govern the preparation financial statements Accrual (vs. Cash) Basis of Accounting “Promulgated” by FASB Required by the SEC FINANCIAL STATEMENTS Balance Sheet Income Statement Statement of Cash Flows Statement of Changes in Owner Equity BOOK VS. MARKET V a lu e o f E q u ity R a tio , M a rk e t ($ m illio n s C om pany Book A M F B o w ling Inc . B o is e C a s c a d e C o rp . C a s tle & C o o k e Inc . C o c a -C o la Inc . D o w J o ne s & C o . Inc . V a lu e to M a rk e t B o o k V a lu e 530 306 0 .6 1 ,3 4 3 1 ,7 4 6 1 .3 537 251 0 .5 8 ,4 0 3 1 6 5 ,1 9 0 1 9 .7 509 4 ,4 2 6 8 .7 F o rd M o to r C o . 2 3 ,4 0 9 7 1 ,7 1 7 3 .1 H e w le tt-P a c k a rd C o . 1 6 ,9 1 9 6 9 ,3 6 5 4 .1 L TV C o rp . 1 ,6 2 7 575 0 .4 S a fe c o C o rp . 5 ,5 7 6 5 ,8 5 2 1 .0 Tim b e rla nd C o m p a ny 266 506 1 .9 U g ly D uc k ling C o rp . 163 73 0 .5 Ya ho o Inc . 536 2 3 ,5 7 8 4 4 .0 ACCRUAL VS. CASH GAAP Preferred Not for Taxes Matches Revenues with Expenses ACCRUAL BASIS Simultaneous Cash flows and revenue and expense recognition (Same for Cash Basis) Accruals Revenues and expense recognition preceding cash in flow and out flow Deferrals Cash flows precedes revenue and expense recognition EXAMPLES John began working at XYZ Co. in December and got paid $5,000 on the first of January for the preceding month. What is the salary expense for John in the month of December using: the accrual basis of accounting? the cash basis of accounting? EXAMPLE In December ABC Co. purchased and received $20,000 worth of XYZ’s services on 30 day terms. What is the revenue related to this sale for XYZ in December using the accrual basis of accounting? the cash basis of accounting? EXAMPLE If John was the only cost related to the services received by ABC in Decembe r what was the profits related to this job for XYZ in December and January using the accrual basis of accounting? the cash basis of accounting? EXAMPLE XYZ received a deposit of $10,000 in December from ABC for a new project which is to start in the new year? What is the Revenue for December using the accrual basis of accounting? the cash basis of accounting? ACCOUNTING CONVENTIONS Conservatism Although accuracy is paramount, it is preferable to err on the side of conservatism Measurement Consistent Currency Unit Consistent Time Periods Going Concern Reliability Objective Cost COST Historical cost Amount originally paid for the asset Net realizable value (NRV) Amount expected to be realized Replacement cost Current cost to replace (e.g., certain marketable securities). Present value Amount of estimated future cash flows (e.g., monetary assets and liabilities) Fair Market value (or FMV) What the market will bear TYPES OF BUSINESS ORGANIZATIONS Sole Proprietorships Limited Partnerships Partnerships LLP Corporations LLC Hybrids PC ORGANIZING A BUSINES S Sole Proprietorship Partnership Corporation Ownership The Manager Partners Shareholders Owners are managers Yes Yes Usually Not Liability Unlimited Unlimited (exceptions) Limited Taxes Personal Personal Corporate GOALS OF THE CORPORATION Shareholders desire wealth maximization Do managers maximize shareholder wealth? Managers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners MANAGING CORPORATIONS Shareholder Elects Board of Directors Shareholder Votes vs. Proxy Board of Directors Hires Management Oversight of Management Management makes decision Authorizes Dividends to Shareholders Usually Approved by the Board BA L A N C E S H E E T PERFORMANCE CORPORATION Balance Sheet At December 31, 19A Assets: Cash Merchandise inventory (for resale) Supplies inventory (for use in rendering services) Accounts receivable (from customers) Service vehicles Less accumulated depreciation Total assets $ 32,000 42,000 15,000 13,000 50,000 (10,000) $142,000 Liabilities: Accounts payable (to suppliers) Note payable (to bank) Total liabilities Stockholders' equity: Contributed capital, 6,500 shares Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $22,000 25,000 47,000 $65,000 30,000 95,000 $142,000 BALANCE SHEET FORMAT Current Assets Current Liabilities Non Current Liabilities Non Current Assets Total Liabilities Total Equity Total Assets Total Liabilities & Equity VALUE OF ASSETS Record the asset at either the FMV of what is received or the FMV of what is given up, whichever is more clearly determinable. Cash, value of services, other assets If unclear, emphasize the asset received ACQUISITION OF ASSET S Paying cash Issuing debt Notes payable, leases Issuing equity Common stock, preferred stock By self-construction CURRENT ASSETS (SHORT TERM) Cash and equivalents Short-term investments Receivables (net of allowance for doubtful accounts) Inventories Prepaid expenses Notes receivable Deferred income taxes NON CURRENT ASSETS ( LONG TERM ASSETS) Property, plant and equipment Natural resources Intangible assets FIXED ASSETS Property, plant and equipment (PP&E) Land Buildings Furniture, vehicles and equipment Leasehold improvements Less: allowance for accumulated depreciation PROPERTY PLANT & EQU IPMENT Tangible Used in the operations of the business Relatively long-lived Not intended for resale “COSTS” CAPITALIZED Transportation Installation Additions Maintenance is not Capitalized NATURAL RESOURCES Acquisition costs (capitalized) Exploration costs – two methods Successful efforts (capitalize costs related only to successful completion) Full costing (capitalize costs related to all exploration) INTANGIBLE ASSETS Patents Copyrights Trademarks and Trade names Organization costs Goodwill Capitalized R&D Cost Allocation through “Amortization” RESEARCH & DEVELOPME NT Expensed as incurred until feasibility is established Capitalized as an Asset after feasibility point COST ALLOCATION Method is Management’s Decision Depreciation & Amortization Long Term Assets Matches Use of Asset to related Revenue Depletion Natural Resources Cost of Resources Extracted RELATED DEPRECIATION EXPENSE Reduce the Value of the asset on the Balance Sheet Accumulated Depreciation is a “contra asset” account Increase in Accumulated Depreciation results in a corresponding increase in Depreciation Expense on the Income Statement LIABILITIES Current liabilities Accounts payable Accrued expenses payable Short term Notes Current portion of long-term debt Long-term liabilities Long Term Notes and Bonds Payable Capital Leases Mortgages LIABILITIES (OBLIGAT IONS) ARISE FROM: Using or taking possession of resources in the course of operations before paying for them Receive payment in advance of delivery of service or products Raise Cash from Financial Institutions or Other Debt holders Promises that obligate the company in the future like warranties REQUIREMENT OF LIABILITIE S An obligation has been incurred Amount of obligation can be measured with reasonable certainty Determine when the debt will be due and payable with reasonable certainty Time value of money IS THIS A LIABILITY ABC Company has placed an order for 200 units to be delivered in 30 days Is this a liability? Why or why not? IS THIS A LIABILITY All of ABC Company’s products come with a one year warranty. Costs are incurred when repairs are made under the warranty. Is this a Liability? Why or why not? IS THIS A LIABILITY ABC Company has been notified that it is being sued for discrimination. Is this a liability? What do you need to know? Would a shareholder want to know about this? IS THIS A LIABILITY Hilton Hotels has a frequent visitor program which award points and allows redemption for free stays. Is this a liability? What do you need to know? Would a shareholder want to know about this? SHORT TERM OR CURREN T LIABILITIES Expected to be paid within 1 year (or business cycle) May also incur Interest Expense Include: Accounts Payable Short Term Portion of Long Term Debt Accrued Expenses •Payroll not yet paid out •Utilities LONG TERM OR NON CUR RENT LIABILITIES Do not expect to pay off within the next year Include Long Term Loans Bonds Mortgages LONG TERM DEBT Obligation to Repay Unlike Stocks Interest Rate Even if not stated Gives Rise to Interest Expense Security Claims against specific asset (secured) General claims against all assets (unsecured) Maturity Have a definite maturity date May be callable earlier at the borrower’s discretion INTEREST Principal x Interest Rate x Time Interest Rate always stated on an annual basis Ex. On a 10% loan the monthly interest equals Principal x 10% x 1/12 LEASES Operating leases Like renting an apartment Risks and benefits of ownership is not transferred to Lessee (renter) Payments are recorded as an Expense only Leased Asset is not recorded on the Balance Sheet LEASES Capital Lease Economic Benefits and Risks are transferred to Lessee Lease is for 75% of assets useful life or Present value of the lease payments equals 90% of the value of the Asset or Lease has a bargain purchase option Asset must be recorded on the books Lease is recorded as a Liability Interest has to be calculated for each payment on the lease IS THIS A LIABILITY ABC Company takes a 4 year lease on a vehicle that has a useful life of 5 years IS THIS A LIABILITY ABC Company takes a 2 year lease on a vehicle that has a useful life of 5 years. At the end of the second year, ABC can purchase the car for less than its Fair Market Value. IS THIS A LIABILITY ABC Company takes a 3 year lease on a vehicle that has a useful life of 5 years. The sticker price on the car is $20,000. The present value of all the lease is $19,000. How will this affect the financial statements? ANSWER Increase in Assets Increase in Liabilities Must Depreciate Asset Must “break out” Interest Expense when lease payment is made CAPITAL LEASE ABC makes an annual payment on the lease of $7,911 on this 3 year Capital Lease. What is the effect on the Financial Statements? CALCULATE INTEREST E XPENSE AND PRINCIPAL PAYMENT Interest Expense $19,000 x 12% = $2,280 Principal Pay Down $7,911 - $2,280 = $5,631 Principal Balance $19,000 - $5,631 = $13,369 AMORTIZATION TABLE Loan Principal Amount Annual Interest Rate Year 2001 2002 2003 Balance $19,000.00 $13,369.00 $7,062.28 Monthly Payments Interest Over Term of Loan Sum of All Payments $19,000.00 12.00% Payments $7,911.00 $7,911.00 $7,911.00 Principal $5,631.00 $6,306.72 $7,063.53 Interest $2,280.00 $1,604.28 $847.47 Cummulative Principal $5,631.00 $11,937.72 $19,001.25 $7,911.00 $4,731.75 $23,733.00 Cummulative Interest $2,280.00 $3,884.28 $4,731.75 To get Payment amount, use the Excel Function: =PMT(.12, 3, 19000) CALCULATE DEPRECIATI ON Use Straight line Depreciation Historical Cost = $19,000 Lease (proxy for useful life) = 3 Annual Depreciation Expense •$19,000/3 = $6,333 Corresponding Accumulated Depreciation Ending Balance $13,369.00 $7,062.28 ($1.25) STOCKHOLDERS’ EQUITY Contributed capital Common stock Preferred stock Additional contributed capital Retained earnings EQUITY Residual Rights Assets = Liabilities + Equity Difference between Assets and Liabilities SOURCES OF EQUITY Sales of Stock Stock = Par Value x Shares sold Additional Paid in Capital Retention of Profits (earnings) TYPES OF STOCK Common Voting rights Last to get anything in a liquidation Preferred No voting rights Has preference over Common Shareholders if dividends are declared Has preference over Common Shareholder in a liquidation May include a Preferred Stock Dividend which is based on the Par Value of the Preferred Stock COMMON STOCK Authorized In the Charter Issued Sold to Investors Outstanding Still in Investors hands Treasury Bought back by the Company for future Reissue Retired Bought back by the Company and “disposed” of ISSUE STOCK FOR CASH ABC Company is authorized to issue 1,000,000 shares of $2 par value common stock. The company issues, 100,000 shares at $10 per share. If it costs ABC $50,000 to issue the shares how are the financial statements affected ANSWER Assets Cash Total Effect on Assets $950,000 $950,000 Stockholders’ Equity Common stock, $2 par Additional paid-in capital Total Effect on Equity $200,000 750,000 $950,000 ISSUE STOCK FOR SERV ICE ABC Company issues 5,000 shares of $2 par common stock, in exchange for services quoted at $20,000. How are the financial statements affected? ANSWER (NOT INCLUDING THE E ARLIER TRANSACTION) Income Statement Professional Services Balance Sheet Stockholders’ Equity Common stock $2 par Additional paid-in capital $20,000 $10,000 10,000 $20,000 DIVIDENDS Management is under no obligation to declare dividends on Common Stock Management can declare dividends but not pay them out right away (in arrears) Not included in calculating profit Deducted from profit to calculate Retained Earnings DECLARING DIVIDENDS At the end of the fiscal year, ABC Company had a profit of $2 mil lion. Management with consent of the Board of Directors declares a $.50 dividend per share. Remember, ABC has 105,000 shares outstanding. How are the financial statements affected? ANSWER Income Statement Profit $2,000,000 Statement of Shareholder Equity Dividends $52,500 Balance Sheet (Equity) Retained Earnings $1,947,500 DILUTION When more shares are issued, the % of the company that existing stockholder own is reduced. In public companies shareholders may not care In closely held companies shareholders may care a whole lot! Stock rights for common stock Gives shareholder preemptive right to buy new share Allows shareholders to maintain a proportional ownership in the corporation when additional shares are issued Rights are usually for a few weeks Like a warrant which can be for years STOCK DIVIDENDS A company may declare a stock dividend to reward shareholders without paying out cash Shareholders do not pay anything for these shares Total Value of Equity Section does not change STOCK SPLIT Doubles the number of shares each stockholder owns Reduces Par Value by half Does not affect Additional Paid in Capital or Retained Earnings Total Equity stays the same Does not increase the number of shares not yet issued by the com pany ASSET? Since Advertising should result in future sales and therefore future benefits, is advertising an Asset? BEEN ON PETS.COM LATELY? Seventeen dot-coms, as Internet companies are known, were among about three dozen advertisers who paid a record average of $2.2 million for a 30-second commercial on the ABC telecast which saw the St. Louis Rams beat the Tennessee Titans, 23-16. Pets.com: "Don't Go" (30 Seconds) The company's sock puppet dog sings a woeful tale of a pet's life when his or her owner leaves home to buy pet food. PETS.COM IS GONE Still think it’s a good idea to capitalize advertising and marketing cost?