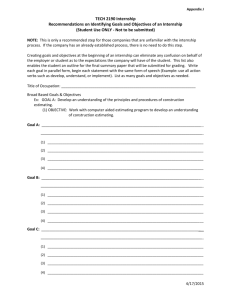

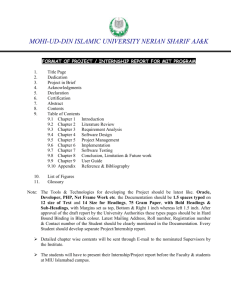

chapter 1 - Internship reports

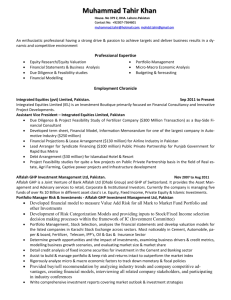

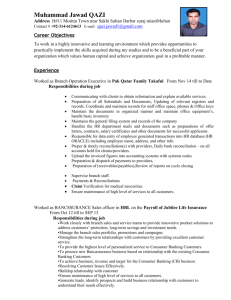

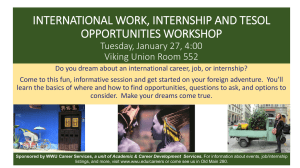

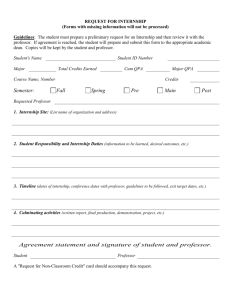

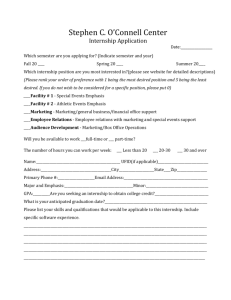

advertisement