File

advertisement

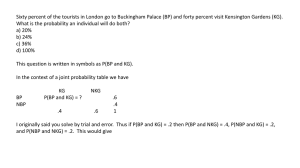

SECTION : - 01 1.0:- INTRODUCTION & HISTORY OF NATIONAL BANK OF PAKISTAN (Incorporated under the National Bank of Pakistan Ordinance, 1949) National Bank of Pakistan (the bank) was incorporated in Pakistan under the National Bank of Pakistan Ordinance, 1949 and is listed on all the stock exchanges in Pakistan. Its registered and head office is situated at I.I. Chundrigar Road, Karachi. The bank is engaged in providing commercial banking and related services in Pakistan and overseas. The bank also handles treasury transactions for the Government of Pakistan (GoP) as an agent to the State Bank of Pakistan (SBP). Under a Trust Deed, the bank also provides services as trustee to National Investment Trust (NIT) including safe custody of securities on behalf of NIT. National Bank of Pakistan was established on November 9, 1949 under the National Bank of Pakistan Ordinance, 1949 in order to cope with the crisis conditions, which were developed after trade deadlock with India and devaluation of Indian Rupee in1949. Initially the Bank was established with the objective to extend credit to the agriculture sector. The normal procedure of establishing a banking company under the Companies Law was set aside and the Bank was established through the promulgation of an Ordinance due to the crisis situation that had developed with regard to financing of jute trade. The Bank commenced its operations from November 20, 1949 at six important jute centers in the then East Pakistan and directed its resources in financing of jute crop. The Bank’s Karachi and Lahore offices were subsequently opened in December 1949. The nature of responsibilities of the Bank is different and unique from other banks/financial institutions. The Bank acts as the agent to the State Bank of Pakistan for handling Provincial/Federal Government Receipts and Payments on their behalf. The Bank has also played an important role in financing the country’s growing trade, which has expanded through the years as diversification took place. Today the Bank finances import/export business to the tune of Rs. 52.7 billion, whereas in 1960 financing under this head was only Rs. 1.54 billion. 1 SECTION : - 02 2.0:- Overview of the Organization 2.1:- Vision To be recognized as a leader and a brand synonymous with trust, highest standards of service quality, international best practices and social responsibility. 2.2:- Mission NBP will aspire to the values that make NBP truly the Nation’s Bank, by : • Institutionalizing a merit and performance culture. • Creating a distinctive brand identity by providing the highest standards of services. • Adopting the best international management practices. • Maximizing stakeholder’s value. • Discharging our responsibility as a good corporate citizen of Pakistan and in countries where we operate. 2.3:- Core Values • • • • • • Highest standards of Integrity. Institutionalizing teamwork and performance culture. Excellence in service. Advancement of skills for tomorrow’s challenges. Awareness of social and community responsibility. Value creation for all stakeholders. 2 SECTION : - 03 3.0:- Nature of the Organization National Bank of Pakistan is a Governmental Organization. It is functioning as an agent of State Bank of Pakistan. It implements the policies of SBP. Its basic objective was to extend credit to the agriculture sector. It is the major business partner for the Government of Pakistan with special emphasis on fostering Pakistan's economic growth through aggressive and balanced lending policies, technologically oriented products and services offered through its large network of branches. It deals all Govt Revenue, collection and payments of salaries, pensions and Govt Treasury. It is a complete commercial, retail and corporate bank as well. National Bank of Pakistan is naturally a Financial Organization, which deals with lending, and borrowing and investing activities. The National Bank of Pakistan a commercial bank generally makes advances for a period not exceeding one year, except in case of small and medium industries for which advance may be made for a maximum period of five years. The bank makes not only against the security of stocks and goods hypothecated or pledged to the bank, but also against documents of goods and properly, shares are various joint stock companies, Government securities, Insurance policies deposits receipts, etc. The margin, and rate of interest are determined by several factors including the type of security the size of loan and the integrity of the party. 3 SECTION : - 04 4.0:- NATIONAL BANK OF PAKISTAN ALL SCHEMES 4.1:- (1) National Bank of Pakistan Saiban Scheme National Bank of Pakistan lending for construction of to general public as well as employees of government non-government institutions. Main features of this scheme are as under. And home • Finance available for home purchase, home construction, home improvement and Balance Transfer Facility. • Period of repayment ranges between 30-20 years. • Loan available up to a maximum of Rs. 15-20 million. • NBP provide markup choices to its consumer i.e. Variable Discount Rate, Fixed Rate. • Minimum approval and disbursement timing. • Limited to areas where there are no documentations, fee, resale and foreclosure related issues, so to protect the bank’s interest. 4.2:- (2) NBP Advance Salary Scheme National Bank of Pakistan facilitates to employees with advance salary under certain conditions. • NBP facilities to employee by 20 Months salaries in advance. • Minimum documents required for advance salaries scheme. • Advance salaries are repayable in 60 months installments. • NBP impose no processing charges, no collaterals and no insurance on advance salaries. • NBP charged mark-up at 18 percent per annum on reducing balance method. 4 4.3:- (3) National Bank Cash Gold Scheme • • • • • • National Bank provides facility of Rs. 10000 against 10 gms of gold. No maximum limit of cash. Roll over facility. Mark-up 14.50 percent per annum. Repayable after one year. No penalty for early repayment. 4.4:- (4) National Bank Kisan Dost Scheme National Bank of Pakistan lending in agricultural field. National Bank of Pakistan lending farmers for development of agriculture sector of the country under certain terms and conditions. • NBP provide loan to farmers for production, development purposes, for purchase of tractors, for installation of tube wells, for purchase of agricultural instruments, micro loan, for construction of god won, for construction of fish pond, for development of livestock and farming, for mil processing, for cold storage, bio-gas plants. • NBP charged interest @ 14.5 percent per annum. • NBP lending at farmer’s doorsteps. • NBP facilitates to farmers with agricultural experts. • NBP provide loans against agricultural passbooks, gold ornaments and paper securities. 5 4.5:- (5) National Bank Premium Aamdani Certificate Scheme A monthly income scheme introduced by National Bank of Pakistan for investors as well as for general public. • Minimum investment required Rs. 50,000/• Maximum investment allowed Rs. 5,00,000/• A 5 years scheme with year wise increasing profit rates. • Incentives available for investors. • NBP provide finance facility against these certificates. • NBP allowed to customers to convert existing deposits into National Bank Premium Aamdani Certificates. 4.6:- (6) NBP Karobar Scheme National Bank of Pakistan providing financing under President Karobar Scheme. The purpose of this scheme to reduce unemployment from the country. Main features are as under. • Age limit is 18-45 years. • Finance limit to Rs. 200,000/-. • Tenure of this loan 1-5 years. • Markup rates are variable. i.e. KIBOR +2% per annum. The customers will pay 6% as long as government provides the balance markup to NBP on monthly basis. • NBP’S loan available for: Utility Store, Mobile General Store, Transport, PCO/Tele-centers. 6 SECTION : - 05 5.0:- International Baking National Bank of Pakistan is at the forefront of international banking in Pakistan which is proven by the fact that NBP has its branches in all of the major financial capitals of the world. Additionally, we have recently set up the Financial Institution Wing, which is placed under the Risk Management Group. The role of the Financial Institution Wing is: To effectively manage NBP’s exposure to foreign and domestic correspondence Manage the monetary aspect of NBP’s relationship with the correspondents to support trade, treasury and other key business areas, thereby contributing to the bank’s profitability. Generation of incremental trade-finance business and revenues. NBP offers: The lowest rates on exports and other international banking products. Access to different. local commercial banks in international banking. 5.1:- DEMAND DRAFTS: If you are looking for a safe, speedy and reliable way to transfer money, you can now purchase NBP’s Demand Drafts at very reasonable rates. Any person whether an account holder of the bank or not, can purchase a Demand Draft from a bank branch. 5.2:- MAIL TRANSFERS: Move your money safely and quickly using NBP Mail Transfer service. And we also offer the most competitive rates in the market. 5.3:- PAY ORDER: NBP provides another reason to transfer your money using our facilities. Our pay orders are a secure and easy way to move your money from one place to another. And, as usual, our charges for this service are extremely competitive. 5.4:- TRAVELER'S CHEQUES: Negotiability: Pak Rupees Traveler’s Cheques are a negotiable instrument Validity: There is no restriction on the period of validity. Availability: At 700 branches of NBP all over the country. Encashment: At all 400 branches of NBP. Limitation: No limit on purchase. Safety: NBP Traveler’s Cheques are the safest way to carry our money. 7 5.5:- LETTER OF CREDIT: NBP is committed to offering its business customers the widest range of options in the area of money transfer. If you are a commercial enterprise then our Letter of Credit service is just what you are looking for. With competitive rates, security, and ease of transaction, NBP Letters of Credit are the best way to do your business transactions 5.6:- COMMERCIAL FINANCE: Let us help make your dreams become a reality. Our dedicated team of professionals truly understands the needs of professionals, agriculturists, large and small business and other segments of the economy. They are the customer’s best resource in making NBP’s products and services work for them. 5.7:- FOREIGN REMITTANCES: To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has taken a number of measures to: Increase home remittances through the banking system. Meet the SBP directives/instructions for timely and prompt delivery of remittances to the beneficiaries 8 SECTION : - 06 6.0:- TRADE FINANCES OTHER BUSINESS LOANS 6.1:- AGRICULTURAL FINANCE: NBP provides Agricultural Finance to solidify faith; commitment and pride of farmers who produce some of the best agricultural products in the World. “I Feed the World” program, a new product, is introduced by NBP with the aim to help farmers maximize the per acre production with minimum of required input. Select farms will be made role models for other farms and farmers to follow, thus helping farmers across Pakistan to increase production. Agricultural Credit: The agricultural financing strategy of NBP is aimed at three main objectives:-Providing reliable infrastructure for agricultural customers Help farmers utilize funds efficiently to further develop and achieve better production Provide farmers an integrated package of credit with supplies of essential inputs, technical knowledge, and supervision of farming. Agricultural Credit (Medium Term): Production and development: Watercourse improvement Wells Farm power Development loans for tea plantation Fencing Solar energy Equipment for sprinklers Farm Credit: NBP also provides the following subsidized with ranges of 3 months to 1 year on a renewal basis. Operating loans Land improvement loans Equipment loans for purchase of tractors, farm implements or any other equipment Livestock loans for the purchase, care, and feeding of livestock Production Loans: Production loans are meant for basic inputs of the farm and are short term in nature. Seeds, fertilizers, sprayers, etc are all covered under this scheme. If you require any further information, please do not hesitate to e-mail us. 9 6.2:- CORPORATE FINANCE: Working Capital and Short Term Loans: NBP specializes in providing Project Finance – Export Refinance to exporters – Preshipment and Post-shipment financing to exporters – Running finance – Cash Finance – Small Finance – Discounting & Bills Purchased – Export Bills Purchased / Preshipment / Post Shipment Agricultural Production Loans Medium term loans and Capital Expenditure Financing: NBP provides financing for its clients’ capital expenditure and other long-term investment needs. By sharing the risk associated with such long-term investments NBP expedites clients’ attempt to upgrade and expand their operation thereby making possible the fulfillment of our clients’ vision. This type of long term financing proves the bank’s belief in its client's capabilities, and its commitment to the country. Loan Structuring and Syndication: National Bank’s leadership in loan syndicating stems from ability to forge strong relationships not only with borrowers but also with bank investors. Because we understand our syndicate partners’ asset criteria, we help borrowers meet substantial financing needs by enabling them to reach the banks most interested in lending to their particular industry, geographic location and structure through syndicated debt offerings. Our syndication capabilities are complemented by our own capital strength and by industry teams, who bring specialized knowledge to the structure of a transaction. Cash Management Services: With National Bank’s Cash Management Services (in process of being set up), the customer’s sales collection will be channeled through vast network of NBP branched spread across the country. This will enable the customer to manage their company’s total financial position right from your desktop computer. They will also be able to take advantage of our outstanding range of payment, ejection, liquidity and investment services. In fact, with NBP, you’ll be provided everything, which takes to manage your cash flow more accurately. 6.3:- SHORT TERM INVESTMENTS: NBP now offers excellent rates of profit on all its short term investment accounts. Whether you are looking to invest for 3 months or 1 year, NBP’s rates of profit are extremely attractive, along with the security and service only NBP can provide. 10 6.4:- EQUITY INVESTMENTS: NBP has accelerated its activities in the stock market to improve its economic base and restore investor confidence. The bank is now regarded as the most active and dominant player in the development of the stock market. NBP is involved in the following: Investment into the capital market Introduction of capital market accounts (under process) NBP’s involvement in capital markets is expected to increase its earnings, which would result in better returns offered to account holders. 11 SECTION : - 07 7.0:- Competitors Competitors of National Bank of Pakistan are all scheduled banks, which are listed/trading under Banking Companies Ordinance 1962.Competitive Banks are as under: • • • • • • • • • Habib Bank Limited United Bank Limited Muslim Commercial Bank Limited Allied Bank Limited Askari Commercial Bank Limited Soneri Bank Limited Bank Al-Habib Limited Bank Al-Falah Limited. Standard Chartered Bank Limited & The Bank of Punjab 12 SECTION : - 08 8.0:- Organizational Structure Organizational Hierarchy Chart: PRESIDENT DIRECTORS / SEVPS Provisional Chiefs / EVP Regional Chiefs / EVP Zonal Chiefs / SVP Voice President Assistant Voice President Officer Grad I, II, III Clerical / Non-Clerical Staff 13 SECTION : - 09 9.0:- Span of Control Span of control is the number of subordinates who report directly to a specific manager. There are three types of branch categories i.e. I, II, & III in National Bank of Pakistan. Category I Branches: Four employees report to their branch manager. Category II Branches: Eleven employees report to their branch manager. Category III Branches: Fifteen employees report to their branch manager. At branches level there is broader span of control but due to tall structure of the organization we find narrow span of control in the bank. Main Officers Audit Committee Auditors Legal Advisors Registered & Head Office: NBP BUILDING I.I. Chundrigar Road, Karachi PAKISTAN 14 SECTION : - 10 10.0:- International Level 15 Branches 10.1:- Plan of your internship program Introduction of Branch: Name of Branch NBP main branch Mirpurkhas Branch Code 0036 Region Hyderabad Address M.A Jinnah Road Mirpurkhas Phone No. 0233-9290255 Fax No. 0233-9290259 Name of Manager: Nazeer Ahmed Baloch Name of My Supervisor: Hafeez Maher 15 SECTION : - 11 11.0:- Departments of Training During the internship period of 6 weeks I got training in various departments in the branch. A brief introduction of these departments is as under: Deposit of Current and PLS Saving Accounts & Account Opening (2 Weeks) Remittances and Bills (2 Weeks) Govt. Payments and Receipts (1 Weeks) Advances (1 Weeks) 11.1:- Training program Introduction of all the departments There are many different departments in National Bank of Pakistan: i) Deposit Customers keep their savings in PLS Saving Accounts and businessmen save their money in bank Current Accounts. NBP gives profit on saving accounts and special saving accounts i.e. Premium Saving Accounts and NBP Premium Amadni Certificates for one to five year’s period. ii) Advances (Credit department) NBP give loans to the borrowers for different purposes. These loans are given for various sectors for different periods. Small Finance, Cash Finance, Agriculture Finance, Cash & Gold Loan, Personal Loans, Demand Finance, Running Finance, Corporate Finance, Export Import Financing, House Building Finance (Saiban) and NBP Karobar Scheme etc. iii) Government Payments National Bank of Pakistan is functioning as an agent of SBP. All types of Government Payment i.e. Pension, Salaries, Grants, Zakat, Benevolent Fund, Treasury Refund and Taxes Refund proceed through the bank. 16 iv) Government Receipts In this department all types of Government receipts i.e. Revenues, Taxes, Abyana, Agriculture Tax, Government Fees, EOBI Funds and Utility Bills are deposited. This way NBP is serving great job of revenue collection. v) Remittances Another important department in the bank is remittances. People send their money to the other persons and organizations through various way i.e. Bank draft, Telegraphic Transfer, Mail Transfer, Coupons, Govt. Draft and Western Union Money Transfer etc. It works both inward and outward. vi) Bills Customers collect their money/amount through bills. They present their cheques, drafts and other bills for collection within the city and out of the city through mail. Now a days Online Banking is becoming more popular for this purpose but the branch where I got training is still not have this facility. vii) Cash Department National bank deals Government treasury on behalf of State Bank of Pakistan. There are Chest, Sub-chest and Non-chest branches in the bank. SBP supplies currency notes to the bank and monitors its cash flow. Cash In charge and other cashiers deal with cash receipt and payment in the bank. viii) Compliance Role of branch compliance department is to reconcile the prescribed frequencies, investigate long pending reconciliation item, and ensure correct treatment every half-year and clearing system service branch-in major cities. Internal control is the integration of the activities, plans, attitudes, policies and efforts of the people of the bank working together to provide reasonable assurance that the organization will achieve its objectives and mission. 17 ix) Agriculture Department Agriculture Credit Department is playing a vital role in development the economy of Pakistan. Commercial banks being the greatest mobilizer of savings in the country with their large network of branches play important role in financing agriculture. The National Bank of Pakistan has also been trying to ensure that loans are disbursed to genuine agriculturists within a reasonable time and that the bank turns down no viable loan request. ix) Human Resources Management Human Resources Management Department works for the betterment of the employees. Enhances skills, training management, service benefits, wages, medical facilities, staff loans are basic functions of this department. x) Information Technology Department Bank’s data collection and information system run by Regional Data Collection Center. This department manages staff training programs regarding computer. xi) Online Banking This department is functioning only in online branches in the bank. This is a fast track banking system in modern banking. NBP is also trying to enhance this facility for their customers. xi) Retail & Commercial This is the department that boosts the profitability of the bank. National Bank becomes the largest profit-earning bank of the country by introducing personal loans i.e. NBP Advance Salary Scheme and Saiban Scheme. xii) FBR Collection Department NBP is playing great role for collection of FBR (CBR) taxes/revenue. A separate counter is established at branch level to facilitate the taxpayers. 18 xiv) Islamic Banking The marked the first year of Islamic banking operations. During the year under review, in addition to active participation in various Sukuk transactions, two more Islamic banking branches at Lahore and Peshawar started operations. NBP’s plans for include opening of Faisalabad and Rawalpindi branches with the focus on growing organically by opening more standalone Islamic banking branches, utilizing NBP’s existing branch network of 1,200 plus conventional branches and looking into strategic acquisitions for expansion in this field 19 SECTION : - 12 12.0:- Detail of the Departments I Worked In i) Deposit of Current and PLS Saving Accounts & Account Opening: All banks depend on deposits. It is a very important department where customers deposit and withdrawal their money. Banks use this money for loaning on higher rate to earn profit. Account opening is also very vital now a days in banking system due to KYC (Know your customer) , AML (Anti Money Laundering) and ATF (Anti terrorist financing) because ANL has become a global problem and all the countries of the world are vulnerable to it. I got training in this department for two weeks and after understand the basic concept I practically opened account of walk-in-customers. ii) Remittances and Bills Another important department in the bank is remittances and Bills for Collection. People send their money to the other persons and organizations through various way i.e. Bank draft, Telegraphic Transfer, Mail Transfer, Coupons, Govt. Draft and Western Union Money Transfer etc. It works both inward and outward. Customers collect their money/amount through bills. They present their cheques, drafts and other bills for collection within the city and out of the city through mail. Now a days Online Banking is becoming more popular for this purpose but the branch where I got training is still not have this facility. iii) Government receipt and Payment In this department all types of Government receipts i.e. Revenues, Taxes, Abyana, Agriculture Tax, Government Fees, EOBI Funds and Utility Bills are deposited. This way NBP is serving great job of revenue collection. Another important department in the bank is remittances. People send their money to the other persons and organizations through various way i.e. Bank draft, Telegraphic Transfer, Mail Transfer, Coupons, Govt. Draft and Western Union Money Transfer etc. It works both inward and outward. iv) Credit Department NBP give loans to the borrowers for different purposes. These loans are given for various sectors for different periods. Small Finance, Cash Finance, Agriculture Finance, Cash & Gold Loan, Personal Loans, Demand Finance, Running Finance, Corporate Finance, Export Import Financing, House Building Finance (Saiban) and NBP Karobar Scheme etc. The National Bank of Pakistan has also been trying to ensure that loans are disbursed to genuine agriculturists within a reasonable time and that the bank turns down no viable loan request. Retail and Commercial wing enhanced the profitability of the bank. National Bank became the largest profit-earning bank of the country by introducing personal loans i.e. NBP Advance Salary Scheme and Saiban Scheme. 20 SECTION : - 13 13.0:- Structure of Finance Department Department Hierarchy: Finance Director Accounts Officer Assistant Accounts Officer Numbers of Employee: Total No. of Employees are 02 in Finance Department Finance and Accounting Operations: Finance and Accounting operations are operated with the help of subordinate staff. Bank is financing in multiple sectors. 13.1:- Functions of the Finance Department Finance Department performs following functions. Borrowing from State Bank of Pakistan. Lending to Commercial Banks Lending to Investors. Lending to General Public for multi-business 21 SECTION : - 14 14.0:- Critical Analysis 14.1:- Financial Analysis Pre tax profit stood at Rs. 12,674 million from Rs. 14,002 million of corresponding period of last year, a reduction of 9.5%. Bank’s operating performance have been quite impressive, operating revenue increased by 30% from Rs. 20376 million to Rs.26,497 million, while pre provision profit increased by Rs. 4,293 million an increase of 31.4%. Diluted earning per share declined to Rs. 8.79 from Rs. 10.05 during the same period of last year. Pre tax return on equity stands at 35.8% whereas Pre tax return on assets is at 3.3%. Cost to income ratio of the bank remained in the top tier at 0.32 Net interest margin registered an impressive growth of Rs. 2,670 million or 16.4% mainly due to growth in volumes. Net advances increased by Rs. 41 billion and Rs. 32 billion as compared to corresponding period of last year. The growth in advances mainly emanated from corporate and commodity financing. Deposits show impressive growth of Rs. 68 billion or 12.3% over corresponding period last year. Compared to year the deposits have increased by Rs. 29 billion or 5% mainly due to our marketing efforts and the trust that customers have in NBP. Non interest base income has shown an impressive increase of Rs. 3.4 billion or 84% over corresponding period due to higher commission, exchange income and a one off receipt of Rs. 977.8 million as compensation for delayed tax refunds. The compensation on delayed refunds pertains to various assessment years from 1991-92 to 2001-02. Administrative expenses show a rise of Rs. 1,828 million or 27% compare to corresponding period mainly due to inflation and salary increases. Going forward we expect that with the technological / human resource up gradation program our costs will rise in short term however we need to invest today for better returns in the future. Provision charge against advances for the corresponding period last year includes a) one off items of Rs. 1.4billion on account of one large cash recovery and reversal in general provision of Rs. 825 million due to reduction in provision requirement on advance salary from 5% to 3%. If we exclude these one offs the provision charge last year comes to Rs. 1.8 billion. Further b) last year the SBP changed its prudential regulations and withdrew the benefit of Forced Sales Value in the third quarter of last year, therefore this year the banks can no longer take the benefit of forced sales value of the collateral securities. The additional provision charge on account of withdrawal of FSV impact last year was Rs. 3.1 billion, which was made in the 3rd and 4th quarter of last year. This benefit of Rs 3.1 billion was being carried in the first half. Therefore the comparison between the provisions for the two periods should take into account both these factors. Additionally the bank is making all out efforts for recovery of non-performing loans and aggressive targets have been assigned to the units. We extend our appreciation to the bank’s staff for their commitment, dedication and hard work in achieving these excellent results. We would like to express our appreciation to our stakeholders, regulators and our valued customers for their support and continued confidence in NBP. On behalf of Board of Directors & President 22 SECTION : - 15 15.0:- Ratio Analysis 15.1:- Net Profit Margin: This ratio measures the firm’s profitability of sales/ interest earned after taking account of all expenses and income taxes. This ratio can be calculated as: Net profit margin ration = Net Profit after taxes / interest earned Net Profit Ratio 12709/33634 X 100 37.78% 17255/44014 X 100 39.20% 19037/50569 X 100 37.64% Explanation: from the calculation it is very much clear that the performance of NBP is very good. And the trend is upward. It tells us a firm’s net income per rupee of revenue. As the trend is upward it shows the high profits in revenue per rupee in case of NBP. It is because of high advances the NBP has given to the people. 15.2:- Return on Equity: Dividing profit after taxation by shareholder’s equity. ROE compares net profit after taxes to the Shareholder’s Equity. This ratio is calculated as: ROE=Profit after taxes/Share holder’s Equity ROE 12709/36158 X 100 35.14% 17255/53045 X 100 32.53% 19037/69271 X 100 27.48% 23 15.3:- Return On Assets: This ratio shows the efficiency of organization that how efficiently utilizes their assets. This ratio relates profits to assets. It is calculated as: ROA = Profit after Tax/Total Assets ROA 12709/577719 X 100 2.19% 17255/635133 X 100 2.71% 19037/762194 X 100 2.49% From calculation it is clear that this ration of NBP is increasing. It shows that NBP using it’s assets very efficiently. That is why they are earning very high profits. This shows that how efficiently they investing the assets that’s why they are earning high profits. 15.4:- Investment deposit Ratio: This ratio shows the comparison of investments and deposits. This is calculated as. Investment deposit Ratio=Investment/deposits Return on Investment 156986/463427 X 100 33.87% 139947/501872 X 100 27.88% 210788/591907 X 100 35.61% 15.5:- Advances deposit Ratio: This ratio show that how much efficiently the bank advances the deposits of their customer to borrower. It is calculated as. Advances deposit ratio = Advances/ deposit Advances Deposit Ratio 268839/463427 X 100 58.01% 316110/501872 X 100 62.98% 340677/591907 X 100 57.56% From above table it is clear that the ratio is going high. Which means the efficiency on NBP is good and they use their deposits efficiently in advancing to borrowers. Here high ratio is required. The next side of the picture is that the people will think that is risky to deposit the money in the bank. 24 SECTION : - 16 16.0:- SWOT Analysis of the organization 16.1:- Strength • Declared World’s best Foreign Exchange bank • Stable AAA/A-1+ (Tipple A/a-One Plus) rated bank • Best Return on Capital Bank for amongst all the banks in Asia • Highest Profitability bank of Pakistan • 10 the Best Bank in terms of ‘ Profit on Capital’ in the world • Having Highest Assets and Capital in Pakistan • Functioning as an agent of State Bank of Pakistan • Dealing Government Treasury where SBP has not its own branch • Having unshakable trust of the public and its stakeholders • Giving Loans alone in the market against Gold Ornaments • Performing social responsibilities and claiming “The Nation’s Bank” • Disbursing Salaries and Pensions to the Government employees and earning high profit on NBP-Advance Salary Loan Scheme • Earning commission from SBP on Government transaction • Facing never problem of cash/currency being its Chest and Sub-chest Branches all over the country • NBP have presence in the countries having sizeable trade volumes with Pakistan by its overseas operations • Holds largest deposit base in the market share in terms of number of accounts • Leading bank in agriculture financing amongst commercial banks with the market share of 15% • Helping in earning of foreign exchange, remittances and leading agent of Western Union Money Transfer • SBP rated “Fair” for capital & human resources, “Strong” for assets, “Fair” for management and “Satisfactory” for both earning (Rs.24.1 for per share) and liquidity 25 16.2:- Weakness • Lowest Internal Control and Compliance System, SBP rated “Marginal” which is alarming for the Bank • Unsatisfactory corporate culture of the Bank • Physical environment and atmosphere compare to other banks is not meet the standard • Less number of Online Branches • Ineffectively use of technologies i.e. Information technology • Shortage of staff- per employee customer is very high side • Technical education and training of staff is insufficient 26 16.3:- Opportunities • Being a Government Bank NBP having wide scope in economic market. • Trust and reliability creates chances to enhance deposit and profitability. • Its vast network of domestic and overseas branches can help to expand business. • Bank’s deposit is increasing rapidly so there is a great opportunity to enhance its investment and financing. • Being an agent of State Bank of Pakistan it can play vital role in local economy. • Earning commission/exchange on Government transactions. 27 16.4:- Threats • SBP penalties due to low internal control and compliance. • Government, SBP and Prudential Rules and Regulations. • Schedule banks and Multinational/International bank’s profit rates. • Its staff switching over to other private banks due to more facilities. • Other bank’s charming atmosphere and relaxation in documentation. • SBP rated just “Marginal” in respect of System & Control which is alarming for the Bank to survive its license. • NBP staff code of ethics and practices. • High number of complaints regarding staff behavior. • Government Schemes, Government Revenue Collection, Government. • Payments and FBR Collections create heavy workload. 28 Conclusion & Recommendations • In my opinion the process of a transaction should be short in order in save time for both customers and the bank. • Staff strength should be enhanced and professional qualified persons should be recruited. • It is recommended that proper training be provided to the staff members that will ultimately increase the performance of Bank over all. • It is suggested that promotion be given to the staff in due time and on the basis of performance to provide job satisfaction. • The bank should spend more on renovation of the branches to improve environment and atmosphere to attract the customers. • Sitting arrangement, air conditioning and new furniture should be facilitated • The Bank should introduce the computers software to cope the heavy load of work and better control. • Extra counters should be established in order to facilitate during the rush days the difficulties faced by the bank staff as well as the customers. • All Branches of the Bank must be online. • All the departments should be established separately. • Bank can increase its profit ratio by reducing extra expenditures and to enhance the volume of advanced especially retail loans. • I done internship, I recommend that security level in the bank should be enhanced especially where I got internship and operation of Mobile phones must not be allowed inside the Bank. • Bank should take step to establish separate counters for the old age employees and pensioners. • The Bank should locate new market for its operational activities in the country as well as abroad. • The Bank should increase profit rate on deposits and saving schemes especially for pensioners and old age citizens. • For improvement of internal control and system the compliance wing and surprise inspection system should work more effectively. • To avoid complaints and leaving the bank job number of staff should be enhanced and their salaries should be leveled to the private/multinational banks. • Double shift system should be introduced to improve attitude and behavior of the employees. • Payment of salaries and pensions should be made separately to accommodate the valued customers and depositors. • For collection of utility bills i.e. Electricity bills, Telephone bills, Water and Gas bills separate cash receipt counter must be established. • Procedure of receiving loans should be easy and short time to facilitate the borrowers and enhance the profitability of the Bank. 29 References Book Name Author Banking Law & Practices M.L tanton In Pakistan. Banking organization M.H. Ali Pract6ives & Law of Banking In Pakistan Ansar H. Siddiui Banking currency and finance Prof. M. Saeed Nasir Website: www.nbp.com.pk www.google.com.pk www.ask.com 30