6 table of contents

advertisement

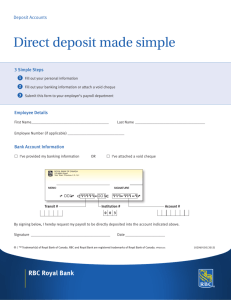

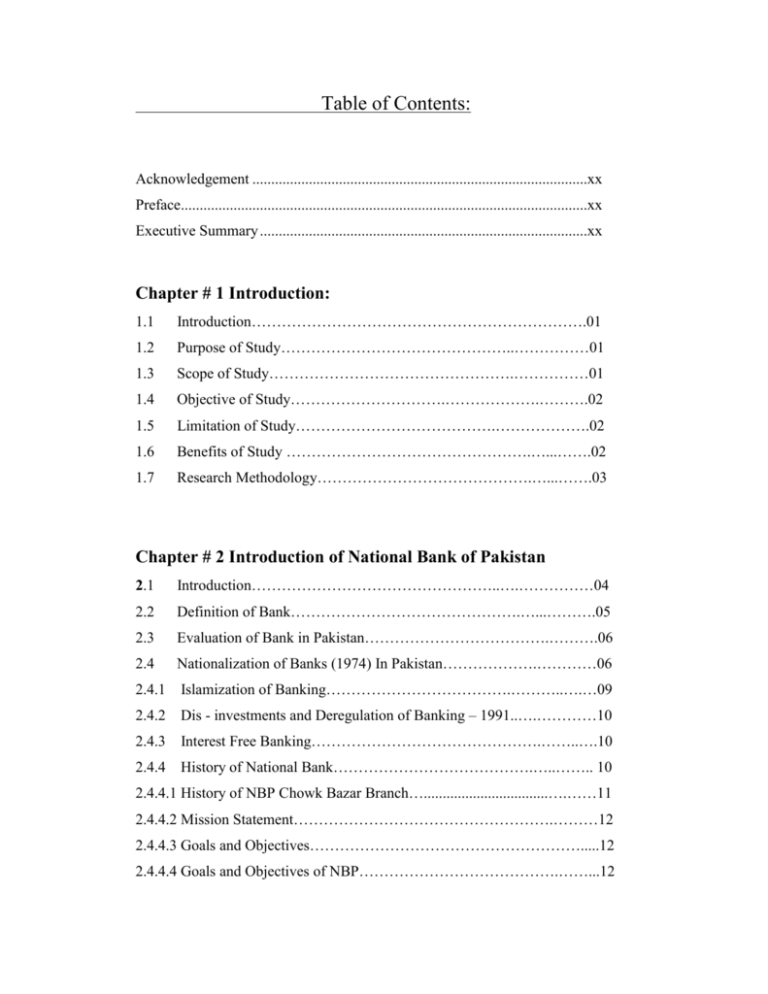

Table of Contents: Acknowledgement .........................................................................................xx Preface............................................................................................................xx Executive Summary .......................................................................................xx Chapter # 1 Introduction: 1.1 Introduction………………………………………………………….01 1.2 Purpose of Study………………………………………..……………01 1.3 Scope of Study………………………………………….……………01 1.4 Objective of Study………………………….……………….……….02 1.5 Limitation of Study………………………………….……………….02 1.6 Benefits of Study ………………………………………….…...…….02 1.7 Research Methodology…………………………………….…...…….03 Chapter # 2 Introduction of National Bank of Pakistan 2.1 Introduction…………………………………………..….……………04 2.2 Definition of Bank……………………………………….…...……….05 2.3 Evaluation of Bank in Pakistan……………………………….……….06 2.4 Nationalization of Banks (1974) In Pakistan……………….…………06 2.4.1 Islamization of Banking……………………………….………..….…09 2.4.2 Dis - investments and Deregulation of Banking – 1991..….…………10 2.4.3 Interest Free Banking……………………………………….……..….10 2.4.4 History of National Bank………………………………….…..…….. 10 2.4.4.1 History of NBP Chowk Bazar Branch….................................….……11 2.4.4.2 Mission Statement…………………………………………….………12 2.4.4.3 Goals and Objectives……………………………………………….....12 2.4.4.4 Goals and Objectives of NBP………………………………….……...12 Table of Contents: 2.4.4.5 Board of Directors………………………………………….……..13 2.4.4.6 Board of Directors ……………………………………….…….....14 2.4.4.7 Regional Headquarters…………………………………….………14 2.4.4.8 Regional Management Committee…………………………....…...14 2.4.4.9 Provincial Level Region…………………………………………...15 2.4.10 Names of Regions………………………………………………......15 2.5.1 Management………………………………………………………..16 2.5.2 Senior Management of NBP……………………….…………….....17 2.6 Network Branch……………………………….……………….…..18 2.6.1 Objective of NBP……………………………………………….….18 2.6.2 Increase in Deposits………………….………………………….….19 2.6.3 Extension of Loans…………………….…………………………...19 2.6.4 Function of NBP……………………….…………………………...19 2.6.5 Accepting of Deposits………………….…………………………..20 2.6.6 Discounted Bills Of Exchange…………….……………………….20 2.6.7 Agency Services………………………….…………………….…..20 2.6.8 Unmatched Banking Facilities…….……….………………………20 2.6.9 Summation………………………………….………………….......20 Chapter # 3 Information Departmentalization of NBP 3.1 Introduction……………………………………………………..…21 3.2 Demand Draft………………………………………………..…….21 3.3 Swift System………………………………………………...….….21 3.4 Letters of Credits………………………………………………......21 3.5 Traveler’s Cheque…………………………………………………22 3.6 Pay Order………………………………………………….…….....22 3.7 Mail Transfers…………………………………………….…….....22 3.8 Foreign Remittances………………………………………………22 3.8.1 New Features………………………………………………….…..23 Table of Contents: 3.9 Short Term Investments……………………………………….…..23 3.10 Commercial Finance………………………………………….…...23 3.11 Trade Finance and Other Loans…………………….…...……..….23 3.11.1 Agriculture Finance……………………………………..……...….23 3.11.1.1 Agriculture Finance Services……………………...………….….24 3.11.1.2 Agriculture credits…………………………………………….…24 3.11.1.3 Agriculture credits (Medium Term)…………………….....…….24 3.11.2 Corporate Finance………………………………………………....25 3.12 International Banking………………………………………….…..25 3.12.1 NBP offers………………………………………………………....26 3.12.2 Cash and Gold Finance………………………………………….…26 3.12.3 Advance Salary Loan……………..……………………………….26 3.13 Departmentalization of B…………………………………………26 3.1531 Cash Department…………………………………………………..26 3.13.2 Receipts……………………………………………………………26 3.13.3 Payments…………………………………………………………..27 3.13.4 Cheque and Their Payments………………………………………27 3.13.5 The Requites of Cheque……………………………………….......27 3.13.6 Parties of Cheque………………………………………………….27 3.13.7 Types of Cheque…………………………………………………..28 3.13.8 Payments of Cheque………………………………………………28 3.14 Advance Department………………………………………………29 3.14.1 Name and Address of the Brower……………………………….30 3.14.2 Principles and Advances………………………………………...30 3.15 Remittance Department……………………………….………...31 3.15.1 Demand Draft……………………………………………….…..32 3.15.2 Pay Order…………………………………………………….….32 3.15.3 Telegram Order…………………………………………….……32 3.15.4 Mail Transfer……………..……………………………………...33 Table of Contents: 3.16 Deposit Department…………………………………………….....33 3.16.1 Account Opening………………………………………………….34 3.16.2 Issuing the Cheques Book………………………….……………...35 3.16.3 Current Account……………………………………….………..…35 3.16.4 Saving Account……………………………………………………36 3.16.5 Cheque Cancellation………………………………………….…...36 3.16.6 Cash………………………………………………………….…….37 3.17 Cash Department…………………………………………………..37 3.17.1 Operation Department……………………………………………..38 3.17.2 Government………………………………………………………..38 Chapter # 4 Deposit Department 4.1 Current Account…………………………………………….…….39 4.2 Saving Deposit Account…………………………………….…….40 4.3 Profit and Loss Sharing Saving Account……………....….………40 4.4 National Income Daily ACCOUNTS (nida)………………………40 4.5 Joint Account……………………………………………….……..40 4.6 Minor Account……………………………………………….……41 4.7 Individual Account…………………………………………...……41 4.8 Procedure of Opening of Accounts………………………….…….41 4.8.1 Formal Application Form………………………………….………41 4.8.2 Obtaining Introduction………………………………..……………41 4.8.3 Specimen Signature Minimum Initial Deposit……………….……42 4.8.4 Minimum Initial Deposit………………………………….……….42 4.8.5 Next of Kin……………………………………………….………..42 4.8.6 Operating the Account………….……………………….…………42 Table of Contents: Chapter # 5 SWOT Analysis 5.1 Strengthens………………………………………………………….43 5.1.1 Serving as an Agent…………………………………………………43 5.1.2 Numbers of Branches………………………………………………..43 5.1.3 Experience Employees………………………………………………43 5.2 Weaknesses………………………………………………………….44 5.2.1 Delegation of Authority……………………………….……..………44 5.2.2 Seniority Based Promotion…………………………….…………….44 5.2.3 Job Rotation…………………………………………….……………44 5.2.4 Lack of theoretical Knowledge of Employees……………………….44 5.2.5 Discouragements of Small Deposits………………………………….45 5.2.6 Lack of Disciplines…………………………………………………...45 5.2.7 Excessive Paper Work………………………………………………..45 5.2.8 Lengthy Process of Loans………………………….………..…….….45 5.2.9 Low Rate of Return………………………………………….………..45 5.3 Opportunities………………………………………………………….46 5.3.1 Financing……………………………………………………………...46 5.3.2 Modernization…………………………………………………………46 5.4 Threats…………………………………………………………………46 5.4.1 Other Bank…………………………………………………..…………46 5.4.2 Political interference………………….………………………………..46 5.4.3 Stronger Competition…………………….………………….…………47 5.5 SWOT Matrix of NBP………………………….………………....……47 5.6 Interpretation …………………………………………………………..50 Chapter # 6 Recommendation & Suggestions 6.1 Introduction………………………………….………….……………...51 6.2 Professional Training……………………………….…….….…...……51 6.3 Delegation of Authority……………………………….……………….52 Table of Contents: 6.4 Performance Appraisal……………………………….…...……………. 52 6.5 Transfer……………………………………………………….…………52 6.6 Need of Qualified Staff……………………………………….…………52 6.7 Utility Bills Charges…………………………………………….……….52 6.8 Link with Headquarter…………………………………………………..52 6.9 Clean Loans…………………………………………………….………..53 6.10 Staff Relation ship……………………………………………………….53 6.11 Improve Distribution of work…………………………….……………...53 6.12 Interdepartmental Transfer………………………………………………54 6.13 Complaints of Customers………………………………………………..54 6.14 Housing and house Gold Loans………………………………………….54 6.15 Summation……………………………………………………………….54 Chapter # 7 Implementation Plan 7.1 Business Development Plan………………………………….….………55 7.2 Plan for Monitoring and Evaluation System……………….…………...56 7.3 Internship Program Plan………………………………………………...57 7.4 Summation………………………………………………………………57 Bibliography……………………………………………………….58 *****************************