Document

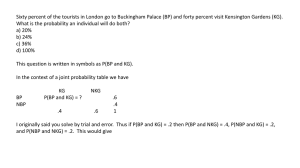

advertisement

Samina Ameer Din Mc090404110 MBA Finance National Bank of Pakistan Brief Introduction of the Organization History of National Bank of Pakistan NBP is the largest commercial bank. Acts as an agent of central bank. Moved from public sector organization to commercial bank. Provide both public sector and commercial banking services. Handle treasury transactions. A major lead player. Business Volume of NBP 2010 (Particulars) Total Assets (Rs. in Million) 1,035,025 Deposits Advances Investments 832,152 477,507 301,324 Shareholder’s Equity Pre-tax Profit After-tax Profit 103,762 24,415 17,563 Earning Per Share (Rs.) Number of Branches Number of Employees 13.05 1,289 16,457 Competitors of NBP Competitors at Public Sector First Women Bank Limited The Bank of Khyber The Bank of Punjab (FWB) (KB) (BOP) Competitors at Private Sector My Bank Limited Allied Bank Limited Bank Al-Falah Limited Atlas Bank Bank Al Habib Limited Habib Bank Limited Askari Bank Saudi Pak Bank Limited Faysal Bank Limited Metropolitan Bank limited Muslim Commercial Bank Limited Organizational Hierarchy Chart 1. President Executive s 2. SEVP 4. SVP 3. EVP 5. VP 6. AVP Officers OG-II OG-I Cash Dept. Head Cashier OG-III Clerical Staff Assistant Cashier Non Clerical Staff Peon, Guards etc Hierarchy of Branch Branch Manager Credit Officer Operations Manager All other staff HR Officer Training Program 1) 2) 3) Account Opening Department Clearing Department Remittance Department Description of the Tasks Assigned to me During my Internship PLS Saving A/C Current A/C Inward / Out ward Clearing Local Clearing Intercity Clearing Pay Order (PO) Demand Draft (DD) Call Deposit at Receipts (CDR) Ratio Analysis Financial Statements All the financial statements for the preparation of these PPT slides are downloaded from the Website of NBP: www.nbp.com.pk National Bank of Pakistan Ratio (Net profit/ Revenue) *100 Analysis Year 2010 Year 2009 Year 2008 1. Net 17,563,214/ 17,561,846/ 15,458,590/ Profit 88,472,134*100 77,947,697*100 60,942,798*100 Margin =19.85% = 22.53% = 25.36% Net Profit Margin 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Year 2008 Year 2009 Year 2010 National Bank of Pakistan Ratio (Mark-up / return / interest earned - Mark-up / return Analysis / interest expensed) / Mark-up / return / interest earned*100 Year 2010 Year 2009 Year 2008 2. Gross 43,221,658/ 37,458,048/ 37,058,030/ Spread 88,472,134*100 77,947,697*100 60,942,798*100 Ratio = 48.85% = 48.05% = 60.80% Gross Spread Ratio 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% Year 2008 Year 2009 Year 2010 Working of Net Interest Margin Net Interest Margin = Mark-up / return / interest earned Mark-up / return / interest expensed 2010) Net interest margin = (88,472,134-45,250,476) = 43,221,658 2009) Net interest margin = (77,947,697-40,489,649) = 37,458,048 2008) Net interest margin = (60,942,798-23,884,768) = 37,058,030 National Bank of Pakistan Ratio non mark-up/interest income/ (non mark-up/interest Analysis income +Mark-up/return/interest earned)*100 Year 2010 Year 2009 Year 2008 3. Non 17,632,640/ 19,025,357/ 16,415,862/ Interest 106,104,774*100 96,973,054*100 77,358,660*100 Income = 16.61% = 19.61% = 21.22% to Total Income Non Interest Income to Total Income Ratio 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Year 2008 Year 2009 Year 2010 Working of Total Income Total Income = (non mark-up / interest income +Mark-up / return / interest earned) 2010) Total Income = (17,632,640+88,472,134) = 106,104,774 2009) Total Income = (19,025,357+77,947,697) = 96,973,054 2008) Total Income = (16,415,862+60,942,798) = 77,358,660 National Bank of Pakistan Interest Earned / Interest Expensed Ratio Analysis Year 2010 4.Spread 88,472,134 / Ratio 45,250,476 =1.95 times Year 2009 77,947,697 / 40,489,649 = 1.92 times Spread Ratio 3 2.5 2 1.5 1 0.5 0 Year 2008 Year 2009 Year 2010 Year 2008 60,942,798 / 23,884,768 = 2.55 times National Bank of Pakistan Ratio (Net profit/ Total assets) *100 Analysis Year 2010 Year 2009 Year 2008 5.Return 17,563,214/ 17,561,846/ 15,458,590/ on 1,035,024,680*100 944,582,762*100 817,758,326*100 Assets = 1.69% = 1.85% = 1.89% Return on Assets 1.90% 1.85% 1.80% 1.75% 1.70% 1.65% 1.60% 1.55% Year 2008 Year 2009 Year 2010 Working of Total Assets Total Assets Year 2010 (Rs) 115,442,360 Year 2009 (Rs) 115,827,868 Year 2008 (Rs) 106,503,756 30,389,664 28,405,564 38,344,608 23,025,156 19,587,176 17,128,032 301,323,804 477,506,564 26,888,226 217,642,822 475,243,431 25,147,192 170,822,491 412,986,865 24,217,655 6,952,666 3,062,271 3,204,572 Other assets-net 53,496,240 59,666,438 44,550,347 Total 1,035,024,680 944,582,762 Cash and balances Balances with other banks Lending to financial institution-net Investments-net Advances-net Operating fixed assets Deffered tax assets 817,758,326 Ratio Analysis 6. Dupont Return on Assets National Bank of Pakistan ((net income/revenues)*(revenues/assets))*100 Year 2010 ((17,563,214/ 88,472,134)* (88,472,134/ 1,035,024,680)*100 = 1.69% Year 2009 ((17,561,846/ 77,947,697)* (77,947,697/ 944,582,762)*100 = 1.85% Dupont Return on Assets 1.90% 1.85% 1.80% 1.75% 1.70% 1.65% 1.60% 1.55% Year 2008 Year 2009 Year 2010 Year 2008 ((15,458,590/ 60,942,798)* (60,942,798/ 817,758,326)*100 = 1.88% National Bank of Pakistan Ratio Net Income/ Total equity*100 Analysis Year 2010 Year 2009 Year 2008 7.Return 17,563,214/ 17,561,846/ 15,458,590/ on Total 103,762,310*100 94,141,919*100 81,367,002*100 Equity = 16.92% = 18.65% = 18.99% Return on Total Equity 19.00% 18.50% 18.00% 17.50% 17.00% 16.50% 16.00% 15.50% Year 2008 Year 2009 Year 2010 Working of Total Equity Total Equity Year 2010 (Rs) Year 2009 (Rs) Year 2008 (Rs) Share capital Reserves Un appropriated profit 13,454,628 24,450,244 65,857,438 10,763,702 22,681,707 60,696,510 8,969,751 19,941,047 52,456,204 Total 103,762,310 94,141,919 170,822,491 National Bank of Pakistan Ratio (Total debt/ Total assets)*100 Analysis Year 2010 Year 2009 Year 2008 8. Debt 906,528,852/ 825,676,384/ 715,299,108/ Ratio 1,035,024,680*100 944,582,762*100 817,758,326*100 =87% =87% =87% Debt Ratio 90.00% 80.00% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% Year 2008 Year 2009 Year 2010 National Bank of Pakistan Ratio (total debt/ total equity) Analysis Year 2010 Year 2009 Year 2008 9. Debt / 906,528,852/ 825,676,384/ 715,299,108/ Equity 103,762,310 94,141,919 81,367,002 Ratio = 8.73 times = 8.77 times = 8.79 times Debt / Equity Ratio 8.79 8.78 8.77 8.76 8.75 8.74 8.73 8.72 8.71 8.7 2008 2009 2010 National Bank of Pakistan Ratio (EBIT/ total interest) Analysis Year 2010 Year 2009 Year 2008 10. Time 69,665,595/ 61,789,822/ 46,885,766/ Interest 45,250,476 40,489,649 23,884,768 Earned = 1.53 times = 1.52 times = 1.96 times Ratio Time Interest Earned Ratio 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 2008 2009 2010 Working of EBIT EBIT= Profit before Taxation+ Mark-up / return / interest expensed 2010) EBIT = 24,415,119+45,250,476= 69,665,595 2009) EBIT = 21,300,173+40,489,649= 61,789,822 2008) EBIT = 23,000,998+23,884,768= 46,885,766 National Bank of Pakistan Ratio Total Advances/ Total Deposits Analysis Year 2010 Year 2009 Year 2008 11. 477,506,564/ 475,243,431/ 412,986,865/ Advances 832,151,888 727,464,825 624,939,016 /Deposits = 0.5738 times = 0.6532 times = 0.6608 times Ratio Advances / Deposits Ratio 0.68 0.66 0.64 0.62 0.6 0.58 0.56 0.54 0.52 2008 2009 2010 Ratio Analysis 12. OCF Ratio National Bank of Pakistan Net cash generated from operating activities/ Current Liabilities Year 2010 Year 2009 Year 2008 93,163,784/ 867,626,368 = 0.107 times 41,576,364/ 725,293,720 = 0.057 times Operating Cash Flow Ratio 0.12 0.1 0.08 0.06 0.04 0.02 0 2008 2009 2010 2,532,681/ 682,905,461 = 0.003 times Working of Current Liabilities Total Current Liabilities Year 2010 (Rs) Year 2009 (Rs) Year 2008 (Rs) Bills payable (short term) Borrowings (short term) Deposits and other accounts (short term) Liabilities against assets subject to finance lease (short term) 8,006,631 10,621,169 10,219,061 17,154,131 816,172,861 37,057,189 655,031,896 37,409,288 614,538,859 43,963 20,408 16,517 26,248,782 22,563,058 20,721,736 867,626,368 725,293,720 682,905,461 Other liabilities (short term) Total National Bank of Pakistan Ratio Dividends paid to Shareholders/ Average common Analysis shares outstanding Year 2010 Year 2009 Year 2008 13. Div Per Share 8,072,777/ 1,345,462.8 = Rs.6 5,830,338/ 1,076,370.2 = Rs.5.41 6,115,739/ 869,975.1 = Rs.6.81 Dividend Per Share 7 6 5 4 3 2 1 0 2008 2009 2010 National Bank of Pakistan Ratio Net income/ outstanding number of shares Analysis Year 2010 Year 2009 Year 2008 14. 17,563,214/ 17,561,846/ 15,458,590/ Earning 1,345,463 1,345,463 1,076,370 Per = Rs. 13.05 = Rs. 13.05 = Rs. 14.36 Share Earning Per Share 14.4 14.2 14 13.8 13.6 13.4 13.2 13 12.8 12.6 12.4 12.2 2008 2009 2010 National Bank of Pakistan Ratio Analysis Current Market Share Price/ EPS Year 2010 Year 2009 Year 2008 15. Price 76.82/13.05 74.37/13.05 /Earning = Rs. 5.88 = Rs. 5.69 Ratio 50.32/14.36 = Rs. 3.50 Price / Earning Ratio 6 5 4 3 2 1 0 2008 2009 2010 Conclusion The net profit margin of NBP in all of the years is good. Gross spread ratio is also good in all of over the years. Spread ratio of NBP is also good because it covers its interest expenses. Non Interest Income to Total Income Ratio of NBP is good. Return on assets ratio of NBP is low. Dupont return on assets ratio is also low. Return on total equity ratio is good in all over the years. Debt ratio of NBP is very high in all of the year that is not good. Conclusion Debt ratio of NBP is very high in all of the year that is not good. Debt to equity ratio is also too high of NBP that is not god. Time Interest earned ratio of NBP is good. Advances / Deposits ratio is very low and not good for NBP. Operating Cash Flow ratio is also very low in all over the year that is not good. Dividend per share ratio of NBP is good. Earning per share ratio is very good. P / E ratio is also good of NBP. Recommendations NBP can also increase the net profit margin ratio by decreasing its non mark-up interest expenses and taxes. NBP can increase more its gross spread ratio by decreasing the interest expenses. Return on assets ratio & Dupont return on assets ratio can also be increased by utilizing the assets in an efficient manner. NBP need to decrease its debts to manage the debt ratio because a high debt is not a good sign for NBP. Recommendations Debt to equity ratio is also very high. NBP should decrease its debts because the equity investors will not invest in it due to high debts. NBP can increase its advances / deposits ratio by giving advances to the customers. NBP needs to improve its liquidity by increasing assets for operating cash flow. Thank You