USC Marshall - University of Southern California

advertisement

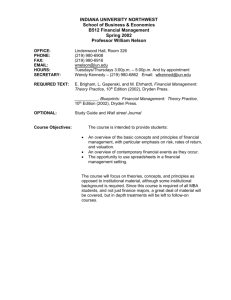

University of Southern California Foundation of Business Finance BUAD 215 Spring 2006 Building: HOH 101 MW: 8:00-9:50 a.m. Instructor: Dr. J. Kashefi “Dr. Kash” Course Web Page: WWW.drkash.com Please turn-off your cell phone. Course Assistance: Room: Hoffman Hall 702 L Telephone:(213) 740-8864 Cal Poly: (909) 869-2396 Fax: (213) 740-6650 E-mail: Jkashefi@cox.net or Dkashefineja@csupomona.edu Please note my website e-mail does not work. Office hours: MW 7:00-7:45 am and Monday 12:00-1:00 pm. Catalogue Description: Principles and practices of modern financial management; use of financial statements; valuation of investment; asset pricing under uncertainty; and elements of financial decisions. Not available for credit to business majors. (4 units) Prerequisite: BUAD 100 and ACCT 410 (no exception). Course Description: This course is primarily designed to introduce non-business majors to fundamentals of corporate finance. It explains the procedures, practices, and policies by which financial managers contribute to the successful performance of organization. The course also provides students with knowledge of key finance concepts and theoretical principles relating to the time value of money, the effects of debt and dividend policy on firm value, the operation of financial markets, and the operation of foreign exchange markets. In addition, the course is intended to provide students with the tools to calculate the value of stock and bond investments, to evaluate investments in productive firm assets, to assess the risk of investments, to determine the cost of capital for firms and for individual projects, and to calculate exchange rates across different national currencies. Academic Integrity: The University is committed to maintaining academic integrity throughout its academic units. Academic dishonesty is a serious offense that can diminish the quality of scholarship, the academic environment, the academic reputation, and the quality of a USC degree. Please read the University catalogue to learn about academic dishonesty at the University of Southern California and to the responsibility of students, faculty, and administrators relating to this subject. Disability Services and Programs (DSP) "Any student requesting academic accommodation based on a disability is required to register with Disability Services and Programs (DSP) each BUAD 215 – Foundations of Business Finance 2 semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me (or to TA) as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m. - 5:00 p.m., Monday through Friday. The phone number for DSP is (213) 740-0776." Text Requirement: Title: Author: Publisher: Date: Essentials of Corporate Finance Stephen Ross, Randolph Westerfield & Bradford Jordan Irwin/McGraw-Hill 2007, Fifth Edition Course Requirements: Readings: You are responsible for the following readings in preparation for class participation and examinations. Reading the assigned topics, as outlined in the lecture schedule, from chapters in the required textbook. Homework: 1. The homework assignment and due dates will be announced during the class meeting. 2. Please make sure your homework is legible and shows all your calculations (not just the answer!). Please print your name and ID/SS number on each homework assignment. 3. There are absolutely no points for late homework. If you cannot attend the class when homework is due, please fax it to the department before 10:00 a.m. of the due dates. E-mail attachment will not be accepted. Quizzes: There are three quizzes in this course, which are equally weighted. Each quiz will cover the material discussed in class and presented in the textbooks. Questions will be in multiple-choice essay and problems. Questions will be similar to those listed at the end of each chapter in the textbook. Please make a careful note of the quiz dates as listed in the lecture schedule because there is absolutely no make-up test! Examinations: There is one mid-term and one final examination in this course. The final examination is comprehensive. Each exam will cover material discussed in the class and textbook. Questions will be in the forms of multiple-choice essay and problems. The problem section will contain questions similar to those recommended in the lecture schedule. Please make a careful note of the examination dates as listed in the lecture schedule because there is absolutely no make-up test! Examination Policy: All exams are closed book and closed notes. You are required to follow all instructions given on the cover sheet of each test. Failure to do so may result in not receiving credit for correct answers. It is your responsibility to check your test to ensure that no pages are omitted. The cover sheet to each test will explain how many pages there are to the test, how many questions are included in the test, and how many points are assigned to each question. BUAD 215 – Foundations of Business Finance 3 You are responsible to check the number and sequence of the pages of each test. If your test is missing a page, ask the instructor for a new test. Requests for re-grades because pages are claimed to have been missing from a test will not be accepted. If you have any questions during a test, raise your hand and ask the instructor. No discussion with other class members will be allowed during a test. You may be asked to change seats during a test. This does not necessarily mean that you are suspected of cheating. You may be asked to show proper identification before, during, or after a test. You are required to bring your university student picture identification to each test. No programmable calculators or palm-held computers are allowed during a test. You cannot leave the classroom after examinations are distributed. Please turn-off your pager and cell phone. No partial credit will be awarded for objective questions. Requests for grade changes for such reasons as “I am only 2 points from a B” or “I need a few more points to be admitted into the Business School” will not be considered. If you change your answer on the scantron sheet, it is your responsibility to properly erase any other answers you had previously selected. Scantron sheets that are misgraded because of poor erasure marks will not be re-graded. Grading Policy: Grades are determined in the following format: Class attendance Homework Three quizzes Mid-term Examination Final Examination Total 10 percent 10 percent 15 percent 25 percent 40 percent 100 percent Important Dates: Date Events Jan 16, 2006 Feb. 20, 2002 March 20, 2006 March 13-17, 2006 May 8, 2006 No Class No class Mid-term Examination Spring recess Final Examination BUAD 215 – Foundations of Business Finance Lecture Schedule: Jan 9 Checking Student List Review of Course Outline Chapter 1: Introduction to Financial Management Finance: A Quick Look Business Finance and The Financial Manager Jan 11 Chapter 1: Introduction to Financial Management Forms of Business Organization The Goal of Financial Management The Agency Problem and Control of the Corporation Financial Markets and the Corporation Jan 16 Martin Luther King Day, university holiday Jan 18 Chapter 2: Financial Statements, Taxes, and Cash Flow The Balance Sheet The Income Statement Taxes Jan 23/25 Chapter 3: Working with Financial Statements Jan 30/ Feb 1 Chapter 4 Introduction to Valuation: The Time Value of Money Future Value and Compounding Present Value and Discounting Feb. 6/8 1st Quiz Chapters 1-3 Chapter 5: Discounted Cash Flow Valuation Future and Present Values of Multiple Cash Flows Valuing Level Cash Flows: Annuities and Perpetuities Feb 13 Chapter 5: Discounted Cash Flow Valuation Future and Present Values of Multiple Cash Flows Valuing Level Cash Flows: Annuities and Perpetuities Feb 15 Chapter 6: Interest Rates and Bond Valuation Bonds and Bond Valuation More on Bond Features Bond Ratings Some Different Types of Bonds 4 BUAD 215 – Foundations of Business Finance 5 Feb 20 No class Feb 22 Chapter 6: Interest Rates and Bond Valuation Bonds and Bond Valuation More on Bond Features Bond Ratings Some Different Types of Bonds Feb 27 Chapter 7 Equity Markets and Stock Valuation Common Stock Valuation Some Features of Common and Preferred Stock March 1 Chapter 7 Equity Markets and Stock Valuation Common Stock Valuation Some Features of Common and Preferred Stock Quiz 2 Chapter 4-6 March 6 Chapter 7: Equity Markets and Stock Valuation Common Stock Valuation Some Features of Common and Preferred Stock March 13-15 Spring recess March 20 Mid-term Examination: Chapters 1-7 March 22/27 Chapter 8: Net Present Value and Other Investment Criteria Net Present Value The Payback Period Rule The Internal Rate of Return The Profitability Index The Practice of Capital Budgeting March 29 Chapter 9: Making Capital Investment Decisions Pro Forma Financial Statements and Project Cash Flow Evaluating NPV Estimates & additional Considerations Scenario and Other What-If Analyses April 3 Chapter 10: Some Lessons from Capital Market History Returns Average Returns BUAD 215 – Foundations of Business Finance The Variability of Returns Capital Market Efficiency Quiz 3. Chapter 8- 10 April 5 Chapter 11: Risk and Return Expected Return and Variances Portfolios Risk: Systematic and Unsystematic April 10 Chapter 11: Risk and Return Diversification and Portfolio Risk Systematic Risk and Beta The Security Market Line April 12 Chapter 12: Cost of Capital The Cost of Capital The Cost of Equity The Costs of Debt and Preferred Stock April 17 Chapter 12: Cost of Capital The Weighted Average Cost of Capital Divisional and Project Costs of Capital April 19 Chapter 14: Dividends and Dividend Policy Cash and Dividend Payment Does Dividend Policy Matter? Establishing a Dividend Policy Stock Repurchase Stock Dividends and Stock Splits April 24 Chapter 15: Raising Capital Corporate Taxes and Capital Structure Bankruptcy Costs Optimal Capital Structure Observed Capital Structure April 26 Review for Final Exam Final Examination: Comprehensive covering all of the chapters covered. Monday May 8 11:00-1:00 p.m. 6