Course Syllabus - University of British Columbia

advertisement

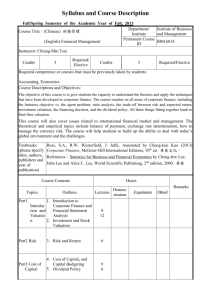

COMM 371 – THEORY OF FINANCE – Section 101, Sep - Dec 2007 Instructor: Oliver Boguth Phone: (604) 822-2032 Office: Henry Angus 873C Email: oliver.boguth@sauder.ubc.ca Course Web Page: All materials are available on WebCT ( http://www.webct.ubc.ca ) Classes: Tuesday & Thursday, 8:30-9:50, SWNG 109 Office Hours: Tuesday & Thursday, 10:30 – 12:00, and by appointment I. Description This course undertakes in-depth study of specific financial decisions and events that are important in the life of a corporation. The objective is to help the student develop an understanding of the underlying economic issues, and to gain experience applying empirical and theoretical tools. The course builds on the foundation provided by Commerce 370. The course balances theoretical content and practical applications by using several case-studies that are useful for real-life decisions you may need to make. The basic topics are financial planning and working capital management, project valuation, sources of capital, types of securities, and capital structure, moral hazard and adverse selection in financial markets, the effect of real options on valuation, and risk management. II. Course Materials Text Because our course touches upon different topics that are not contained in any single book, we will rely heavily on the lecture notes. Thus, there is no required text for the course; however, it will be helpful to have one of the standard corporate finance texts for background reading. I can recommend (RWJR) Ross, Westerfield, Jaffe, and Roberts, Corporate Finance, Fourth Canadian Edition, McGrawHill Ryerson, 2005. This text will be the basis for several lectures. Several copies of this text are on reserve in the David Lam Library for your exclusive use. You should make copies of the chapters you plan to read and return it to the library. 1 Reading Packet This is required and available from Duplication Services Center in Henry Angus 423. The packet contains the cases that we will use throughout the course. Articles that appear as required readings in the course outline but are not included in this packet are available for download on the course home page. Lecture notes and supplements Lecture notes and supplements will be posted on the course web page several days before they are discussed in class. You should check the course website for updates regularly, and print and bring the lecture notes to class. In addition, it will often be helpful for you to read these notes before coming to class. Lecture notes are made available for your convenience, but be aware that these notes may contain typos and other problems. III. Evaluation Group Project Groups of 3-4 students will work on a project that will be announced at the end of October. This project will take about 2 weeks, and completion is required for a passing grade. Try to form your own groups as soon as possible, and contact me if you have any difficulties. For evaluation purposes, style and presentation are as important as quantitative factors. Marks are based on the project, and thus all members of a group will receive the same mark. No solution will be posted for this project. Exams There will be a mid-term and a (cumulative) final examination. You are required to take both exams. If you miss an exam, you must contact the Undergraduate Office immediately and provide them with the documentation necessary to justify your absence. You will keep good standing in the course only if the Undergraduate Office confirms the validity of your excuse. Any student who misses the mid-term will have all of the weight from that exam transferred to the final exam. The midterm is tentatively booked for Thursday, October 11th during class. Date and time for the final exam will be announced later. Homework & Class Participation Short homework assignments, to be completed individually, will be given approximately once a week. I will collect and mark the homework about 3 times during the term at random days. Active class participation is expected and encouraged. Grades for homework and participation are based on effort. Weighting Project 10% Midterm Exam 35% Final Exam 55% Homework and Class Participation: If your homework and class participation grade exceeds your lowest exam grade, the exam weight will be reduced by 15% and substituted by the participation grade. 2 Course Outline (subject to changes) TOPIC BACKGROUND MATERIAL Introduction & Overview Lecture 0 Financial Planning Lecture 1 Working Capital Short-Term Financial Planning Lecture 2 / RWJR 27 Financing Growth Lecture 3 / Clarkson Lumber case ABC example & simulation Lecture 4 / Excel spreadsheet Capital Budgeting with Debt The basics: WACC, APV, & FTE Lecture 5 / RWJR 18 APV Example: Valuation of Delphi Lecture 6 When to use APV & Example Lecture 7 RWJR 16 & 17 (background) Capital Structure Raising Capital Lecture 8 Review of Theory & Empirical Facts Lecture 9 Financial Distress Costs Lecture 10 / Cutler & Summers article Capital Structure & Product Market Competition Lecture 11 / Massey-Ferguson, 1980 case Information Asymmetries in Financial Markets The Moral Hazard Problem Lecture 12 The Adverse Selection Problem Lecture 13 RWJ 23, 24 Real Options and Valuation Valuation of a Call Option Review Lecture 14 Managerial Options & Capital Budgeting Lecture 15 Risk Management Why and How Firms Manage Risk Lecture 16 Managing Risk in Practice Lecture 17 3