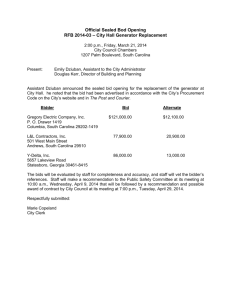

The west rand district municipality proposed procurement policy

advertisement