Short Run

advertisement

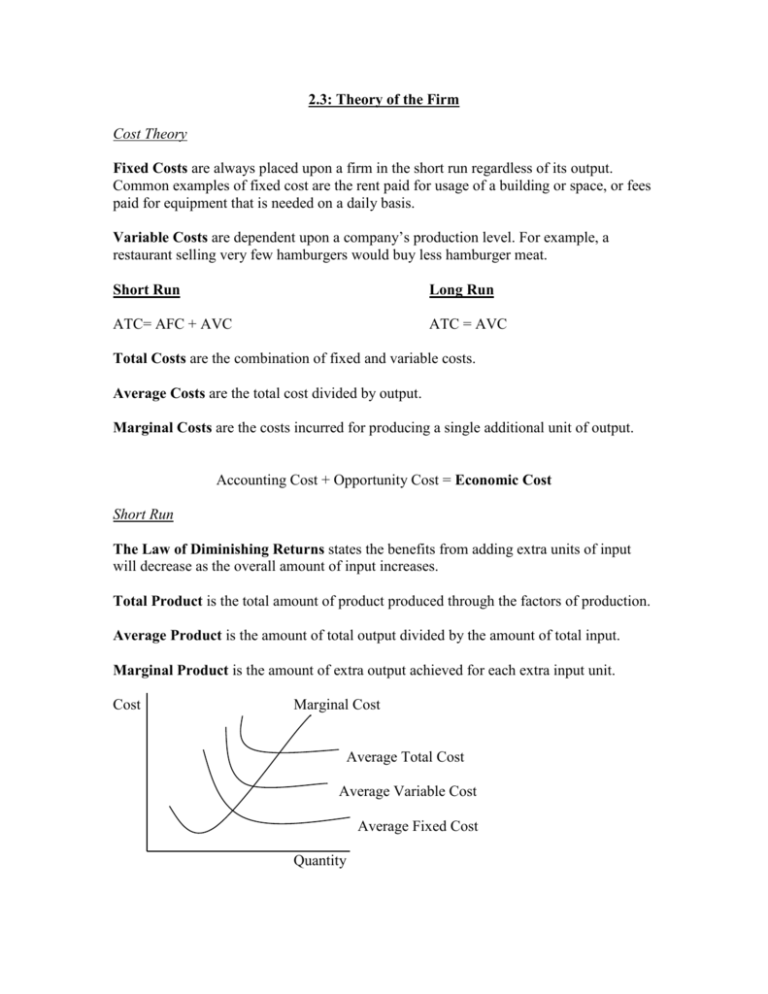

2.3: Theory of the Firm Cost Theory Fixed Costs are always placed upon a firm in the short run regardless of its output. Common examples of fixed cost are the rent paid for usage of a building or space, or fees paid for equipment that is needed on a daily basis. Variable Costs are dependent upon a company’s production level. For example, a restaurant selling very few hamburgers would buy less hamburger meat. Short Run Long Run ATC= AFC + AVC ATC = AVC Total Costs are the combination of fixed and variable costs. Average Costs are the total cost divided by output. Marginal Costs are the costs incurred for producing a single additional unit of output. Accounting Cost + Opportunity Cost = Economic Cost Short Run The Law of Diminishing Returns states the benefits from adding extra units of input will decrease as the overall amount of input increases. Total Product is the total amount of product produced through the factors of production. Average Product is the amount of total output divided by the amount of total input. Marginal Product is the amount of extra output achieved for each extra input unit. Cost Marginal Cost Average Total Cost Average Variable Cost Average Fixed Cost Quantity Long Run Economies of Scale is when a firm increases its production scale and as a result, a lower average per unit cost exists. This often occurs following the establishment of a new business, like Netflix a few years prior to now. Diseconomies of Scale is when a firm increases its production scale and as a result, a higher average per unit cost exists. This occurs with businesses that have existed for a great length of time like General Motors or McDonald’s. Cost Long-run average Total Cost Economies Constant Returns Of Scale to Scale Diseconomies of Scale Quantity Revenues Total Revenue is the total amount that a company makes from selling its products. For example, Sony’s profits from televisions, video game systems, films, etc. Marginal Revenue is a company’s additional profit after increasing input by a single unit. For example, it is the extra profit of a restaurant after spending more money on food supplies. Average Revenue is the profit a company earns from one product. For example, Sony’s profits from the Playstation 3. Profit In Normal profits, all costs are recouped and the entrepreneur involved receives a return upon his investment. When profits are gained past this point they are considered to be Supernormal or Abnormal. When marginal revenue is equivalent to the marginal cost of producing an extra unit of output, Profit Maximization occurs. Profit Maximization is the main goal of a company. Sales Volume Maximization is when a firm attempts to obtain the maximum amount of revenue possible. A nuclear plant could achieve sales volume maximization by ignoring environmental matters and saving money by dumping waste in a wildlife reserve. Sales Volume Maximization, Environmental Concerns, and Revenue Maximization are secondary goals for firms. Perfect Competition Assumptions of the model: - It is easy to enter or exit because no barriers exist Numerous buyers and sellers exist but none of them can influence the market. All of the products are the same- homogenous The available information is perfect. Example of Demand Curve: P sM P MC ATC D dM Q Q - Profit Maximization occurs at the point in which MC = MR - Abnormal profits and losses can occur in the long run yet never occur in the short run. - Shut down price, break-even price: A company will be forced to shut down in the short-run when it cannot cover its variable costs. The company will have to cover its average costs to stay afloat in the long run. - Allocative Efficiency- When output has reached the optimum level of P = MC. - Productive Efficiency- When a company saves money by producing each unit of output at the lowest possible cost level. AC =MC. - Perfect Competition allows for allocative and productive efficiency. Yet, it limits new technology and research prospects. Profits in the long-run ultimately limit production possibilities. Monopoly Assumptions of the model: - Allows easy entry and exit due to a lack of barriers. Only one firm rules over the marketplace. One example was the case of Microsoft early in the company’s existence. Sources of monopoly power/barriers to exit: - Lawmakers pass legislation to prevent monopolies. A company establishes patents or copyrights on a product so that a monopoly becomes ensured. When one company controls all of the supplies needed to make a product, a monopoly becomes ensured. The existence of massive economies of scale. A Natural Monopoly exists when one company can provide a good or service to a market for less cost than could multiple companies. It emerges due to large economies of scale. P MC D = AR PM MR QM Q MC = MR is the point of profit-maximization in output. Monopolies produce higher profits and lower outputs as a result a lack in competition. Yet, these two problems can be combated using economies of scale. Perfect Competition, on the other hand, allows low price levels along with high output levels. Production costs are also lower and more efficient. Yet companies cannot obtain abnormally high profits like in the case of a monopoly. Ultimately, a monopoly is not efficient in an allocative or productive manner. Yet, it can achieve abnormal profits and dynamic efficiency by maintaining itself as a monopoly. Monopolistic Competition Assumptions of the model: - Numerous different producers that can all influence price. No firm has total control over market prices. Easy entry and exit exist due to a lack of barriers. Short-run and Long-run equilibrium: The short-run allows for abnormal profits to be earned when MC is equivalent to MR. Only normal profit levels can be achieved in the long-run. Short Run Monopolistic Competition: MC PE ATC ATCE D MR QE Long Run Monopolistic Competition: MC P=ATC ATC D MR QE Monopolistic Competition is ultimately inefficient. Productive and Allocative efficiency are not achieved in the long-run or the short-run. Oligopoly Assumptions of the model: - Only a few firms are selling similar products, and thus, they all have near equal power. Entry is difficult because oligopolies are competitive and attempt to block entry into the market. No price-competition exists. This causes companies to compete based on quality. For example, blockbuster online and netflix both try to ship dvds at the fastest rate possible. Non-collusive oligopolies are when competition between firms exists normally. Collusive oligopolies are when firms collaborate in order to prevent the emergence of new competition. These are illegal and can cause the formation of cartels. Cartels are when companies work together to fix output and then share in the profits together. These are usually employed in criminal enterprises like the drug trade. Yet, OPEC is a legal cartel. Kinked Demand Curve: P D Q The Kinked Demand Curve shows that changes in the price of a raw material for the production of a good will ultimately not cause a change in the price of that good. Price Discrimination Price Discrimination is when people pay different prices for the same good. It typically occurs as a result of geography. A man in Colombia probably pays less for sugar than the man in the U.S. who pays increased rates due to tariffs and shipping costs necessary to bring the sugar to the U.S. It is also most common in monopolies. Time, Age, and Income are necessary for its existence.