Competition and Monopoly

advertisement

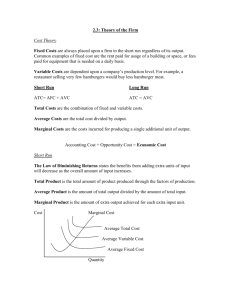

Profit Maximization, Supply, Market Structures, and Resource Allocation Market Structure • Firms are assumed to maximize economic profits • Economic Profit = Revenue – Total Opportunity Costs = Explicit and Implicit Costs • Costs are dependent on technology and input prices • Revenue is dependent upon the market structure in which a firm operates • Therefore, the profit maximization decision must be analyzed by market structures Market Structures • • • • Competitive Markets Monopoly Oligopoly Monopolistic Competition Quick Overview of Supply and Resource Allocation in Competitive Markets • Marginal benefits from a firms perspective are marginal revenue from selling output • Marginal revenue equal the extra revenue from selling another unit of output • Assuming the firm produces (does not shutdown), the firm will maximize profit (or minimize losses) where MR=MC • The level of output will determine the costs of production (measured by ATC) • Comparing price to average costs show if the firm is making profits, losses or will shutdown production • All the buyers in the market combined form the market demand curve and all the sellers for the market supply curve • Market demand and supply determine the price and along with firms’ costs determine economic profits (hereafter simply profits) • Changes in demand and supply, cause market prices to change, and thus cause profits to rise or fall • In the short-run, existing firms in an industry change production as price changes. • In the transition to the long-run, firms enter or exit an industry depending on whether profits are greater than or less than zero. • In the long-run, profits are driven to zero or to the level of NORMAL profits (accounting profits that just cover all opportunity costs). • Resource allocation is determined by: – Buyers and sellers follow their self-interest • Buyers maximize utility • Seller maximize profit – Market demand reflects buyer behavior (and thus each individual buyers behavior) and market supply reflect seller behaviors (and thus individual firm behavior) – Prices signal increases or decreases in quantity demand and supply and profits signal resources to enter or exit an industry causing market supply to change – Long-run equilibrium occurs where: • The price paid by the consumer, which is equal to the marginal benefit of another unit, is just equal to the marginal cost, which is equal to the opportunity cost of another unit to society. MB = MC • From the videos, – Resources dedicated to farming have decreased – If rents are not controlled, the supply of housing will respond to increased demand without shortages – The same is true of gasoline and water – Also, in class, DVDs versus VCRs • This is Adam Smith’s “Invisible Hand at work”. – Every individual necessarily labours to render the annual revenue of the society as great as he can. He generally neither intends to promote the public interest, nor knows how much he is promoting it...He intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. Wealth of Nations, 1776) Marginal Revenue and Market Structure • Competitive markets – sellers are price takers so MR = Market Price, MR =P • Monopoly – the seller is a price maker and faces the entire market demand curve so MR < Price • Oligopoly – the seller directly competes with a few firms so MR depends on the actions of competitors • Monopolistic Competition – sellers possess some market power and can set their own prices in the short-run, so MR<P Competitive Markets or Pure Competition • Assumptions revisited – Many buyers and sellers • Each buyer and seller is a price taker – Homogenous or identical products • Competition is based only on the price – Perfect information or knowledge • All firms have access to the same technology • Competition is based upon price – Firms can freely enter or exit • Profits will be eliminated in the long-run Revenue in Competitive Markets • The market demand and supply curves determine the equilibrium price and quantity and the price that buyers will pay and sellers receive • As with producer surplus, sellers are price takers and the price they receive is their MR. The marginal revenue and the price remain the same no matter how much output is sold. Table 1 Total, Average, and Marginal Revenue for a Competitive Firm Copyright©2004 South-Western Competitive Firm in the Short-run • Short-run – at least one fixed factor = fixed costs. Assume the plant size is fixed. • Set MR=MC to find profit maximizing level of output. Use the average cost curves to determine whether one – – – – Operates and earn profits Operate and breakeven Operates and make losses Shutdowns and minimize losses Table 2 Profit Maximization: A Numerical Example Copyright©2004 South-Western Figure 1 Profit Maximization for a Competitive Firm Costs and Revenue The firm maximizes profit by producing the quantity at which marginal cost equals marginal revenue. MC MC2 ATC P = MR1 = MR2 P = AR = MR AVC MC1 0 Q1 QMAX Q2 Quantity Copyright © 2004 South-Western Conditions for Profits, Breakeven, Losses and Shutdown • Profits – P > ATC • Breakeven – P = ATC • Fixed Costs are sunk costs and irrelevant to decisionmaking. To operate you must cover variable costs! • Losses but operate – P > AVC but P < ATC or – ATC < P < AVC • Shutdown – P > AVC Figure 5 Profit as the Area between Price and Average Total Cost (a) A Firm with Profits Price MC ATC Profit P ATC P = AR = MR 0 Quantity Q (profit-maximizing quantity) Copyright © 2004 South-Western Figure 5 Profit as the Area between Price and Average Total Cost (b) A Firm with Losses Price MC ATC ATC P P = AR = MR Loss 0 Q (loss-minimizing quantity) Quantity Copyright © 2004 South-Western Short-run Losses • Shutdown occurs when a firm cannot cover its variable costs. • If a firm operated with revenues that did not cover variable costs, it would lose more than their fixed costs. • Therefore, a firm must cover its variable costs first. If it can cover them it can pay down some of the fixed costs. Long-run Supply and Price Determination • Long-run – all factors are variable = no fixed costs and plant size can be changed, ALSO firms can enter and exit • If economic profits are positive, new firms will enter. • If economic profits are negative, existing firms will exit. • Long-run equilibrium: – Firms must chose the plant that minimizes LRATC or they will suffer losses. – Economic profits are reduced to zero. • Therefore, supply is more elastic in the long-run. Figure 7 Market Supply with Entry and Exit (a) Firm’s Zero-Profit Condition (b) Market Supply Price Price LRMC MC LRATC ATC P = minimum ATC 0 Supply Quantity (firm) 0 Quantity (market) Copyright © 2004 South-Western Figure 8 An Increase in Demand in the Short Run and Long Run (a) Initial Condition Market Firm Price Price MC ATC Short-run supply, S1 A P1 Long-run supply P1 Demand, D1 0 Quantity (firm) 0 Q1 Quantity (market) Figure 8 An Increase in Demand in the Short Run and Long Run (c) Long-Run Response Market Firm Price Price MC ATC B P2 S1 S2 C A P1 Long-run supply P1 D2 D1 0 Quantity (firm) 0 Q1 Q2 Q3 Quantity (market) Copyright © 2004 South-Western Long-run Supply Curve • Constant cost industries – horizontal or perfectly elastic supply • Increasing cost industries – upward sloping supply – Some resource may be available in limited quantities (farm land) – Some resources may increase in cost or be less productive (skilled labor) • Decreasing cost industries – downward sloping supply – Increased output may stimulate increased productivity or technological change (computers) Competitive Markets: Short-run and Long-run • Short-run supply response to changes in demand are to increase or decrease the use of existing capacity. • Long-run supply response is to build efficient plant size and increase or decrease capacity. • In both the short-run and long-run, the profit maximizing behavior of firms leads to supply responses to accommodate changes in demand. • In the short-run, prices act as signals and, in the long-run,prices and profits act as signals to increase or decrease output. Efficiency Revisited • Maximize human satisfaction from resources = maximize total surplus = maximize consumer surplus + producer surplus. • Two conditions: – Produce what is most highly valued and the amount that maximizes total surplus – Produce it at the least possible cost. • In the absence of market failures, competitive markets are efficient in both the short-run and the long-run: – Supply responds to what consumers demand – Goods are produced at least possible cost • Price and profits are extremely important as signals for the allocation of scarce resources. – Examples of when prices and profits no longer act as signal are rent controls and price supports Market Structures: Monopoly Monopoly Assumptions • One seller and many buyers – Implication: The seller is a price maker and the buyers are price takers. • Barriers to Entry – Ownership of a unique resource (Diamonds) – Government granted rights for exclusive production (e.g. patents, copyrights, licenses, concessions) – Economies of scale and declining long-run average costs – Implication: Monopolist faces the entire market demand curve and profits can persist in the short and long-run. Limits to Monopoly • Size of the market (Pavarotti versus Joe, uncongested bridge) • Definition of market and close substitutes (ornamental versus industrial diamonds, bottled water). • Potential competition Production Decisions • Monopolist versus competitive firm. – CF is a price taker who faces a perfectly elastic demand curve MR=P – M is a price maker who faces the entire market demand curve MR<P • Intuitive proof – to sell another unit the monopolist must lower the price. This means lowering the price not only on the extra unit sold, but also all the other units the monopolist was selling. So MR = Price of the additional unit – the sum of the decreases in all the units previously sold ( e.g. selling 4 units @$100, to sell the 5 unit the price must be lowered to $90, so the monopolist’s MR = $90 – 4X$10=$50) • Tabular proof – see next table and handout • Graphical proof A Monopoly’s Revenue • Total Revenue P Q = TR • Average Revenue TR/Q = AR = P • Marginal Revenue DTR/DQ = MR Table 1 A Monopoly’s Total, Average, and Marginal Revenue Copyright©2004 South-Western Figure 2 Demand Curves for Competitive and Monopoly Firms (a) A Competitive Firm’s Demand Curve Price (b) A Monopolist’s Demand Curve Price Demand Demand 0 Quantity of Output 0 Quantity of Output Copyright © 2004 South-Western Figure 3 Demand and Marginal-Revenue Curves for a Monopoly Price $11 10 9 8 7 6 5 4 3 2 1 0 –1 –2 –3 –4 Demand (average revenue) Marginal revenue 1 2 3 4 5 6 7 8 Quantity of Water Copyright © 2004 South-Western Profit Maximization • A monopoly maximizes profit by producing the quantity at which marginal revenue equals marginal cost. • It then uses the demand curve to find the price that will induce consumers to buy that quantity. • Profit Maximization – – Set MR = MC to find Q that maximizes profits. – Use the market demand curve to find the P that the Q brings – Find ATC and AVC cost to determine profits, losses, or shutdown. • Difference between the monopolist decision and the competitive firms decision – The monopolist does not have a supply curve like the CF, rather they pick a single price and quantity – Monopolists produce where P>MR and P>MCversus CFs who produce where P=MR and P=MC. Figure 4 Profit Maximization for a Monopoly Costs and Revenue 2. . . . and then the demand curve shows the price consistent with this quantity. B Monopoly price 1. The intersection of the marginal-revenue curve and the marginal-cost curve determines the profit-maximizing quantity . . . Average total cost A Demand Marginal cost Marginal revenue 0 Q QMAX Q Quantity Copyright © 2004 South-Western Figure 5 The Monopolist’s Profit Costs and Revenue Marginal cost Monopoly E price B Monopoly profit Average total D cost Average total cost C Demand Marginal revenue 0 QMAX Quantity Copyright © 2004 South-Western Figure 6 The Market for Drugs Costs and Revenue Price during patent life Price after patent expires Marginal cost Marginal revenue 0 Monopoly quantity Competitive quantity Demand Quantity Copyright © 2004 South-Western Welfare Costs of Monopoly • In competitive markets, firms produce where P=MC And since P=MB=willingness to bud And MC=willingness to sell P=MC MB=MC or Maximum total surplus • In monopoly, P>MR so P>MC Or MB>MC Output falls short of the efficient amount Deadweight Welfare Loss Figure 7 The Efficient Level of Output Price Marginal cost Value to buyers Cost to monopolist Value to buyers Cost to monopolist Demand (value to buyers) Quantity 0 Value to buyers is greater than cost to seller. Value to buyers is less than cost to seller. Efficient quantity Copyright © 2004 South-Western • Monopoly profit is not usually a social cost but a transfer of surplus from consumer to producer. • Profit can be a social cost if extra costs are incurred to maintain it, such as political lobbying, or if the lack of competition leads to costs not being minimized (Xinefficiency again!) Public Policy and Monopolies Working towards P=MC • Attempts to increase competition through antitrust legislation – Sherman Antitrust Act of 1890 – Examples: Breakup of Standard Oil and turning MA Bell into Baby Bells • Regulation – Natural Monopolies – P=MC doesn’t work with extensive economies of scale – Regulated forms have little incentive to minimize costs • Public Ownership – Public utilities and the Postal Service • Hands-off Approach