Overview

advertisement

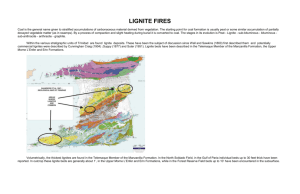

ESTIMATION OF CASH FLOWS VOLATILITY FOR RISK ANALYSIS OF A NEW LIGNITE POWER PLANT Leszek Jurdziak, PhD, Inst. of Mining Eng., Wroclaw Univ. of Technology, Poland, 48713206830, leszek.jurdziak@pwr.wroc.pl Justyna Wiktorowicz, MSc, Inst. of Mining Eng., Wroclaw Univ. of Tech., Poland, 48713206851, justyna.wiktorowicz@pwr.wroc.pl Overview Liberalization and structural changes on electric energy markets as well as forced by politics and environmentalists regulations regarding CO2 emissions pricing through emission trading schemes (ETS) together with the global financial crisis cause that the production of electricity is becoming a very risky business. In atmosphere of radical requirements to ban new coal power plants without carbon capture and storage (CCS) installations finding the finance for developing a new pit or building a new power plant based on lignite is extremely difficult. Lack of money in banking systems due to financial crisis additionally worsens the situation. It is especially true in Poland where electricity production is based mainly on hard coal (60%) and lignite (35%). In effect this cheapest source of electricity must compete with other alternative sources and its profitability and safety of investments in this new conditions have to be proved. In this paper the authors concentrate only on power sector based on lignite (including mining), which in comparison to hard coal sector, in his whole history in Poland never use taxpayers money in the form of government aid or donation due to it was always profitable and has made his recent investments (e.g. development of “Szczerców” deposit or new blocks in Bełchatów or ZE PAK power plants) based on own money and commercial credits secured by future cash flows estimates. Due to the situation is going to be worse in next years e.g. since the year 2020 the whole decreasing limit of CO2 emission allowances will have in Poland to be purchased on auctions it is wise to develop methodology which can estimate future cash flows volatility from selling electricity produced from a new lignite based power plant taking into account all uncertain and risky conditions to show how they influence the profitability and risk of such investments. Poland has several billion tons of lignite in undeveloped resources (e.g. “Legnica” and “Gubin” deposits), which can guarantee security of electric energy sector for over one hundred years, but it is necessary to find funds on new investments. Otherwise existing, developed deposits will be exhausted about 2040 and Poland will loose its independency in electric energy supply. Methods Results of recent research (Jurdziak, 2007) has shown that in order to maximise profits from electric energy production it is necessary to optimise joint activity of a lignite mine supplying fuel together with a nearby power plant (Jurdziak, 2008c). Otherwise both sides of a bilateral monopoly could realise the solution, which could not be optimal in Pareto sense (Jurdziak, 2008b). New lignite mine and a power plant investment should be conducted by the vertically integrated firm due to integration brings also other valuable benefits, which additionally can increase profitability of the whole operation (Jurdziak, 2008a). The analysis of the future investment should start from lignite deposit evaluation, resources classification and identification of mineable lignite reserves. As early as on this stage it has to be taken into account that joint operation and not only a mining part of it should be considered (Jurdziak & Kawalec, 2008). Lignite price has no influence on joint profits (Jurdziak, 2007) therefore it is difficult to depict optimal reserves and their location in 3D space based on it. Instead the influence of electric energy price on lignite reserves should be taken into account. It is therefore necessary to design the lignite price formula which could show its net value from the point of view of particular power plant (or rather its boilers) e.g. it should take into account lignite productivity resulting from its quality and costs connected with environment protection (e.g. costs of ashes utilization, SO2 removing etc.) in order to properly value any deviations from the reference lignite required by the power plant. It is more important to properly value the differences in lignite quality than to establish the proper price level due to blending of lignite from different faces and levels can add value to joint operations. Such formula should be used to build the value model of the deposit which together with 3D lignite quality model should be used for designing of the optimal pit maximizing joint profits and preparation of the optimal schedule of lignite excavation maximizing NPV of future cash flows from the sale of electric energy. On each stage of this value creation chain of optimal ultimate energy production from lignite there are several uncertain parameters, which can cause the variability of future cash flows increasing the risk of not attaining the required level of profitability (Jurdziak & Wiktorowicz, 2008b). In order to quantify this uncertainty it is proposed to use several techniques to forecast future cash flow variability including application of conditional simulation (CS) of equally probably 3D lignite deposit models, application of Geo-Risk Assessment (GRA) during optimal scheduling of lignite excavation and usage of Monte Carlo simulations (MCs) of economic conditions of future electric energy production and sale including uncertainty connected with required amount and prices of allowances on CO2 emissions under ETS (Jurdziak&Wiktorowicz, 2008). The integrated risk evaluation method has been described in (Jurdziak & Wiktorowicz, 2008). Now this approach is presented based on the example data of the planned “Legnica” mine supplying fuel to the proposed power station within the Foresight Project “Scenarios of the Technological Development for the Lignite Mining and Process Industry” sponsored by the EU. Results Results from conditional simulation (CS) conducted in Datamine Studio 3 program and Geo-Risk Assessment (GRA) processes build in version 4 of NPVScheduler software together with other parameters from the “Legnica-West” prospective lignite deposits and selected distributions have been used as inputs to Crystal Ball and &Risk models created in the Excel spreadsheet. They allowed on estimation of future cash flows (CFs) on the year-by-year basis from electricity production in proposed power plant and its sale on liberalized energy market. Excel models contained the build in solution for the bilateral monopoly of a mine and a power plant described in the paper (Jurdziak, 2004) and in the monograph (Jurdziak, 2007). Then several thousands of simulations have been performed showing variability of cash flows (CFs) in each year of the optimal long-term excavation schedule (Life of Mine plan) what allowed on the proper selection of risk adjusted discount rate (RADR) to determine the resulting histogram of NPV. Both CFs and NPV histogram where used to estimate such measures of risk as Cash Flows at Risk and VAR as well as probability of loss and sensitivity analysis of outputs upon changes in chosen parameters. Such results gave much more information about risk of the analysed investment than standard statistics as expected NPV and its . The obtained results have shown that uncertainty connected both with prices of CO2 emission allowances as well as with their required amount substantially increases the risk of profitable energy production from lignite and decreases the size of optimal pit lowering utilization of the lignite deposit. Conclusions Risk analysis of energy production from lignite should be based on the worked out solution for the bilateral monopoly model of lignite mine and power plant (Jurdziak, 2004,2007) and observation of forecasted CFs volatility Estimation of CFs variability can be done in an appropriate software environment allowing on exchange and integration of data. CS together with GRA in open pit optimisation program appeared to be the objective tools, which can be used for proper preparation of input data to Monte Carlo simulation in order to attain variability estimates of annual CFs in the optimal longterm mining schedule. Optimisation of joint activity and preparation of strategy for long-term development of a lignite mine and a power plant allows on substantial risk reduction. Increase of carbon dioxide allowances prices and decrease of their limits decreases the profitability of energy production from lignite lowering utilization of the lignite deposits. All mentioned software is available at the Institute of Mining Engineering at Wroclaw University of Technology for educational and consultancy purposes. References Jurdziak L., 2004: Tandem: lignite opencast mine & power plant as a bilateral monopoly, Proceeding of the Mine Planning and Equipment Selection 2004, A.A Balkema Publishers, Taylor & Francis Group. Jurdziak L., 2007: Economic evaluation of a lignite mine and a power plant operations with application of a bilateral monopoly model, pit optimisation and game theory (in Polish), Oficyna Wydawnicza Politechniki Wroclawskiej. Jurdziak L., 2008a Benefits of vertical integration of lignite mines and power plants. Bridging energy supply and demand: logistics, competition and environment. 31st Conference of the International Association for Energy Economics. IAEE'08. Istanbul, Turkey, 18-20 June. Jurdziak L., 2008b: Inherent conflict of individual and group rationality in relations of a lignite mine and a power plant. Economic evaluation and risk analysis of mineral projects. Taylor and Francis, s. 73-83. Jurdziak L., 2008c: Optimisation of joint activity of a lignite surface mine and a power plant as a bilateral monopoly. IVth Int. Conf. COAL. Beograd, 15-18 October, p.208-220. Jurdziak L., Kawalec W., 2008: Method of identification of mineable lignite reserves in the bilateral monopoly of an open pit and a power plant. Economic evaluation and risk analysis of mineral projects. Taylor and Francis, s. 85-94. Jurdziak L.,Wiktorowicz J., 2008a: Conditional and Monte Carlo simulation - the tools for risk identification in mining projects, Economic evaluation and risk analysis of mineral projects, Taylor and Francis. Jurdziak L.,Wiktorowicz J., 2008b Identification of risk factors in a bilateral monopoly of a mine and a power plant (in Polish) Górnictwo i Geologia X, Oficyna Wydawnicza Pol.Wroc. Jurdziak L., Wiktorowicz J., 2008c: Influence of uncertainty related to the CO2 emission restrictions on profitability of production of electric energy out of lignite, IV Int. Conference Coal in Belgrade. Jurdziak L., Wiktorowicz J., 2008d: Risk analysis during evaluation of profitability of energy production from lignite, IAEE Conference in Istanbul, Turkey. Publication sponsored by the Polish Ministry of Science and Higher Education - project N524 010 32/2086 "Economic analysis of a lignite mine and a power plant operation in condition of uncertainty with application of bilateral monopoly model, pit optimisation methods, game theory and real options".