FIN 46 Adds Billions to Bank Balance Sheet

By PricewaterhouseCoopers

CFOdirect Network Newsdesk

22-April-2004

Close This Window

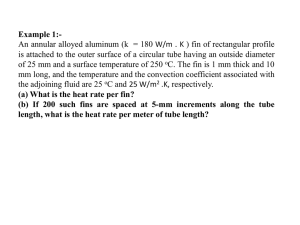

In this post-Enron financial reporting environment, the Financial Accounting

Standards Board (FASB) is intent on putting certain unconsolidated Special

Purpose Entities (SPEs) onto consolidated financial statements.

The vehicle for achieving this is Financial Interpretation Number 46, Consolidation

of Variable Interest Entities (FIN 46) that was issued January 17, 2003 and, with

subsequent revisions, reissued on December 24, 2003 as FIN 46(R). FIN 46(R)

was intended to clarify certain provisions of FIN 46 and revise certain other

provisions.

In this "era of securitization" – when financial assets are transferred into, packaged

and marketed to investors as securities – the SPEs that have been created are

estimated to have a worldwide value of as much as a trillion dollars.

These Asset-Backed Securities, which include such vehicles as Asset-Backed

Commercial Paper Conduits, Collateralized Debt Obligations and others, are very

much a part of today's financial services landscape.

"Banks are big users of such SPEs and are particularly impacted," says Woody

Wallace, a Partner at PricewaterhouseCoopers LLP. "Many of those SPEs will

probably qualify as variable interest entities (VIEs)."

If so, the "primary beneficiaries" must be determined and those primary

beneficiaries – whether it be banks, bank holding companies, investment houses or

other financial institutions – are required to bring the VIEs onto their books to be in

compliance.

For its part, the banking industry has been keenly aware of this potential

ramification.

"A couple of the large banks and global financial institutions participated on different

working groups and provided comment during the Standard's development

process," says Chip Currie, Senior Manager in PwC's Structured Finance Group.

"They have committed significant resources to preparing for and adopting FIN 46

and FIN 46(R)."

But given the complexity of the Standard, confusion over how to comply, changing

deadlines, and updated guidance, this Interpretation has been a challenge for bank

CFOs and their staffs.

Changing the Playing Field

"The process of applying the Interpretation has been less than smooth," says

PwC's Mr. Wallace. He attributes that to varying interpretations. "There has been

inconsistent application of the Interpretation to similar entities because of a lack of

clarity on how to apply the underlying concepts. People have taken different views."

Tom Barbieri, Partner at PricewaterhouseCoopers LLP, notes that there is a degree

of vagueness on how to allocate expected losses and expected residual returns to

the different interest holders of a VIE to determine which is the primary beneficiary.

"That is making it difficult to understand how to comply."

Mr. Wallace adds that this can lead to completely different decisions -- using the

same facts about the same VIE -- as to which party is the primary beneficiary.

"There is definitely the potential for conflicting decisions, especially in the

commercial paper conduit market."

Generally considered a complex Standard that is both far-reaching and difficult to

adopt, FIN 46(R) has introduced new accounting terms, requires considerable

information gathering and analysis, and calls for complex calculations and decisionmaking.

Key concepts and terms are:

o

o

o

o

VIEs: entities (defined as any legal structure used to conduct

activities or hold assets) that meet the consolidation requirements

of FIN 46(R).

Primary Beneficiary: the company (or, "enterprise") that reports a

VIE on its consolidated financial statements.

Expected Losses: present value of an entity's expected cash flow

risks.

Expected Residual Returns: present value of an entity's cash flow

benefits.

Of these, expected losses is especially important because it is a key calculation

that determines if an entity is a VIE and, if so, may identify the primary beneficiary.

At the core of the Interpretation is FASB's position "that if a business enterprise has

a controlling financial interest in a VIE, the assets, liabilities and results…should be

included in consolidated financial statements with those of the business interest."

Impacting Securitizations

The concept that led to this "era of securitization" dates to the 1980s and, as Mr.

Wallace describes it, became "a robust market" in the 1990s that today is "huge."

Through securitization, financial assets are combined and transferred into

negotiable securities via Special Purpose Vehicles, another name for SPEs.

In banking, these assets are generally receivables, such as loans and credit card

portfolios, and are the financial underpinnings of the securities. Examples of these

Asset-Backed Securities include:

Asset-Backed Commercial Paper Conduits that are vehicles setup to

access the commercial paper market. Loans are sold by "originators" to

these conduits, which then issue commercial paper offered to investors.

This raises funds for the originator with the receivable assets being held in

the SPE conduit. As payments are made on the loans, investors receive

income from the SPE and the entity's manager receives a management

fee. Compliance with FIN 46(R) may result in the consolidation of those

conduits determined to qualify as VIEs.

Collateralized Obligations are a class of asset-backed securities where

multiple parties sell different levels, or tranches, of debt into SPEs for

securitization. Collateralized Bond Obligations (CBOs) and Collateralized

Debt Obligations (CDOs) have bank bonds and debt instruments as the

underlying receivables assets. These vehicles are general market value

investments designed for appreciation. Collateralized Loan Obligations

(CLOs) have bank loan receivables as the underlying asset and are cash

flow investments. Any of the entities that qualify as a VIE under FIN 46(R)

must be reflected on the books of their primary beneficiary, if there is one.

Interpretation 46 Revisions

As banks and other public companies digested and began to apply the original

provisions of the Interpretation (FIN 46), questions and issues emerged.

The FASB responded with FIN 46(R) saying that "additional guidance is being

issued in response to input received from constituents regarding certain issues

arising in implementing Interpretation 46."

According to PwC's Chip Currie, "FIN 46(R) involves some clarifications and some

actual modifications to the model." These "clarifications and modifications" affect

banks and financial institutions in three particular areas:

Asset Management Activities. This focuses on the managers of CBOs,

CDOs, and CLOs and has the effect of "leveling the playing field" in

determining the primary beneficiary of these entities if found to be VIEs.

In the original Interpretation, asset managers of these entities – because of

the fees they received and their decision-making responsibilities – were

likely to be identified the primary beneficiary. Many banks serve as such

managers and their fees were being included in the calculations that

determine the primary beneficiary on a "gross" basis as opposed to other

variable interest holders whose calculations are based on "variability from a

mean." FIN 46(R) eliminates the requirement to include fees on a gross

basis.

In making this change, FASB said that the original Interpretation "did not

allow for a distinction to be made between a decision maker who is hired

merely to provide services and is compensated commensurate with the

level of effort required, and one who has the ability to reap the rewards

(and suffer the risk of loss) of his decisions."

This subtle change is significant, Mr. Currie says. By including the asset

manager's fees on a gross basis, the calculations "tilted" toward that asset

manager being identified as the primary beneficiary. "Now, equal treatment

is being given to all parties in making that determination," he observes.

Derivatives. Appendix B, "Variable Interest" has "been rewritten" in FIN

46(R).

That Appendix, through its subheadings, addresses how to identify variable

interest in:

Equity Investments, Beneficial Interests and Debt

Instruments

Guarantees, Written Put Options and Similar Obligations

Forward Contracts

Other Derivative Instruments

Assets of the Entity

Fees Paid to a Decision Maker

"The original Interpretation provided some guidance on certain derivative

contracts," Mr. Currie says. "FIN 46(R) expands that with new words on

how to think about derivatives with SPEs and potential VIEs.

Trusts Preferred Securities. The third and perhaps most significant

impact of FIN 46(R) on banking pertains to trusts preferred securities

(TPS).

A TPS is a different type of securitization entity created by banks or bank

holding companies. It is organized as a business trust, or some other form

of SPE, and issues two classes of securities:

Common securities that amount to a small percentage of

the trust's capital and all of which are purchased and held

by the bank.

Trust preferred securities that are sold to investors.

The proceeds are invested in deeply subordinated debentures of the bank.

Interest payments provide cash to pay periodic dividends to investors. The

subordinated debentures have a set maturity date and may be redeemed

under other circumstances.

Historically, these trusts were consolidated onto financial statements. The

trusts were structured so that banks could raise preferred share capital

through the vehicles and include the minority interest created in "Tier I

(core) Capital", supplementing traditional capital sources needed to meet

bank regulatory capital requirements. Depending on the structure and state

jurisdiction, some banking organizations also were able to realize some tax

benefits.

At issue with FIN 46 was whether TPS structures could continue to be

carried on a consolidated basis by banks because the trusts either served

as a source of capital or borrowed funds; or because investments were

made only in the "lower levels" of the trusts.

"The FASB has settled the debate," says Mr. Currie "To be in compliance

with FIN 46(R), your must deconsolidate most TPS structures from your

financial statements."

The deconsolidation of TPS structures from a bank's financial statements

due to the dynamics of applying the Interpretation was not anticipated by

many financial statement preparers.

Supervisory Perspective

The industry dialogue and developments that led to the Interpretation has

generated considerable interest among "the agencies" responsible for bank

oversight. These include the Federal Reserve Board (FRB), the Federal Deposit

Insurance Corporation (FDIC), the Office of Thrift Supervision (OTS) and the Office

of the Comptroller of Currency (OCC).

At the heart of their respective regulatory missions are the safety, soundness and

capital adequacy of banks and the banking industry.

The agencies require banks to maintain Capital Adequacy Ratios to help monitor

and ensure the financial stability of individual institutions and the banking system.

That ratio is calculated as a percentage of Tier I Capital and Tier II Capital.

Tier I Capital is considered to be fully available to absorb unexpected losses. It is

called "core" capital and it results from stockholders equity, non-redeemable

preferred stock and minority interest, including those in Trust Preferred Securities.

Tier II Capital is considered to be generally available to absorb losses. In general, it

is composed of general loss reserves, subordinated debt and limited life preferred

stock.

Dan Weiss, Director of PwC's Regulatory Advisory Services says regulators view

accounting and financial reporting through a particular prism. "With any change in

accounting and disclosure requirements, they ask how will the information on which

examiner, bank management and public judgments of institution and banking

system performance be affected."

While respecting GAAP reporting, he notes that regulators "reserve the right to

require different reporting and capital treatment for safety and soundness

purposes."

Thus, there is considerable interest in how banks comply with FIN 46(R) and how

securitization structures are accounted for and reported on financial statements

going forward. The recourse requirements in risk-based capital rules that were

adopted to address retained or acquired risk in securitizations are an example of

supervisory adjustments to financial reporting for capital adequacy purposes.

This can be glimpsed from "instructions" issued on July 2, 2003 by the Federal

Reserve's Division of Banking Supervision and Regulation. It directs bank holding

companies to continue, for now, "to include Trust Preferred Securities in their Tier I

Capital for regulatory capital purposes…."

This guidance provides similar "standstill treatment" for the risk based capital

measurement of certain consolidated exposures arising out of the application of FIN

46, and by implication FIN 46(R).

The agencies, however, noted that the Tier 1 leverage capital measure, which

employs average on-balance sheet assets as defined by GAAP, would be impacted

for any consolidated balances. The standstill of the risk based capital treatment

structures affected by the Interpretation, in particular asset backed commercial

paper conduits, is expected to expire after the second quarter 2004. A revised

interim capital treatment proposal is expected during the second quarter 2004 to

become effective shortly thereafter.

How does that square with the FASB's Trust Preferred Securities position as

articulated in FIN(R)? Have the agencies reacted to FIN 46(R)?

"They are continuing to assess the capital policy and industry impact and, for the

most part, have maintained existing capital treatment guidance." says Dan Weiss.

Examples of the competing aspects that the agencies may be weighing are:

o

o

The recognized benefits that qualifying TPS offer to bank issuers –

such as the availability to absorb losses even in times of stressful

conditions, and a means to diversify and make more cost effective

capital raising on the margin.

An objective to conform accounting and capital concepts where

possible and appropriate, including consistency to international

capital guidelines.

Some of the options that the agencies may be considering in clarifying the capital

treatment of FIN 46(R), impacted securitizations and TPS are:

o

o

Maintaining the risk-based capital off-balance sheet treatment

consolidated positions.

Grand-fathering some, or all, existing TPS as Tier I capital and/or

providing a transition period to migrate qualifying TPS to Tier II

capital status.

Determining whether the subordinated debt concentration limit will apply to TPS

included in Tier II capital.

Compliance Timelines

As the Interpretation has evolved, so too have the compliance dates. For public

companies reporting on a calendar year basis, these deadlines can be viewed as

"phases."

Phase One: When issued by the FASB in January 2003, FIN 46 required that the

Interpretation be applied "immediately" to all new entities created after January 31,

2003. This requirement and deadline has never changed.

For existing entities – created before February 1, 2003 – that might qualify as a

VIE, the compliance deadline was "no later than the first interim or annual reporting

period beginning after June 15, 2003." In effect, a July 1, 2003 deadline.

Phase Two: Responding to questions for clarification and further compliance

guidance, FASB in October 2003 deferred that original deadline for existing entities.

Applying FIN 46 to those determined to be VIEs was deferred "until the end of the

first interim or annual reporting period ending after December 15, 2003." This

meant the compliance deadline was December 31, 2003.

Phase Three: FIN 46(R) was issued by FASB on December 24, 2003 and replaced

FIN 46. Compliance with the "provisions" of FIN 46(R) for existing entities

determined to be VIEs "is required in financial statements for periods ending after

March 15, 2004." Effectively a compliance deadline of March 31, 2004.

Despite the changing timelines and compliance dates, banks and financial

institutions have moved forward during 2003 and early 2004 with their compliance

strategies. For example:

In its 2003 Annual Report to Shareholders, J.P. Morgan Chase & Co. said

that it implemented FIN 46 effective July 1, 2003. "The effect of adoption

was an incremental increase in the Firm's assets and liabilities of

approximately $17 billion at July 1, 2003 and $10 billion at December 31,

2003. The bank said the increase primarily related to "…Firm-sponsored

multi-seller asset-backed commercial paper conduits…."

Also, J.P. Morgan Chase made reference to FIN 46(R) and said that "The

Firm will adopt FIN 46(R) at the effective date and is currently assessing

the impact of FIN 46(R) on all VIEs with which it is involved."

The PNC Financial Services Group, Inc. also adopted FIN 46 effective July

1, 2003. In its Form 10-K for fiscal year ended January 31, 2003, PNC said

that it complied with FIN 46 "…by consolidating those VIEs that

management believed were then subject to the standard and of which PNC

was considered at the time to be the primary beneficiary." The VIEs that it

consolidated onto its balance sheets included a multi-seller asset-backed

commercial paper conduit, collateralized debt obligation funds, limited

partnerships that sponsor affordable housing projects utilizing the Low

Income Housing Tax Credit and private investment funds organized as

limited partnerships or off-shore corporations.

PNC then adopted FIN 46(R) at the end of 2003. Reporting this in Form 10K, PNC said: "Application of the revised rules resulted in the Corporation

determining that it was no longer the primary beneficiary of certain VIEs. In

accordance with the transition provisions of FIN 46(R), the Corporation

deconsolidated certain entities effective July 1, 2003 that had previously

been consolidated as of that date under the provisions of FIN 46."

Bank One Corporation implemented FIN 46 effective December 31, 2003

and consolidated $39.6 billion of assets and liabilities related to its assetbacked conduit business according to its 4th-Quarter 2003 press release

(January 20, 2004). In that release, the bank said: "Interim regulations

issued by the banking regulators, which provided risk-based capital relief

for these assets, remained in effect. The adoption of FIN 46, therefore, did

not have a material impact on Tier I or Total Capital."

Thus, a sampling of the broad reach and differing affect that this Interpretation is

having on banking. While FIN 46(R) resolved some issues from the original

FIN 46 and clarified others, there remains uncertainty, differing views and

compliance questions – an environment that suggest that the full impact of FIN

46(R)

has yet to be fully realized.

###

For more information on the impact of FIN 46 on the banking industry, please

contact the following PwC professionals:

Woody Wallace at woody.wallace@us.pwc.com;

Tom Barbieri at thomas.barbieri@us.pwc.com;

Chip Currie at frederick.currie@us.pwc.com; and

Dan Weiss at dan.weiss@us.pwc.com.

©2004 PricewaterhouseCoopers. All rights reserved. PricewaterhouseCoopers refers to the network of member

firms of PricewaterhouseCoopers International Limited, each of which is a separate and independent legal

entity. Legal Disclaimer, Copyright & Privacy Notices