Competition Policy in Asean - International Network of Civil Society

advertisement

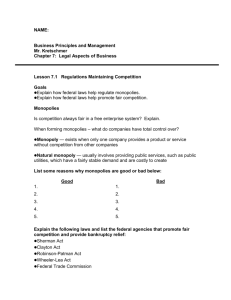

Competition Policy in ASEAN G.Sivalingam1 I. Introduction This paper discusses the structure of competition in several sectors of the economies of the ten countries that are members of the Association of Southeast Asian Nations (ASEAN). The ten countries are at various stages of development and of these only three have a competition law, while the most advanced that is Singapore does not have a competition law. The reluctance of governments to introduce competition law is that it conflicts with the strategy of economic development that they have adopted. Most of the countries have evolved from a communist, socialist, authoritarian, feudal or colonial past and state intervention in the economy is quite pervasive. Their experience is in managing mixed economies as most governments have to be concerned with distributional issues because of the need to avoid social unrest and political turmoil. The Asean countries have however been undergoing a process of change from a “growth with distribution strategy’ to a market oriented economic strategy. The role of the government has been dominant in the “growth with distribution” strategy and as a consequence the transition to a market economy has been marked by tensions between the market and the government. Not all countries in ASEAN have similar economic systems but they have several features in common, that is, opening up to foreign trade, being more responsive to deeper integration with the global economy, liberalizing their investment regime to compete for foreign direct investment, closing of strategic sectors of the economy to foreign competition, reducing tariff barriers consistent with the demands of the Asean Free Trade Area (AFTA) and the World Trade Organization (WTO). Most of them have also embarked on a strategy of privatizing state owned enterprises and building institutions to sustain a market economy. The rolling back of the role of the state has been due to government failure to generate growth; corruption and mismanagement of state owned enterprises. The 1997 East Asian financial crisis also exposed the vulnerabilities and weaknesses of the financial and broader economic strucutures. This together with the decline in Foreign Direct Investment flows, which went to China has made it mandatory for the Asean countries to undertake far reaching reforms to strengthen institutions that will facilitate the operation of a market economy. The reforms include improving standards of corporate governance and the rule of law. In this chapter we review the recent economic strategy followed by most of the Asean countries before we look atexternal pressures for reform of these economies. We then discuss the origins of the call for competition policy and theories of competition policy before describing the status of competition policy and law in these ten countries. 1 Faculty of Business, University of Malaya, Malaysia II. Growth with Distribution Strategy The Southeast Asian economies are in a process of transition to a market economy as a result of the deeper integration of these economies with the global economy and as a consequence of membership in multilateral organizations especially the World Trade Organization, ASEAN, AFTA and APEC (Lloyd and Associates, 1999:27) . In the 1970s, with the threat of communism looming high as the Vietnam War escalated, the prevailing doctrine was that the market was not efficient at distributing the gains from economic growth. The allocation of resources was not Pareto optimal because winners did not compensate losers. The Kaldor-Hicks criteria sought to overcome this oversight by providing some ground rules for the winners to compensate losers so that nobody was made worse off as a result of economic growth and change. Even though winners could compensate losers theoretically, using the Kaldor-Hicks criteria, in practice the compensation did not take place and hence the need for government intervention. Absolute poverty was perceived as increasing and income inequality was worsening and this posed a threat to the world capitalist system as the probability that the impoverished may opt for a communist state was high. The capitalist growth strategy, which ignored distributional concerns and alienated or marginalized the poor was abandoned for a growth with distribution strategy, which required government to correct market failure and distribute the gains from growth more evenly by facilitating the participation of the poor in the development process in the form of employment and in some cases in the form of equity ownership in listed and unlisted incorporated companies. The main instrument for achieving the redistribution goal were public enterprises or state owned enterprises as they are known in several countries. However, by the early 1980s it was realized that these public enterprises distorted incentives when they intervened in the market to set “politically correct” prices that did not recover costs and promote sustainable development. It was also realized that they depended on government subsidies and government protection from competition as they were inefficient and generally loss making (Khemani and Dutz, 1995) as they pursued political and not economic goals (Shleifer and Vishny, 1998). As a result of government industrial policy and subsidies, dominant enterprises or public monopolies arose (Khemani and Dutz (1995), which resulted in a loss of consumers’ surplus. At the same time that public enterprises were intervening in the economy to correct for market failure, many of the more developed Asean countries were liberalizing their investment laws to attract labor intensive foreign direct investments to generate exports and economic growth. Asean countries, most of whom had historically depended on natural resources to generate growth, provided more and more attractive incentives to foreign investment, at various stages of their development, as commodity prices fell. The initial import substituting industrialization strategy gave way to a more labor intensive and export oriented industrialization strategy as import substituting industries could not generate sufficient jobs as they were capital intensive and the domestic market was too small for these industries. Today, the multinationals engaged in manufacturing in several Asean countries, for example, Singapore, Malaysia, Thailand, Philippines, Indonesia, Vietnam and Cambodia account for a large portion of the export earnings generated in these countries. III. Industrial Policy The governments’ industrialization strategy was also guided by either an explicit or implicit industrial policy. The economic plans gave a large role to the public sector and industrial policy coordinated by the government guided the process of industrialization. Some of the governments also chose “national champions” or “captains of industry” and cultivated close relationships with the conglomerates they created and emulated the Japan Incorporated model by labeling themselves, for instance, as Singapore Incorporated, Philippines Incorporated and Malaysia Incorporated. Industrial Policy, it has been alleged, has been used consciously by governments to discriminate against foreign competition in the domestic economy. Industrial policy created two economies, that is, the enclave export processing zones dominated by multinationals and the domestic economic sector dominated by small and medium enterprises that depended on government subsidies and soft commercial loans. The linkages between the foreign and domestic industrial sectors was not strong. The foreign multinationals were not treated as national companies. The multinationals were only given incentives to produce for exports and competition in the domestic economy was discouraged in some countries. The hoped for liberalization and deregulation of the domestic sector as a result of the large presence of multinationals in the export processing zones did not occur. The domestic economy remained fairly closed and dominated by inefficient monopolies. This was because of barriers to entry and exit erected by governments of several countries. According to the World Bank, “the main institutional barrier to domestic competition are government regulations on entry and exit of firms. Even in the tradable sector, international competition may not lead to domestic competition, partly because institutional barriers to competition, such as government regulations in product and factor markets that deter firm entry, exit and growth. Excessive and costly government regulations also facilitate corruption and lead to adverse distributional consequences by inducing workers and firms to escape into the informal sector” (World Bank, 2001:135). Marcus Noland of the Institute for International Economics argues that not only was the foreign firm discriminated against in the domestic economy but the government also affects the level, composition or form of foreign investment, “through official prohibitions, restrictions or official approvals processes, in which the government intervenes directly” and sometimes by the “behavior and practices of private parties, facilitated by government policies not directly aimed at foreign investment”(Noland, 1999:1). Several sectors of the domestic economy including the services sector were not opened until recently to foreign entry. These included telecommunications, water, power and financial services which are characterized by important dominant positions by incumbent firms where contestability of markets is limited because of large fixed costs. The utilities, for example, water, telecommunications, power were considered as natural monopolies before technological changes occurred and as such were considered as appropriate to be left to public provision. New banking licenses were seldom issued and foreign banks were denied entry. Government and family owned banks dominate in many of the Asian countries. Wholesale and retail trade was also protected from foreign competition and kept as a national preserve. Industrial policy was also pursued to protect domestic industries that were not competitive internationally. Ross in reviewing research in this field reports that Gifford and Matsushita (1996) found that the most frequent and widely experienced conflicts between industrial policy and competition policy occur in circumstances where domestic industry is subject to competition from foreign competitors after having lost its international competitiveness. Under such circumstances , governments may intervene to encourage the restructuring of the domestic industry and to temporarily protect the local industry from foreign competition. The restructuring often consolidates domestic firms, reducing domestic competition as well as preventing foreign firms from acquiring the assets of these firms no longer able to compete with foreign firms (Ross, 2003:3). Sometimes the infant industry argument has also been used to justify protecting domestic firms from foreign competition until they reach a certain degree of dominance in the domestic market to compete in the international market. The industrial policies pursued by the various governments in a creating a dual economic structure came under pressure as commodity prices collapsed in the mid 1980s. Governments dependent on natural resources had to provide more incentives to attract labor intensive, export oriented industries to substitute for the loss of export earnings from primary commodity production and to provide employment to the growing labor force. At the same time the multinationals were campaigning for national treatment in the host countries and to roll back the role of the state and to allow resources to be allocated by market forces worldwide so that resources will flow to their most valued users or uses. IV. Neo Liberalism and Competition Policy The ideological underpinnings of the current reversal of policy to roll bank the role of the state and to make the private sector the engine of growth in most or all the Asean countries can be found in the Reagan-Thatcher doctrine enunciated in 1983 in which the virtues of privatization and the market economy were enunciated. The Reagan-Thatcher doctrine provided support for the Washington Consensus as a strategy of global resource allocation. The focus of the Washington Consensus according to the person who coined the term in 1990, that is, John Williamson of the Institute for International Economics was: fiscal discipline; a redirection of public expenditure priorities towards fields offering both high economic returns and the potential to improve income distribution, such as primary health care, primary education and infrastructure; tax reform to lower marginal tax rates and broaden the tax base; interest rate liberalization, a competitive exchange rate; trade liberalization; liberalization of inflows of foreign direct investment; privatization; deregulation to abolish barriers to entry and exit and secure property righ (Williamson, 2004). Privatization is perceived to be pro-competition as it opens entry to private participation in the production of goods and services under competitive market conditions. The theoretical justification for the Reagan-Thatcher doctrine and the Washington Consensus was provided by the Chicago School. In the 1970s, Milton Friedman and the Chicago School economists developed free market ideas based on deregulation and privatization similar to the laissez-faire capitalism of the nineteenth century (hence the term neo-liberalism). This was to become the economic orthodoxy of globalization. In the early 1980s, the full political resources of corporate America were mobilized to regain control of the political agenda and the court system. Reagan and Thatcher, using the Chicago School ideas, made the world safe for corporations. They dismantled the social contract through tax cuts, ignoring unemployment, rolling back social welfare and increasing privatization. The debt crisis of 1982 gave the USA its chance to dominate the world economy and for the rich nations to re-subordinate the global South through structural adjustment via the World Bank and the IMF (New Internationalist, 2002:2). In support of rolling back the role of the state, Ronald Coase (1991) of Chicago argued that the market is the most efficient allocator of scarce resources. According to Coase if property rights are clearly defined and enforceable and if economic agents had full information and transaction costs are low or zero and if there is a market to buy and sell these property rights than these resources will flow to their most valued uses. There is no need for government intervention to correct for externalities because the economic agents can bargain to achieve a Pareto optimal allocation of resources. Furthermore, the ability of economic agents to achieve the Pareto optimal allocation does not depend on which economic agent is given the property right. This argument was recast into what is today the most cited theorem in economics, that is, the Coase theorem (Stigler, 1989) for which the author won a Nobel Prize awarded to the science of economics in early 1991 (The Bank of Sweden, 1991). The Coase theorem gave a powerful reason to roll back the role of the state and to define private property rights and to create market institutions and a sympathetic court system so that these property rights could be traded continuously so that they could be used efficiently. Even if one distributed assets to someone who did not know how to manage them well, in a society with well defined property rights that person would have an incentive to sell to someone who could manage the assets more efficiently. However, when property rights are vested in public enterprises or State Owned Enterprises they cannot be bought and sold and as a result the probability is high that they would not be used efficiently. The Coase theorem as stated earlier provide theoretical support for the Washington Consensus to push for reducing tariff barriers and free trade so as to reduce transaction costs and to facilitate the free flow of resources to their most valued users. The three big ideas of the Washington Consensus were macroeconomic discipline, market economy and openness to the world (Williamson, 2002:2). The formation of the World Trade Organization in 1995, provided an opportunity not only to reduce tariff barriers but also to push for measures that would open domestic economies to competition. The need for liberalizing the domestic investment regime had been discussed at WTO Ministerial Meetings in Singapore, Doha and Cancun. The issue of competition policy had been classified together with investment, transparency in government procurement and trade facilitation as the Singapore Issues, which were brought up in Doha and Cancun but not resolved. V. WTO and Competition Policy – The Singapore Issues The Working Group of the WTO on the Singapore Issues summed up the need for competition policy as follows: “as government barriers to trade and investment have been reduced, there have been increasing concerns that the gains from such liberalization may be thwarted by private anti-competitive practices. There is also a growing realization that mutually supportive trade and competition policies can contribute to sound economic development, and that effective competition policies help to ensure that the benefits of liberalization and market-based reforms flow through to all citizens” (WTO,2004:1) The Working Group looked at the interaction between trade and competition policy including the impact of anti-competitive practices of enterprises and associations on international trade; the impact of state monopolies, exclusive rights and regulatory policies on competition and international trade; the relationship between trade related aspects of intellectual property rights and competition policy; the relationship between investment and competition policy and the impact of trade policy on competition. It also addressed the issue of the contribution of competition policy to achieving the objectives of the WTO including the promotion of international trade. The Singapore Issues were not resolved in Singapore and were brought forward to the WTO ministerial meeting at Doha in 2001. There was no consensus achieved and the issues were brought forward to the Cancun WTO ministerial meeting in 2003, with the USA and the EU pressing for resolution of the issues because “in the context of globalization, … competition policy is intimately connected with the policy pillars of liberalization, deregulation and privatization, known as the Washington Consensus or neoliberalism” (Lee and Morand, 2003:1). There has been a clear recognition that in the absence of a strong competition policy, deregulation may result in the transfer of power from the state to powerful private sector oligarchies. Competition policy is seen as critical in creating a market economy because it is concerned with reining in the excessive market power of large corporations as manifested in cartels, restrictive business practices and abuse of market power. There has been opposition to competition policy from the developing countries because from “the developent perspective … there is a need for government to assist and promote local firms so that they can be viable and develop despite their present relative weakness, so that they can successfully compete with their foreign firms and their products” (Choudhury, 2004:2). The developed countries however argue that the foreign firm should be given the right and equality of opportunity to compete with local firms in the local market, and governments should be prohibited from giving preferences or assistance to local firms. They invoke the WTO’s non discrimination principle in support of their argument (Choudhury, 2004:2-3). However, regardless of the outcome of the WTO meetings, competition policy and law has been pursued by developing countries, including Asean countries such as Indonesia, Thailand and the Philippines, interested in benefiting from foreign direct investment and trade and deeper integration with the world economy. Competition policy is not rejected outright as the debate is on the form of regulation that is needed for developing countries. There have also been arguments to have a dual competition policy, one for domestic enterprises and the other for foreign enterprises (Third World Network, 2003:1). There have also been conflicting theories of competition policy. VI. Theories of Competition Policy Theories of Competition Policy can be classified as belonging to the Chicago School, the Austrian School a’la Schumpeter and the German School. The Chicago School (Demsetz, 1979) argues against government intervention in the market because governments more often than not prohibit competition and the emergence of efficient firms. If the government provides the framework for competition in the form of policy and law, then competition between firms will see the “survival of the fittest.” The inefficient firms will be forced out of the market. In other words the most efficient and lowest cost firms will emerge and the consumers will benefit with better quality products and more choice and affordable goods and services. According to Singleton (1997:2), “concentrated market structures and even dominant firm market structures that result from this process (survival of the fittest) are assumed to be efficient and to generate maximum social welfare … According to this school, policy makers impede the competitive process by prohibiting business practices that enhance efficiency and innovation or by punishing firms that have attained a large market share by virtue of superior efficiency or innovation.” There is no need for competition policy because the threat of entry forces enterprises to increase efficiency and pursue product and process innovation. There is also no need for government induced barriers to entry and exit. The Chicago School of thought is of the views that monopolies are not inefficient because they are the outcome of a long process of survival of the fittest. The monopolies entered a competitive industry and were able to become large and dominant because of superior technology, economies of scale and other attributes. So the existence of monopolies are not by themselves a detriment to consumer welfare. Posner has argued that the existence of a natural monopoly does not provide adequate justification for government regulation. Natural monopoly is a circumstance where it is economically more efficient for a single organization to have a monopoly in order to avoid duplication and wasted investment. The arguments in favor of a natural monopoly are (i) overheads are reduced; (ii) zero competition means less money on advertising, sales and marketing and (iii) more money is available to be spent on product development.. Examples of natural monopolies are the utilities, for example, water, power, telecommunications and cable (Lea, 1999:1). However, as pointed out earlier natural monopolies tend to become non dominant because of technological change. The telephone industry was considered a natural monopoly because it had huge fixed costs and was non contestable. However, with technological change the cellular phone companies have eroded the market share of fixed line operators. The Chicago School claims that monopolies are occasional, unstable and transitory. As a consequence, antitrust law is really unnecessary, since all monopolies will eventually be broken by competitive pressures (Cobb, 1999:4). The Chicago School reminds us that the aim of competition law is to provide the framework for competition that increases efficiency and not the equitable distribution of income. The emergence of monopolies has also been argued by Schumpeter (1954) and the Austrian School as not being detrimental to social welfare if they emerge as a result of technological innovation and efficiency. Technical change lowers the average total cost and as a result one firm may become dominant. The dominant monopoly may not be dominant for long because other firms may enter the industry and capture some of the abnormal profits. A new discovery may also displace the existing monopoly by a process which Schumpeter terms “creative destruction.” According to the Austrian School competition is a dynamic discovery process as rival entrepreneurs seek new profit opportunities in a world that is changing. Through successful innovation, firms out compete rivals and dominate the market for a while. The dominant position is constantly threatened. High profits mean that the industry is active. Competition policy ought not to prohibit or penalize enterprise behavior that may be regarded as efficient in a dynamic sense, although it does agree that policy ought to ensure that the playing field is level. The third view of competition calls for an explicit competition policy. According to this view, the origins of which can be traced back to Germany and the United States of America, competition policy is necessary to curb the power of large firms. According to Kerr and Word, “in general, the objective is to protect small firms from the abuse of dominant firms and thereby encourage competition to flourish. German law singles out dominant firms for special treatment. They alone are prohibited from engaging in certain business practices that are thought to impede the entry or expansion of smaller firms. Furthermore, small and medium-sized firms are, by exemption, allowed to engage in cooperative efforts to realize economies of scale and scope otherwise available only to large firms” (Kerr and Wood, 2000:7). The United States has had a long history of influencing competition policy around the world. The Sherman Act of 1890 which forms the basis of US anti-trust law prohibits agreements in restraint of trade, monopolization and conspiracies to fix prices. The Clayton Act of 1914 prohibits price discrimination, tie in sales, exclusive dealing contracts and prohibits acquisitions, mergers or joint ventures that may substantially reduce competition. The Clayton Act “prohibits acquisitions, mergers, or joint ventures that may substantially reduce competition” (Devuyst, 2000:320). In reacting to the rise of Nazism, the United States of America, wanted to check the concentration of industries because the large industries created the conditions for the rise of Hitler and Nazism. To reduce concentration, the United States insisted on a strict anticartel policy for post War Germany, which was subsequently incorporated in the 1957 Treaty of Rome, which established the European Community (Devuyst, 2000:321). The European Competition Policy today has the role of protecting new entrants especially small enterprises from rivalry of large enterprises (Singleton, 1997). This was related to the need to disperse economic power that is linked to political influence. This view is based on the broad notion that large enterprises wield considerable political power that is gained through influencing policies that end up protecting them from competition. When the USA occupied Japan it also introduced the 1947 Antimonopoly Act. “The Act was designed to break the power of the zaibatsu, the gigantic family trusts that dominated Japanese society before and during the war. However, in 1952, once the American Occupation had ended, Japanese anticartel policy was reviewed, and numerous exemptions were granted to allow so-called crisis and rationalization cartels and to permit anti-competitive coordination in the framework of business associations. During the late 1980s and the 1990s, under international pressure, the number of exemptions was gradually reduced. At the same time, an important deregulation program was put in place” (Devuyst, 2000:321). The USA has also influenced Competition Policy in the Philippines to be modeled after the Sherman Act of 1840. The Philippines has had an Act to Prohibit Monopolies and Combinations in Restraint of Trade since 1925. The USA has also been active in advocating the opening of markets and the deeper integration of ASEAN countries with the global economy. According to a former Secretary of State, “the Asean nations form a half-trillion-dollar regional economy that is expected to double in size over the next decade. With expanding middle classes, swelling demand for consumer goods and services and need for infrastructure, ASEAN looms large in the strategies of American companies …, and has attracted the attention of the United States Government as one of the world’s ten Big Emerging Markets” (Christopher, 2003:2). The USA has also urged ASEAN to speed up regional liberalization, promote greater openness to global economy, make a commitment to market reforms, seek AFTA’s (Asean Free Trade Agreement) agreement to intellectual Property Rights, promote trade related aspects of International Property Protection; toughen enforcement of national laws; liberalize trade in financial services; open up competition in massive emerging telecommunications market; treat all service providers as equal; break up long entrenched monopolies to encourage price competition and improve service. Create independent regulatory bodies that will follow non-discriminatory and transparent procedures to safeguard against monopoly domination of markets.(Christopher, 2003:1-4) VII. Ingredients of Competition Policy Competition policy is not a new issue in the world trading system. The 1947 Havana Charter and the International Trade Organization that it contemplated highlighted the need to prevent “Restrictive Business Practices”. Chapter V of the Havana Charter contains a number of articles “to prevent, on the part of private or commercial public enterprises, business practices affecting international trade which restrain competition, limit access to markets or foster monopolistic control. The Charter specified six key anticompetitive practices considered potentially harmful to trade, namely: (i) price fixing and other related practices; (ii) exclusion of enterprises from markets or allocation of markets and customers and fixing sales and purchase quotas; (iii) discrimination against certain enterprises; (iv) output restrictions and quotas; (v) agreements preventing the development of patented or unpatented technology and inventions and (vi) certain extensions of the use of rights under patents, trademarks or copyrights. Furthermore, the ITO envisaged investigating and ruling on complaints with the power to request members to take remedial action” (OECD, 2002: 5). The need for a competition policy in a free market economy is to regulate the invisible hand of Adam Smith (1776) so as to promote the public good. As we have noted a monopoly may be undesirable per se but it may perform a useful function by rule of reason. If a monopoly arose because of efficiency and it is the lowest cost provider of the good or service then its continued existence may be justified on grounds of rule of reason although per se a monopoly may be declared undesirable. If however a monopoly restricts entry and is inefficient then we need a competition policy and authority to restraint the monopoly to avoid the deadweight loss to society of the monopolist’s continued activity in the economy. The focus of competition policy is to create the conditions and develop institutions for the efficient allocation of scarce resources. According to Maddock (1995:31), “Competition policy is guided by the belief that the domain of markets should be exploited as far as possible to perform allocative tasks with benefits expected in terms of allocative, productive and dynamic efficiency.” The objective of competition policy is to ease entry and exit conditions by removing government erected barriers, structural barriers and entry deterrent strategies of incumbents. Government induced barriers include trade restrictions, regulations, price controls, procedure for allocation of inputs. These barriers increase opportunities for rent seeking. Structural barriers include the need for high sunk costs, that is investments that do not have alternative uses and hence create markets that are not contestable. Strategic entry deterrents by incumbent firms include: predatory pricing, product differentiation and advertising (Dixit, 1982). Cartels are also anti competitive as they are agreements to fix prices by reducing quantity to the detriment of consumer welfare. Similarly mergers and acquisitions that lead to the creation of inefficient monopolies may reduce social welfare. Three types of mergers can be identified, they include, vertical, horizontal and conglomerate mergers. Horizontal mergers occur between enterprises producing similar products. They may have an incentive to reduce output and increase price thus adversely affecting consumer welfare. Vertical mergers occur when enterprises combine their resources at different stages of production and hence involve enterprises that are both supplier and producer or producer and retailer of the same good or service. They may be motivated by economies of scale but from the point of view of society there is a trade off between efficiency gains and economic or market power. Conglomerate mergers occur when enterprises producing different products combine their resources to capture economies of scope (Lipczynski and Wilson, 2001). Once the appropriate or enabling environment for competition is created by public policy, the only form of government intervention will be in the enactment of Competition Law and a Competition Authority to ensure that the rules of the game are adhered to. Competition Law is a subset of Competition Policy because policy encompasses the whole economic, political, social and legal environment, whereas law stipulates appropriate standards of behavior, deviations from which can be penalized under the provision of the law. An equally important focus of the government in formulating competition policy is to give sufficient protection to consumer interests so that the consumer is not made worse off as a result of the introduction of competition policy. The focus of competition authorities is to prevent the formation of monopolies that cannot be justified by rule of reason or on economic grounds. Monopolies may be formed by collusive behavior, price fixing, vertical and horizontal integration and government regulation. The most pervasive form of monopoly formation in ASEAN countries has been by the government as it feels that it has superior information in “picking winners” This restricts competition and the efficient allocation of resources. Vertically integrated industries also tend to have considerable monopoly power especially if they require heavy capital investments for start ups and are in essence, therefore, noncontestable. Examples are power, telecommunications and water, which were previously defined as natural monopolies because scale economies are achievable only at very high levels of output and the plant size required as a result is only affordable by the government or very large enterprises. In the case of power, vertical integration occurs because power generation, distribution, retailing and billing are concentrated in one agency. This has recently been broken up by privatizing power generation by competitive bidding to Independent Power Producers (IPPs). Theoretically, these IPPs are to compete to lower costs and these costs are expected to be passed on to consumers in the form of lower prices. In the case of telecommunications, vertical integration occurs because the fixed lines are laid by the authority, which also retails and bills the consumers. However, with the introduction of mobile or cellular phones and the internet and the granting of equal access to all operators at a cost, the competition in the market has become intense and the former so-called natural monopoly has lost a considerable portion of its market share in the telecommunications market. The objectives of competition policy are then: (i) to ensure efficient allocation of resources; (ii) to prevent domination of the economy and price fixing by a few large conglomerates. The focus of anti-trust policy is to break up monopolies unless there are strong economic reasons to justify that they are better able to allocate resources than a competitive firm; (iii) to protect consumers against abuses of market dominance and against price increasing and choice reducing agreements between companies; (iv) to create conditions whereby competition helps to stimulate technological change and innovation and (v) to keep markets open to competitors, whether local or foreign. VIII. Competition Policy and Development The distributional consequences of open competition among firms is not the direct concern of competition policy. This is because it is expected that through a competitive process, economic growth will occur and this growth will trickle down and hence it is argued that there is no need for government intervention. This form of economic growth through open competition is superior to a government led growth process because it uses resources more efficiently. However, there is no broad agreement on this interpretation of economic growth and there are doubts that the benefits will trickle down to the poor and the disdavantaged. There are those who believe that a competitive growth process based on the philosophy of the “survival of the fittest,” will marginalize the poor and isolate them. This is the point of contention between the developed and developing countries over the Singapore Issue on competition policy. It has been noted the deregulation and privatization, the cornerstones of the Washington Consensus did not lead to a flowering of liberal markets but simply served the interests of powerful capitalists, whose wealth and authority had previously been based on their control of protected industries. However, the developmental role of monopolies has been highlighted by Ajit Singh (2002), who argues that the chaebols in Korea although dominant as conglomerates were the prime movers of the rapid economic growth of Korea, which was also adversely affected by the 1997 East Asian crisis. The chaebols received subsidized credit, government protection and used their resources to make huge investments, which generated massive rents. The investments were necessary to increase productivity and generate economic growth. In the case of Japan, the oligopolies were also competitive as contest based competition among them was encouraged so as to enable them to get cheap credt, foreign exchange and protecton from international competition. According to Ajit Singh, “these rewards were contingent on relative performance either in export markets, technological development, or in introducing new products” (Singh, 2002:24). Similarly, in other Asan countries privatization of infrastructure projects required massive investments, which it is believed can only be carried out by conglomerates with close relations with the government. However, this is transferred as higher prices to consumers because the present vlue of tolls are mortgaged to banks for loans. The cost of construction in other instances may include the present value of the tolls so that the conglomerate does not bear any risk. In these cases, the benefits are privatized to the conglomerate and the costs are socialized to the public. Ajit Singh (2002) is of the opinion that the developing countries are not ready for competition. He cites Laffont, who calls for a second best solution to the competition problem. According to Laffont: “Competition is an unambiguously good thing in the first-best world of economists. The world assumes large numbr of participants in all markets, no public goods, no externalities, no information asymmetries, no natural monopolies, complete markets, fully rational economic agents,a benevolent court system to enforce contracts, and a benevolent government providing lump sum transfers to achieve any desirable distribution. Besides developing countries are so far from this ideal world, it is not always the case that competition should be encouraged in these countries” (Laffont, 1998:237). The conditions that Laffont lists for the encouragement of competition do not even exist in the developed countries. Negative externalities, forexample, air pollution, crime an terrorism are common throughout the world. When the history of the recent performance of the New York stock market is written, it will be a story of imperfect markets and asymmetric information. Furthermore, Laffont does not address the problem of whether competition that is based on the “survival of the fittest” is inferior to feudalism as an economic philosophy. Whether a country adopts a country adopts a competitive regime is not dependent on policy but technology especially if it is dependent on foreign capital to generate growth. Competition in telecommunications was not generated by policy but by technology, which put a check on the abuse of dominant power by the fixed line monopolies because mobie phones were a substitute. The mobile phone market is contestable because of equal access to the fixed line. The mobile phones are needed to generate economic growth. According to Ajit Singh, “Laffont is quite pessimistic about developing countries being able to implement competition laws because of widespread rent seeking, corruption and ineffective governments in these countries. He makes a valid pioint that implementation of competition laws requires a strong state which many developing countries lack” (Singh, 2002:20). However it must be pointed out that the East Asian miracle economies were credited with a strong state and that is why they were able to create huge conglomerates as the generators of economic growth and development (World Bank, 1993). Corruption and rent seeking is endemic in all societies where enforcement is weak. The problem is if states are unwilling to generate competition and enforce laws then because of technological change driving the globalization of capital, external forces may take over the role of national governments in creating strong states. Global technological changes are forcing countries to formulate and implement competition laws or be subject to foreign domination or be marginalized from the benevolence or otherwise of the world capitalist machine. IX. Current Status of Competition Policy in ASEAN Some ASEAN countries have tended to use the Japanese model of competition law as an example of anti-competitive legislation that seems workable. The origins of the Japanese Antimonopoly Act (1947) can be traced back to the American occupation of Japan. As a consequence it has been influenced by the American anti-trust law and is focused on ensuring free and fair competition (Matsusita, 1990). Malaysia has been discussing using the Japanese model to enact its anti-competitive legislation, which is currently in the draft legislation stage. Only three out of the ten ASEAN countries have enacted Competition Acts or Anti-Monopoly Acts. These include Thailand, the Philippines and Indonesia. We review the status of competition policy and law in the ASEAN countries below. In depth studies of competition policy in each of the ten countries discussed below is provided in the country studies that follow this chapter. Indonesia The introduction of legislation to prohibit anti-competitive activities in Indonesia came as a consequence of the adverse effects of the 1997 East Asian crisis on the Indonesian economy. The American response was to subject Indonesia to the conditionality of the International Monetary Fund (IMF) in exchange for financial aid to resolve the balance of payments and the rupiah crisis. As part of the conditionality, Indonesia signed the Letter of Intent committing itself to “promoting competition in the domestic economy by accelerating privatization and expanding the role of the private sector in the provision of infrastructure” (IMF, 1997). A draft competition bill was submitted to the Indonesian Parliament in July 1997, which was subsequently passed by the Parliament in 1999. The Act that received the assent of the President and came into effect in 2000 was “The Law Concerning the Prohibition of Monopolistic Practices and Unfair Business Competition”. The Law covers unfair business practices with regard to: prohibited agreements; oligopoly; price determination, division of territory; boycotts; cartels; vertical integration, oilgopsony; trusts; monopoly; monopsony; conspiracy; dominant position; mergers, consolidations and acquisitions and share ownership. The law has also provisions for dispute settlement and penalties for violations of the law. The law which was inspired by the German model is expected to be implemented by the newly formed Business Supervisory Committee, which also is expected to play an advisory role in advising the government on needed policy and legislative reforms to further enhance the conditions for competition in the domestic economy. The members of the Committee are appointed by the President and have wide powers to regulate restrictive business practices, abuse of dominance and mergers and acquisitions that lead to monopolies. The Committee has the powers to suspend, cease or vary any anticompetitive agreements or behavior. The Committee has just begun its work and it is too early to evaluate its effectiveness. However, there have been critics of the need for a competition law in Indonesia. According to the Asean Focus Group at the Australian National University, “many of Indonesia’s anti-competitive problems have been the direct result of government- sanctioned monopolies, in the form of protection for cronies and state-owned enterprises. It would have been far simpler to remove these distortions at their source, rather than to create a whole new, complex apparatus,” that is, the competition law that has just been enacted (Asean Focus Group, 1999:1). Malaysia Malaysia has yet to enact a Competition Law although it has a Consumer Protection Act. The Ministry of Domestic Trade and Industry has been drafting a comprehensive competition law since 1993 based partly on the Fair Trade Act of Japan. The Malaysian Government has gone through various drafts of the law but the bill has not been tabled in Parliament and this has led some commentators to speculate that this inertia “demonstrates a reluctant attitude … toward competition policy” and this reluctance may be due to the fact that they “consider that it might hinder rapid economic development because it deprives the government of its discretionary and regulatory power for development” (Yasuda, 2000:5). Malaysia has since the early 1980s, privatized several government agencies including education and utilities (power, water, telecommunications). Infrastructure development has also been privatized. However, regulatory reform has lagged behind and the only privatized activity that has a regulatory commission is telecommunications. The Malaysian Multimedia and Communications Commission was formed in 1999 to regulate the telecommunications sector. Philippines Competition legislation in the Philippines has been in existence since 1925 when the “Act to Prohibit Monopolies and Combinations in Restraint of Trade” was enacted. It was influenced by the Sherman Anti-Trust Act of the United States of America. There are two pieces of legislation to protect consumers. These are: the Consumer Protection Price Act, 1991 and the Consumers Act of the Philippines, 1992. However, the Act to prohibit monopolies has not been implemented given the Philippines’ long history of close relations between the government and businessmen and the practice of granting monopolies by the government to favored businessmen. Recent attempts to draft a comprehensive Competition Act has not been tabled in Congress because of failure to reach a consensus. A recent review of Competition Policy and Law in the Philippines suggests that: “The present laws have proven to be inadequate or ineffective to stave off the ill-effects of anti-competitive structure and behavior in the market. Despite the considerable number of laws and their varied nature, competition has not been fully established in all sectors of the economy, nor has existing competition in other sectors of the economy been enhanced. These laws have hardly been used or implemented, as may be seen by the lack of cases litigated in court” (APEC,1999:82). Singapore Although Singapore has liberalized and deregulated her economy well ahead of her ASEAN neighbors given that it is an open economy and a global entrepot city, she has not enacted a Competition Law. The explanation appears to be that one of the externalities of international competitiveness will be the creation of the conditions or environment for domestic competition. The privatized entities are also not regulated by independent institutions. Singapore has argued that an open trade and investment regime will transmit competitive forces throughout the domestic economy. However, the experience of other countries shows that local firms and even government monopolies may collude to restrict entry. As Kerr and Wood have pointed out, “Although an open trade and investment regime is a powerful device to ensure competition, it may not be adequate in the face of concerted efforts by firms to collude or to restrict entry” (Kerr and Wood, 2000:10). Success in trade and liberalization is also dependent on a domestic competitive market environment. Thailand There is a provision in Article 87 of the 1997 Constitution of Thailand to prevent or regulate private monopolies. Article 87 of the 1997 Constitution of Thailand explicitly states that “the State shall encourage a free economic system through market forces, ensure and supervise fair competition, protect consumers and prevent direct and indirect monopolies, repeal and refrain from enacting laws and regulations controlling businesses which do not correspond with the economic necessity, and shall not engage in an enterprise in competition with the private sector unless it is necessary for the purpose of maintaining the security of the State, preventing the common interest, or providing public utilities.” The Price Fixing and Anti-Monopoly Act was enacted together with the Consumer Protection Act in 1979. The Public Limited Companies Act was enacted in 1979 to encourage large family held companies to be listed in the Thai Stock Exchange to improve public disclosure standards. The objective of the Price Fixing and Anti-Monopoly Act was prevent unfair and restrictive business practices including abuse of dominant position of monopolies and price fixing. Price control was extended over to 22 items in 1999. According to the APEC study the objective of this act is to promote free and fair competition among businesses. The provisions of the Act focus on control of business conduct and the abuse of market power (APEC, 1999:84). Deregulation and privatization has been carried out. As in other countries, the state owned enterprises became private monopolies after privatization and had to be regulated. However, the regulatory mechanisms that have been instituted remain weak. To improve conditions for corporate performance, the Trade Competition Act was enacted in 1999 together with the Price of Goods and Services Act, 1999. The objective of the latter is “to protect consumers against unfair service charges and to oversee sufficient supply of goods to meet domestic consumption” (The Nation, 22 April, 1999). The focus of the TCA is to restrict abusive of dominant position of monopolies and price fixing. It also provides for the formation of the Trade Competition Commission (TCC), the dispute resolution mechanism and penalties for offences committed under the TCA. The TCC has powers to regulate restrictive agreements, check abuse of dominant position by monopolies and to regulate mergers and acquisitions. The TCC has also the powers to issue an order to suspend, cease or vary any anti-competitive act including the formation of cartels. Thai Law applies the per se principle in regard to the formation of cartels or restrictive agreements although the rule of reason principle is applicable to some market domination and merger activities. However, to date the Thai Competition Commission has only tried two cases, reflecting the strength of latent anti-competitive forces in Thailand. Vietnam Vietnam is gradually being transformed from a socialist economy to a capitalist economy. It does not have a comprehensive competition policy or law but has given property rights to farm households, which rights hitherto had been held by the state. The government has introduced new foreign investment regulation beginning in 1987 to encourage the inflow of foreign direct investment. The government continues to be dominant in the economy and the state owned enterprises operate as monopolies. The growth of the market economy depends on further reforms especially with regard to the role of the government in the economy. Laos Laos has been declared a least developed country where three quarters of the population live in absolute poverty and are dependent on subsistence agriculture. The private sector is underdeveloped and foreign direct investment is relatively miniscule. Public monopolies are dominant in the economy. The economy is centralized and entry into the various industries is highly regulated by the bureaucracy. However, recently there was some attempt to introduce competitive bidding for hydroelectric projects. The telecommunications sector has also been liberalized. Given the stage of economic development it may be a bit premature to talk of competition policy and law for Laos. Myanmar Myanmar has been relatively isolated because of international economic sanctions applied against the military regime. It is a poor agrarian economy with very high levels of government intervention. Public monopolies are held by the military which restricts entry into several sectors of the economy. The introduction of competition policy and law is premature given the political and economic problems that Myanmar currently faces. Brunei Brunei is an oil rich economy which until the 1997 East Asian financial crisis did not see a reason to encourage foreign direct investment or enlarge its private sector. The government is dominant in the economy and operates several public monopolies. Recently there was an effort to privatize non-strategic state owned enterprises. The banking sector has been liberalized and is dominated by foreign banks. There has been an implicit recognition of the need for a competition policy but its implementation is not urgent as long as the economy can maintain its present standard of living with oil revenues. Cambodia Cambodia is also one of the least developed countries of the world, where more than 80 percent of the population live in rural areas and more than a third live in absolute poverty. Over the last two decades it has been war torn and subject to communism and the Vietnamese occupation. It has only returned to normalcy since the UN brokered peace in the early 1990s and the democratic elections in 1993. The economy is dominated by public monopolies and growth has been dependent on foreign direct investment and textile exports. The services sector is large but underdeveloped and is best characterized as an informal sector. Growth is dependent on bilateral and multilateral aid and investment and trade. Under these circumstances it may be unrealistic for the Cambodian government to enact a competition law or formulate a competition policy. X. Conclusion It is interesting to note that only four of the ten ASEAN countries have enacted competition or anti-monopoly laws. An APEC study in 1999 found that member developing countries were reluctant to formulate and implement competition policies or laws because of resistance from the politicians and bureaucrats, who perceive an erosion of discretionary authority. According to the World Bank (1999) and Shirley and Walsh (2000), “significant obstacles to reforming conditions for entry by enterprises into markets continue to be mounted by particular interest groups in the public sector, resisting competition for public enterprises, and by powerful private sector lobbies wishing to protect their markets (Cook, 2002:14). The exit policy is also weak as there are regulations that prevent enterprises from closing. According to Cook, inadequate bankruptcy rules and policies enable the government to keep ailing public enterprises to serve social and political purposes (Cook, 2002:14). There was also an inadequate infrastructure to support a competitive system because of excessive corruption, bureaucratic inertia, poor corporate governance and lack of transparency. The judicial system in most countries are weak and independent and judges are reluctant to act against the interests of the government or prominent businesses. The study also found that countervailing sources of power in the form of professional and consumer groups was also not well organized. The competition authority has also been handicapped because of the lack of qualified personnel (APEC, 1999:43). It is also difficult to detect anti-competitive behavior among firms because of information asymmetry between the competition authority and the firms, which have an incentive to conceal information from the regulators. As Cook has pointed out, ‘the lack of civil society institutions, such as consumer lobbies and the absence of a relatively open media and an auditing tradition, may seriously undermine the disclosure of collusive practices” (Cook, 2002:16). Laffont (1998) has also argued that the attempt to police collusion in developing countries may end up in replacing collusion between enterprises with a more complex process, involving collusion with the regulators. ASEAN has also not developed a common competition law or policy. The 1999 Hanoi Plan of Action “to explore the merits of common competition policy” (ASEAN, 1999) remains a plan. This has led some observers to note that competition law is relatively underdeveloped in most of the ASEAN countries. (Lloyd and Associates, 1999:26). References “Government Draft Rules on Unfair Trade Practices,” The Nation, 22 April, 1999. Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, (London: Methuen), 1776. APEC, Study on Competition Laws for Developing Countries, (Singapore:APEC), 1999. Asean Focus Group, Asian Analysis- Indonesia: An Uncertain Business Environment, (Canberra: ANU), 1999 Association of Southeast Asian Nations (ASEAN), Hanoi Plan of Action, (Jakarta: ASEAN Secretariat), 1999. Christopher, W., Statement by His Excellency Mr. Warren Christopher, Secretary of State of the United States of America, (Jakarta: ASEAN Secretariat), 2003. Coase, R.H., The Institutional Structure of Production, Lecture to the memory of Alfred Nobel, December 9 1991. Cobb,C, “Review of: From Posner to Post-Modernism by Mercero and Medema,” The School of Cooperative Individualism, January 1999. Cook, P., Competition Policy, Market Power and Collusion in Developing Countries, Center on Regulation and Competition, Working Paper Series, Paper Number 33, University of Manchester, 2002. Demsetz, H., Industrial Concentration and the Market System, (Washington, D.C.: American Bar Association Press), 1979. Devuyst, Y., Toward a Multilateral Competition Policy Regime?, Global Governance, Volume 6, Issue 3, July-September 2000:319-339. http://the register.com.uk/content/archive/7984.html http://www.aseanfocus.com/asiananalysis/article.cfm?article ID=140 http://www.findarticles.com/cf_dls/MOJQP/2002_July/89148684/P3/article.jhtml?te rm. http://www.imf.org/external/np/loi/103197.HTM-memo http://www.twnside.org.sg/title/cancun5.doc http://www.wto.org/english/thewto_e/min99_e/english/about_e/16comp_e.htm Hylleberg, S., and Overgaard, P.B, Competition Policy with a Coasian Prior?, Department of Economics, University of Aarhus, Denmark, 1998. International Monetary Fund, Letter of Intent, Indonesia, (Washington, D.C.: International Monetary Fund), October 31 1997. Lea, G., “Who the heck is … Judge Richard Posner,” The Register, 22.11.1999 Lloyd, P.J. and Associates, Harmonizing Competition and Investment Policies in the East Asian Region. Paper presented at the Third Asia Development Forum on “Regional Economic Cooperation in Asia and the Pacific,” organized by the Asian Development Bank, 11-14 June 2001, Bangkok. Maddock, R, “Australian Lessons in Implementing Competition Reform,” Economic Papers, Vol 14, Number 3, September 1995: 31-40. New Internationalist, July 2002. Noland, M., Competition Policy and FDI: A Solution in Search of a Problem? Institute for International Economics, Working Paper, 99-3, 1999. OECD, The Relationship between Regional Trade Agreements and the Multilateral Trading System: Competition, (Paris:OECD), 2002. Schumpeter, J., Capitalism, Socialism and Democracy, (London: Unwin), 1954. Singleton, R.C., “Competition Policy for Developing Countries: A Long-Run EntryBased Approach,” Contemporary Economic Policy, Volume 15, Number 2, April 1997:1-11. Stigler, J.G., “Two Notes on the Coase Theorem,” Yale Law Journal, 1989, 631-633. Third World Network, The Singapore Issues – Rhetoric and Reality. Williamson, J., Did the Washington Consensus Fail? (Washington, D.C.: Institute for International Affairs), 2002. World Bank, World Development Report, 2001, (Washington, D.C.: World Bank), 2001. World Trade Organization (WTO), Trade And Competition Policy, (Geneva: WTO),2004. Yasuda, N., ASEAN Competition Laws: Current Status and Future Perspectives, Graduate School of International Development, Nagoya University. Paper presented at ASEAN Workshop: Making Markets Work, hosted by the Australian Competition and Consumer Commission, Bangkok, 6 March 2000. Lipczynski, J. and J.O.S. Wilson, Industrial Organization: An Analysis of Competitive Markets, (London: Financial Times, Pearson), 2001. The Bank of Sweden Price in Economic Sciences in Memory of Alfred Nobel, 1991. http://www.nobel.se/economics/laureates/1991 Lee, M., and C. Morand, Competition Poicy in the WTO and FTAA: A Trojan Horse for International Trade Negotiations, August 2003. Canadian Center for Policy Alternatives. http://www.policy alternatives.ca/publications/competitionsummary.html. Stigler, G., The Theory of Price, (New York: McMillan), 1966. Stigler, Memoirs of an Unregulated Economist, (New York: Basic Books), 1989. Dixit, A., “Recent developments in oligopoly theory,” The American Economic Review, 1982, 72:12-17. Khmeni, R. Shyam and M. Dutz, “The Instruments of Competition Policy and t Revance for Economic Development,” in C. Frischtak (ed.), Regulatory Policies and Refrm: A Comparative Analysis, (Washington, D.C.: The World Bank), 1995. Schleifer, A., Vishny, R.W., The Grabbing Hand, Government Pathologies and their Cures, (Cambridge (Mass): Harvard University Press), 1998. Gifford, D.J., and M. Matsushita, “Antitrust for Competition Laws Viewed in a trading context: Harmony or Dissonance,” in J. Bhagwati and R.E. Hudec, Fair Trade and Harmonization,Volume 2, (Cambridge, Mass: The MIT Press), 1996. Williamson, J., The Washington Consensus as a Policy Prescription for Development. A lecture in the series “Practitioners for Development,” delivered at the World Bank on January 13, 2004. Institute for Intenational Economics, 2004. Choudry, A., Another Corporate Steal? The Proposed WTO Competition Policy, 2004. http://www.boell.org/docs/Cancun-Aiz-Competition Policy.pdf Choudry, A., Propsed WTO Competition Policy Agreement, ZNET, August 24, 2003. Kerr, I.A., and M. Wood, “Globalization and Competition Policy: Policies for the Developing and Transitional Economies of Asia.” Paper presented at the EAMSA Conference on Globalization and the Uniqueness of Asia, INSEAD Campus, Singapore, November 23-25, 2000. Budzinski, O., Pluralism and Competition Policy Paradigms and the Call for Regulatory Diversity, (New York: New York University), 2003. World Bank, The East Asian Miracle, (New York: Oxford University Press), 1993.