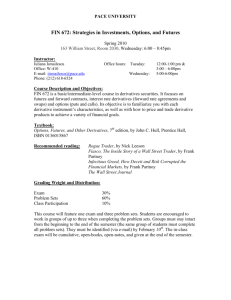

apter 2 1

advertisement