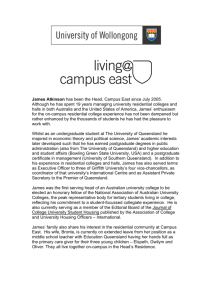

Department of Justice and Attorney-General

advertisement