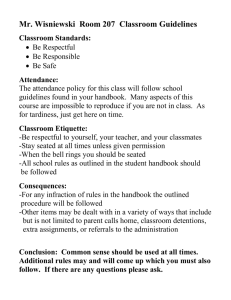

APH

advertisement