Nepal – New Emerging Pharma Market

Nepal – New Emerging Pharma Market

Dr. R. K. Srivastava

Nepal is fast emerging market. Total market size today stands around 5 billion.

There are around 350 companies. Market has around 4000 brands, which are either local brands, Indian brands, or brands which are imported and sold. This market is growing fast. With more professional approach it can give rich dividend to Indian companies. Moreover, their operation in Nepal can give gateway to other SARC countries like Bangladesh, Bhutan or even China due to proximity, low cost of manufacturing and distribution logistics. It is heartening to know, during the recent visit to Nepal at the invitation of No. 1 Pharma Company NPL, that many Nepali companies are eager to start their operation in India or have joint ventures in Nepal.

Hindustan Lever, Dabur have done a good job in Nepal and got immense benefits from such venture. There are many reasons to look at these options:

1 Market Size

According to Nepali Authority like DDA or Drug Manufacturing

Association, market is around Rs. 600 crores with Nepali companies dominating with 30% and others are dominated by Indian/MNC companies.

10-15% is institution business . It is a prescription-based market often influenced by Retailers.

There are around 37 Nepalese companies. Royal Drug Ltd. was the first

Nepali company to start their operation in 1972. There is No Bulk Drug

Units and raw materials are imported from India/China.

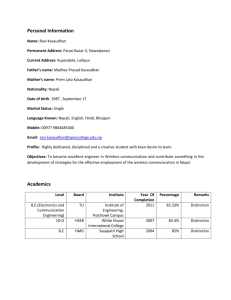

As per data available the top 15 companies based on sales are given below :

Rank Company

1 Nepal Pharma

2 Lomus Pharma

3 Aristo

4 Deurali Janata

5 Knoll Pharma

Origin Value

(in crore)

Nepal

Nepal

Indian

Nepal

MNC

6 Dabur

7 Lupin

Indian

Indian

8 National Health Care Nepal

9 Hoechst MNC

13.2

11.8

11.4

10.7

9.6

9.1

8.7

8.6

8.1

10

11

Alkem

Ranbaxy

12 Cadila Pharma

14

15

E Merck

Novartis

Indian

Indian

Indian

13 Cadila Health Care Indian

MNC

MNC

7.8

7.4

6.3

6.3

6.0

5.6

M.S.

(%)

3.85

3.47

3.31

3.08

2.78

2.65

2.50

2.50

2.35

2.27

2.14

1.84

1.83

1.75

1.64

Source : Market Data

As per industry source, the actual sales are very high. NPL for example has a turnover of 17 crore and is No. 1 company in Nepal.

The leading segments are :

Segment

Antiobiotic

Cough & Cold

Vitamins

Musculoskeletal

Anti Inflammatory

Dermatological

Antacid/Ulcerant

Cardiovascular

Amoebicides

Anthelmintics

Sex Hormones

Anti-anaemics

Others

Percentage

24.7

7.1

6.6

6.6

6.0

4.9

4.6

3.9

2.4

2.5

30.7

Others

30%

Cough& Cold

7%

Amoebicides/Anthe lmintics

4%

Musculoskeletal

Anti Inflm.

7%

Antacid/Ulcerant

5%

Vitamins

3%

Cardiovascular

5%

Dermatological

6%

Sex Hormones

2%

Antibiotic

24%

Antacid/Ulcerant

Vitamins

Antianaemics

Cardiovascular

Dermatological

Sex Hormones

Antibiotic

Musculoskeletal Anti

Inflm.

Amoebicides/Anthelmi ntics

Cough& Cold

Others

2

Thus like India, Antibiotic segment is No. 1 segment followed by cough and cold. Vitamins and anti-inflammatory are 3 rd & 4 th big segment. However,

Nepal in Dermatological segment is much larger which is not so when compared to India. Similarly, Amoebicidal/Anthelmintic segments too are important segment, which is contrary to Indian market potential. These data can be useful in penetration of Nepal market.

The leading brands are

Rank Brand

1 Rabipur

2 Polybion

3 Megapen

4 Digene

5 Althrocin

6 Keflor

7 Vovran

8 Chyawanprash

Aval

9 Sporidex

10 Decold

Company

Hoechst

Merck

Aristo

Knoll

Alembic

Ranbaxy

Novartis

Dabur

Ranbaxy

-

Data : 2003

The above table indicated that there is good scope for third and fourth generation antibiotic and newer antiulcerant. Company can get good reception and penetration provided company goes with the newer molecules.

Therefore, market is a virgin market for a highly professional skilled company provided they have determination to emerge a leader.

Less Degree of Competition :

Competition with professional skills are missing. Due to lack of unskilled field force a determined company with good strategy and skilled field force can make a “Difference“ in Nepalese market. There is need to adopt more marketing tools to become more aggressive in the market. This should generate good productivity.

3 Low cost of Manpower :

Manpower cost is low in Nepal. Therefore, training and proper input utilization should help the company to:

Shorten the period of break even point

Achieve and improve ROI in shorter duration

Generate higher productivity

This can be added advantage specially if a company plan to have joint venture or set up its own factory. Hindustan Lever Ltd. and Dabur have got tremendous advantage.

4 Availability of low cost raw materials and natural herbal ingredients .

China being nearer and abundance of natural resources offer a great opportunity for Indian Company to manufacture the product and export to

China, India, Bangladesh etc. Low cost of manufacturing can give a marketing edge.

5 Low investment on Area coverage :

Though doctors are spread over all the important cities of Nepal, however, a field force of 30-50 should be sufficient to cover entire Nepal. Thus, 3-5 managers with a team of 6-7 medical representatives under him should be sufficient to get maximum returns.

How to get into Nepal

In case company does not want to set up joint venture/company in Nepal, they can get themselves registered by filling up from through stockist and pay $ 1500 as inspection charge. Factory should be WHO GMP certified. Per product Rs. 2000/- is paid once company is registered. Other documents required are finished products, specification like size, colour, total weight, description regarding packing and labelling, method of analysis, analytical report of company with endorsement from

Ita Lab/Shree Ram Lab or RDRL, Nepal of one batch, pharmacopeal standards, manufacturing licence, price list with expiry date etc. This will help them to get product registered.

Thus, Nepal offers a good opportunity to Indian companies. This will make their presence in SARC countries and also help in penetrating China. Nepal government encourages such activities with facilities. HLL/Dabur have taken lead. Many more companies are looking at it. Similarly, many Nepalese companies too are thinking of starting their operation in India. Coming months may be more exciting in these respects.

DR. R. K. SRIVASTAVA IS A MARKETING CONSULTANT

Has published article in Economic Times, Pharma Pulse, Journal of

Marketing, BMA Review, Medical Marketing Media, USA etc.