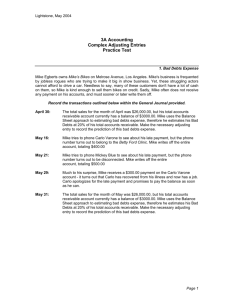

Chapter 8: Receivables

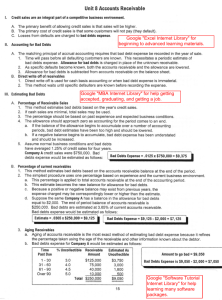

advertisement

Receivables • Setting credit policies • Accounting for bad debt • Computing interest Setting credit policies • Why sell on credit ??? – Increase sales ??? – To remain competitive Setting credit policies • Should I sell on credit to you? – Credit department • Approve credit sales – Small businesses • Generally prefer credit cards – In effect, company’s credit department – Credit scoring for individuals • If denied credit, can get free copy of credit report – Want stability – Don’t apply for a lot of cards at the same time • Credit reports can impact job, rental, life insurance Bad Debts and Valuing A/R • Bad debts: an expense of selling on credit – It should be matched with sales period that generate bad debts (matching principle) – If no bad debts… Methods of recording bad debt expense • Direct charge-off: record expense at the time you find you won’t be paid – Entry • Bad Debts Expense • A/R – Acceptable for income tax purposes – Not acceptable for GAAP as violates matching principle Allowance Method • Bad debt expense is matched against sales in period the sales were recorded – Losses must be estimated since companies don’t know in the period of sale which account will go bad • Should take into account prior experience and current economic conditions • Must be realistic • Subject to manipulation ??? ADA • On balance sheet – Caterpillar – A/R – - ADA 5,611 - 376 Allowance Methods • • • • Percent of sales method Net sales x % bad debt For example, $1 million x 5% Then make this entry – Bad debts expense – ADA $50,000 $50,000 • Focus: income statement, not balance sheet • Not concerned about ADA balance Allowance Methods • A/R aging method • A/R is aged – Further past due, likelihood of bad debts grows rapidly • • • • • For example, 4% of < 30 days; 40% over 90 days Multiply A/R x % bad debt for each time period Calculate total balance needed in ADA Assume need $50,000 and $20,000 already in ADA Then make this entry – Bad debts expense – ADA $30,000 $30,000 • Focus: balance sheet, not income statement • Not concerned about Bad Debts expense Entry for write-off of A/R • Already recorded expense when estimated bad debts expense under one of allowance methods – Entry: • ADA • A/R – Reduces ADA and A/R – Net A/R remains the same – If underestimate bad debts, ADA will have a debit balance Credit Cards • VISA and MasterCard – Credit card slips are similar to depositing checks into company bank account – Discount may range from 2-4% – Entry • Cash • Credit card expense • Sales 98 2 100 Credit Cards • Factoring – Sale of receivables – With recourse? – Cost of funds? Credit Cards • Store credit card – No discount fees – Entry • A/R • 100 Sales 100 Gift Cards • Store gift cards – Stores love these – Entry • Cash • ????? – On expiration date 100 100 Notes Receivable • Promissory note versus A/R • A/R – No interest – Unsecured creditor • N/R – Interest – Secured creditor Calculating Interest • Principal x Rate x Time • Principal = amount loaned • Make sure time and rate are expressed in same units • Interest on $1,000 for 30 days at 10% – 360 day versus 365 day method