Pretest Chapter 13

advertisement

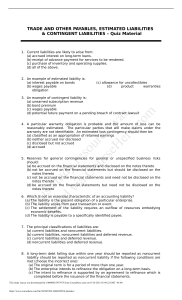

Pretest Chapter 13 1. Stock dividends distributable should be classified on the a. income statement as an expense. b. balance sheet as an asset. c. balance sheet as a liability. d. balance sheet as an item of stockholders' equity. 2. A contingent liability a. definitely exists as a liability but its amount and due date are indeterminable. b. is accrued even though not reasonably estimated. c. is not disclosed in the financial statements. d. is the result of a loss contingency. 3. Which of the following is the proper way to report a gain contingency? a. As an accrued amount. b. As deferred revenue. c. As an account receivable with additional disclosure explaining the nature of the contingency. Pretest Chapter 13 4. Which of the following is a current liability? a. A long-term debt maturing currently, which is to be paid with cash in a sinking fund b. b. A long-term debt maturing currently, which is to be retired with c. proceeds from a new debt issue c. A long-term debt maturing currently, which is to be converted into common stock d. None of these 5. On September 1, 2004, Gaston Co. issued a note payable to National Bank in the amount of $1,500,000, bearing interest at 12%, and payable in three equal annual principal payments of $500,000. On this date, the bank's prime rate was 11%. The first payment for interest and principal was made on September 1, 2005. At December 31, 2005, Gaston should record accrued interest payable of a. $ 60,000. b. $ 55,000. c. $ 40,000. d. $ 36,667.