Suggested Case Titles

advertisement

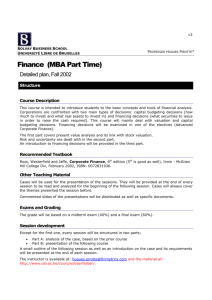

Financial Application 2011 Faculty Dr. Jerry Song The University of Texas, Arlington Tel: 310-699-6409, Fax. 310-550-8213 Email: jerrysong@yahoo.com Syllabus Objectives Effective utilization of capital markets, both domestic and foreign, is essential for a thriving firm. Leaders must be able to assess relative benefits and costs of both short-term and long-term sources of expansion capital not only within their home markets but also within the context of global markets. Evaluation of and access to foreign capital markets requires an understanding of characteristics of international financial instruments, the operation and structure of foreign capital markets and fundamentals of measurement and management of foreign exchange exposure In this class, we will learn how to make financing decisions within our home markets and within the context of global financial markets, where we will examine the sources of financing and whether there is an optimal mix of financing. We will also provide special introduction to global IPOs and cross border merger and acquisition process. Finally, there is valuation, where all of the financial decisions made by a firm are traced through to a final value, in venture capital financing, public listing or merger and acquisition. The text book will only provide the basic knowledge and information for this class. More advanced training is going to be provided through the real world case analysis, analytical tools and models we are going to introduce in the class. After finishing the class, you will gain hands-on experience in making financial and investment decisions. Course Readings Required Text Ross, Stephen A., Randolph W. Westerfield and Jeffrey Jaffe, Corporate Finance, 9th edition, Irwin/McGraw-Hill (RWJ). Special Topics, PowerPoint Presentation (PPT) Tentative Class Arrangement Day 1 Objectives in Global Financial Management Reading Materials 1. Introduction to Global Financial Management 2. Valuation Methods Discussion: China Economy 2010-2011 Day 2. Risk, Return and CAPM Reading Materials 1. How to Measure Risk and Return 2. International CAPM Case Study: Disney in China Discussion: Is valuation a Black Art? Day 3 Global Capital Markets Reading Materials 1. What have happened in the Wall Street? 2. New Trends in Global Capital Markets 3. Private Equity vs. Venture Capital 4. Understand Hedge Fund Discussion: Financial Markets in the US and China: Discussion: Subprime and Bernie Madoff Discussion: Investment Philosophies Day 4 How to Access Global Capital Markets 1. Equity Financing 2. Cross-Border Merger and Acquisition 3. Financial Derivatives Discussion: Technical Issues Related to Public Listing Case Study: China.Com Case Study: Compaq RWJ Ch.1 RWJ Ch.5, 6 PPT RWJ Ch.9 RWJ Ch.10, 12 PPT PPT PPT PPT PPT PPT PPT RWJ Ch.19 RWJ Ch. 29 RWJ Ch. 22 PPT PPT Grading Policy and Class Project Requirements You will write a case in this class. This will be 60% of your grade. The other 40% will be a take home/open book examination. I expect you to use the tools and decision rules learned in the class to analyze the case. What you need to do before the class: The second day of the class, I need the following information from you for the case. 1. A list of the members of your group. 2. A short description, the title and a detailed outline of your case. 3. A summary of what you have done so far, and a schedule for completion of the case (using the Group Work Plan excel file compiled for the class). 4. Familiar yourselves with the International Database and China Database compiled for this Class. 5. Familiar yourselves with financial analysis models compiled for this class. The Case Format should be as follows: 1. An one page executive summary describe the case and its relevance to this class 2. The detail of the case 3. Your analysis of and solution to the case. 4. Data resources (i.e. spreadsheet in Excel, company annual reports, press clippings, prospectus, and online databases). 5. A copy of the PowerPoint presentation 6. An email from each group member detailing the percentage contributions of each member. The contribution should not just reflect the time devoted but the quality of the time. If you fail to send an email, I assume that your vote for the contributions is for equal. Case Content 1. The case has to have some finance content related to this class. 2. The case needs to provide a valuation, i.e. how much is a particular company worth. 3. The case needs to use detailed financial statement information. Value using discounted cash flows as well as market comparables. 4. You need to provide an analysis of risk and the cost of capital. 5. You can use the financial projection and valuation models we introduced in the class. Suggested Case Titles 1. The company you work for. 2. Public companies listed on NYSE, NASDAQ or AMEX. 3. Other well-established private companies or start-up companies which you have access to their financial statements. Note: Most information can be found in our International Database and China Database