Course outline 2002 - Université Libre de Bruxelles

advertisement

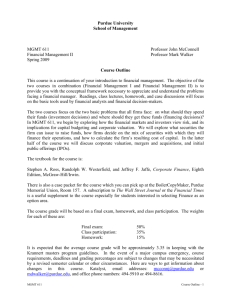

V3 SOLVAY BUSINESS SCHOOL UNIVERSITÉ LIBRE DE BRUXELLES PROFESSOR HUGUES PIROTTE* Finance (MBA Part Time) Detailed plan, Fall 2002 Structure Course Description This course is intended to introduce students to the basic concepts and tools of financial analysis. Corporations are confronted with two main types of decisions: capital budgeting decisions (how much to invest and what real assets to invest in) and financing decisions (what securities to issue in order to raise the cash required). This course will mainly deal with valuation and capital budgeting decisions. Financing decisions will be examined in one of the electives (Advanced Corporate Finance). The first part covers present value analysis and its link with stock valuation. Risk and uncertainty are dealt with in the second part. An introduction to financing decisions will be provided in the third part. Recommended Textbook Ross, Westerfield and Jaffe, Corporate Finance, 6th edition (5th is good as well), Irwin - McGraw Hill College Div, February 2002, ISBN: 0072831936. Other Teaching Material Cases will be used for the presentation of the sessions. They will be provided at the end of every session to be read and analyzed for the beginning of the following session. Cases will always cover the themes presented the session before. Commented slides of the presentations will be distributed as well as specific documents. Exams and Grading The grade will be based on a midterm exam (40%) and a final exam (60%). Session development Except for the first one, every session will be structured in two parts: • • Part A: analysis of the case, based on the prior course Part B: presentation of the following course A small outline of the following session as well as an introduction on the case and its requirements will be presented at the end of each session. The instructor is available at: hugues.pirotte@finmetrics.com and the material at: http://www.ulb.ac.be/cours/solvay/farber/. Outline Details Cases should be distributed a week earlier than mentioned. All sessions take place at 6-9 PM. Session n° 1 Date Day of week 04.11.2002 Monday Theme Readings prior COURSE: Introduction + Financial statement analysis and forecasting (Chap 1+2) RWJ 1+2 This session will provide a general introduction to financial analysis. We will examine what finance is about, identify the main financial decisions and analyze the objective of value creation (or shareholder’s wealth maximization). Financial markets will be introduced and their central role for financial decisions making will be stressed. We will also introduce a number of useful techniques to assess the financial health of a company. We will cover ratio analysis, liquidity analysis based on the statement of cash flows and financial forecasting. 2 18.11.2002 Monday î CASE: Carrefour or Great Universal Stores? + Bayern Brauerei COURSE: Present value (Chap 3) RWJ 3+4 We will introduce present and future values, present the general present value formula and examine its meaning. We will then present some simplifying formulas for specific streams of cash flows. These formulas will be used to analyze some simple investment decisions. 3 25.11.2002 Monday î CASE: The Investment Detective COURSE: Bonds and stocks valuation (Chap 4+5) RWJ 5 We will first apply our newly acquired knowledge of present value calculation to the valuation of discount bonds and coupon-bearing bonds. We will then examine the relationship between stock prices and future dividends and try to see through the veil of dividends to uncover the core variable underlying the value of companies. 4 02.12.2002 Monday î CASE: Interbrew COURSE: Investment Rules + Capital Budgeting (Chap 6+7) Even though the net present value rule is the best for evaluating capital budget projects, this rule has contenders that are commonly used by companies. In this session, they will RWJ 6+7+8 be analyzed. We will then examine how to apply the NPV rule: identifying the cash flows to be discounted and taking inflation into account. We will also analyze investments of unequal lives and have a closer look at the economic significance of a positive net present value. We will also develop various useful techniques to assess the reliability of NVP calculations and introduce flexibility (or real options) in the analysis. 5 14.01.2003 Tuesday î CASE: United Metal COURSE: Capital Market Theory (Chap 8) RWJ 9+13 In this session, we will approach the topic of valuation when the future payoffs are risky. The statistical properties of past returns will be examined, a statistical measure for the risk of a portfolio identified, and we will have a first look at the importance of diversification for the determination of the expected return of individual securities. 6 15.01.2003 Wednesday COURSE: Portfolio Selection + Risk and Expected Return (Chap 9+10) RWJ 10+11 This session will be devoted first to an analysis of the causes of diversification. We will develop a method to choose an optimal portfolio. Then, we will analyze the Capital Asset Pricing Model (CAPM) which is a method to relate the expected return on a security to its risk. 7 08.02.2003 Saturday î CASE: Beta Management Company + Aunt Agatha COURSE: Risk, return and capital budgeting (Chap 11) RWJ 12 Drawing upon the CAPM, we will discuss in this session capital budgeting analysis when future cash flows are uncertain. The distinction between the average cost of capital and the cost of equity will be introduced. 8 11.02.2003 Tuesday î CASE: Pioneer Petroleum COURSE: Review + Guest speaker *My sincere acknowledgements go to Prof. André Farber for its kindness and support in structuring this course, while sharing material and a long teaching experience.