Accounting I

advertisement

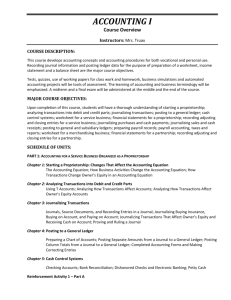

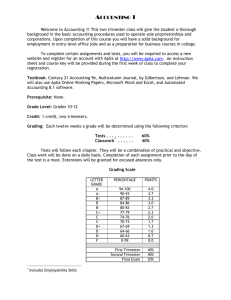

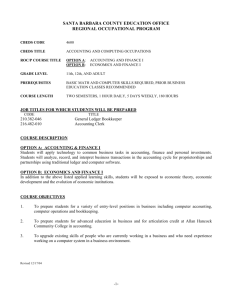

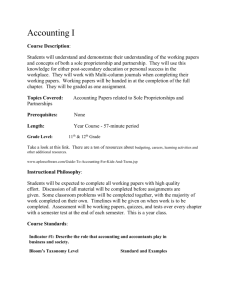

Accounting I Advisor – Victoria Abel vabel@stjschools.org 573-265-2300 Ext 3233 Purpose: To provide students with the skills necessary to make wise financial decisions. This course will also prepare students for their future whether collegiate or the work force. Course Objectives for all Accounting I students: The student will – 1. Classify financial items such as assets, liabilities, and capital; analyze transactions into debit and credit parts, and record transactions into a multicolumn general journal and special columns for sole proprietorship. 2. Maintain banking records 3. Complete an eight-column worksheet, adjusting and closing entries, and prepare a post-closing trial balance for a sole proprietorship. 4. Post to a general and subsidiary ledger from a combination journal. 5. Prepare financial statements for a sole proprietorship. Course of Action: 1. Part 1 a. Starting a Proprietorship b. Analyzing Transactions into Debit and Credit Parts c. Journalizing Transactions d. Posting to a General Ledger e. Cash Control Systems f. Work Sheet for a Service Business g. Financial Statements for a Proprietorship h. Recording Adjusting and Closing Entries for a Service Business 2. Part 2 a. Journalizing Purchases and Cash Payments b. Journalizing Sales and Cash Receipts Using Special Journals c. Posting to General and Subsidiary Ledgers d. Preparing Payroll Records e. Payroll Accounting, Taxes, and Reports Calendar of Events: Day 1: Introduction/Syllabus Day 2: (1-1)The Accounting Equation Day 3: (1-2)How Business Transactions Change the Accounting Equation Day 4: (1-3)How Transactions Change Owner’s Equity in an Accounting Equation. Day 5: Review/Mastery Problem Day 6: Test Day 7: (2-1)Using T Accounts Day 8: (2-2)Analyzing Transactions in T Accounts Day 9: (2-3)Analyzing How Transactions Affect Owner’s Equity Accounts Day 10: Review/Mastery Problem Day 11: Test Day 12: (3-1)Journals, Source Documents, and Recoding Entries in a Journal Day 13: (3-2) Journalizing Buying Insurance, Buying on an Account, & Paying on Account Day 14: (3-3) Journalizing Transactions that Affect Owner’s Equity and Receiving Cash on Account Day 15: (3-4) Proving and Ruling a Journal Day 16: Review Day 17: Test Day 18: (4-1)Preparing a Chart of Accounts Day 19: (4-2) Posting Separate Amounts from a Journal to a General Ledger Day 20: (4-3) Posting Column Totals from a Journal to a General Ledger Day 21: (4-4) Completed Accounting Forms and Making Correcting Entries Day 22: Review Day 23: Test Day 24: (5-1) Cash Control Systems Day 25: (5-2) Bank Reconciliation Day 26: (5-3) Dishonored Checks Day 27: (5-4) Petty Cash Day 28: Extra Checking Day Day 29: Review Day 30: Test Day 31: (6-1) Creating a Work Sheet Day 32: (6-2) Planning Adjusting Entries on a Work Sheet Day 33: (6-3) Extending Financial Statement Information on a Work Sheet Day 34: Review Day 35: Test Day 36: (7-1) Preparing an Income Statement Day 37: (7-2) Preparing a Balance Sheet Day 38: Review Day 39: Test Day 40: (8-1) Recording Adjusting Entries Day 41: (8-2) Recording Closing Entries Day 42: (8-3) Pre-paring a Post Closing Trial Balance Day 43: Review Day 44: Test Day 45: (9-1) Journalizing Purchases Using a Purchase Journal Day 46: (9-2) Journalizing Cash Payments Using a Cash Payments Journal Day 47: (9-3) Performing Additional Cash Payments Journal Operations Day 48: (9-4)Journalzing Other Transactions Using a General Journal Day 49: Review Day 50: Test Day 51: (10-1) Journalizing Sales on Account Using a Sales Journal Day 52: (10-2) Journalizing Cash Reciepts Using a Cash Receipts Journal Day 53: (10-3) Recording Transactions Using a General Journal Day 54: Review Day 55: Test Day 56: (11-1) Posting to an Accounts Payable Ledger Day 57: (11-2) Posting to an Accounts Receivable Ledger Day 58: (11-3) Posting from Journals to General Ledger Day 59: (11-4) Posting Special Journal Totals to a General Ledger Day 60: Review Day 61: Test Day 62: Accounting Enrichment Day 63: Accounting Enrichment Day 64: Accounting Enrichment Day 65: (12-1) Preparing Payroll Time Cards Day 66: (12-2) Determining Payroll Tax Withholding Day 67: (12-3) Preparing Payroll Records Day 68: (12-4) Preparing Payroll Checks Day 69: Extra Payroll Day Day 70: Review Day 71: Test Day 72: (13-1) Recoding a Payroll Day 73: (13-2) Recording Employer Payroll Taxes Day 74: (13-3) Reporting Withholding and Payroll Taxes Day 75: (13-4) Paying Withholding and Payroll Taxes Day 76: Review Day 77: Test Day 78: Enrichment Activity Day 79: Enrichment Activity Day 80: Make Up Day Day 81: TBA Day 82: TBA Day 83: Prepare for Final Day 84: Final Day 85: Week 38: 1. Make-Up Day 2. Make-Up Day Grading Procedure Class work/homework for each unit must be completed and checked by the teacher before the students is allowed to take the unit test. Points will be given for attendance in class and will be a part of the student’s quarter grade. Grade percentages are listed in the Student Handbook. ALL MISSING WORK WILL NOT BE ACCEPTED AFTER EACH THREE WEEK GRADING PERIOD. A note from the teacher – I will lead a respectful and disciplined classroom. To achieve this I have implemented a few simple classroom policies and procedures. These will be enforced in order to maintain a fair and orderly classroom. As a student, it is your responsibility to comply with these policies and procedures. They are listed as follows – *Come to class prepared to learn – Always bring your book, folder, writing utensil, and any other supplies you might need. If you borrow something of mine, I will borrow something of yours. Bringing your materials to class is important, so important that I will give you a grade for it. *Be respectful of all students and teachers that enter our classroom – Offensive language, derogatory gestures, and any other disrespectful behaviors will not be tolerated. Hateful comments concerning race, gender, sexuality, political views, appearance, or any other type will not be tolerated; this applies to serious and joking comments. *Do your own work – Students found plagiarizing, copying, or cheating in any way will receive an automatic zero. *Follow directions the first time they are given – there will be plenty of time to discuss the matter after you follow directions. *Daily Questions – A daily question will be posted on ClassJump. When you enter the classroom, you will get your laptop on logon to ClassJump and find your daily questions. Daily questions are worth 2 points each. To earn both points, you must answer the question in full sentence form and respond to another classmates answer in sentence form. *Dismissal From Class – The bell does not dismiss you from class, I DO! Do not pack up your things until I have told you to. We will be working until the bell rings. *Leaving the classroom – when leaving the classroom, you must have a pass. When one has been shown the student must sign the clip board by the door stating where they are going. Even if you have a pass it does not mean that I must let you leave the room. Use your best judgment. If we are in the middle of something don’t even ask! *Student Work – From time to time, student work will be displayed throughout the classroom. *ClassJump – Each student will have a “ClassJump” account. ClassJump will be used to discuss classroom topics, submit assignments, and review classroom activities. Students will only use this site for classroom purposes. School administrators will have access to the site and will review the site. *Website – I am currently working on my school website and will updating it as the year progresses. My website can be located at www.vabel.weebly.com. ***Procedures may be changed or added by the teacher. I, __________________________________ have read and fully understand the class policies and procedures. Signature ____________________________________ Parent Signature ______________________________