economics

advertisement

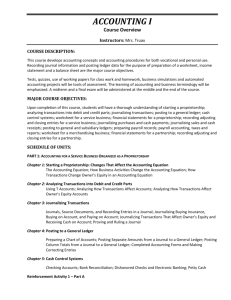

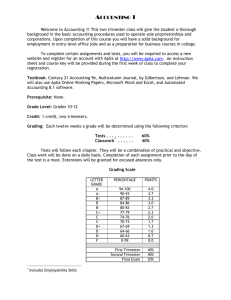

SANTA BARBARA COUNTY EDUCATION OFFICE REGIONAL OCCUPATIONAL PROGRAM CBEDS CODE 4600 CBEDS TITLE ACCOUNTING AND COMPUTING OCCUPATIONS ROC/P COURSE TITLE OPTION A: OPTION B: GRADE LEVEL 11th, 12th, AND ADULT PREREQUISITES BASIC MATH AND COMPUTER SKILLS REQUIRED, PRIOR BUSINESS EDUCATION CLASSES RECOMMENDED COURSE LENGTH TWO SEMESTERS, 1 HOUR DAILY, 5 DAYS WEEKLY, 180 HOURS ACCOUNTING AND FINANCE I ECONOMICS AND FINANCE I JOB TITLES FOR WHICH STUDENTS WILL BE PREPARED CODE 210.382-046 216.482-010 TITLE General Ledger Bookkeeper Accounting Clerk COURSE DESCRIPTION OPTION A: ACCOUNTING & FINANCE I Students will apply technology to common business tasks in accounting, finance and personal investments. Students will analyze, record, and interpret business transactions in the accounting cycle for proprietorships and partnerships using traditional ledger and computer software. OPTION B: ECONOMICS AND FINANCE I In addition to the above listed applied learning skills, students will be exposed to economic theory, economic development and the evolution of economic institutions. COURSE OBJECTIVES 1. To prepare students for a variety of entry-level positions in business including computer accounting, computer operations and bookkeeping. 2. To prepare students for advanced education in business and for articulation credit at Allan Hancock Community College in accounting. 3. To upgrade existing skills of people who are currently working in a business and who need experience working on a computer system in a business environment. Revised 12/17/04 -1- SANTA BARBARA COUNTY EDUCATION OFFICE REGIONAL OCCUPATIONAL PROGRAM OPTION A: ACCOUNTING AND FINANCE I COURSE OUTLINE Hours I. COURSE INTRODUCTION A. Class rules and regulations B. Safety C. Automated Accounting Concepts and Terminology 2 II. STARTING A PROPRIETORSHIP A. The Accounting Equation B. How Business Activities Change the Accounting Equation C. Reporting Financial Information on a Balance Sheet 8 III. STARTING A PROPRIETORSHIP: CHANGES THAT AFFECT OWNER’S EQUITY A. How Transactions Change Owner’s Equity in an Accounting Equation B. Reporting a Changed Accounting Equation on a Balance Sheet 10 IV. ANALYZING TRANSACTIONS INTO DEBIT AND CREDIT PARTS A. Using T Accounts B. Analyzing How Transactions Affect Accounts C. Analyzing How Transactions Affect Owner’s Equity Accounts 10 V. RECORDING TRANSACTIONS IN A GENERAL JOURNAL A. Journals, Source Documents, and Recording Entries in a Journal B. Journalizing Buying Insurance, Buying on Account, and Paying on Account C. Journalizing Transactions That Affect Owner’s Equity and Receiving Cash on Account D. Starting a New Journal Page 10 VI. POSTING FROM A GENERAL JOURNAL TO A GENERAL LEDGER A. Preparing a Chart of Accounts B. Posting from a General Journal to a General Ledger C. Completed General Ledger, Proving Cash, and Making Correcting Entries 10 VII. CASH CONTROL SYSTEMS A. Checking Accounts B. Bank Reconciliation C. Dishonored Checks and Electronic Banking D. Petty Cash 10 VIII. WORK SHEET FOR A SERVICE BUSINESS A. Creating a Work Sheet B. Planning Adjusting Entries on a Work Sheet C. Extending Financial Statement Information on a Work Sheet D. Finding and Correcting Errors on the Work Sheet 10 -2- Option A: Accounting and Finance I (Course Outline Cont.) Hours 10 IX. FINANCIAL STATEMENTS FOR A PROPRIETORSHIP A. Preparing an Income Statement B. Balance Sheet Information on a Work Sheet X. RECORDING ADJUSTING AND CLOSING ENTRIES FOR A SERVICE BUSINESS A. Recording Adjusting Entries B. Recording Closing Entries C. Preparing a Post-Closing Trial Balance 10 XI. JOURNALIZING PURCHASES AND CASH PAYMENTS USING SPECIAL JOURNALS A. Journalizing Purchases Using a Purchases Journal B. Journalizing Cash Payments Using a Cash Payments Journal C. Performing Additional Cash Payments Journal Operations D. Journalizing Other Transactions Using a General Journal 10 XII. JOURNALIZING SALES AND CASH RECEIPTS USING SPECIAL JOURNALS A. Journalizing Sales on Account Using a Sales Journal B. Journalizing Cash Receipts Using a Cash Receipts Journal 10 XIII. POSTING TO GENERAL AND SUBSIDIARY LEDGERS A. Posting to an Accounts Payable Ledger B. Posting from Other Journals to an Accounts Payable Ledger C. Posting to an Accounts Receivable Ledger D. Additional Posting to an Accounts Receivable Ledger E. Posting from Journals to a General Ledger F. Posting Totals to a General Ledger 10 XIV. WORK SHEET FOR A MERCHANDISING BUSINESS A. Beginning an 8-Column Work Sheet for a Merchandising Business B. Analyzing and Recording Work Sheet Adjustments C. Completing Work Sheets 10 XV. PAYROLL ACCOUNTING A. Computing wages and withholding B. Preparing payroll checks and records C. Recording and report employer payroll tax forms D. Paying withholding and payroll taxes 10 XVI. PERSONAL FINANCE A. Checking Accounts B. Consumer Credit C. Savings and Retirement Options D. Internet Applications 10 XVII. INVESTMENTS A. Investment Analysis (1) Stocks, Bonds, Mutual Funds, Retirement Plans, Real Estate, etc. B. Internet Applications C. Investment Policy -3- 10 Option A: Accounting and Finance I (Course Outline Cont.) Hours 10 XVIII. PERSONAL INCOME TAXES A. Preparing a Personal Income Tax Form B. Ethics XIX. JOB SEEKING SKILLS/GENERAL WORKPLACE SKILLS A. Job Search Fundamentals B. Résumé and Employment Applications C. The Employment Interview D. General Workplace Skills (1) Job Attitudes/Work Ethics (2) Personal Organization, Goal Settings and Time Management (3) Personal Grooming (4) Oral and Written Communication (5) Teamwork (6) Common Workplace Rules and Regulations (7) Further Training and Career Ladders 10 ___ 180 OPTION B: ECONOMICS AND FINANCE I COURSE OUTLINE ECONOMICS I. Hours 2 COURSE INTRODUCTION A. Class rules and regulations B. Safety C. An Economic way of thinking D. Scarcity and Choice E. Opportunity Costs II. ECONOMIC SYSTEMS A. Types of economic systems B. U.S. Economy 4 III. DEMAND AND SUPPLY A. The nature of demand and supply B. The elasticity of demand C. The changes in demand and supply 4 IV. PRICES A. The price system B. Determining prices 4 -4- Option B: Economics & Finance (Course Outline Cont.) Hours 4 V. MARKET STRUCTURES A. Competitive markets B. Market regulation VI. LABOR UNIONS A. U.S. labor force B. Unions and management 4 VII. SOURCES OF CAPITAL A. Saving and investing 4 VIII. ECONOMIC PERFORMANCE A. Gross domestic product B. Business cycle C. Economic growth D. Unemployment E. Inflation F. Income distribution G. Macroeconomic and Microeconomic integration 6 IX. ROLE OF GOVERNMENT A. Growth of government B. Economic goals 4 X. MONEY AND THE BANKING SYSTEM A. U.S. Banking B. The Federal Reserve System C. Monetary policy strategies D. Fiscal policy and strategies 4 XI. COMPARING ECONOMIC SYSTEMS A. Capitalism, Socialism and Communism 6 XII. INTERNATIONAL TRADE A. Foreign exchange and currencies B. Trade barriers 4 ACCOUNTING AND FINANCE I. STARTING A PROPRIETORSHIP A. The Accounting Equation B. How Business Activities Change the Accounting Equation C. Reporting Financial Information on a Balance Sheet 7 II. STARTING A PROPRIETORSHIP: CHANGES THAT AFFECT OWNER’S EQUITY A. How Transactions Change Owner’s Equity in an Accounting Equation B. Reporting a Changed Accounting Equation on a Balance Sheet 7 -5- Option B: Economics & Finance (Course Outline Cont.) Hours 7 III. ANALYZING TRANSACTIONS INTO DEBIT AND CREDIT PARTS A. Using T Accounts B. Analyzing How Transactions Affect Accounts C. Analyzing How Transactions Affect Owner’s Equity Accounts IV. RECORDING TRANSACTIONS IN A GENERAL JOURNAL A. Journals, Source Documents, and Recording Entries in a Journal B. Journalizing Buying Insurance, Buying on Account, and Paying on Account C. Journalizing Transactions That Affect Owner’s Equity and Receiving Cash on Account D. Starting a New Journal Page 7 V. POSTING FROM A GENERAL JOURNAL TO A GENERAL LEDGER A. Preparing a Chart of Accounts B. Posting from a General Journal to a General Ledger C. Completed General Ledger, Proving Cash, and Making Correcting Entries 7 VI. CASH CONTROL SYSTEMS A. Checking Accounts B. Bank Reconciliation C. Dishonored Checks and Electronic Banking D. Petty Cash 7 VII. WORK SHEET FOR A SERVICE BUSINESS A. Creating a Work Sheet B. Planning Adjusting Entries on a Work Sheet C. Extending Financial Statement Information on a Work Sheet D. Finding and Correcting Errors on the Work Sheet 7 VIII. FINANCIAL STATEMENTS FOR A PROPRIETORSHIP A. Preparing an Income Statement B. Balance Sheet Information on a Work Sheet 7 IX. RECORDING ADJUSTING AND CLOSING ENTRIES FOR A SERVICE BUSINESS A. Recording Adjusting Entries B. Recording Closing Entries C. Preparing a Post-Closing Trial Balance 7 X. JOURNALIZING PURCHASES AND CASH PAYMENTS USING SPECIAL JOURNALS A. Journalizing Purchases Using a Purchases Journal B. Journalizing Cash Payments Using a Cash Payments Journal C. Performing Additional Cash Payments Journal Operations D. Journalizing Other Transactions Using a General Journal 7 XI. JOURNALIZING SALES AND CASH RECEIPTS USING SPECIAL JOURNALS A. Journalizing Sales on Account Using a Sales Journal B. Journalizing Cash Receipts Using a Cash Receipts Journal 7 -6- Option B: Economics & Finance (Course Outline Cont.) Hours 7 XII. POSTING TO GENERAL AND SUBSIDIARY LEDGERS A. Posting to an Accounts Payable Ledger B. Posting from Other Journals to an Accounts Payable Ledger C. Posting to an Accounts Receivable Ledger D. Additional Posting to an Accounts Receivable Ledger E. Posting from Journals to a General Ledger F. Posting Totals to a General Ledger XIII. WORK SHEET FOR A MERCHANDISING BUSINESS A. Beginning an 8-Column Work Sheet for a Merchandising Business B. Analyzing and Recording Work Sheet Adjustments C. Completing Work Sheets 7 XIV. PAYROLL ACCOUNTING A. Computing wages and withholding B. Preparing payroll checks and records C. Recording and report employer payroll tax forms D. Paying withholding and payroll taxes 7 XV. PERSONAL FINANCE A. Checking Accounts B. Consumer Credit C. Savings D. Internet Applications 7 XVI. INVESTMENTS A. Investment Analysis (1) Stocks, Bonds, Mutual Funds, Retirement Plans, Real Estate, etc. B. Internet Applications 8 XVII. PERSONAL INCOME TAXES A. Preparing a Personal Income Tax Form B. Ethics 7 XVIII. JOB SEEKING SKILLS/GENERAL WORKPLACE SKILLS A. Job Search Fundamentals B. Résumé and Employment Applications C. The Employment Interview D. General Workplace Skills (1) Job Attitudes/Work Ethics (2) Personal Organization, Goal Settings and Time Management (3) Personal Grooming (4) Oral and Written Communication (5) Teamwork (6) Common Workplace Rules and Regulations (7) Further Training and Career Ladders 10 ___ 180 -7-