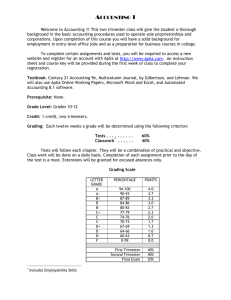

SVHS Accounting 1 Syllabus

advertisement

Accounting 1 Syllabus Curriculum: Business & Technology Course Duration: 1 Year Grade Level: All Levels Materials: Accounting Book Working Papers Online Software Instructors: Cathie Murphy COURSE DESCRIPTION: This is a skill level course valuable to all students pursuing business, marketing and management programs. This course provides planned learning experiences and activities to develop abilities necessary for keeping, summarizing, and analyzing financial records. In addition to stressing fundamental concepts of terminology of accounting, instruction will provide initial understanding of the preparation of financial reports, and computer applications. Also stressed is the development of proper work habits and employability skills, and exploration of accounting careers and opportunities. *Students may take this course for articulated credit at Rock Valley College. REQUIRED SUPPLIES: Students will need the following supplies for this class. Do not count on your H drive to be functional. The flash drive is required DAILY. USB/Jump drive or external hard drive (at least 2g) STUDENT LEARNING OUTCOMES Act as a responsible and contributing citizen and employee. Apply appropriate academic and technical skills. Attend to personal health and financial well-being. Communicate clearly and effectively and with reason. Consider the environmental, social and economic impacts of decisions. Employ valid and reliable research strategies. Model integrity, ethical leadership and effective management. Plan education and career paths aligned to personal goals. Use technology to enhance productivity. Work productively in teams while using cultural global competence. Utilize critical thinking to make sense of problems and persevere in solving them. METHOD OF STUDENT INSTRUCTION Class Activities Hands on work Small Group work One-on-one contact METHOD OF STUDENT ASSESSMENT _x_ _x_ _x_ _x_ Hands on Test and/or Quizzes Problem Solving Exercises Unit Testing Accounting Mini Projects Student Essential Outcomes 1) Gain knowledge of accounting careers by: a) Investigating meaning and roles of accounting clerks, accountants, and CPAs. b) Categorizing accounting educational requirements and on-the-job responsibilities a) Identifying financial remuneration for accountants and CPAs b) Providing information on the top accounting colleges/universities c) Utilizing new vocabulary in research and hands-on activities 2) Explore basic concepts of accounting and business by: a) Recognizing the skills of an effective entrepreneur b) Identifying forms and types of businesses c) Defining & applying the three business assumptions to specific real-world situations d) Connecting key terms in the chapter with application 3) Connect the three basic assumptions to case studies by: a) Applying the three business assumptions to specific real-world situations b) Connecting key terms in the chapter with application 4) Apply rules for the accounting equation by: a) Implementing the rules for assets, liabilities and owner’s equity accounts b) Applying the rules for debits and credits c) Connecting key terms in the chapter with application. 5. Apply debit and credit rules for T-accounts by: a) Implementing and applying the rules for the breakdown of the accounting equation b) Connecting key terms in the chapter with application. 6) Record business transactions into the General Journal by: a) Identifying source documents b) Analyzing and breaking entries into debit and credit parts c) Analyzing and correcting entries into the general journal d) Connecting key terms in the chapter with application. 7) Post business transactions from the general journal into a general ledger by: a) Utilizing the steps to posting to a general ledger b) Preparing a Trial Balance in order to apply debit and credit rules c) Recording correcting entries in the general journal and ledger d) Defining the accounting terms in this chapter 8. Complete a six-column worksheet with by: a) Balancing the General Ledger accounts on the Trial Balance section of the worksheet b) Separating temporary and permanent accounts across sections of a worksheet c) Calculating net income or net loss on a worksheet d) Connecting key terms in the chapter with application. 9. Format and interpret financial statements with 85% accuracy by: a) Creating an Income Statement from the Income Statement section of the worksheet b) Preparing the Statement of Changes in Owner’s Equity to determine the new Capital balance c) Completing the Balance Sheet using the Balance Sheet section of the worksheet and the Statement of Changes in Owner’s Equity. d) Connecting key terms in the chapter with application. 10. Prepare Closing entries and the Post-Closing Trial Balance by: a. Journalizing and posting temporary account closing entries b. Transferring and posting net income or net loss to the Capital account through a closing entry c. Recording permanent accounts after the closing entries d. Connecting key terms in the chapter with application. 11. Record necessary banking activities by: a. Identifying internal controls used to oversee cash records b. Preparing check stubs and business checks c. Reconciling a bank statement d. Journalize & posting bank statement reconciliation charges e. Connecting key terms in the chapter with application. 12. Apply employee payroll theories and procedures with 85% accuracy by: a. Calculating gross earnings using different payroll methods b. Identifying and calculating difference between gross earnings and net pay c. Preparing a time card, payroll register and employee’s earnings record d. Connecting key terms in the chapter with application. 13. Apply employer payroll theories and procedures with 85% accuracy by: a. Calculating four employer payroll taxes: FICA, SUTA and FUTA b. Recording and posting employee & employer payroll information c. Journalizing and posting of employer tax liability payments d. Connecting key terms in the chapter with application 14. Record accounting for Sales and Cash Receipts for a Retail business with 85% accuracy by: a. Calculating sales tax for all retail sales b. Analyzing, journalizing and posting sales on account, daily sales, sales tax, sales discounts, and sales returns and allowances into the G.J. & G.L. c. Analyzing, journalizing and posting A/R into the A/R Subsidiary Ledger d. Connecting key terms in the chapter with application 15. Record accounting for Purchases and Cash Payments for a Retail business with 85% accuracy by: a. Calculating purchases discount for a business b. Analyzing, journalizing and posting purchases on account, cash purchases, purchases discounts, and purchases returns and allowances into the G.J. & G.L. c. Journalizing FOB shipping point and prepaid insurance for a business d. Analyzing, journalizing and posting A/P into the A/P Subsidiary Ledger e. Connecting key terms in the chapter with application 16. Utilizing software and technology that is essential for a successful business by: a. Exploring & implementing the Internet and Internet research as successful tools in improving efficiency in the accounting world b. Sharing and collaborating with teacher and class using cloud software (i.e. Google Drive)