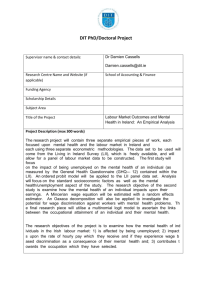

Labour shares and the personal distribution of income in the

advertisement