Premier's ABN AMRO Business Studies, Economics Scholarship

advertisement

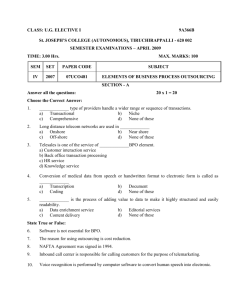

Premier’s ABN AMRO Business Studies, Economics Scholarship Business Process Outsourcing and Finance and Accounting Outsourcing: An analysis of the trends and issues in the Asia-Pacific region Mohan Dhall Presbyterian Ladies College Sponsored by Introduction In classical economics, trade is premised on the notion of firms seeking competitive advantage in order to maximise economic returns. Competitive advantage arises when business firms seek to specialise in those areas over which they have a sustainable competitive advantage. Comparative advantage in classical economics refers to notions of national industrial specialisation based on arbitrage – specialisation in those areas over which an economy experiences the lowest opportunity cost (Black1). Lacity2 argues that labour arbitrage is a central reason for businesses opting to outsource offshore. This drive for lower costs leads to the outsourcing question. That is, is it more cost effective or efficient, to undertake business activities within business hierarchies or is it cheaper to utilise markets (that is, outsource)? Essentially the economic problem becomes one of determining whether to assign internal organisational resources and responsibility to the activity or whether to take that service to the market. The final issue for business then becomes that of what exactly can be outsourced. This involves a determination of what is core and what is non-core and how best to structure the organisation through the use of markets to obtain a competitive advantage. Focus of the Study This study set about to explore the trends and development in Business Process Outsourcing (BPO) and Finance and Accounting Outsourcing (FAO) in the Asia Pacific Region. Research was conducted in Australia, Singapore, Malaysia, India, Hong Kong and China, primarily through a series of face-to-face interviews with major participants in the BPO/FAO industry. Businesses, advisories and vendors were approached in order to obtain a broad overview and analysis of the scope of BPO and FAO and the challenges trends and benefits of outsourcing. Findings/significant learning Outsourcing There is nothing new about either the idea or the practice of outsourcing. Zarella3 says that it is not new in Asia or elsewhere, as evidenced by the use of cleaners, security guards and auditors. As a phenomenon, outsourcing has a long history. In recent times globalisation, or the integration of national economies through the removal of artificial (government imposed) barriers, has led to new opportunities for business. Outsourcing has changed in response to globalisation and, in turn has shaped the practice of global businesses. Moreover, technological advances have enabled outsourcing to enter areas of business operation formerly thought to be immune from the outsourcing phenomenon. As a result business structures are changing markedly. Traditional organisational hierarchies are altering and adapting, labour skills sets changing and whole new industries forming. Indeed, a new business order is emerging that depends on cost arbitrage for its sustainability. The shape of businesses is changing and Business Process Outsourcing (BPO) is a huge factor contributing to this change. There are many business benefits that can be realised from applying and using BPO. However in order to realise the benefits, business must contend with, and surmount, many obstacles. Some of these obstacles are external in nature and arise from locality or geographic factors; others relate to technology and still others to relate to internal business factors. 1 Black, J (2002) Oxford Dictionary of Economics, OUP, New York, p69 Lacity, M (2005) Finding Success Offshore: An interview with Mary Lacity, from www.coinsight.com.au/article2/0,1540,1777105,00.asp 3 Zarella, E (2006) KPMG International/Economist Intelligence Unit Survey (Sept 2006), KPMG Advisory, p4 2 Moreover, technological advances have expanded the types of business services that can be outsourced and the physical location of the providers of those services4. The nature of Business Process Outsourcing (BPO) Business Process Outsourcing (BPO) is a term that captures a range of outsourced business processes including: Operations such as manufacturing, value-adding manufactures, design, merchandising and sourcing Administrative work including data entry Human resources including employee counselling, pensions, non-voice employee data management, training , travel and expenses management5 Finance and accounting (see below) Information technology (IT) data work, desktop outsourcing, enterprise outsourcing and network outsourcing (remotely hosted software applications)6 Managerial work (Knowledge Process Outsourcing, KPO) including financial analysis (‘analytics’), media outsourcing and pharmaceuticals7 Legal work including paralegal support (transcription, word processing and document management, legal support (drafting, proofreading, research and counsel) and patent services8 The nature of Finance and Accounting Outsourcing (FAO) Finance and Accounting Outsourcing (FAO) is a relatively recent form of outsourcing that has emerged in the BPO field. Put simply, FAO involves the outsourcing of business operations relating to the routine aspects involved in the finance and accounting function. Types of sourcing and the outsourcing matrix There are different ways that a business can arrange its structure or utilise markets in order to take advantage of cost. These options are shown in Table 1. The sourcing options Captive or in-house (Do-it-yourself) Non-captive (3rd Party) Use of the market or External providers/vendors On-shore Near shore Off shore BHP Billiton in Adelaide Unilever India using Capgemini in Bangalore, India Dairy Farm in Hong Kong using Capgemini BASF (pharmaceutical company) serving Asia Pac via a Sydney office receiving support from Kuala Lumpur China Mobile using Ericsson (Asia/Pacific) Hewlett Packard European operations for Proctor and Gamble in Barcelona Dell or Intel in Penang serving all Dell and Intel globally British Airways (UK) using WNS Global Services (Mumbai, India) General Motors using AT & T (Americas) Table 1 A summary of the different sourcing and outsourcing options with reference to examples 4 ibid Jamwal, A (2007) “Back (Office) to front”, in Mumbai Mirror, 23.4.07. p54 6 Peisley, K (2007) “IT Outsourcing: ready to rip”, Management Today, August 2007 p31 7 Leahy, J. (2006) “True extending of the law’s long arm”, Financial Times, 1.11.06 8 Nasscom quoted in Leahy, J. (2006) “True extending of the law’s long arm”, Financial Times, 1.11.06 5 The key players in the Business Process Outsourcing (BPO) space In the context of globalisation and rapid advances in technology, global businesses faced with fundamental profitability, and therefore cost, decisions are at a choice point. Typically there are two options that businesses are faced with, but both are premised on financial gains to be made from various forms of arbitrage. Both of the available options lead to significant reengineering opportunities. A huge and growing number of businesses are utilising BPO as a means by which they can manage their operations cost effectively. The BPO decision There are many considerations that have to be factored into the BPO decision. Businesses would typically ask the following questions and may seek the assistance of an advisory or broker to answer them, prior to making the decision: Whether to outsource or not. That is, is a business activity cheaper and more efficiently performed in-house (captive) or by the market (outsource)? If outsourcing is an option then which geographical location is favoured? Which vendor or service provider to use and what do they offer? How to manage the relocation in terms of governance, length of contract, KPIs and service levels? Whether to outsource or not? This decision essentially centres on cost, however many other factors come into the decision as will be seen later. There are four options available to businesses9: Option 1 Shared Services Centres (SSC) or captive centres This option requires that a business create an ‘in-house’ centre that performs work for multiple subsidiaries. That in-house centre may be on-shore near shore or offshore, but is wholly owned by the business. This option uses current organisational hierarchies and adapts them. The offshore approach may be favoured as a means of accessing a market that requires sourcing to be local10 (that is, entry into a market by stealth). Option 2 “Fee-for-service” This is a low risk, short term strategy that involves engaging a supplier for fixed services at a pre-determined price. It allows a business to test the BPO market prior to making the change. Option 3 Joint ventures Here the business works with a BPO provider who has particular expertise (for example, Capgemini undertaking the FAO work for Unilever), but the provider is free to supply to other businesses. An example of a provider working for other businesses in the same market is that of WNS Global Services whose original venture was with British Airways. They now do ticketing for 26 major airlines around the world11. Option 4 ‘build-operate-transfer’ – full BPO This option requires that a business outsource to external organisations utilising an offshoring approach. This option requires a high level of governance and contracts must 9 Lacity, M (2005) Finding Success Offshore: An interview with Mary Lacity, source: www.coinsight.com.au/article2/0,1540,1777514,00.asp 10 ibid 11 Interview with Smitha Gaikwad, Vice President, Corporate Communications, WNS Global Services (P) Ltd., Mumbai, India, 28.04.07 be framed around Service Level Agreements (SLAs) that stipulate targets for KPIs. Once the process has started as a ‘build and operate’ model very few businesses then seek ownership through a transfer inwards, thus moving the process from the market into the hierarchy. This is because of the problem of local knowledge or as Lacity12 puts it, “I don’t know who to call when the lights go out, and the Indian supplier does”. Which geographical location to opt for? There are several regions that are ‘hubs’ for BPO. These include: Central and Eastern Europe (CEE) Latin America (LatAm) Asia-Pacific (AsPac), and North America (NorAm) Each of these regions has particular features and characteristics that make them desirable locations for businesses seeking to make cost savings through various forms of arbitrage. Due to language factors the regions may be further sub-divided. Thus, for example the AsPac can be looked at in terms of South Asia and North Asia. Indeed this ‘NorthSouth’ divide cannot be overcome as China, Japan, Korea and Taiwan (North Asia) are very different culturally from Indonesia, Vietnam, Philippines, Malaysia and Singapore (South Asia)13. Moreover, even within this sub-classification the ‘characteristics vary so significantly from country to country’14 that the concept of averages does not hold much importance. Similarly, Latin American countries primarily speak Spanish or Portuguese. This works to the advantage of business processes that cater to the 380-million people who speak these languages throughout the world15. Important characteristics other than language include infrastructure development, labour costs, levels of education characterising the labour market, regulation and compliance costs, time zone, levels of technological adaptability16 (including communication connectivity17) and the capacity for labour migration18. Which vendor or service-provider? Having made a decision on the actual preferred location, the decision then centres on which provider or vendor to utilise. The vendors vary in size and vary in specialisation – some undertaking IT work others HR, FAO, LPO or BPO activities. This decision can depend on whom the vendor is already serving. For example, WNS Global Services in Mumbai is the preferred BPO vendor to airline companies, primarily based on their expertise in this particular field19. The actual management of the vendor-business relationship shall be explored later. How to manage the relocation? The migration of work, or the transfer from one location to another, requires some management. This issue can determine the initial success of the BPO experience for a business. So called ‘body-to-body’ migration (involving the transfer of some staff to the 12 12 Lacity, M (2005) Finding Success Offshore: An interview with Mary Lacity, source: www.coinsight.com.au/article2/0,1540,1777514,00.asp 13 Interview with Nalin Singh, Convergys, Singapore 18.04.07 14 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p8 15 Ibid, p4 16 A.T. Kearney’s 2004 Offshore Location Attractiveness Index 17 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p13 18 Interview with Lim Yen Suan, Executive Director and Head – Business Performance Services, KPMG, Singapore, 20.04.07 19 Interview with Smitha Gaikwad, Vice President, Corporate Communications, WNS Global Services (P) Ltd., Mumbai, India, 28.04.07 new vendor’s centre) can cause a short term duplication of services. However, some downsizing will accompany the relocation20. This requires some sensitivity in how management approach the change. Trends in outsourcing in the Asia-Pacific Region India is, by far, the preferred outsourcing location for global offshoring. This is true historically21 and also currently. There are many reasons for this. India’s rank on measures of offshore attractiveness is shown in Table 2. It ranks well ahead of any of the other top 25 locations in AT Kearney’s study. However, China, Malaysia and Singapore also rank in the top five22. Nation and Rank (125) Financial Structure23 /4 Business Environment24 /3 People Skills25 /3 Total /10 India (1) 3.72 1.31 2.09 7.12 China (2) Malaysia (3) Singapore (5) Vietnam (20) 3.32 3.09 1.47 3.65 0.93 1.77 2.63 0.70 1.36 0.73 1.36 0.35 5.61 5.59 5.46 4.70 Table 2 A summary of the ranking of key nations according to A T Kearney’s Offshore Attractiveness index (OAI) 2004 An indication of savings to be made on labour alone can be seen in Table 3. Once again, India ranks first. Nation Business Process Outsourcing (BPO) Average ($US per annum) Information Technology (IT) Average ($US per annum) India China Malaysia Singapore $7,779 $7,634 $16,935 $34,295 $9,896 $10,095 $21,823 $41,512 Table 3 Average Salaries of Key Offshore Destinations (2005) – BPO and ITO, Source: neoIT Offshore and Nearshore ITO/BPO Salary Report 2006 India Outsourcing was worth $US12bn in 2006, it having nearly half the global offshoring market. In India the sector has an annual growth rate of 50% and employs about 250,000 people. The sector attracts 250 new employees daily26. As can be seen from both Tables 2 and 3, India has numerous advantages over other destinations when it comes to outsourcing. Apart from a highly educated labour force, well developed infrastructure and regulation, India offers significant benefits arising from 20 Interview with PT Alexander, Capgemini in Bangalore, 1.5.07 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p4 22 The AT Kearney study ranked the top 25 nations in 2004. 23 A.T. Kearney’s 2004 Offshore Location Attractiveness Index, Characteristics of the financial structure include: tax and regulatory environment, infrastructure costs, compensation costs (wages) and exchange rates. 24 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, Characteristics of the business environment include: security of intellectual property (software piracy rate), culture adaptability, country infrastructure (incl. telecommunication and IT services), country risk (incl. economic and political) and geographic proximity. 25 A.T. Kearney’s 2004 Offshore Location Attractiveness Index, Characteristics of people skills include: cumulative business process experience and skills (BPO and IT skills), labour force availability, education and language, attrition rates, literacy rates and size of the labour market. 26 Capgemini/Indigo powerpoint slides and interview with PT Alexander 01.05.07, Bangalore, India 21 labour arbitrage. PT Alexander who runs the Capgemini centre in Bangalore believes that cost savings are in the order of 75 per cent27 by running BPO through India. Singh28 and others29 recognise that labour costs in India are rising quickly and that attrition rates are very high. Rising wage costs are often quoted as leading to an erosion of arbitrage and a reason as to why businesses are turning to Vietnam as an emerging destination. Indeed, Singh30 gives the following example: Indian employees receive a 20per cent wage increment per year on a base average annual salary of $US5,000 – thus costing an additional $US1,000 pa. US employees in the same industry receive a 4per cent wage increment per year on an average base salary of $US45,000 – thus costing an additional $US1,800pa. The gap has, he argues, widened. In terms of attrition, Indian BPO providers do experience a very high labour turnover rate31. However, as the supply of labour outstrips demand there is a constant inflow of highly trained graduates into the industry in India. India is a very attractive location despite rapidly rising wages reducing the comparative advantage and despite high labour attrition. According to Boston Consulting, the Indian outsourcing industry helps its clients to save $1.5bn annually32. Singapore Singapore is a financial hub that is geographically adjacent to both Indonesia and Malaysia, and very close to both Vietnam and the Philippines. Singapore’s main advantage, apart from excellent infrastructure and a very stable government, is its geographical location, ease of entry into, and movement out of, the nation, ease with which work permits are given out (assisting with labour migration)33 high levels of education and technology. Unlike the free market that operates with constraints on the free movement of labour across borders, the Singaporean government makes it very easy for labour to flow in and out. As a result it has become a financial hub. It is also a publishing hub with a high percentage of the world’s outsourced publishing being undertaken in Singapore. Indeed, even India outsources publishing to Singapore34. Malaysia Malaysia benefits from its proximity to Indonesia, Singapore and the Philippines. Malaysia has one of the most developed infrastructures amongst the new industrialised countries of Asia35. Average BPO salaries are in the order of $US17,000 - lower than Singapore, but higher than India and the Philippines36. Thus there has been a net migration of jobs offshore from Australia to Malaysia, and net migration from the Philippines to Malaysia. In Malaysia, PWC estimates that cost reductions are in the order of 20-30 per cent37. Hong Kong 27 Interview with PT Alexander 01.05.07, Bangalore, India Interview with Nalin Singh, President, Convergys, Singapore, 18.04.07 29 Interview with Smitha Gaikwad, Vice President, Corporate Communications, WNS Global Services (P) Ltd., Mumbai, India, 28.04.07 30 Interview with Nalin Singh, President, Convergys, Singapore, 18.04.07 31 Interview with Smitha Gaikwad, Vice President, Corporate Communications, WNS Global Services (P) Ltd., Mumbai, India, 28.04.07 32 Jamwal, A (2007) “Back (Office) to front”, in Mumbai Mirror, 23.4.07. p54 33 Interview with Nalin Singh, President, Convergys, Singapore, 18.04.07 34 Interview with , Desmond Chan, Marketing Manager Craft Print, Singapore, 20.04.07 35 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p37 36 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p37 37 Interview with Carmen Tang, PWC in Kuala Lumpur, 10.5.07 28 Offshoring is not largely prevalent in Hong Kong for various reasons, mainly historical and cultural38. Hong Kong has not been listed in the top 25 locations in AT Kearney studies of offshoring. Hong Kong is one of the most advanced cities in the world, enjoying excellent communications and transport infrastructure. Wage and rental rates are high – thus benefits from arbitrage are unlikely. Nevertheless, Capgemini in Hong Kong is an FAO vendor for Dairy Farm – a subsidiary of the global business Jardine Matheson. Moreover, Hong Kong has undertaken contact centre work in the past; however the trend has been for this to shift offshore to Guangzhou in China39. China China has a high literacy rate of 91 per cent and hiring conditions are easier in China than in other nations in the Asia Pacific40. It also has a fairly well developed infrastructure, although prior to 2005 there were acute power shortages41. Average BPO salaries are about $US7,634 pa – close to the Indian average BPO salary of $US7,779pa42. Dalian in the north of China, and Guangzhou in the south are the main offshoring hubs within China. Both of these locations are experiencing massive growth and investment in infrastructure. The benefits that are associated with use of BPO and FAO BPO and FAO deliver significant benefits to business. Some of these benefits include: Simplification43 Efficiency and cost savings44,45,46 Increased process capability47 Accountabilities and ‘due diligence’48 Access to skills and resources/services lacking in-house49,50 Focus on core business/competencies51,52 Strategic benefits53 Improved in-house performance54 Forging of strategic partnership with vendor55 Challenges facing BPO (and FA) in the region Whilst there are clear financial and hierarchical benefits from utilising BPO and FAO as business strategy, there are also numerous challenges that must be managed by businesses that undertake outsourcing. These challenges include: Language and language training Payback periods for use of BPO vendors 38 Interview with Allan Jackson, Senior Manager Outsourcing Services, Capgemini Business Services (Asia) Ltd, North Point, Hong Kong, 17.05.07 39 Enterprise Innovation Report by Shivanu Shukla in www.enterpriseinnovation.net/popup_article.php?cat1=6&id=335 40 KPMG Advisory (India) and NASSCOM Joint Report: Emerging Destinations, April 2007, p34 41 ibid p35 42 ibid p35 43 Interview with PT Alexander, Capgemini in Bangalore, 1.5.07 44 ibid 45 Peisley, K (2007) “IT Outsourcing: ready to rip”, Management Today, August 2007, p31 46 KPMG International/Economist Intelligence Unit Survey (Sept 2006), KPMG Advisory, p7 47 Interview with PT Alexander, Capgemini in Bangalore, 1.5.07 48 Interview with Carmen Tang, PWC in Kuala Lumpur, 10.5.07 49 Peisley, K (2007) “IT Outsourcing: ready to rip”, Management Today, August 2007 p31 50 KPMG International/Economist Intelligence Unit Survey (Sept 2006), KPMG Advisory, p7 51 Peisley, K (2007) “IT Outsourcing: ready to rip”, Management Today, August 2007 p31 52 KPMG International/Economist Intelligence Unit Survey (Sept 2006), KPMG Advisory, p7 53 Peisley, K (2007) “IT Outsourcing: ready to rip”, Management Today, August 2007 p31 54 KPMG International/Economist Intelligence Unit Survey (Sept 2006), KPMG Advisory, p7 55 ibid Communication through the life of BPO vendor contracts Bureaucracy and the change from a hierarchy to the market Business culture, knowledge transfer and change Losses of arbitrage arising from wage inflation IT platforms and IT support Constraints arising from a requirement for work permits/work visas Overall governance How businesses are adjusting to the challenges facing successful implementation of BPO and FAO The BPO industry has been around for about fifteen years. In the first ten years many global businesses made outsourcing decisions on the basis of perceptions about cost savings alone. Typically, such decisions were framed initially around assessments about whether to operate a captive shared services centre (SSC) or whether to outsource (BPO and FAO). As the industry has matured many business issues have been settled. This means that problems arising with respect to governance and contracting, language difficulties, technological change, bureaucratic change and other issues addressed earlier have all been identified and are negotiated in vendor-business agreements. The reduction in length of contracts is primarily to ensure that issues arising can be addressed earlier in the life of a BPO arrangement. Conclusion Whilst BPO has been a business phenomenon for over 15 years, the industry is still growing rapidly. National and regional characteristics are enabling businesses to realise significant gains from arbitrage. Technological and infrastructure improvements are ensuring that the BPO field is continuing to develop and expand into non-traditionally outsourced business activities. The use of BPO has, and continues to redefine the shape of businesses as we have known them. Evolving in the past fifteen years from BPO, outsourcing has expanded to include FAO, IT Outsourcing (ITO), Knowledge Process Outsourcing (KPO)56 and Legal Process Outsourcing (LPO). This phenomenon has changed the shape of business and with increasing global integration and rapid technological and communications advances shall be a significant factor in global businesses management for the foreseeable future. Implications for the teaching of Economics, Business Studies and Commerce The advent of BPO has significant implications for the teaching of Economics, Business Studies and Commerce. Each of these subject areas will be addressed in turn: Economics BPO raises a number of issues of relevance to the teaching of Economics. A study of comparative advantage and specialisation should include a close study of advantages arising as a result of differences in characteristics of labour markets. This would include an analysis of educational levels. In addition, comparative advantage analysis would need to include an assessment of national infrastructure including telephony, internet coverage, transport and electricity. Other important areas for Economics includes an 56 KPO involves a large range of knowledge processes and includes contracting out research and development functions and specialized projects such as DNA sequencing, and engineering services, as well as Legal Process Outsourcing (LPO). assessment of FDI and its particular use for organisational change in firms realising advantages from various forms of arbitrage. A study of regionalism is crucial and a close assessment of the nature of the trends in Central and Eastern Europe, Latin America, North and South Asia with respect to BPO will give insight into how MNCs and utilising WTO agreements, bilateral and multilateral trade agreements to advantage. Business Studies BPO has gone largely ignored in studies of Business despite its being a major global phenomenon affecting businesses nationally and globally. The study of management needs to be centred on the complexity of global structures and the changing global arrangements with respect to the outsourcing and contracting of accountability via SLAs. Simplistic notions of business hierarchy and flat structures are very outdated. Moreover, the factors driving BPO decisions (which can be very complex) tend to have been construed as largely financial and could be studied from this perspective. The effects on marketing and branding are crucial when in comes to BPO. Branding cannot be outsourced, thus while much can be taken offshore a focus on branding is left onshore and could be analysed as a trend affecting marketing practices globally. Employment relations is an area strongly affected by BPO and structural changes to labour markets need to be addressed from both a domestic worker perspective and from the perspective of management seeking to lead global business that used BPO. Any perceptive study of global business needs to demonstrate an awareness and deep understanding of the Asian region generally and individual nations specifically. Notions of ‘Asia’ are very simplistic and ignore major differences between even neighbouring States such as Singapore, Malaysia, Philippines, Indonesia and Vietnam. Business Studies should include a strong analysis of the Asia Pacific region and business trends, national trends and issues arising there from for Australian enterprises. Commerce Commerce can also be taught from a perspective of understanding the BPO phenomenon. Topics such as e-commerce, travel and global links are all directly relevant to references to aspects of BPO. References Jamwal, A (2007) Back (Office) to front, Mumbai Mirror, Mumbai India 23.4.07 p 54 Peisley, K (2007), IT Outsourcing: ready to rip, Management Today, Australian Institute of Management, Sydney, Australia Udhas, P., et al (2007), Emerging Destinations for Indian IT/ITES Industry, KPMG Advisory Services, Mumbai, India Zarella, E and Udhas, P, and others (2007), Strategic evolution: A global survey on sourcing today, KPMG IT Advisory, Mumbai, India Zarella, E., et al (2006), Asian outsourcing: the next wave. A report written in co-operation with the Economist Intelligence Unit, KPMG International and Economist Intelligence Unit, Sydney, Australia Zavieri, A. and Udhas, P (2006), Sourcing – the trusted frontier, KPMG Sourcing Advisory Services, Mumbai, India Publications (no author given) KPMG (2007), Sourcing Advisory Services, KPMG, Sydney, Australia KPMG (2006), Sourcing Lifecycle, KMPG Sourcing Advisory Services, Mumbai, India Accenture (2006), The Australian CFO Agenda: Setting off towards High Performance Finance, Sydney, Australia Endnote A much fuller account of the academic aspects and findings of this study (including case studies, teacher worksheets and student materials) are available from: www.businessprocessoutsourcing.com.au Or by contacting the Author: Mohan Dhall, PLC Sydney Extension Centre, Boundary Road, Croydon, NSW 2132