SOLUTIONS TO EXERCISES

Exercise 2-1

a.

b.

c.

d.

e.

f.

The owner invested $3,200 cash in the business.

Paid the rent for the current month, $435.

Received and paid the advertising bill, $98.

Bought supplies on account, $280.

Received and paid the bill for a miscellaneous expense, $75.

The owner invested personal equipment with a fair market value of $3,720 in the

business.

g. Bought equipment for $1,835, paying $900 in cash and placing the balance on

account.

h. Sold services on account, $615.

i. Received and paid the utility bill, $92.

j. The owner withdrew $325 in cash for personal use.

k. Sold services for cash, $1,025.

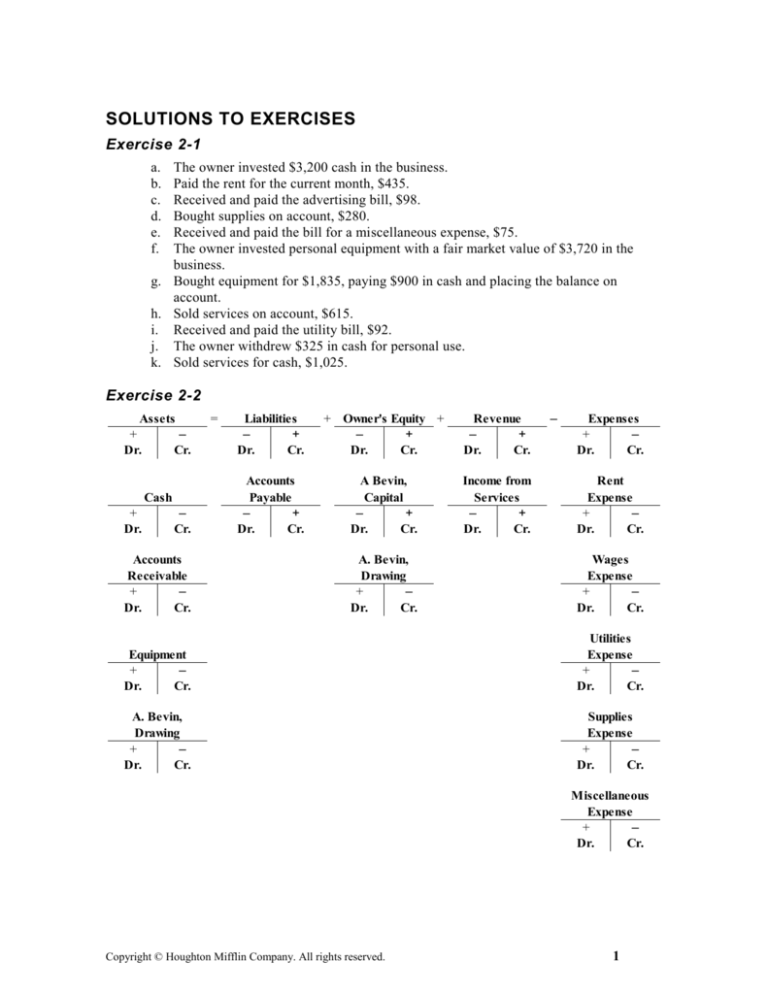

Exercise 2-2

Assets

+

–

Dr.

Cr.

Cash

+

Dr.

–

Cr.

Accounts

Receivable

+

–

Dr.

Cr.

=

Liabilities

–

+

Dr.

Cr.

+ Owner's Equity +

–

+

Dr.

Cr.

Revenue

–

+

Dr.

Cr.

Accounts

Payable

–

+

Dr.

Cr.

A Bevin,

Capital

–

+

Dr.

Cr.

Income from

Services

–

+

Dr.

Cr.

A. Bevin,

Drawing

+

–

Dr.

Cr.

–

Expenses

+

–

Dr.

Cr.

Rent

Expense

+

–

Dr.

Cr.

Wages

Expense

+

–

Dr.

Cr.

Equipment

+

–

Dr.

Cr.

Utilities

Expense

+

–

Dr.

Cr.

A. Bevin,

Drawing

+

–

Dr.

Cr.

Supplies

Expense

+

–

Dr.

Cr.

Miscellaneous

Expense

+

–

Dr.

Cr.

Copyright © Houghton Mifflin Company. All rights reserved.

1

Exercise 2-3

a.

b.

c.

d.

e.

Utilities

Expense

+

–

Dr.

Cr.

81

Supplies

Expense

+

–

Dr.

Cr.

234

Prepaid

Insurance

+

–

Dr.

Cr.

420

Accounts

Payable

–

+

Dr.

Cr.

537

Utilities

Expense

+

–

Dr.

Cr.

86

Cash

f.

–

Cr.

81

+

Dr.

Accounts

Payable

–

+

Dr.

Cr.

234

Cash

h.

–

Cr.

420

+

Dr.

Cash

+

Dr.

g.

i.

–

Cr.

537

Accounts

Receivable

+

–

Dr.

Cr.

875

Truck

Expense

+

–

Dr.

Cr.

129

Cash

+

–

Dr.

Cr.

936

R. Carter,

Drawing

+

–

Dr.

Cr.

400

Income from

Services

–

+

Dr.

Cr.

875

Cash

–

Cr.

129

+

Dr.

Accounts

Receivable

+

–

Dr.

Cr.

936

Cash

+

Dr.

–

Cr.

400

Cash

+

Dr.

–

Cr.

86

Exercise 2-4

0.

1.

2.

3.

4.

5.

6.

7.

8.

9.

Normal

Account

Classification

Increase Side

Decrease Side

Balance Side

Cash ................................. A........................ Debit ................... Credit ................. Debit

Wages Expense ................. E ........................ Debit .................. Credit ................. Debit

Equipment ........................ A........................ Debit .................. Credit ................. Debit

J. Roe, Capital ................. OE ..................... Credit ................. Debit .................. Credit

Service Revenue ............... R........................ Credit ................. Debit .................. Credit

J. Roe, Drawing ............... OE ..................... Debit .................. Credit ................. Debit

Accounts Receivable ........ A........................ Debit .................. Credit ................. Debit

Rent Expense .................... E ........................ Debit .................. Credit ................. Debit

Fees Earned ..................... R........................ Credit ................. Debit .................. Credit

Accounts Payable ............. L ........................ Credit ................. Debit .................. Credit

Copyright © Houghton Mifflin Company. All rights reserved.

2

Exercise 2-5

At Your Service

Trial Balance

December 31, 20 —

ACCOUNT NAME

Cash

Accounts Receivable

Prepaid Insurance

Equipment

Accounts Payable

L. Mas, Capital

L. Mas, Drawing

Income from Services

Rent Expense

Supplies Expense

Utilities Expense

Wages Expense

DEBIT

CREDIT

3,300.00

9,500.00

1,400.00

26,000.00

8,600.00

26,600.00

1,800.00

33,000.00

3,600.00

1,700.00

3,500.00

17,400.00

68,200.00

68,200.00

Exercise 2-6

Ace Modeling Agency

Trial Balance

March 31, 20—

ACCOUNT NAME

Cash

Accounts Receivable

Office Furniture

Office Equipment

Accounts Payable

R. Ralston, Capital

R. Ralston, Drawing

Modeling Fees

Salary Expense

Rent Expense

Utilities Expense

Supplies Expense

Copyright © Houghton Mifflin Company. All rights reserved.

DEBIT

CREDIT

16,455.00

2,600.00

350.00

2,800.00

2,882.00

8,100.00

2,200.00

18,680.00

3,400.00

1,600.00

175.00

82.00

29,662.00

29,662.00

3

Exercise 2-6 (concluded)

Ace Modeling Agency

Income Statement

For Month Ended March 31, 20—

Revenue:

Modeling Fees

Expenses:

Salary Expense

Rent Expense

Utilities Expense

Supplies Expense

Total Expenses

Net Income

$18,680.00

$3,400.00

1,600.00

175.00

82.00

5,257.00

$13,423.00

Ace Modeling Agency

Statement of Owner's Equity

For Month Ended March 31, 20 —

R. Ralston, Capital, March 1, 20—

Investment during March

Net Income for March

Subtotal

Less Withdrawals for March

Increase in Capital

R. Ralston, Capital, March 31, 20—

$

0.00

$ 8,100.00

13,423.00

$21,523.00

2,200.00

19,323.00

$19,323.00

Ace Modeling Agency

Balance Sheet

March 31, 20—

Assets

Cash

Accounts Receivable

Office Furniture

Office Equipment

Total Assets

$16,455.00

2,600.00

350.00

2,800.00

$22,205.00

Liabilities

Accounts Payable

$ 2,882.00

Owner's Equity

R. Ralston, Capital

Total Liabilities and Owner's Equity

19,323.00

$22,205.00

Copyright © Houghton Mifflin Company. All rights reserved.

4

Exercise 2-7

Amount of

Difference

Debit or Credit Column

of Trial Balance

Understated or Overstated

0. Example: A $149 debit to Accounts Receivable

was not recorded.

$149 ... Debit column understated

a. A $32 debit to Supplies Expense was recorded as $320. 288 ... Debit column overstated

b. A $255 debit to Accounts Payable was recorded twice. 255 ... Credit column overstated

c. A $79 debit to Prepaid Insurance was not recorded.

79 ... Debit column understated

d. A $63 credit to Cash was not recorded.

63 ... Debit column overstated

e. A $180 debit to Equipment was recorded twice.

180 ... Debit column overstated

f. A $54 debit to Utilities Expense was recorded as $45.

9 ... Debit column understated

Exercise 2-8

a. Equal totals in the trial balance because $28 was debited to Office Equipment and $28

was credited to Cash. The effect is that Office Equipment is understated by $252 and

Cash is overstated by $252.

b. Equal totals in the trial balance because $160 was debited to Accounts Receivable and

$160 was credited to Cash. The effect is that the $160 should have been debited to Accounts Payable, not Accounts Receivable, and so Accounts Receivable is overstated by

$160 and Accounts Payable is overstated by $160.

c. Equal totals in the trial balance because $105 was debited to Equipment and $105 was

credited to Cash. The effect is that the $105 should have been debited to Supplies Expense, not Equipment, and so Equipment is overstated by $105 and Supplies Expense is

understated by $105.

d. Unequal totals in the trial balance because $96 was debited correctly to Accounts Payable

but the credit to cash was transposed as $69. The effect is that Cash is overstated by $27.

Copyright © Houghton Mifflin Company. All rights reserved.

5