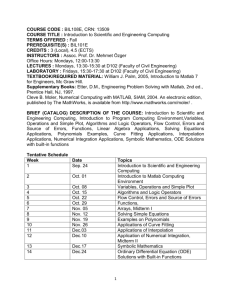

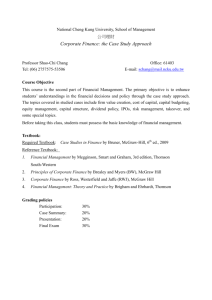

Syllabus

advertisement

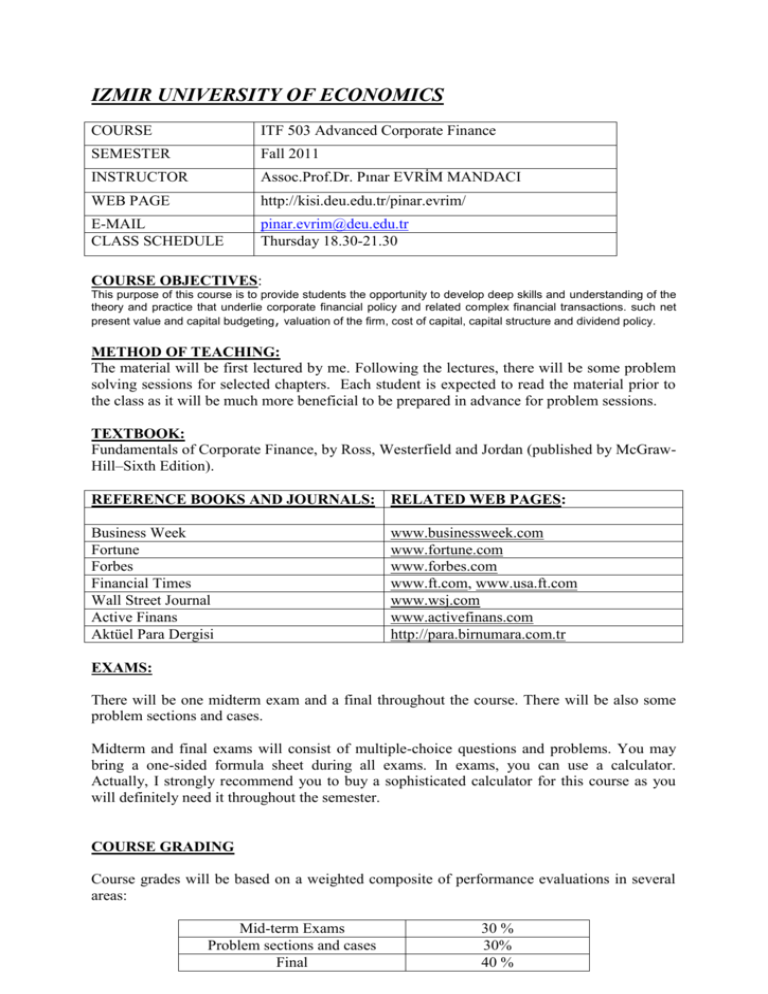

IZMIR UNIVERSITY OF ECONOMICS COURSE ITF 503 Advanced Corporate Finance SEMESTER Fall 2011 INSTRUCTOR Assoc.Prof.Dr. Pınar EVRİM MANDACI WEB PAGE http://kisi.deu.edu.tr/pinar.evrim/ E-MAIL CLASS SCHEDULE pinar.evrim@deu.edu.tr Thursday 18.30-21.30 COURSE OBJECTIVES: This purpose of this course is to provide students the opportunity to develop deep skills and understanding of the theory and practice that underlie corporate financial policy and related complex financial transactions. such net present value and capital budgeting, valuation of the firm, cost of capital, capital structure and dividend policy. METHOD OF TEACHING: The material will be first lectured by me. Following the lectures, there will be some problem solving sessions for selected chapters. Each student is expected to read the material prior to the class as it will be much more beneficial to be prepared in advance for problem sessions. TEXTBOOK: Fundamentals of Corporate Finance, by Ross, Westerfield and Jordan (published by McGrawHill–Sixth Edition). REFERENCE BOOKS AND JOURNALS: RELATED WEB PAGES: Business Week Fortune Forbes Financial Times Wall Street Journal Active Finans Aktüel Para Dergisi www.businessweek.com www.fortune.com www.forbes.com www.ft.com, www.usa.ft.com www.wsj.com www.activefinans.com http://para.birnumara.com.tr EXAMS: There will be one midterm exam and a final throughout the course. There will be also some problem sections and cases. Midterm and final exams will consist of multiple-choice questions and problems. You may bring a one-sided formula sheet during all exams. In exams, you can use a calculator. Actually, I strongly recommend you to buy a sophisticated calculator for this course as you will definitely need it throughout the semester. COURSE GRADING Course grades will be based on a weighted composite of performance evaluations in several areas: Mid-term Exams Problem sections and cases Final 30 % 30% 40 % PERCENT 90-100 85-89 80-84 75-79 70-74 65-69 60-64 50-59 49 AND BELOW GRADE 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 AA BA BB CB CC DC DD FD FF COURSE OUTLINE: CHAPTER Sep. 29,2011 Oct. 6,2011 Oct. 13,2011 7 8 Oct. 20,2011 9 Oct. 27,2011 Nov. 3,2011 Nov. 17,2011 Nov. 24,2011 Dec. 1,2011 Dec. 8,2011 Dec. 15,2011 Dec 22,2011 Dec 29,2011 10 Jan 5, 2012 18 11 15 16 17 TOPIC Introduction Interest Rates and Bond Valuation Stock Valuation Problem section and case solution Net Present Value and Other Investment Criteria Making Capital Investment Decisions Problem section and case solution Project Analysis and Evaluation Problem section and case solution Midterm Cost of Capital Raising Capital Problem section and case solution Financial Leverage and Capital Structure Policy Dividend and Dividend Policy Problem section and case solution Final Exam The above syllabus is tentative and can be changed by the instructor at any time. The student is supposed to be aware of the facts written on the syllabus and should keep a track of changes in the course conduct throughout the semester.