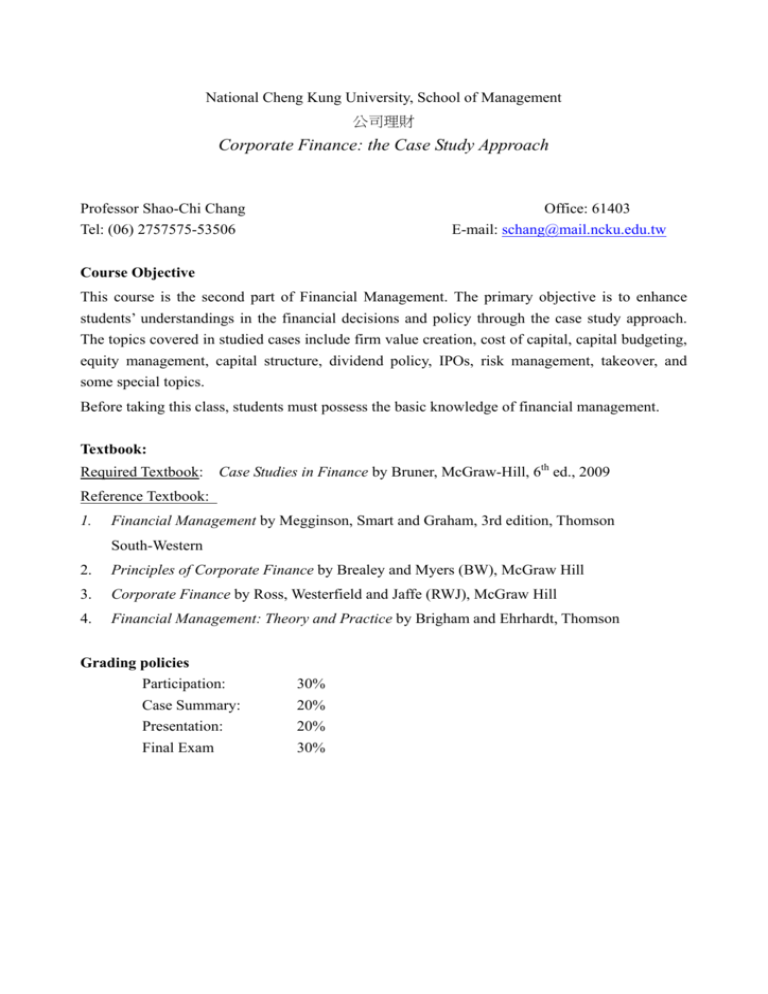

Corporate Finance: the Case Study Approach

advertisement

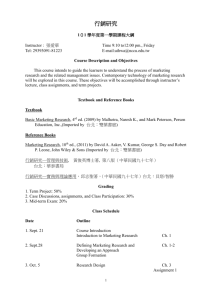

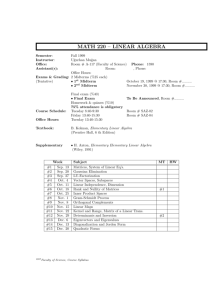

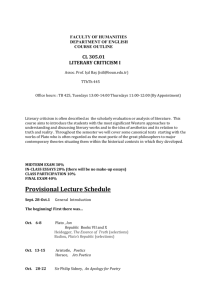

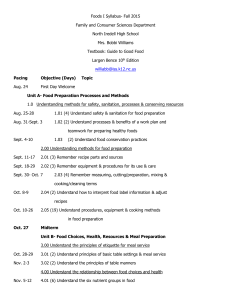

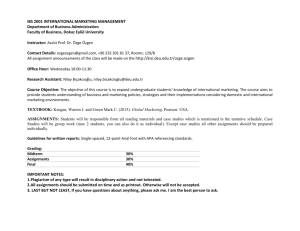

National Cheng Kung University, School of Management 公司理財 Corporate Finance: the Case Study Approach Professor Shao-Chi Chang Tel: (06) 2757575-53506 Office: 61403 E-mail: schang@mail.ncku.edu.tw Course Objective This course is the second part of Financial Management. The primary objective is to enhance students’ understandings in the financial decisions and policy through the case study approach. The topics covered in studied cases include firm value creation, cost of capital, capital budgeting, equity management, capital structure, dividend policy, IPOs, risk management, takeover, and some special topics. Before taking this class, students must possess the basic knowledge of financial management. Textbook: Required Textbook: Case Studies in Finance by Bruner, McGraw-Hill, 6th ed., 2009 Reference Textbook: 1. Financial Management by Megginson, Smart and Graham, 3rd edition, Thomson South-Western 2. Principles of Corporate Finance by Brealey and Myers (BW), McGraw Hill 3. Corporate Finance by Ross, Westerfield and Jaffe (RWJ), McGraw Hill 4. Financial Management: Theory and Practice by Brigham and Ehrhardt, Thomson Grading policies Participation: Case Summary: Presentation: Final Exam 30% 20% 20% 30% Course Structure There will be about 10 cases in this course. Each case will be presented by one group. The presenting group have to upload the presentation ppt file to MOODLE e‐learning webpage one day before the class meeting. All other students should download the presentation files from the website before the class meetings, and are expected to ask questions after each presentation. Students are required to read cases before class and summarize the issues in one page. Students are required to submit each assignment in the beginning of each class. Any late submission will not be graded. Members of the presenting group do not have to submit the one‐page summary Individual Term Paper Each group needs to write a case that is related to the cases discussed in this class. The details will be given in class meetings. The due date of the term paper is the end of semester. Other Requirements Students are expected to attend classes on time. Any late attending or early leaving will affect your participation grade. It is very possible to hand out some materials in class meetings. If you miss any class, you will not be given any make‐up lecture and the class materials. You are responsible to make up everything by yourself. Cellular phone and pager are supposed to be off or at lease be in “vibrate” mode during class meetings. Students are expected to check class website regularly. Any change or announcement about the classes will be posted on the website. * The syllabus is subjective to change, which will be announced by instructor. Class Schedule This will be finalized in the second week. Group Week/Date Topic Case Reading W1/Sep 20 Introduction W2/Sep 27 Value Creation Case preparation ;Case 3 W3/Oct 4 Case 1; G1; W4/Oct 11 Case 4 G2 W5/Oct 18 Cost of Capital and Capital Budgeting Case 14 (CC & EVA) G3 Case 16 (project risk‐return) G4 Whirlpool Europe G5 Case 27 (early stage financing) G6 W6/Oct 25 W7/Nov 1 Presentation W8/Nov 8 Capital Structure W9/Nov 15 W10/Nov 22 Dividend Policy Case 25 G7 W11/Nov 29 IPO Netscape IPO G1 W12/Dec 6 Case 26 G2 W13/Dec 13 Term Project Presentation W14/Dec 20 Risk Management Case 36 (currency) G3 W15/Dec 27 Case 39 (convertible bond) G4 W16/Jan 3 Takeovers Case 33 (financing) G5 W17/Jan 10 Case 45 (valuation) G6 W18/Jan 17 Case 43 (negotiation) G7 W19/Jan 24 Term Project Due Ford’s VEP