Chapter 5

advertisement

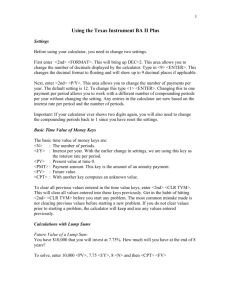

PAGE 1 CHAPTER 5 TIME VALUE OF MONEY (TVM) 1. 2. 3. 4. 5. 6. 7. 8. WHY TIME VALUE OF MONEY IS IMPORTANT? LUMPSUM VS ANNUITY ORDINARY ANNUITY VS ANNUITY DUE SIMPLE INTEREST VS COMPOUND INTEREST TIME LINE TO SHOW TVM PROBLEMS FUTURE VALUE OF A LUMP SUM (FV) PRESENT VALUE OF A LUMP SUM (PV) FINDING INTEREST RATE GIVEN PV AND FV OF A LUMPSUM 9. FUTURE VALUE OF AN ANNUITY (FVA) 10. PRESENT VALUE OF AN ANNUITY (PVA) 11. FINDING INTEREST RATES AND PAYMENTS GIVEN FVA OR PVA 12. PRESENT VALUE OF A PERPETUITY 13. FV (PV) OF ANNUITY VS FV (PV) OF ANNUITY DUE 14. INTRA-YEAR COMPOUNDING IN FV, PV, FVA, PVA 15. NOMINAL VS EFFECTIVE INTEREST RATES 16. MIXED CASH FLOWS PAGE 2 DISCUSSION OF TIME VALUE OF MONEY TOPICS 1. WHY TIME VALUE OF MONEY IS IMPORTANT IN MAKING FINANCIAL DECISIONS, THE DECISION MAKER ENCOUNTERS ALTERNATIVES WITH CASHFLOWS DIFFERING IN AMOUNT, TIMING AND RISKINESS. TO BE ABLE TO COMPARE THESE ALTERNATIVES, THERE IS A NEED TO BRING THE CASHFLOWS TO A COMMON BASE FOR COMPARISON. TIME VALUE OF MONEY MODELS ENABLE US TO ACCOMPLISH THIS. IN FINANCE, THE RECEIPT OR PAYMENT OF MONEY IS REFERRED TO AS CASHFLOWS. CASSH INFLOW IS MONEY COMING IN OR RECEIPT OF MONEY (SHOWN WITH A + SIGN) AND CASH OUTFLOW IS IS MONEY GOING OUT OR PAYMENT OF MONEY (SHOWN WITH A NEGATIVE SIGN) 2. LUMPSUM VS ANNUITY CASHFLOWS IN REAL LIFE CAN BE VARYING. IN ADDITION TO THEIR AMOUNTS, CASHFLOWS CAN DIFFER IN THE MANNER OF THEIR OCCURRENCE. A LUMPSUM IS A CASHFLOW OCCURRING AT A PARTICULAR TIME ONLY IN THAT AMOUNT. E.G. DEPOSITING $100 IN A SAVINGS ACCOUNT TODAY IS AN EXAMPLE OF A LUMPSUM (NOW, PRESENT VALUE). EXPECTING TO RECEIVE $100 A YEAR FROM NOW IS AN EXAMPLE OF A LUMPSUM (LATER COMPARED TO NOW, FUTURE VALUE) AN ANNUITY IS MORE THAN ONE LUMPSUM (EQUAL IN AMOUNT) OCCURRING WITHOUT INTERRUPTION. E.G. EXPECTING TO DEPOSIT OR RECEIVE $100 SUCCESSIVELY A CERTAIN NUMBER OF TIMES WITHOUT INTERRUPTION. PAGE 3 3. ORDINARY ANNUITY VS ANNUITY DUE IF THE CASHFLOWS OF AN ANNUITY WERE TO OCCUR AT THE END OF EACH PERIOD, IT IS CALLED AN ORDINARY ANNUITY OR DEFERRED ANNUITY OR SIMPLY ANNUITY. E.G. $1,000 TO BE RECEIVED AS SALARY AT THE END OF EACH MONTH FOR 12 MONTHS. IF THE CASHFLOWS OF AN ANNUITY WERE TO OCCUR AT THE BEGINNING OF EACH PERIOD, IT IS CALLED AN ANNUITY DUE. E.G. PAYING $500 RENT AT THE BEGINNING OF EACH MONTH FOR 12 MONTHS. 4. SIMPLE INTEREST VS COMPOUNT INTEREST WHENEVER AN INVESTMENT IS MADE (EITHER AS A LOAN OR SOME OTHER TYPE) INTEREST OR RETURN IS REQUIRED AT SOME PRESPECIFIED NOMINAL RATE CORRESPONDING TO THE LEVEL OF RISK PERCEIVED IN THE INVESTMENT. IF INTEREST (RETURN) WERE TO BE COMPUTED ONLY ON THE ORIGINAL INVESTMENT EACH PERIOD, IT WOULD BE SIMPLE INTEREST. IF INTEREST (RETURN) WERE TO BE COMPUTRD NOT ONLY ON THE ORIGINAL INVESTMENT EACH PERIOD, BUT ALSO ON THE RETURN FOR EACH PERIOD, IT WOULD BE COMPOUND INTEREST. EXAMPLE: A LOAN OF $1,000 IS MADE FOR 2 YEARS. THE INTEREST RATE IS 10% THE LOAN AND INTEREST WILL BE PAID AT THE END OF 2YEARS. IF THE INTEREST IS SIMPLE INTEREST, THE INTEREST ON $1,000 AT 10% FOR THE 1ST YEAR IS 1000*.1 OR $100. THE INTEREST ON $1000 AT 10% FOR THE 2ND YEAR IS 1000*.1 OR $100. AT THE END OF 2 YEARS THE LOAN PLUS THE SIMPLE INTEREST WOULD BE $1,000 + $100 + $100 OR $1,200 IF THE INTEREST IS COMPOUND INTEREST, COMPOUNDED ANNUALLY, I.E., INTEREST IS PAID ON THE AMOUNT OUTSTANDING AT THE BEGINNING OF A YEAR IS PAID AT THE END OF THE YEAR, THE INTEREST ON $1,000 AT 10% FOR THE 1ST YEAR IS 1000*.1 OR $100. THE AMOUNT OUTSTANDING FOR THE 2ND YEAR WILL BE THE ORIGINAL $1,000 AND THE INTEREST $100 FOR THE 1ST YEAR OR $1,100. FOR THE 2ND YEAR INTEREST HAS TO BE PAID ON $1,100, I.E., PAGE 4 ON THE ORIGINAL INVESTMENT OF $1,000 AND ON THE $100 INTEREST FOR THE 1ST YEAR. THE INTEREST FOR THE 2ND YEAR WILL BE 1,100*.1 OR $110 ($100 ON THE LOAN AND $10 ON THE 1ST YEAR’S INTEREST). THE TOTAL AMOUNT TO BE PAID AT THE END OF 2 YEARS WOULD BE $1,210 ($1,000 + $100 + $100 + $10). IT IS SEN THAT THE COMPOUND INTEREST OF $210 IS MORE THAN THE SIMPLE INTEREST OF $200! SINCE INVESTORS PREFER TO RECEIVE MORE INTEREST AS OPPOSED TO LESS INTEREST, MOST SITUATIONS INVOLVE OMPOUND INTEREST. THEREFORE IN TIME VALUE OF MONEY COMPUTATIONS COMPOUND INTEREST WILL BE ASSUMED, UNLESS OTHERWISE STATED. ANNUAL COMPOUNDING/DISCOUNTING IS WHEN INTEREST IS PAID/ RECEIVED ONCE EVERY YEAR AT THE END OF THE YEAR ON THE AMOUNT OUTSTANDING AT THE BEGINNING OF THE YEAR. INTRA-YEAR COMPOUNDING/DISCOUNTING IS WHEN INTEREST IS COMPOUNDED/DISCOUNTED WITHIN THE YEAR, I.E., EVERY SIX MONTHS (SEMIANNUALLY), EVERY 3 MONTHS (QUARTERLY), EVERY MONTH (MONTHLY) ETC. WE WILL INITIALLY STUDY ANNUAL COMPOUNDING/ DISCOUNTING. ONCE WE HAVE UNDERSTOOD THIS, INTRAYEAR COMPOUNDING / DISCOUNTING WILL FOLLOW EASILY (TOPIC 14). 5. TIME LINE TO SHOW TVM PROBLEMS A TIME LINE IS A GRAPHICAL DESCRIPTION OF CASH FLOWS AND THEIR TIMING. THE RISKINESS MAY BE CAPTURED BY GIVING THE NOMINAL INTEREST RATE. i OR k = 10% _____ ._______._______.______.______.______.______._________. 0 1 2 3 4 5 6………t…N= 10YEARS -$100 THE ABOVE TIME LINE SHOWS A LUMPSUM CASH OUTFLOW OF $100 (LOAN OR INVESTMENT) AT TIME ZERO (NOW) FOR N (10 YEARS) AT 10%, COMPOUNDED ANNUALLY PAGE 5 i OR k = 10% _____ ._______._______.______.______.______.______._________. 0 1 2 3 4 5 6………t…N= 10YEARS +$1,000 THE ABOVE TIME LINE SHOWS A LUMPSUM CASH INTFLOW OF $1000 AT A FUTURE TIME N (10 YEARS) AT 10%, COMPOUNDED ANNUALLY. -$1000 $-1000 $-1000…………………………. -$1000……..-$1000 _____ ._______._______.______.______.______.______._________. 0 1 2 3 4 5 6………t…N= 10YEARS THE ABOVE TIME LINE SHOWS AN ORDINARY ANNUITY (OUTFLOW) OF $1000 AT THE END OF EACH YEAR FOR 10 YEARS COMPOUNDED ANNUALLY AT 10%,. TOPICS 6 THRU 16 WILL BE DISCUSSED USING PROBLEMS ON THE HANDOUT FOR CHAPTER 5 ON MY WEBSITE. PAGE 6 TIME VALUE OF MONEY PROBLEMS 1. You currently have $1,250 to invest. You want to take risk that will correspond to an annual return of 11%, compounded annually. How much will your investment be worth at the end of 13 years? 2. How much should one invest now, at 12% annual return, to have $20,000 at the end of 15 years from now, if interest is compounded/discounted annually? 3. What should be the annual rate of return on an investment of $372 made today, if it were to grow to $749 at the end of 7 years from now, if interest is compounded/ discounted annually? 4. How much money one can expect to have in a retirement account 25 years from now, if $2,250 is invested every year (at the end of the year) for 25 years? The expected annual rate of return is 9%, compounded annually. 5. How much (same amount) must be invested at the end of each year for 20 years from now,at 11% annual rturn (annual compounding), in order to have $125,000 at the end of the 20th year? 6. If the annual, year-end investment were to be $1,500, for 20 years, what should be the annual rate of return, if the investment were to be worth $130,000 at the end of the 20th year? 7. You take a loan from a bank which is charging you 10% interest ( compounded/ discounted annually). The loan will be amortized by equal annual payments of $1,375 for 5 years. What is the loan amount? 8. What will be your equal, annual year-end payments, that would amortize at the end of 7 years a loan of $7,500 taken currently, if the interest rate is 8.5%? 9. What is the annual interest rate a bank is charging you on a current loan of $12,000 to be amortized in 10 years by making equal, annual, year-end payments of $1,800? 10. What is the value of an investment of $2,730 made today at the end of 6 years from now at an annual rate of return of 8%, if interest is compounded/discounted semiannually? 11. How much same amount should you invest at the end of each month for 30 years to end up with $580,000 at the end of the 30th year, if the annual rate of return is 12% (remember that compounding/discounting is at the same frequency as the cash flow, in this case monthly)? PAGE 7 12. What should be the equal, quarterly (end-of-quarter) payments that would pay off in 5 years a loan of $8,000 taken currently, if the interest rate is 9%? (Remember that interest rates are annual, unless otherwise stated) 13. What annual interest rate is the bank charging you on a loan of $10,000 taken currently and that needs to be paid off in 4 years by making equal, monthly (end-ofmonth) payments of $250? 14. What is the equivalent amount now of a fture cash flow of $1,000 per year (yearend) that is expected to last for ever, if the interest rate is 12%? 15. You are promised a cash flow of $250 per year at the beginning of each year for ten years from now. The applicable rate of return is 7.5%. A. How much would this cash flow be worth at the end of ten years? B. How much is it worth now? PAGE 8 TIME VALUE OF MONEY PROBLEMS SOLUTION USING TI 83/83 PLUS SET THE CALCULATOR TO TVM SOLVER SCREEN #1 #2 #3 #4 P/Y 1 P/Y 1 P/Y 1 P/Y 1 C/Y 1 C/Y 1 C/Y 1 C/Y 1 PMT 0 PMT 0 PMT 0 PV 0 PV -1250 FV 20000 PV -372 PMT END PMT -2250 I% 11 I% 12 FV 749 I% 9 N 13 N 15 N7 N 25 POSITION THE CURSOR TO THE OUTPUT VARIABLE AND INVOKE SOLVE FV 4854.1002 PV -3653.9252 I% 10.5146% FV 190577.0165 #5 #6 #7 #8 P/Y 1 P/Y 1 P/Y 1 P/Y 1 C/Y 1 C/Y 1 C/Y 1 C/Y 1 PV 0 PV 0 FV 0 FV 0 FV 125000 FV 130000 PMT -1375 PV 7500 I% 11 PMT -1500 I%10 I% 8.5 N 20 N 20 N5 N7 POSITION THE CURSOR TO THE OUTPUT VARIABLE AND INVOKE SOLVE PMT -1946.9546 I% 13.5828 PV 5212.3318 PMT -1465.2692 #9 #10 #11 #12 P/Y 1 P/Y 2 P/Y 12 P/Y 4 C/Y 1 C/Y 2 C/Y 12 C/Y 4 FV 0 PMT 0 PV 0 FV 0 PV 12000 PV -2730 FV 580000 PV 8000 PMT -1800 I% 8 I%12 I% 9 N 10 N 6*2=12 N 30*12=360 N 5*4=20 POSITION THE CURSOR TO THE OUTPUT VARIABLE AND INVOKE SOLVE I% 8.1442 FV 4370.8180 PMT -165.9531 PMT -501.1366 #13 #14 # 15 P/Y 12 NO NEED FOR FINANCIAL P/Y 1 A. FV -3802.0298 C/Y 12 FINANCIAL CALCULATOR. C/Y 1 PV10000 INSTEAD USE FORMULA PMTT BGN B. FV 0 PMT -250 PV OF PERPETUITY = PMT/k PV 0 PV -1844.7218 N 4*12=48 = 1000/0.12 FV 0 I% 9.2418 = 8333.3333 PMT 250 I% 7.5 PAGE 9 MIXED (UNEVEN) CASH FLOWS PROBLEM You are given the following cash flows. The risk-appropriate required rate of return is 10% a. b. c. d. $275 $340 $620 $175 $400 _________________________________________________________ 0 1 2 3 4 5 What is the equivalent lump sum now of the above cash flows? What is the equivalent lump sum at the end of the 5th year of the above cash flows? What same amount at the end of each year for 5 years would you be willing to take, instead of the above cash flows? What same amount at the beginning of each year for 5 years would you be willing to take, instead of the above cash flows? Solution: P/Y 1 C/Y 1 PMT END PMT 0 I% 10 a. b. b. (alternate) FV 275 PV 275 PV 1364.7028 N 1 N4 N 5 PV -250.0000 .....(1) FV -402.6275 .....(1) FV -2197.8675 FV 340 PV 340 N 2 N3 PV -280.9917 .....(2) FV -452.5400 ......(2) FV 620 PV 620 N 3 N2 PV -465.8152 .....(3) FV -750.2000 .....(3) FV 175 PV 175 N 4 N1 PV -119.5274 .....(4) FV -192.5000 ......(4) FV 400 PV 400 N 5 N0 PV 248.3685 .....(5) CPT FV -400.0000 ......(5) Add (1) THRU (5): -1364.7028 Add (1) THRU (5) -2197.8675 c. N 5 PV 1364.7028 OR FV 2197.8675 FV 0 OR PV 0 PMT -360.0052 d. PMT BGN PMT -327.2774 PAGE 10 TIME VALUE OF MONEY PROBLEMS SOLUTION USING TI BAII PLUS #1 CLR TVM P/Y 1 -1250 PV 11 I/Y 13 N CPT FV 4854.1002 #2 CLR TVM P/Y 1 20000 FV 12 I/Y 15 N CPT PV -3653.9252 #5 CLR TVM P/Y 1 125000 FV 11 I/Y 20 N CPT PMT -1946.9546 #9 CLR TVM P/Y 1 12000 PV -1800 PMT 10 N CPT I/Y 8.1442% #6 #7 #8 CLR TVM CLR TVM CLR TVM P/Y 1 P/Y 1 P/Y 1 130000 FV -1375 PMT 7500 PV -1500 PMT 10 I/Y 8.5 I/Y 20 N 5N 7N CPT I/Y 13.5828% CPT PV 5212.3318 CPT PMT -1465.2692 #10 #11 CLR TVM CLR TVM P/Y 2 P/Y 12 -2730 PV 580000 FV 8 I/Y 12 I/Y 6*2=12 N 30*12=360 N CPT FV 4370.8180 CPT PMT -165.9531 #13 P/Y 12 10000 PV -250 PMT 4*12=48 N CPT I/Y 9.2418% #3 #4 CLR TVM CLR TVM P/Y 1 P/Y 1 -372 PV -2250 PMT 749 FV 9 I/Y 7N 25 N CPT I/Y 10.5146% CPT FV 190577.0165 #12 CLR TVM P/Y 4 8000 PV 9 I/Y 5*4=20 N CPT PMT -501.1366 #14 No Need for Financial Calculator. Instead Use Formula: PV of Perpetuity = PMT/k = 1000/0.12 = 8333.3333 #15 CLR TVM P/Y 1 BGN 250 PMT 10 N 7.5 I/Y a. CPT FV -3802.0298 b. 0 FV CPT PV -1844.7218 PAGE 11 MIXED (UNEVEN) CASH FLOWS PROBLEM You are given the following cash flows. The risk-appropriate required rate of return is 10% a. b. c. d. $275 $340 $620 $175 $400 _________________________________________________________ 0 1 2 3 4 5 What is the equivalent lump sum now of the above cash flows? What is the equivalent lump sum at the end of the 5th year of the above cash flows? What same amount at the end of each year for 5 years would you be willing to take, instead of the above cash flows? What same amount at the beginning of each year for 5 years would you be willing to take, instead of the above cash flows? Solution: a. CLR TVM b. CLR TVM b. (alternate) CLR TVM P/Y 1 P/Y 1 P/Y 1 10 I/Y 10 I/Y 10 I/Y 275 FV 275 PV 1364.7028 PV 1N 4N 5 N CPT PV -250.0000 .....(1) CPT FV -402.6275 .....(1) CPT FV -2197.8675 340 FV 340 PV 2N 3N CPT PV -280.9917 .....(2) CPT FV -452.5400 ......(2) 620 FV 620 PV 3N 2N CPT PV -465.8152 .....(3) CPT FV -750.2000 .....(3) 175 FV 175 PV 4N 1N CPT PV -119.5274 .....(4) CPT FV -192.5000 ......(4) 400 FV 400 PV 5N 0N CPT PV 248.3685 .....(5) CPT FV -400.0000 ......(5) Add (1) THRU (5): -1364.7028 c. Add (1) THRU (5) -2197.8675 1364.7028 PV OR 2197.8675 FV 5N CPT PMT -360.0052 d. SET BGN CPT PMT -327.2774