Solutions to TVM Practice Set I

advertisement

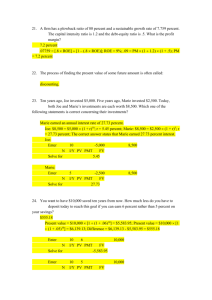

Solutions to TVM Practice Set I 1. The future value is $12,000 in four years, so you wish to find the present value, at a discount rate of 4.5% per year. The timeline looks like this: 0 PV = ? 1 2 3 4 12,000 Using the PVIF, compute the PV as follows: 1 12,000 . Therefore: PV FV PVIF PVIF t (1 r ) (1 0.045) 4 = $10,062.74 On your financial calculator: N 4 I 4.5 PV CPT PMT FV 12,000 -10,062.74 2. For each period, multiply by (1 + r). The timeline looks like this: 0 1 2 3 4 1+r= 1.04 0.948 1.085 0.95 100 104 98.59 106.97 101.62 Therefore: Ending value = Beginning value × 1.04 × 0.948 × 1.085 × 0.95 = $100 × 1.0162 = $101.62 3. a. You wish to find the annual rate that doubles an amount by the end of four years. The timeline looks like this: 0 -100 1 2 In FVIF terms, you must find r such that: => ( 200 14 ) 1 r = .1892 or 18.92% 100 F301 TVM practice set I solutions 1 3 4 200 FV = PV × FVIF 200 = 100 × (1 + r)4 On your financial calculator, compute I: N 4 I CPT PV -100 PMT FV 200 18.92 b. Find t, the number of periods, such that: 200 = 100 × (1.125)t. On your financial calculator, compute N: N CPT I 12.5 PV -100 PMT FV 200 5.88 4. a. The total present value is the sum of the present values of the three payments, discounted at 7% per year. The timeline looks like this: 0 PV = ? 180,000 1.07 168,224.30 PV1 1 180,000 PV2 2 50,000 3 70,000 50,000 PV3 1.07 2 43,671.94 70,000 1.07 3 57,140.85 Sum = $269,037.09 b. The three equal payments must have a present value of $269,037.09. Therefore, find PMT such that PV = 269,037.09. Solve for the payment amount, C, in the annuity present value formula: 1 1 (1 r ) t $269,037.09 APV C C ; C = $102,517.03 ; 1 r 1 3 [ (1.07) ] .07 On your financial calculator: N I PV PMT FV 3 7 -269,037.09 CPT 102,517.03 F301 TVM practice set I solutions 2 5. a. The best option is the one with the highest present value. Therefore, you must calculate the present value of each option and compare them. In Option 1, the payments occur at the beginning of each period, so it is an annuity due. The timeline for the ten cash flows is: 0 25,000 1 25,000 … … 2 25,000 9 25,000 10 Recall that the value of an annuity due is the value of an otherwise similar ordinary annuity * (1+r). Thus, the expression to solve for the value of this annuity due would be as follows: 1 1 10 (1.06) * 1.06 = $195,042.31 APVdue = $25,000 * .06 You can also solve this problem by setting your calculator's TVM settings to begin mode and directly inputting the information into the calculator as follows. Just remember to change the setting back to end mode when you are done. N 10 I 6 PV CPT PMT 25,000 FV -195,042.31 The second option is to receive $190,000 today (this is already at PV) Solution: Choose Option 1. $195,042.31 > $190,000 b. If the two choices are to be equivalent, then the present value of the ten payments must equal $190,000. The setup would be as follows: 1 1 (1 r )10 $190,000 = $25,000 * [ ] * (1 r ) r Solve for r on your financial calculator as follows: Set your calculator to Begin mode, then: N 10 I CPT PV -190,000 PMT 25,000 FV 6.697 Solution: The rate at which the two choices have equal present values is 6.697%. F301 TVM practice set I solutions 3 6. The first thing you should note is that there is a mismatch of periods. The payments are given in years, but the compounding period is given in months. To solve the problem, the periods must match. So if you use the monthly rate of 0.75% per month, then the number of periods is 24 for the first payment and 84 for the second. Alternatively, you can use years as the periods and convert the discount rate to an effective annual rate by compounding the monthly rate for a year: Rate per year EAR (1 monthly rate) months per year 1 (1.0075)12 1 9.3806...% The annual timeline looks like this: 0 PV = ? The PVIF = 1 2 1,000 3 4 5 6 7 3,000 1 1 t (1 r ) (1.0938..)t On your calculator do the following: $1,000 / (1.0938..)2 = $835.83 First payment: N 2 I 9.38… PV CPT PMT FV 1,000 -835.83 $1,000 / (1.0938..)7 = $1,601.54 Second payment: N 7 I 9.38.. PV CPT PMT FV 3,000 -1,601.54 Total present value = $835.83 + $1,601.54 = $2,437.37 If you use the number of months and a monthly rate, you would have the following: The monthly timeline looks like this: 0 PV = ? The PVIF = ….. 24 1,000 …. 1 1 t (1 r ) (1.0075)t F301 TVM practice set I solutions 4 … … … 84 3,000 On your calculator do the following: $1,000 / (1.0075)24 = $835.83 First payment: N 24 I 0.75 PV CPT PMT FV 1,000 -835.83 $1,000 / (1.0075)84 = $1,601.54 Second payment: N 84 I 0.75 PV CPT PMT FV 3,000 -1,601.54 Total present value = 835.83 + 1,601.54 = $2,437.37 7. Compute the effective annual rate by compounding the periodic rate for one year, according to the EAR formula: EAR (1 periodic rate) periods per year 1 APR as a decimal 1 periods per year periods per year 1 a. EAR for Bank A = 9.0% 0.0875 12 EAR for Bank B = 1 1 9.11% 12 0.0865 365 EAR for Bank C = 1 1 9.034% 365 b. Bank A offers the best rate from the borrower’s perspective, because it offers the lowest effective annual rate. F301 TVM practice set I solutions 5 8. First you need to find the periodic rate that matches the monthly cash flows. An APR of 9.6% compounded monthly means the periodic rate is 9.6 ÷ 12 = 0.8 % per month. Then the timeline looks like this: 0 PV = ? 1 -600 2 -600 … … 60 -600 Now that you have a series of sixty, level, monthly cash flows (an ordinary annuity) and a monthly rate, you can solve for PV, the amount you can borrow based on that monthly payment. On your financial calculator: 1 1 (1.008)60 APV = $600 * .008 N 60 I 0.8 = $28,502.53 PV CPT PMT -600 FV $28,502.53 9. You pay $35 in interest on a $700 loan, every two months. The periodic rate, then, is r 35 700 0.05 , or 5% per two-month period. a. Using the periodic rate, you can compute the EAR by compounding the periodic rate (in 1 + r format) by the number of periods in one year. There are 6 two-month 6 periods per year. Therefore: EAR 1 0.05 1 = 34.01%. The effective annual rate is 34.01%. b. Compute the APR by multiplying the periodic rate by the number of periods per year: APR 5% 6 30%. 10. At Period Zero, the value of the initial investment was $800. After 70 periods, the future value turned out to be $174,885. Therefore the timeline looks like this: 0 – 800 1 2 3 … … 70 174,885 You wish to find R, the rate of return, which is given in the Present Value – Future Value relationship: FV PV (1 r ) t 174,885 800 (1 r ) 70 FV ( 1t ) 174,885 ( 170) ) 1 r ; ( ) 1 .08 or 8% => ( PV 800 F301 TVM practice set I solutions 6 On your financial calculator: N 70 I CPT PV –800 PMT FV 174,885 8.0% Your grandparents earned an 8% compound annual rate of return over the 70-year period. 11. This is a two-step problem. The first timeline looks like this: R = 11.5% per year 0 1 – 8,000 2 – 8,000 3 – 8,000 … … 30 – 8,000 ? Use the FVIFA equation to determine how much your grandparents have now as a result of the $8,000 contributions that they made over the past 30 yrs. => AFV = $8,000 * [ N 30 (1.115)30 1 ] = $1,752,811.54 .115 I 11.5 PV PMT -8,000 FV CPT $1,752,811.54 If your grandparents have a total of $1,752,811.54 today, how much can they withdraw each month, for the next 20 years, if their savings is to be exhausted after the last withdrawal? R = 4% compounded monthly 0 $1,752,811.54 1 ?PMT 2 ?PMT 3 ?PMT … … 240 ?PMT FV = 0 Use the PVIFA equation to solve this as follows: => $C = $1,752,811.54 ; $C = $10,621.32 1 1 .04 240 (1 ) 12 [ ] .04 ( ) 12 N 240 I 4/12 PV – 1,752,811.54 PMT CPT $10,621.32 F301 TVM practice set I solutions 7 FV 0