CIVL-3046 d1

advertisement

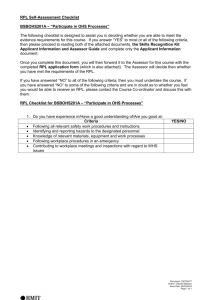

Course Outline Course Information Course Code and Title: CIVL-3046: Management and Economics Course Section: All Sections Department: Department of Civil Engineering Technology Program: Civil Engineering Technology Total Hours: 48 Credit Hours: 5 Course Description: This course focuses on basic principles of Simple Interest, Compound Interest and on various types of Annuities. Students will learn how to evaluate engineering proposals, and will gain insight into organizing and operating their own business. 1 Prior Learning Assessment and Recognition (PLAR): Prior Learning Assessment and Recognition) is a process in which individuals have the opportunity to obtain credit for college level knowledge and skills gained outside the classroom and/or through other educational programs. It is a process which documents and compares an individual’s prior learning gained from prior education, work and life experiences and personal study to the learning outcomes in College courses/programs. For more information about RPL at Red River College, refer to the RPL website at http://www.rrc.mb.ca/index.php?pid=404. Contact Ms. Nancy Wheatley, Program Chair at 632-2221 for information regarding RPL processes and opportunities for this course. For general information and assistance with RPL, contact Red River College’s RPL Advisor at 204.632.3094. Academic Pre-requisites: Year One Progression Requirements Course Equivalencies: None Course Delivery Methods: Classroom Online The following communication tools will be used in this course: Email Online content Course Format: Course delivery may include any combination of lectures, class discussions, problems, case studies, and online lab assignments. Emphasis will be placed on practical application of the theories and principles studied in the course. Effective Date: May, 2012 Instructor Information D. Hammond (Lead) Email: dchammond@rrc.mb.ca Phone: 632-2995 Office: A1-31G, Notre Dame Campus Office hours: Weekdays by appointment 2 Student Readiness Technology & Equipment Readiness: Computer Internet Student Commitments and Contact Times: Weekly daytime attendance (as per class schedule) Online commitments (Lyryx lab assignments) Course Resources: Textbook: Engineering Economics, Financial Decision Making for Engineers 5 th Edition. Niall M. Fraser, Elizabeth M. Jewkes. ISBN 978-0-13-237925-0 Pearson Publishing Other Resources: As supplied by the Instructor Student Learning Learning Objectives: By the end of this course of study, you should be able to.... Use standard methods of financial mathematics to solve simple financial problems likely to be encountered in engineering field and make sound financial decisions. Schedule Instructional Schedule: Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Topic Engineering Decision Making Time Value of Money Cash Flow Analysis Comparison Methods I Comparison Methods II Depreciation and Financial Accounting Replacement Decisions Taxes Public Sector Decision Making Dealing with Uncertainty and Risk 3 Readings Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 10 Chapter 12 Week 11 Week 12 Review Final Exam Cumulative Modules TOPIC LABS October 25, 2010 Introduction Distribute course outlines Discuss over course outline Module I SIMPLE INTEREST Upon completion of this unit, the student will be able to: . Determine the time period under a variety of ways of starting loan periods. Describe the linear behavior of simple interest. . Calculate the value for any variable given data on the other variables. . Construct cash flow diagrams and use these to obtain solutions to problems. LAB#1 Module II APPLICATIONS OF SIMPLE INTEREST AND DISCOUNTING Upon completion of this unit, the student will be able to: . Set up and solve for equations of value. . Understand a negotiable instrument, notes, drafts and promissory notes. . Differentiate between simple discount and bank discount and perform the necessary calculations. . Determine final balances in partial payment plans LAB#2 LAB#3 Module III COMPOUND INTEREST LAB#4 LAB#5 Upon completion of this unit, the student will be able to: . Understand the difference between simple and compound interest. . Determine the interest rate per period and number of conversion periods from any nominal annual rate and loan duration. LAB#6 4 . Apply the compound interest formula to determine present values, future values, interest rates per period and nominal annual rates, number of compounding periods, or loan duration from text information. . Apply the techniques to determine present and future values under fractional periods of compounding. . Convert nominal interest ratio to effective rates. . Determine equivalent interest rates. . Set up and solve for financial equivalence. Module IV ANNUITIES Upon completion of this unit, the student will be able to: . Describe the characteristics of annuities. . Calculate the payment size, present value, future value, interest rate or number of payments for simple ordinary annuities. . Apply the ordinary annuity model to solve for parameters of deferred annuities. . Solve for parameters of the complex case annuity. . Solve for parameters of the perpetual annuity. . Find capitalized costs and apply these in financial evaluation. . Find final odd-sized payments in annuities. LAB#7 -LAB#14 Module V INTRODUCTION TO EVALUATION TECHNIQUES Upon completion of this unit, the student will be able to: . Determine the payback period, simple rate of return, net present value, benefit cost ratio, and internal rate of return from before-tax cash flow schemes. . Identify the advantages and disadvantages of the commonly used techniques of evaluation. LAB#15 LAB#16 LAB#17 Module VI EVALUATION OF PROPOSALS WITH DIFFERENT LIFETIMES Upon completion of this unit, the student will be able to: . 5 Evaluate proposals with differing lifetimes using the method of Lowest Common Multiple of Lifetimes. . Evaluate proposals with differing lifetimes using the method of Capitalized Costs. . Evaluate proposals with differing lifetimes using the method of Equivalent Uniform Annual Worth. LAB#18 Module VII CASH FLOW AFTER TAXES LAB#19 LAB#20 Upon completion of this unit, the student will be able to: . Determine Capital Cost Allowances using the straight line and constant ratio methods. LAB#21 6 . Prepare cash flows after taxes schedules from text descriptions. . Perform net present evaluations incorporating income taxes for single item accounting and grouped assets accounting. Module VIII REPLACEMENT EVALUATION Upon completion of this unit, the student will be able to: . Evaluate replacement of asset proposals in the before-tax situation. . Determine EUAC for assets belonging to a grouped CCA class in the after-tax situation. . Determine the optimal replacement policy for new assets in the after-tax situation. . Evaluate replacement of existing asset. LAB#22 Module IX OPERATING YOUR OWN BUSINESS Upon completion of this unit, the student will be able to: . Understand the differences between a Sole Proprietor, Partnership, and Corporation . Understand the various methods of financing a business . Understand the different types of insurance requirements . Understand the differences between Income Statement, Balance Sheet, and Daily Ledger 7 Important Dates: NOTE: Dates are subject to change, based on student needs and at the instructor’s discretion. Students will be notified ahead of time of any changes. Terms Exams will be written at the end of each term. The exact date will be announced at least a week prior to writing the particular Term Exam. The marks per questions will be shown on the exam. An equation/formulae sheet will be available for every exam. Students are required to bring a pencil, ruler and a calculator only to the test. Each term test will cover material studied in that term only (i.e. term tests are not cumulative). Students will be able to review tests; however the tests are kept by the instructors. Assessment and Evaluation: Assessment Weight Term Test 1 30% Term Test 2 30% Term Test 3 40% Total: 100% 8 Letter Grade Distribution Letter Grade Distribution (as per RRC Academic Policy C5) A+ 4.5 90 to 100% A 4.0 80 to 89% B+ 3.5 75 to 79% B 3.0 70 to 74% C+ 2.5 65 to 69% C 2.0 60 to 64% D 1.0 50 to 59% F 0.0 0 -49% Minimum performance requirement for this course: 50% However, the student’s cumulative GPA must be maintained at 2.00 or above (C or 60%) in order to progress from term to term (both academic and co-op work terms). Course Policies: General Academic Policies: It is the student's responsibility to be familiar with and adhere to the Red River College (RRC) Academic Policies. These Policies can be found in the RRC calendar or online under “A SERIES – ACADEMIC MATTERS at http://www.rrc.mb.ca/index.php?pid=4523. Supplementary Policies: The student is expected to attend all lectures and labs, so is responsible for any material missed. Regular attendance is imperative because of the building-block nature of the skills. Although students will have the opportunity to review all the exams, however the marked exams will not be returned to students and remains the property of Red River College. Authorization: This course is authorized for use by: ______________________________________________________ Nancy Wheatley, Civil Engineering Technology October, 2010 Chair, Department Name Date ©Red River College 2012 9