Primary Objective

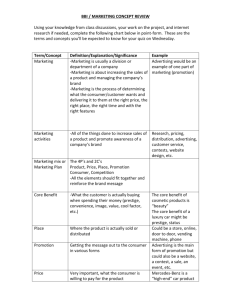

advertisement

SWOT Analysis Nabob Company Strengths Established R&D Department (Efficient Innovation) Market Leader High Volume of Sales Weaknesses Summit Brand Cannibalizing Tradition Brand (50% Cannibalization Rate GTA) Opportunities Both Current Nabob Brands Have Yet to Reach Maturity in Product Lifecycle Inclement Weather* Threats Maxwell House – Primary Competitor Tim Horton’s, Second Cup, Starbucks (GTA) – Secondary Competitors Inclement Weather* * Inclement weather can be either a threat or opportunity given the time of year it happens and our stockpiles at the time. If frost drives up price after production but before sale, we could be looking at profit increases of 70%. If the frost comes either before production or after selling off our product, then we could be looking at sales volumes dropping anywhere from 5%-15% depending on other company’s supplies. Summit Brand Strengths Most Successful Launch in Coffee History Distribution Exceeds 50% in All Areas Marketed (High of 89%) Currently Perceived as “Top of the Line” Brand Weaknesses Poorly Designed Product Has Led to Product Cannibalization of More Profitable Brands such as Tradition Opportunities Continued Growth due to Early Stages of Product Lifecycle Excellent Co-op Advertising Subsidies Threats Maxwell House Gold – Primary Competitor’s Premium Brand Private Label Coffee Shops Primary Objective Re-Marketing Brand / Expanding Business to make up the $2,461,368 lost as a result of product cannibalization last year Increase weighted co-op advertising subsidy from 16 cents to 23 cents to provide a viable business model for sustained growth Alternative 1 – Nabob Prestige Nabob Prestige product line: Flavour Disks Vitamin Disks Vitamin Coffee CoffeeShop w/Flavour Injection Portable Flavour Packs (Cofshots) Proprietary Filters We will be launching our Nabob Prestige product line in order to better position ourselves as a source of relaxing energy for individuals in the most healthy and delicious way possible while exploring the utility of a drink. Our Proprietary coffee brewer, CoffeeShop, will be the centerpiece, including the never-before-seen flavour and vitamin disk capabilities. Our flavour disks will come in flavours such as white chocolate, hazelnut, strawberry shortcake, etc. There will be over 15 flavours at launch. In addition to flavours we will also have vitamin disks. These disks will have different uses, such as a multivitamin or an energy source with all the NATURAL ingredients to provide you with energy and counter-act the caffeine crash for all those adults needing the energy that drinks like red bull can provide, but without enduring all of that sugar. The best part is there are two ejectable “disk-drives” allowing for customer creations between flavours and vitamin boosts. The CoffeeShop will also have special filters only made by Nabob. For your coffee on the go we also have Cofshots, portable single-serving packets of our flavour disks. Currently, our company profitability is at an average of 46% over all product lines and brands. The Federation of Columbian Coffee Growers has agreed to increase their weighed co-op advertising budget for us from 16 to 23 cents if we can raise that average profit margin 7% (6% = +6 cents, 5% = +5 cents etc). We are going to accomplish that profit margin through our product line expansions and the added brand equity that will come into play from the CoffeeShop. The CoffeeShop has the ability to mix and match up to 2 of the disks (of either type) leading to wonderful user creations. This will allow our summit brand to operate on its own at the same profit margin as Tradition, effectively eliminating our cannibalization problem. Furthermore, because this increase in funding will further accelerate our profit margins, completion of this deal would take our average profit margin up an extra 2%. These efforts will be supported by heavy TV advertising and in-store product promotion as well as demonstration. Sales bonuses will be calculated on a retailer-by-retailer basis, but will not be large enough to constitute a heavy pull factor with regards to initially stocking our new product line. These commercials will be indicative of our all-around premium positioning and played on channels such as CBC, CH, TSN, Food Network, W, Home & Garden, Slice, or other lifestyle channels directly predominantly baby-boomers. Our in store promotions will NEVER include coupons, but will have draws for free brewers and coffee supplies. We will have our maker ONLY placed RIGHT beside the fresh ground self-serve coffee stations because of the ambience of that specific area of the store. Of course our products will only be found in high-end grocery retailers such as Sobeys, Fortino’s, A&P, to maintain its premium positioning. This will further be supported by taste-testing demonstrations in the stores. Online product sales will strengthen our revenue base. *14 Months After Nabob Prestige Launch* Fourteen months after the Prestige launch we will be doing a major advertising shift as well as a tentatively scheduled new brand. We will be doing market research to measure the penetration and market share in our target areas (Ontario, British Columbia, Alberta). From these results we will determine if the time is appropriate to make a shift from new product advertising in those areas to “upkeep” advertising (cheaper, less prevalent, used to remind as opposed to educate) in those targeted Areas. This will allow a shift in focus (financially) so that we will now be able to hit Manitoba, Saskatchewan, Quebec, & the Maritimes with new product advertising, further penetrating our brand into their markets and ensuring prolonged brand life in Canada for years to come. This shift in advertising will be for coffee only, and will also allow us to use our successfully developed markets for cost-effective deployment of a test market program. This test market program will first be used for a potential new brand of Energy drink aimed at the baby boomers. This non-carbonated energy drink could have a very lucrative market if the right segment is selected to target, and we have two full years to complete the market research and then time on top of that to allow for a strategic decision to be made. Nabob Prestige Objectives 60% awareness for our Nabob CoffeeShop in the advertised area within 6 months. 75% awareness within 12 months. o 5% of aware audience making CoffeeShop purchase Maintain or increase market share Alternative 2 – Nabob Sunrise/Sunset Instead of trying to expand operations with the intention of increasing brand equity to provide a sustainable future, this alternative is a more conservative approach to refining our operations to increase efficiency with minimal product line changes. While this is the most conservative, it’s also foreseen as the least profitable. With this alternative we will try to re-tool our company to have brands that work very well together collectively, as opposed to having brands that work very well on their own. This will be done by associating Nabob with a personal routine. We also needed to take an angle that showed consumers that one flavour of coffee is not enough. We will associate ourselves with personal routine through the release of two (or three depending on how you look at it) new products. The first of which is a new Night/Day team of coffees bringing a balanced position of yin and yang to the table of perception. Our morning coffee has the invigorating ingredients you need such as ginseng, taurine, guarana, to start you day; while the night coffee has relaxing ingredients such as chamomile and lavender to help you unwind after a long day. This will be the first coffee to ever take a specific time-oriented stance in terms of usage. This would be limiting if there was only the one brand, but since we provide enough selection to have the consumer satisfied at ANY of the different times required we actually get a synergetic effect because they feel like they are getting more benefit from their coffee, also increasing brand loyalty. These brands will both be made of 100% Columbian coffee beans and will be heavily marketed as such in order to maintain the co-op advertising support of the Columbian federation of coffee growers. They will be priced at parity with the competition because of the increased value consumer receive for the same price. The other product line extension would be our vitamin coffee. Coffee enriched with enough vitamins and minerals to get you feeling happy and healthy throughout the day on only one cup. This would also speak to replacing a daily personal routine with our brand as this coffee would be developed in partnership with large pharmaceutical manufacturers to essentially create customers’ morning multivitamin in a cup of coffee. This will be supported by large amounts of TV advertising, as well radio advertising in traffic-heavy areas of Ontario (no radio done in Western Canada) and billboards. Our ads will also be sported on billboards and home magazines all focusing on our new slogan “Need My Morning Bob” Nabob Revisited Objectives 55% awareness for Nabob Sunrise/Sunset in the advertised area within 6 months. 70% awareness within 12 months. o 45% of aware areas making purchase Maintain or increase market share Recommendation Because of the aggressiveness of the marketing strategies employed, and also because of the breadth of new products being released, it is our recommendation to proceed with Nabob Prestige as a strategic course of action. The added brand equity from a premium position as a market leader will provide us with the sustainable business model we need to remain a viable, competitive company for years to come. At Nabob we haven’t been immune to slow economic growth in our sector, but with Nabob Prestige this issue will be addressed as Nabob will be shifting its focus from coffee, to providing relaxing energy Prestige Line Development Prestige Release Start up Stage of Advertising/Promotion Aggressive Advertising/Promotion • Mkt Research for NRG Bev. • I.D. for future • Gauge success of discs Implementation Plan Energy Beverage Release Sustaining Stage of Advertising/Promotion without the high-impact crash of tradition sources of energy. This will be done while still at all times remaining true to our companies vision, to make the best coffee possible. Implementation Plan Timeline Break-Even Analysis Profitablility Product Summit Tradition CoffeeShop Flavour Disk Margin Operations Cost Price 42% 50% 65% 88% Wages $4,800,000.00 R&D $1,000,000.00 Production Total $1,300,000.00 $7,100,000.00 % of Projected Total Profits Summit Tradition CoffeeShop Flavour Disk Profit Per $3.50 $3.50 $119.95 $5.99 Break-Even Marketing Expenses Operations Expenses Total Expenses Required Sales 44 36 2 8 $1.47 $1.75 $77.97 $5.27 Summit Tradition CoffeeShop Flavour Disk $15,270,000.00 $7,100,000.00 $22,370,000.00 $ Units $9,842,800.00 $8,053,200.00 $447,400.00 $1,789,600.00 Marketing Details TV ($24,300/GRP/channel) CBC → Hockey Night in Canada, News, Prime Time TSN → All Shows, 11am – 1pm, 4pm – 2am W → All Shows, All times Food Network → All Shows, All Times Slice → All Shows, 7am – 5pm CTV → News, Primetime Print ($16,000/year/publication) Women’s World, Home & Garden, In Style, Chatelaine, Women’s Health, Men’s Health, Shape, Health & Home, and 14 yet-unselected publications Billboard ($1,000/week/location) GTA (Toronto, Mississauga, Scarborough, Markham, Vaughan, Oakville, etc) – 24; St Catharine’s – 2; Sarnia – 2; Guelph – 3; Niagara Falls – 2; Owen Sound – 1; Thunder Bay – 4; North Bay – 4; Sault St. Marie – 2; Conclusion Expanding our product lines will not only allow us to develop more favourable profit margins but further ensure our position atop our market as the premium provider of coffee, providing us with an excellent financial foundation for continued growth. 686,043 471,499 5,738 339,505 The increased sales will secure the co-op advertising budget provided by the Federation of Colombian Coffee Growers.

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)