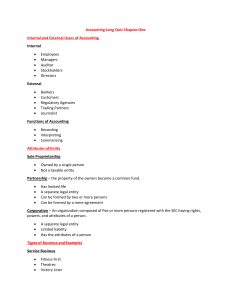

Introduction to Accounting & Business

advertisement

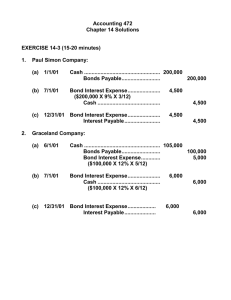

Introduction to Accounting & Business Chapter 1 Business An organization in which basic resources such as materials and labor are assembled and processed to provide goods and services to customers Profit – difference between the amount received from customers and amounts paid for inputs Goal of business Types of Business Merchandising Sell products to customers Retail Food Gasoline Type of Business Manufacturing Change basic inputs into products that are sold to individual customers Type of Business Service Provide services rather than products to customers Types of Business Organization Proprietorship Is owned by one individual Partnership Is owned by two or more individuals Corporations Is organized under state or federal statutes as a separate legal entity Sells shares of stock Obtain large amounts of capital Business Stakeholders Is a person or entity that has an interest in the economic performance of the business Owners Managers Employees Customers, government, and creditors Role of Accounting An information system that provides reports to stakeholders about the economic activities and condition of a business Process Identify stakeholders Assess stakeholders Design the system Record economic data Prepare accounting reports Business Ethics Are the moral principles that guide the conduct of individuals Foundations of ethical behavior Avoid small ethical lapses Focus on your long term reputation Expect to suffer adverse personal consequences for holding to an ethical position Profession of Accounting Private accounting Employment by one business Management accountants Controllers- CMA Internal Auditors – CIA Public Accountants Provide services on fee basis CPA Generally Accepted Accounting Principles (GAAP) Financial Accounting Standards Board Business entity concept Cost concept Classifications of Accounts Assets Resources owned by the business • • • • Cash Accounts receivable Prepaid expense Merchandise inventory • Equipment • Land • building Classification of Accounts Liabilities Rights of creditors or debts of the business • • • • • Accounts payable Dividends payable Accrued expenses Mortgage payable Notes payable Classification of Accounts Owner’s Equity Shareholder’s equity Rights of the owner’s Capital stock Retained earnings Dividends Accounting Equation ASSETS = Liabilities + Shareholder’s Equity Classifications Revenues Income from operation of the business Sales Fees earned Commission income Expenses Cost of doing business Salaries expense Rent expense Depreciation expense Misc expense