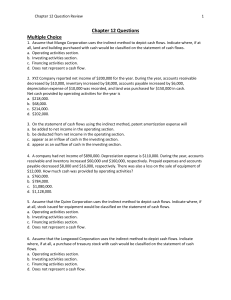

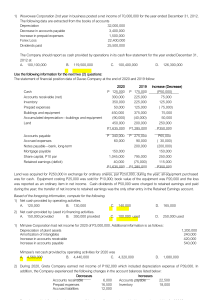

Statement of Cash Flows (Indirect Method) • The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. • In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow. ACCRUAL ACCOUNTING PRINCIPLE • revenue should be recognized when earned regardless of collection and expenses should be recognized when incurred regardless of payment. Example: • When a barber finishes performing his services he should record it as revenue. When the barber shop receives an electricity bill, it should record it as an expense even if it is unpaid. Use the following information to calculate net cash flow from operating activities using indirect method: Net Income Depreciation Expense Increase in Accounts Receivable Increase in Prepaid Rent Decrease in Prepaid Insurance Increase in Accounts Payable Increase in Wages Payable Decrease in Income Tax Payable Gain on Sale of Equipment P 7,000 1,000 4,400 7,000 1,300 14,000 1,000 700 1,800 Cash Flows from Operating Activities Net Income Add back: Depreciation Expense Less: Gain on Sale of Equipment P 7,000 1,000 Increase in Accounts Receivable Increase in Prepaid Rent Decrease in Prepaid Insurance Increase in Accounts Payable Increase in Wages Payable Decrease in Income Tax Payable (1,800) P 6,200 (4,400) (7,000) 1,300 14,000 1,000 (700) Net Cash generated by Operating Activities P10,400