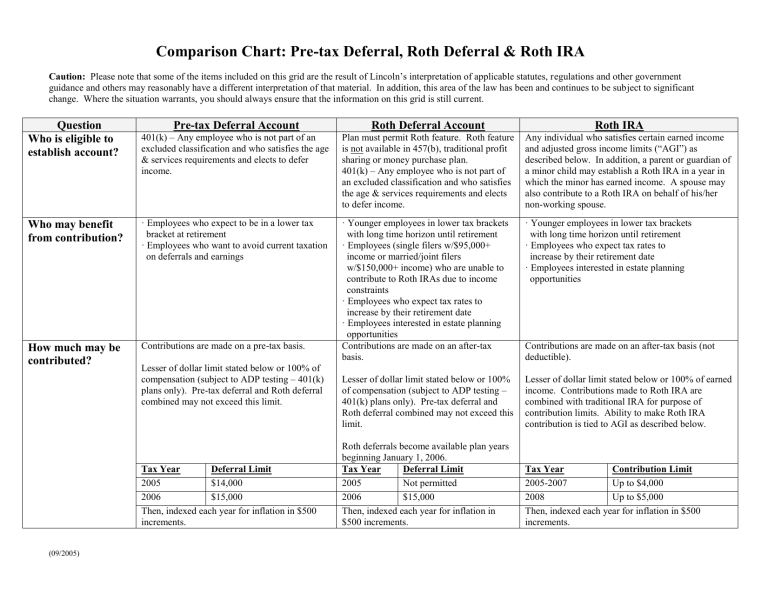

Comparison Chart: Pre-tax Deferral, Roth Deferral & Roth IRA

Comparison Chart: Pre-tax Deferral, Roth Deferral & Roth IRA

Caution: Please note that some of the items included on this grid are the result of Lincoln’s interpretation of applicable statutes, regulations and other government guidance and others may reasonably have a different interpretation of that material. In addition, this area of the law has been and continues to be subject to significant change. Where the situation warrants, you should always ensure that the information on this grid is still current.

Question

Who is eligible to establish account?

Pre-tax Deferral Account

401(k) – Any employee who is not part of an excluded classification and who satisfies the age

& services requirements and elects to defer income.

Roth Deferral Account

Plan must permit Roth feature. Roth feature is not available in 457(b), traditional profit sharing or money purchase plan.

401(k) – Any employee who is not part of an excluded classification and who satisfies the age & services requirements and elects to defer income.

Roth IRA

Any individual who satisfies certain earned income and adjusted gross income limits (“AGI”) as described below. In addition, a parent or guardian of a minor child may establish a Roth IRA in a year in which the minor has earned income. A spouse may also contribute to a Roth IRA on behalf of his/her non-working spouse.

Who may benefit from contribution?

How much may be contributed?

· Employees who expect to be in a lower tax

bracket at retirement

· Employees who want to avoid current taxation

on deferrals and earnings

Contributions are made on a pre-tax basis.

Lesser of dollar limit stated below or 100% of compensation (subject to ADP testing – 401(k) plans only). Pre-tax deferral and Roth deferral combined may not exceed this limit.

Tax Year

2005

2006

Deferral Limit

$14,000

$15,000

Then, indexed each year for inflation in $500 increments.

· Younger employees in lower tax brackets

with long time horizon until retirement

· Employees (single filers w/$95,000+

income or married/joint filers

w/$150,000+ income) who are unable to

contribute to Roth IRAs due to income

constraints

· Employees who expect tax rates to

increase by their retirement date

· Employees interested in estate planning

opportunities

Contributions are made on an after-tax basis.

Lesser of dollar limit stated below or 100% of compensation (subject to ADP testing –

401(k) plans only). Pre-tax deferral and

Roth deferral combined may not exceed this limit.

Roth deferrals become available plan years beginning January 1, 2006.

Tax Year Deferral Limit

2005

2006

Not permitted

$15,000

Then, indexed each year for inflation in

$500 increments.

· Younger employees in lower tax brackets

with long time horizon until retirement

· Employees who expect tax rates to

increase by their retirement date

· Employees interested in estate planning

opportunities

Contributions are made on an after-tax basis (not deductible).

Lesser of dollar limit stated below or 100% of earned income. Contributions made to Roth IRA are combined with traditional IRA for purpose of contribution limits. Ability to make Roth IRA contribution is tied to AGI as described below.

Tax Year

2005-2007

2008

Contribution Limit

Up to $4,000

Up to $5,000

Then, indexed each year for inflation in $500 increments.

(09/2005)

Question

Are age 50 catch-up contributions permitted?

What income restrictions apply?

How is payroll & withholding handled?

Pre-tax Deferral Account

Available to participant who attains age 50 by the end of the taxable year.

Lesser of dollar limit stated below or compensation reduced by other elective deferrals. Pre-tax catch-up deferral and Roth catch-up deferral combined may not exceed this limit.

Roth Deferral Account

Available to participant who attains age 50 by the end of the taxable year.

Lesser of dollar limit stated below or compensation reduced by other elective deferrals. Pre-tax catch-up deferral and

Roth catch-up deferral combined may not exceed this limit.

Roth deferrals become available plan years beginning January 1, 2006.

Tax Year Catch-up Amount

2005

2006

Not permitted

$5,000

None. Participant may contribute regardless of income level.

Roth IRA

Available to individual who attains age 50 by the end of the taxable year.

Tax Year

2005

2006

Catch-up Amount

$4,000

$5,000

None. Participant may contribute regardless of income level.

Pre-tax deferrals are not subject to federal income tax withholding. However,

FICA/Medicare withholding is based on Social

Security wages which includes pre-tax deferrals.

Note: Pre-tax deferrals are not subject to state withholding with few exceptions.

Roth deferrals are subject to federal income tax withholding. FICA/Medicare withholding is based on Social Security wages which includes Roth deferrals. Note:

Roth deferrals are typically subject to state withholding.

Tax Year Catch-up Amount

2005 $500

2006 – 2008 and thereafter $1,000

An individual’s ability to make Roth IRA contribution is determined by single or married filing status and Adjusted Gross Income (AGI) as described below:

Filing status

Adjusted Gross

Income (AGI)

Full/Partial

Contribution

<$95,000 Full Single or

Married

Filing

Separately

Married

Filing

Jointly

Married

Filing

Separately

N/A.

$95,000 - $109,999

≥$110,000

<$150,000

Partial

None

Full

$150,000 - $159,999 Partial

≥$160,000 None

$0

$1 - $9,999

≥$10,000

Full

Partial

None

(09/2005)

Question

How are deferrals reflected on Form

W-2?

What are distributable events?

Are hardship withdrawals available?

Pre-tax Deferral Account

Box 1 – 401(k) deferral is excluded from

Wages, tips, other compensation (used to determine compensation subject to federal income tax withholding).

Box 3 – Include 401(k) deferral (used to determine compensation subject to Social

Security/Medicare).

Box 12 – Show deferral amount and Code D for

401(k) plans.

Death

Disability

Severance from Employment

Retirement

Plan termination (401(k) only)

Subject to the terms of plan document. Other inservice withdrawals described below.

Withdrawals that meet hardship “needs” and

“satisfaction” tests may be permitted from pretax deferral account. Typically deferrals only, not earnings.

Roth Deferral Account

Box 1 – Roth 401(k) deferral is included in

Wages, tips, other compensation (used to determine compensation subject to federal income tax withholding).

Box 3 – Include Roth 401(k) deferral (used to determine compensation subject to Social

Security/Medicare).

Guidance From IRS Required :

Awaiting guidance from IRS in final regulations and/or W-2 Instructions for

2006. We anticipate that the IRS will instruct employer to place Roth deferral amount in Box 12 and provide new code for

Roth deferral (instead of D).

Death

Disability

Severance from Employment

Retirement

Plan termination (401(k) only)

Subject to the terms of plan document.

Other in-service withdrawals described below.

Withdrawals that meet hardship “needs” and “satisfaction” tests may be permitted from Roth Account. Roth deferrals only, not earnings.

Guidance From IRS Required --

Ordering Rules: If participant has pre-tax and Roth account, the IRS may require prorating distribution. Guidance is expected in final regulations.

N/A.

Roth IRA

Roth IRA Account is available for distribution at any time.

Treated as any other distribution.

(09/2005)

Question

Are in-service withdrawals permitted?

Are loans permitted?

Are required minimum distributions (RMD)

@ age 70 ½ necessary?

What is a “qualified distribution”?

Pre-tax Deferral Account

Pre-Age 59 ½ withdrawal of pre-tax deferral in

401(k) plan – Not permitted.

Post-Age 59 ½ -- Plan may permit in-service withdrawal of pre-tax deferrals.

Plan may offer loan from pre-tax as well as other sources (up to certain limits – generally

50% of the participant’s vested account balance).

If loan default occurs, entire outstanding loan balance becomes taxable.

RMD required at the later of attainment of age

70 ½ or retirement.

N/A. The term “qualified distribution” is used in context of Roth account only.

Roth Deferral Account

Pre-Age 59 ½ withdrawal of Roth deferral –

Not permitted.

Post-Age 59 ½ Withdrawal in 401(k) plan --

Plan may permit in-service withdrawal of

Roth deferrals.

Guidance From IRS Required --

Ordering Rules: If participant has pre-tax and Roth account, the IRS may require that in-service withdrawal be pro-rated.

Guidance is expected in final regulations.

Plan may offer loan from Roth deferral account as well as other sources (up to certain limits – generally 50% of the participant’s vested account balance).

Guidance From IRS Required : We are awaiting additional guidance from the IRS to address appropriate taxation of loan if loan default occurs and loan originated from

Roth deferral account.

RMD required at the later of attainment of age 70 ½ or retirement.

May roll to Roth IRA to avoid RMD.

Roth IRA

Treated as any other distribution.

No. Loans are not available.

RMD rules do not apply to Roth IRAs.

Two requirements must be met so distribution can be qualified:

Roth Account has been in place for

five taxable years (from date of first

contribution)

One of the following events has

occurred:

Attainment of age 59 ½

Disability

Death

Two requirements must be met so distribution can be qualified:

Roth Account has been in place for

five taxable years (from date of first

contribution)

One of the following events has

occurred:

Attainment of age 59 ½

Disability

Death

Purchase of a first home (up to $10,000)

(09/2005)

Question

What is a “nonqualified distribution”?

What tax rules apply at distribution?

Does the premature

10% distribution penalty apply?

What are the mandatory income tax withholding requirements?

Pre-tax Deferral Account

N/A. The term “non-qualified distribution” is used in context of Roth account only.

Following a distributable event, the entire pretax account – deferrals and earnings are subject to federal and state taxation.

The premature 10% distribution penalty may apply to entire distribution taken prior to age 59

½.

Exceptions apply such as – age 55 and severance from employment, death, disability, substantially equal periodic payments, QDRO payment to alternate payee, IRS levy, and deductible medical expenses.

Payor is required to withhold 20% (on taxable amount – entire withdrawal) for income tax on distribution that is eligible for direct rollover but not directly rolled over.

Mandatory state tax withholding may also apply.

Roth Deferral Account

Participant may take a distribution (as permitted in plan) even if the criteria above have not been met (5-year requirement and/or event). This is referred to as a “nonqualified” distribution.

Guidance From IRS Required --

Ordering rules: Yet to be clarified in final regulations. IRS may require that withdrawal contain pro-rated earnings with after-tax contributions.

Taxation of earnings is determined based on whether distribution is “ qualified ” or “ nonqualified ”. Note: Roth deferrals are never subject to taxation upon distribution.

Qualified distribution – Both Roth deferrals and earnings are tax-free.

Non-qualified distribution – Earnings are subject to federal and state taxation.

The premature 10% distribution penalty (on

Roth earnings only) may apply to nonqualified distributions taken prior to age 59

½.

Exceptions apply such as – age 55 and severance from employment, death, disability, substantially equal periodic payments, QDRO payment to alternate payee, IRS levy and deductible medical expense.

Payor is required to withhold 20% (on taxable portion of account only) for income tax on distribution that is eligible for direct rollover but not directly rolled over.

Qualified distribution – no mandatory withholding

Non-qualified distribution – mandatory withholding on earnings would apply.

Mandatory state tax withholding may also apply.

Roth IRA

Roth IRA Account holder may take a distribution even if the criteria above have not been met (5-year requirement and/or qualifying event). This is referred to as a “non-qualified” distribution.

Ordering rules: First assets distributed are contribution amounts.

Taxation of earnings is determined based on whether distribution is “ qualified ” or “ non-qualified ”. Note:

Contributions are always considered tax-free.

Qualified distribution – Both Roth deferrals and earnings are tax-free.

Non-qualified distribution – Earnings are subject to federal and state taxation.

The premature 10% distribution penalty (on earnings only) may apply to non-qualified distributions taken prior to age 59 ½.

Exceptions apply such as – death, disability, substantially equal periodic payments, payment of certain health insurance premiums after job loss, unreimbursed medical expenses, education expense,

IRS levies and first time home buyer expenses.

N/A. Voluntary withholding applies.

(09/2005)

Question

How are distributions reported?

What direct rollover opportunities exist?

Pre-tax Deferral Account

Form 1099-R

Participant may roll over* to another eligible retirement plan – 401(k)/401(a), 403(b), 457(b) governmental if receiving plan permits or to a traditional IRA. Amounts distributed and rolled over within 60 days are not subject to premature

10% distribution penalty.

* Participant must have distributable event in order for rollover to occur. RMDs, hardship distributions and payments spread over 10 years or more are not eligible for rollover.

Roth Deferral Account

Form 1099-R

Participant may roll over* to another eligible retirement plan – 401(k)/401(a) or

403(b) if receiving plan permits rollover of

Roth Account or to a Roth IRA. Rollover of a Roth Account to a 457(b) plan is not permitted. Amounts distributed and rolled over within 60 days are not subject to premature 10% distribution penalty.

* Participant must have distributable event in order for rollover to occur. RMDs, hardship distributions and payments spread over 10 years or more are not eligible for rollover.

Form 1099-R

Roth IRA

Account holder may not roll over Roth IRA dollars to another eligible plan but may roll Roth IRA to another Roth IRA. Amounts distributed and rolled over within 60 days are not subject to premature 10% distribution penalty.

The information included in this chart is presented solely for the purpose of educating the user about pre-tax and Roth deferral feature in employer-sponsored plans and Roth IRAs. The Roth deferral information is based on

Proposed Rules published by the IRS on March 2, 2005. The Lincoln Life & Annuity Company of New York (“Lincoln”) makes no representation that any or all of the material is appropriate or applicable to all employers or participants. Those who choose to use this information do so on their own initiative and are responsible for compliance with all laws, if and to the extent such laws are applicable. Lincoln strongly encourages you to consult your legal or tax advisors for additional information.

For further information regarding Roth IRAs, please consult Publication 590 – Individual Retirement Arrangements (IRAs). This publication is available at www.irs.gov

.

The Lincoln Director

SM

is a group variable annuity contract issued by the Lincoln Life & Annuity Company of New York, Syracuse, NY on policy form #19476NY-A 7/04 (and variations thereof) and is distributed by broker/dealers with effective selling agreements.

Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates.

IRS CIRCULAR 230 DISCLOSURE: Any discussion pertaining to taxes in this communication (including attachments) may be part of a promotion or marketing effort. As provided for in government regulations, advice (if any) related to federal taxes that is contained in this communication (including attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code. Individuals should seek advice based on their own particular circumstances from an independent tax advisor.

LFD0509-1298NY

(09/2005)