Problem Set 5 Izmir University of Economics Department of Economics

Izmir University of Economics

Department of Economics

Econ 102 Principles of Macroeconomics

Problem Set 5

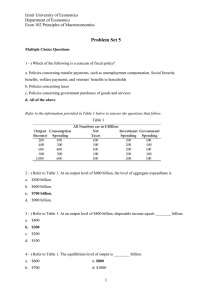

Multiple Choice Questions

1 - ) Which of the following is a concern of fiscal policy? a. Policies concerning transfer payments, such as unemployment compensation, Social Security benefits, welfare payments, and veterans’ benefits to households b. Policies concerning taxes c. Policies concerning government purchases of goods and services d. All of the above

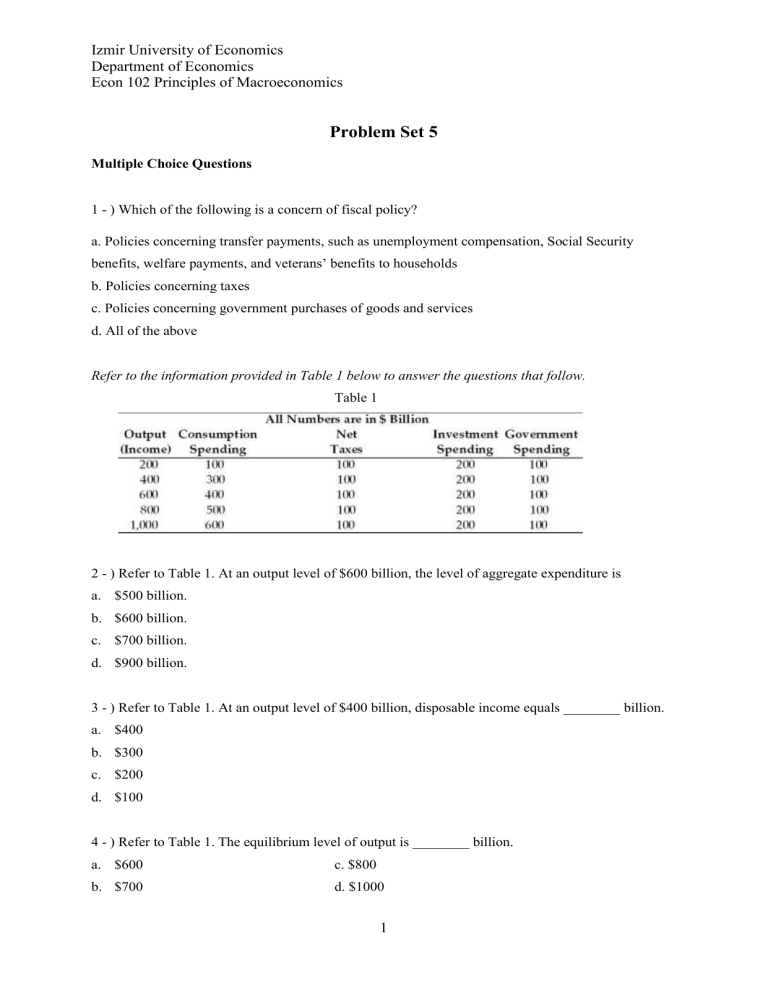

Refer to the information provided in Table 1 below to answer the questions that follow.

Table 1

2 - ) Refer to Table 1. At an output level of $600 billion, the level of aggregate expenditure is a.

$500 billion. b.

$600 billion. c.

$700 billion. d.

$900 billion.

3 - ) Refer to Table 1. At an output level of $400 billion, disposable income equals ________ billion. a.

$400 b.

$300 c.

$200 d.

$100

4 - ) Refer to Table 1. The equilibrium level of output is ________ billion. a.

$600 b.

$700 c. $800 d. $1000

1

Izmir University of Economics

Department of Economics

Econ 102 Principles of Macroeconomics

5 - ) The government spending multiplier shows: a. The ratio of the change in government spending to a change in autonomous planned investment b.

The ratio of the change in equilibrium output to an initial change in government spending c. The amount by which government spending changes with changes in the level of output d. How government spending is one of those variables that does not change in response to changes in the economy

6 - ) The tax multiplier is: a. The ratio of a change in the equilibrium level of output to a change in taxes b. A negative multiplier c. Not the same as the multiplier for a change in government spending d . All of the above

7 - ) What happens when there is a simultaneous increase in government spending of $100 and a lumpsum tax of $100? a. Equilibrium income would decrease by $100, or the amount of increase in T b. Nothing happens. Equilibrium income remains the same because the amount of government spending (G) is compensated by the amount of taxation (T) c. Equilibrium income would decrease by $200, or double the amount of the increase in T d . Equilibrium income would increase by $100, or the amount of increase in G

8 - ) Which of the following expressions represent the leakages/injections approach to equilibrium? a. Y = C + I + G b. Y = a + bT + I + G c. S + T = I + G d. C + S = I + G

9 - ) The term fiscal drag refers to: a. The time it takes for the government to discover a problem in the economy, determine the correct action, and implement policies to deal with it b. The drag of budget deficits on the economy c. The impact of taxes on the economy, which may put a drag on an economic expansion d. Increases in government spending that put a drag on planned investment spending

2

Izmir University of Economics

Department of Economics

Econ 102 Principles of Macroeconomics

10 - ) Automatic stabilizers refer to: a. Discretionary monetary policy maneuvers that keep inflation automatically under control b. Inherent stock market mechanisms that automatically cause stock market gains to be cancelled out by losses c. Government revenue and expenditure items that automatically change with changes in economic activity d. Invisible hand mechanisms that automatically bring the economy out of a recession

11 - ) The balanced-budget multiplier has a final impact on equilibrium income equal to: a. ΔG b. ΔT * (MPC) c. ΔT * (–MPC/MPS) d. ΔG * (1 – MPS)

Essay Questions

1-) Consider an economy where C = 100 + .8Y, I = 100, G = 100, and T = 100, a. What is the equilibrium level of output? Show your work with graphical illustration.

b. What is the value of the government spending multiplier and tax multiplier? c. Suppose that investment has risen to 200 and government expenditure decreased to 50. What is the level of output in the new equilibrium?

2-) Briefly discuss the concepts of fiscal and monetary policy which are the two policy channels that government uses to affect macroeconomy.