accounting ii

advertisement

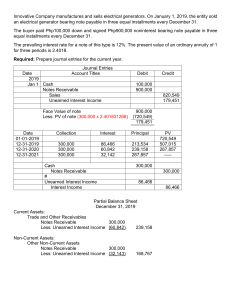

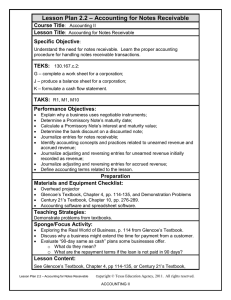

Due: Name: Hour: ACCOUNTING II Chapter 10 Reading Guide Answer the following questions as you read Chapter 10, pages 288-304. 10-1: NOTES RECEIVABLE 1. What is the difference between a Notes Payable and a Notes Receivable (think back to what you know about a Notes Payable and who owes who)? [2] 2. Why are Notes Receivable classified as current assets? [1] 3. There are two types of Notes Receivable a business may issue. What are they? [2] 4. A general journal is sometimes used for issuing a Notes Receivable. Other times, a cash receipts journal is used. When is a note recorded in a General Journal? When is a note recorded in a Cash Receipts journal? [2] 5. How is Interest Income classified? [1] 6. Employers sometimes issue Notes Receivable to employees for a variety of reasons. What kind of transactions are these known as? (See FYI, page 292) [1] 7. What is a dishonored note? [1] ACCOUNTING II 8. Chapter 10 Reading Guide What accounts are affected and how when a notes receivable is dishonored? Include debit/credit parts. [3] 9. When a Notes Receivable is dishonored and journalized, there is a chance the amount will never be paid back. What happens if the business thinks the note is uncollectible? (See REMEMBER box, page 293) [1] 10. Sometimes a note that was dishonored is paid. What accounts are affected and how (debit/credit)? Why is Interest Income charged again? [4] 10-2: UNEARNED AND EARNED REVENUE 11. What is unearned revenue? [1] 12. What is unearned revenue also referred to as? [1] 13. A business can choose one of two ways to record unearned revenue. What are the two ways? [2] 14. If a business chooses to record unearned revenue as a revenue, why must an adjusting entry be recorded at the end of the fiscal period? [1] 2 ACCOUNTING II Chapter 10 Reading Guide 15. How is Unearned Rent classified? How is Rent Income classified? [2] 16. When is a reversing entry needed? [1] 17. What is accrued revenue? [1] 18. For a note issued on December 1 for 60 days, how many days of interest must be calculated in the current fiscal period (that ends December 31)? If the note is for $1,000 at an interest rate of 12%, how much interest will be recorded in an adjusting entry (show work)? [2] 19. Which account is credited for the Interest that is due from the customer, but not received? How is this account classified? [2] 20. Which account is debited for the Interest that is due from the customer, but not received? How is this account classified? [2] 21. How do reversing entries make the work of accounting personnel easier? (See REMEMBER box on page 300) [1] 3