Week 7 Practice Quiz c Answers - The University of Chicago Booth

advertisement

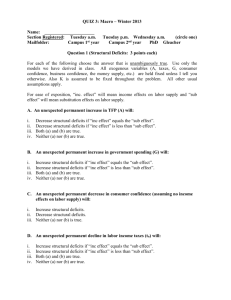

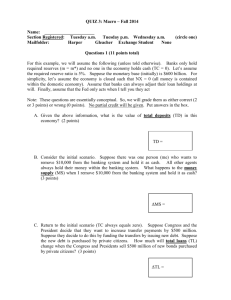

QUIZ 3: Macro – Winter 2013 Name: __ANSWERS____________________ Section Registered: Tuesday a.m. Tuesday p.m. Wednesday a.m. (circle one) Mailfolder: Campus 1st year Campus 2nd year PhD Gleacher Question 1 (Structural Deficits: 3 points each) For each of the following choose the answer that is unambiguously true. Use only the models we have derived in class. All exogenous variables (A, taxes, G, consumer confidence, business confidence, the money supply, etc.) are held fixed unless I tell you otherwise. Also K is assumed to be fixed throughout the problem. All other usual assumptions apply. For ease of exposition, “inc. effect” will mean income effects on labor supply and “sub effect” will mean substitution effects on labor supply. Note: Structural deficits are the deficits at Y*. define structural deficits: Formally, from the notes, we can G + Tr – (tn)Y* ( I set the part of transfers that change with GDP to zero) What makes structural deficits increase? 1. Increases in G and Tr (holding Y* fixed) 2. A decline in tax rates (holding Y* fixed) 3. A fall in Y* Note: As always, we assume G has no effect on A. Changes in G have no effect on labor demand or labor supply, so it does not affect N*. Therefore, G will not change Y*. A. A permanent increase in TFP (A) will: i. ii. iii. iv. Decrease structural deficits if “inc effect” equals the “sub effect”. Decrease structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. As A increases, we know that the labor demand curve shifts out, so W/P will increase, permanently. The substitution effect (movement along the labor supply curve) tells us we increase N* as W/P increases. As W/P increases, this means, PVLR will increase and the income effect will cause the labor supply curve to shift in (N* falls). If the effects are equal in magnitude, N* will not change. Thus, the only effect on Y* is the positive shock to A so Y* unambiguously increases and structural deficits fall as we can clearly see in the identity above. So, i is true. If the substitution effect is stronger in magnitude, N* will increase. So we have N* increasing and A increasing which means Y* increases. So, ii is also correct. B. A permanent increase in government spending (G) will: i. ii. iii. iv. Increase structural deficits if “inc effect” equals the “sub effect”. Increase structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. An increase in G will unambiguously increase structural deficits assuming G has no effect on TFP. See above. C. A decrease in consumer confidence (assuming no income effects on labor supply) will: i. Increase structural deficits. ii. Decrease structural deficits. iii. Neither (a) nor (b) is true. An increase in consumer confidence will cause C to increase which will shift out the IS curve and the AD curve which will cause Y to increase in the short run relative to Y*. This means r will increase and P will increase. As P increases, W/P will fall which will cause N (not N*) to increase in the short run. However, we know only N*, K, A and oil will affect Y*. What do we have? An increase in Y and N in the short run but no long run effects on N* or Y*. So, consumer confidence will have no effect on structural deficits. D. A permanent decline in labor income taxes (tn) will: i. ii. iii. iv. Increase structural deficits if “inc effect” equals the “sub effect”. Increase structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. As tn falls permanently, we know after tax wages will increase. Thus, we know the substitution effect will cause labor supply to shift out (increasing N*) and the income effect will cause labor supply to shift in (decreasing N*). If the effects offset, there will be no change in N*. So, we only have to consider the effect of the decrease in tn on structural deficits through tn (not through Y*). As tn falls, the government is collecting less revenue so structural deficits must increase. If the income effect is less than the substitution effect, we know N* increases. So Y* increases. We have 2 effects working in opposite directions: tn declining causes structural deficits to increase but Y* increasing causes structural deficits to decrease. So ii cannot be true. Question 2 (Money and Banking Sector) Suppose you are given the following baseline information about the U.S. banking system. A. Total deposits in the U.S. banking system: The required reserve ratio is 5%: No one in the economy ever holds cash: Banks always hold excess reserves such that they always hold 10% of their deposits as reserves: One year real interest in the economy are 3%: TD m TC = $1 Trillion = 5% = 0 (always) m* r = 10% = 3% Given the above information, what is the monetary base in this economy? When answering this question write down the mathematical definition of the monetary base as defined in class. Put your numerical answer in the box. Show your work to receive full credit. (2 points total: question graded either 0 or 2). Recall, the monetary base is all the physical currency in the market: Base = TC + TR = TC + m*(TD) = 0 + .10*$1Trillion = $100 Billion B. Suppose the U.S. Treasury decided to buy $10 billion of U.S. Treasury securities on the open market. By how much would the money supply (MS) increase? When answering this question write down the mathematical definition of the money supply as defined in class. Put your numerical answer in the box. (3 points total: question graded either 0 or 3). Money supply (MS) = Total deposits in banking system (TD) + Total currency held outside the banking system (TC) Note here that the Treasury is buying U.S. Treasuries. We should be clear to distinguish this from the Fed engaging in open market operations. This will have no effect on the money supply, = 0. C. Suppose that banks suddenly decide to hold only 7.5% of their deposits as reserves (i.e., m* falls from 10% to 7.5%). By how much would the monetary base change if m* falls from 10% to 7.5%? Put your numerical answer in the box. Provide a brief justification for your answer (math intuition is fine). (3 points total: either 0 or 3). Let’s practice using some of the equations we learned in lecture: Monetary Base = Total Reserves (TR) + Total Currency held outside the banking system (TC) Money supply (MS) = Total deposits in banking system (TD) + Total currency held outside the banking system (TC) Total Reserves (TR) = (m*) TD banks) (where m* is the actual reserve ratio held by the Total Loans (TL) = TD – TR TD = $1 Trillion m* = 10% TC = 0 So plugging in: MS = $1T (TD) + 0 (TC) = $1T TR = .10 * $1T = $100 B (this is what you solved for in the first part of this question) Base = $100B (TR) + 0 (TC) TL = $1T - $100B = $900 B Now, onto this problem.. The answer we are looking for is that there is zero change in reserves (change in total reserves = 0). Math explanation: Using the money multiplier where the initial deposit is the total reserves in the economy (that is what is held in the banking system that banks can leverage). TD = (1/m*) * TR (which in this case is like the original initial deposit) = $100 billion/0.075 = $1.333T TR = $100 billion (which is 0.075 * $1.333) What does this mean? about $333 B TL= $1.333T - $100B = $1.233T so TL increased by Intuitive explanation: There was originally $100 billion in the banking system as reserves initially. There were no new reserves injected into the system. That means that at the end, there could only be $100 billion of reserves in the banking system. All the increase in the money supply comes from the generation of new loans. This occurred because banks chose to leverage their initial reserves to a higher extent by making more loans based on the same amount of reserves (because banks could hold lower reserves from every level of deposits). The net effect is that deposits increase, the reserve ration falls – yet the total reserves remain unchanged. Because we know the monetary base = TC + TR and TC=0 by assumption and TR does not change, the base does not change, = 0.